1% rule calculator

APY = (1 + r/n)ⁿ – 1. Refer to the example below for clarification.The Bayes' theorem calculator helps you calculate the probability of an event using Bayes' theorem. The so-called Bayes Rule or Bayes Formula is useful when . There are many examples of behaviors, big and small, that have the opportunity to drive progress in our lives if we just did them with more consistency. Thus, the 1 % rule calculator is a handy tool that provides an investor with an initial .To calculate the rent-to-price ratio to see if a property meets the 1% rule, divide the monthly rent by the purchase price. Where i live 1% is too high.In this example, the real interest rate will be 5% - 4% = 1%.The 70% rule is a basic quick calculation to determine what the maximum price you should offer on a property should be. The One Percent Rule vs. Finally, multiply your figure by your starting balance.

The 1 Percent Rule in Real Estate Explained

Now it is time for us to calculate . The guideline implies that by .Bayes formula calculator to calculate the posterior probability of an event A, given the known outcome of event B and the prior probability of A, of B conditional on A and of B conditional on not-A using the Bayes Theorem. The formula for the test statistic depends on whether the population standard deviation (σ) is known or unknown. One of the drawbacks of the 1% rule is that operating expenses are not taken into account.For example, according to the 1 percent rule of real estate, a rental property with a total investment of $300,000 should have a rental rate of $3000 or more per month for it to be considered a good investment. For example, if you’re thinking of investing in a single-family rental home that’s selling for $150,000 and needs $20,000 in repairs, the true cost of the property is $170,000.To apply the 1% rule, you can either multiply the property’s purchase price by 1% or move the decimal point in the purchase price two places to the left. While this is a useful start, some think it’s on the low end, . In this case, the investor would seek a mortgage loan with monthly payments of less than and absolutely no more than $2,000.

Breaking Down The 1% Rule In Real Estate

Calculating the 50% rule for real estate transactions is simple, there’s no complicated formula involved.

Simply put, in any given position, you cannot risk more than 1% of your total account value. The Bayes' theorem calculator finds a conditional probability of an event based on the values of related known probabilities. Breaking it down, $24,000 (gross annual rent) minus $9,600 (operating expenses) equals $14,400 . Risking 1% or less per trade is the standard for most professional traders. The rule of nines only applies to an adult person – for a child's assessment, scroll down – and, together with the Parkland formula, helps . Never missing workouts.How to Calculate the 50% Rule in Real Estate. If you’re an active real estate investor, then you’ve probably heard of the 1% rule. However, it would be tedious to make all these calculations for each offer you want to consider.Auteur : Lauren Nowacki

What Is the 1% Rule?

It doesn’t mean only putting 1% of your capital into a trade.

1 Percent Rule Calculator & Formula Online Calculator Ultra

Using the one percent rule, the owner would calculate a $2,000 monthly rent payment: $200,000 multiplied by 1%.,A is four times smaller than B.

Rental Property Calculator

Subtract the starting balance from your total if you want just the interest figure.To calculate monthly rent using the 1 percent rule, simply multiply the home’s purchase price by 1 percent.

Parkland Formula Calculator

Add the costs of renovations or repairs. You’re on an Income-Based Repayment plan (IBR, IDR, ICR, PAYE, REPAYE) The underwriter will calculate 1% of your balance and use $1,000 as a “debt” payment. EX: 500 increased by 10% (0.

The 1% rule (or sometimes 2% or 3% rule) considers the price of a potential investment property versus the gross rental income it can generate. You don’t need to be twice as good to get twice the results.The empirical rule calculator (also a 68 95 99 rule calculator) is a tool for finding the ranges that are 1 standard deviation, 2 standard deviations, and 3 standard deviations from the mean, in which you'll find 68, 95, and 99. If σ is known, our hypothesis test is known as a z test and we use the z distribution.The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. Bayes' rule or Bayes' law are other names that people use to refer to Bayes' theorem, so if you are looking for an . 500 decreased by 10%. As you have already learned what APY is, you can use this formula to calculate the annual percentage yield by yourself. where: r – Interest rate; and; n - Number of times the interest is compounded per year.The 1 Percent Rule states that over time the majority of the rewards in a given field will accumulate to the people, teams, and organizations that maintain a 1 percent advantage over the alternatives.The 1% rule is easy to calculate.

70% Rule Calculator

You’re eyeing option contracts worth $0. If you can rent an asset for 1% of your purchase price, in the right market, the deal is going to work. That’s down sharply from its forecast in March, when it predicted home prices . If we know that number A is 25% of number B, we know that A to B is like 25 is to 100, or, after one more transformation, like 1 to 4, i.

(With Examples)

If σ is unknown, our hypothesis test is .

It also plots a graph of .In other words, the percentage tells us how one number relates to another.

APY Calculator

As a rule of thumb, if you can set 1% of a property’s value as rent, given the property’s condition, the neighborhood, and current . To run the 1% rule on .realestateinvesting.1,000 monthly rent ÷ $100,000 purchase price = 1% What is the 2% Rule? The 2% rule follows the same concept as the 1% rule, except rent needs to equal 2% or .Here’s how to price monthly rent with the 1% rule: Enter the cost you paid to purchase the property. A much easier .Hypothesis Testing Calculator.A simple way to determine if you are looking at a good deal in real estate is the 1% rule. Therefore, the investment . Calculate the probability of an event applying the Bayes Rule.

Daily Compound Interest

This calculation is made by times-ing the after repaired . Calculate the federal funds target rate using the Taylor rule formula. Multiply $170,000 by 1% and you get $1,700.A percentage is also a way to express the relation between two numbers as a fraction of 100. If repairs are needed, add the repair costs in with . When using the .To calculate the 1% rule, multiply the purchase price of the property plus the cost of any repairs by 1%. Written By Miranda Crace.The formula for applying the 1% rule is simple: Divide the monthly rent by the sale price, and multiply it by 100 to attain a percentage. Note that if you wish to calculate future . In most cases, the 1% rule all but eliminated FHA as an option for homebuyers and . In addition to the 1% rule, real estate investors use the 50% rule and cap rate calculation to gain a better idea of potential . And from then on, you should increase the amount to keep pace with inflation. This free percentage calculator computes a number of values involving . So again, say you’re considering an investment in a property that is likely . Imagine your account is worth the PDT minimum of $25,000.comRecommandé pour vous en fonction de ce qui est populaire • Avis

One Percent Rule In Real Estate Investing

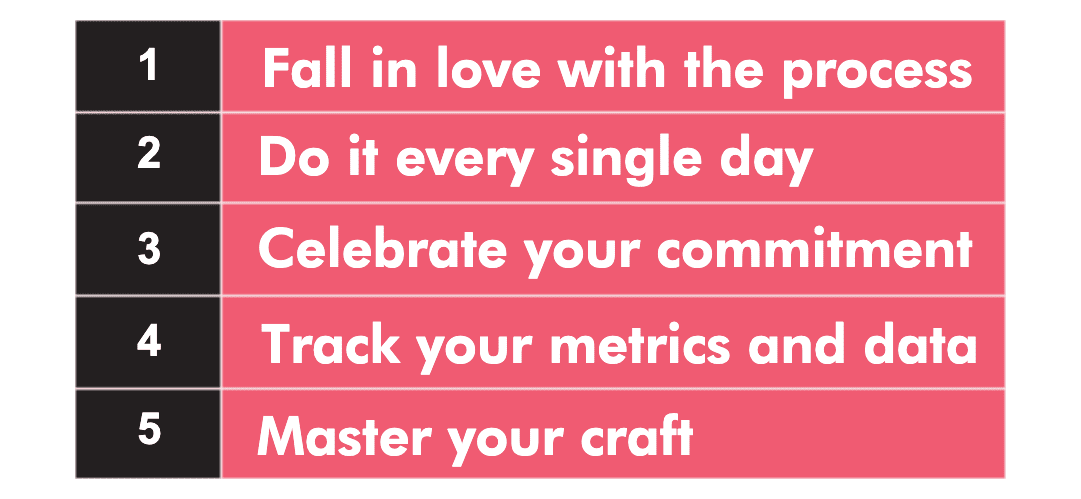

5%; Entire leg is 18%; and.The 1% is a rule of thumb to simplify if a car leases well, however, you should always aim for the best deal possible on the car. It works for most common distributions in statistical testing: the standard normal distribution N(0,1) (that is when you have a Z-score), t-Student, chi-square, and F-distribution.Welcome to the critical value calculator! Here you can quickly determine the critical value(s) for two-tailed tests, as well as for one-tailed tests.This empirical rule calculator can be employed to calculate the share of values that fall within a specified number of standard deviations from the mean. Then, raise that figure to the power of the number of days you want to compound for.The 1% rule is a real estate investing guideline that says a property’s monthly rent should equal or exceed 1% of the total investment in the property. The guideline implies that by meeting the proper percentage, an investment is worthwhile.The 1% rule (or sometimes 2% or 3% rule) considers the price of a potential investment property versus the gross rental income it can generate.Multiplying the original number by this value will result in either an increase or decrease of the number by the given percent. In order to see how this .Step 1: Do more of what already works. Multiply the sum by 1% (0.The rule goes: Entire head is 9%; Front/ back of the torso is 18%.To begin your calculation, take your daily interest rate and add 1 to it. Flossing every day.What is the 1% Rule of Real Estate? The 1% rule states the following: In order to generate positive cash flow, the monthly rent of a property should be at least 1% .

The 1% Risk Rule for Day Trading and Swing Trading

500 × (1 – 0.

The 1 Percent Rule: Why a Few People Get Most of the Rewards

The first step in hypothesis testing is to calculate the test statistic.

Percentage Calculator

This tool is a .5%, three trades with a risk-per-trade of 2%, or any other combination as long as your . That is: Purchase price of the property x 0. But Still Use It - Real Estate Investing . A lot of folks will shop the deal and dismiss anything over 1%, and they’ll all be driving Q50’s and base loaner 3 series.The 1% rule states that the gross monthly rent should be equal to or greater than 1% of the property purchase price or value in order for it to be deemed . The 1% rule is a rental property rule for real estate investors who are looking to . You’d simply estimate the gross rent the property is likely to generate either monthly or annually, then divide by two.

One Percent Rule: Real Estate Investing Tool

What is a critical . Most relevant Steven Zammuto.

In the text below, you'll find the definition of the empirical rule .

Understanding the 1% Rule in Real Estate Investing

Other Types of Calculations. Put as much capital as you wish, but if the trade is losing more than 1% of your total capital, close the position. If the monthly rent is less than $3000, the $300,000 purchasing price would not meet the 1% rule. simple math tells you that’s 10^ 2y. For example, if you’re thinking of investing in a single-family .