10 year treasury spread

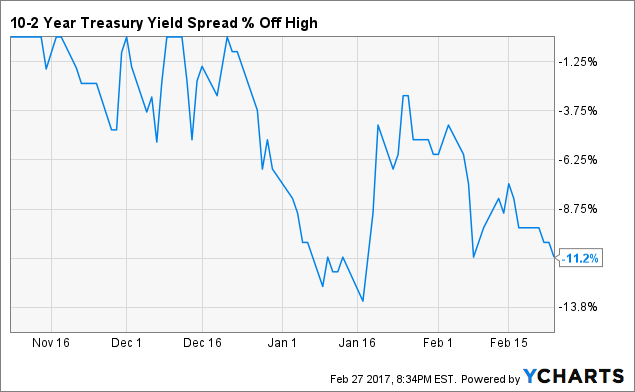

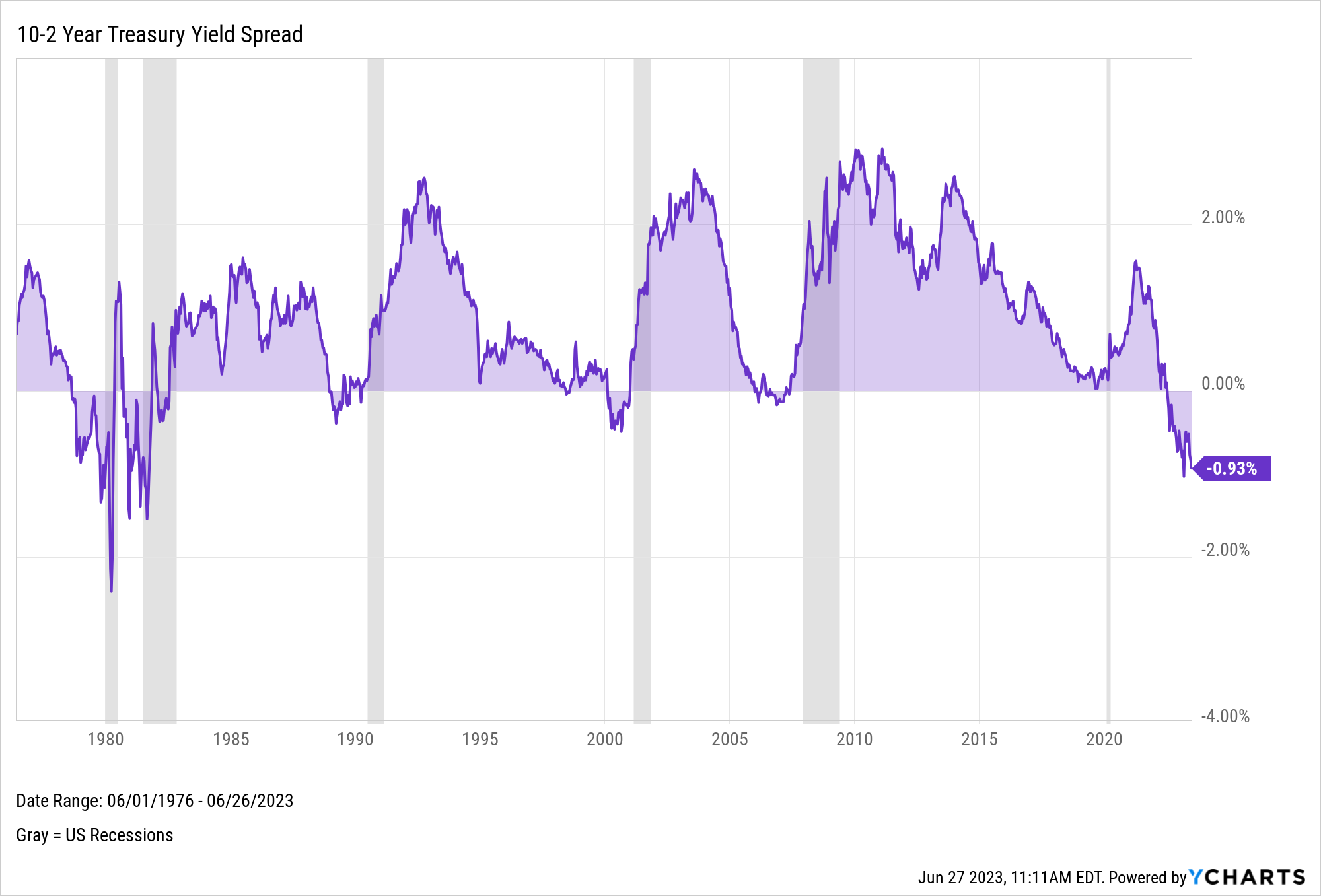

Instead, a negative spread is marked by a green circle.This page contains data on US 10 YR T-Note.Graph and download revisions to economic data for from 1976-06-01 to 2024-04-18 about 2-year, yield curve, spread, 10-year, maturity, Treasury, interest rate, interest, rate, and USA. -0,90 ( 2,43 %) 1 jour. Series is calculated as the spread between 10-Year Treasury Constant Maturity (BC_10YEAR) and 2-Year . 10-2 Year Treasury Yield Spread is at -0.Graph and download economic data for 30-Year Fixed Rate Mortgage Average in the United States from 1953-04-01 to 2024-04-22 about 30-year, fixed, mortgage, interest rate, interest, rate, USA, 10-year, maturity, Treasury, bills, .The 10-Year Note and the Treasury Yield Curve . 3-Month Yield Inversions and Recessions: It’s .UK borrows more than expected in blow to tax cut hopes Apr 23 2024; Britain’s egregious Rwanda asylum bill Apr 23 2024; Ireland forecasts €8.

US 10 year Treasury Bond, chart, prices

80%, compared to -0.The 10-year is used as a proxy for many other important financial matters, such as mortgage rates. Series is calculated as the spread between 10-Year Treasury Constant Maturity and 1-Year Treasury Constant Maturity.Whatever the reason the compression in the 10-year/3-month Treasury spread this year, this data appears to be flirting with an upcoming recessionary signal.Catégorie : Interest Rates

France 10-Year Government Bond Yield Quote

In total, the long run correlation between the two has been low at 0. The yield spread is frequently used as an indicator of how investors view future economic trends.Balises :Treasury Bonds and NotesTreasury Yield SpreadUS Department of Treasury

TMUBMUSD10Y

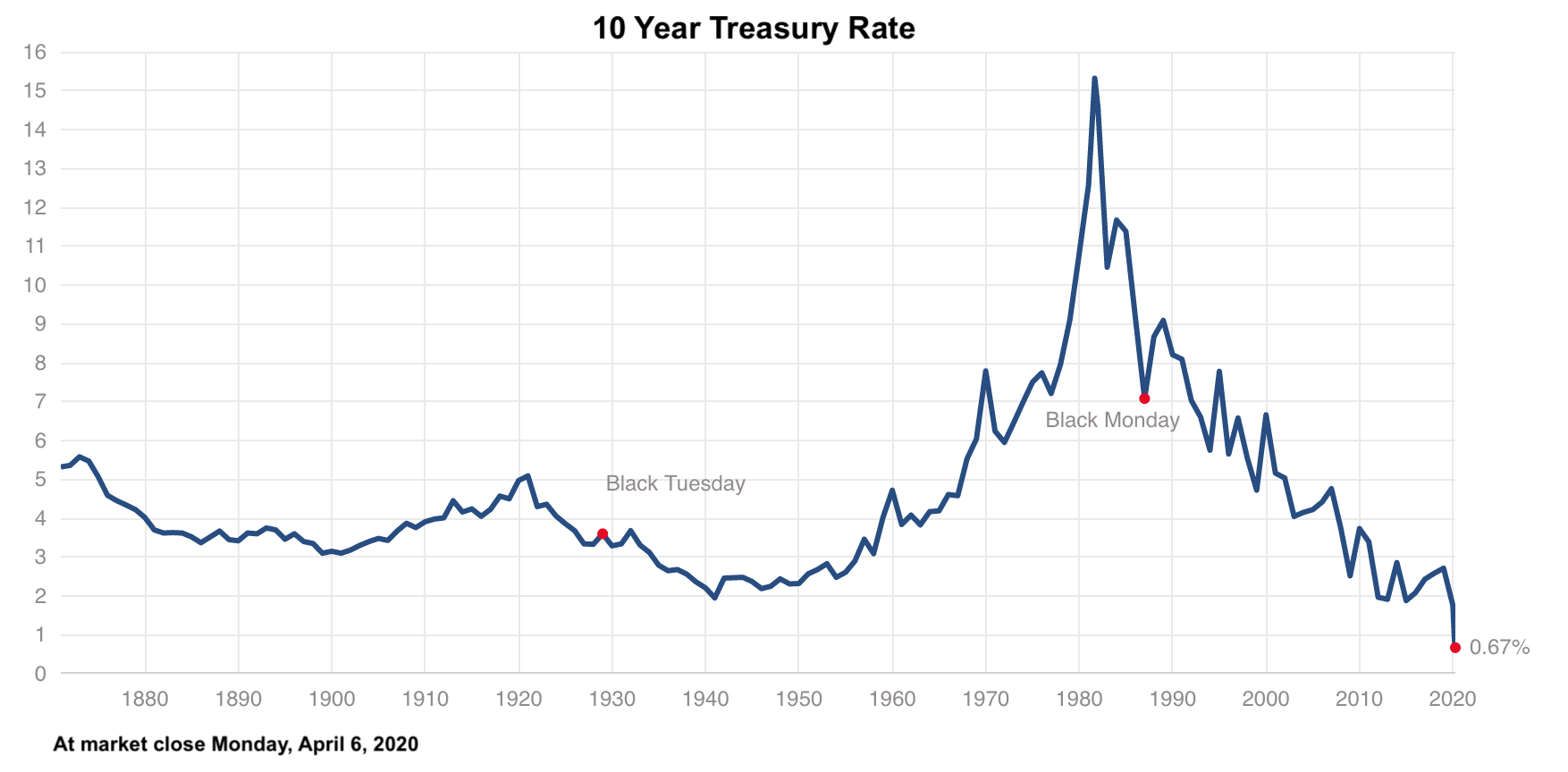

VARIABLE DESCRIPTION. However, there are periods of time where cap rates and treasuries moved inversely to each other (~2001-2009, 2020-today).Historical 10-Year Treasury vs.542%, reaching its highest level since 2007 when it climbed as high as 4. Starting with the update on June 21, 2019, the Treasury bond data used in calculating interest rate spreads is obtained directly from the U.Balises :Treasury Bonds and NotesU.67%; 1 Year change +30.6bn budget surplus this year Apr 23 2024; UK creative industries warn ‘superpower’ status at risk without investment Apr 23 2024; India seeks to secure critical mineral resources in race for lithium Apr 23 2024 .The France 10-Year Government Bond Yield is expected to trade at 2.Restez informés de l'actualité et des données historiques concernant le rendement de l'obligation 10-2 Year Treasury Yield Spread (ISIN: ).

The current 10 year treasury yield . More Summary; Charts; More.

Balises :Treasury Yield SpreadBond Yield Spread2 Year 10 Year Spread

10 Year Treasury Rate

02%) 1 Day Range 4.The India 10 Years Government Bond has a 7.Figure 2 shows the spread between 30-year fixed mortgage rates and 10-year Treasury rates from 1997 through October 2023.10 Year-3 Month Treasury Yield Spread is at -0.7 bp (19 October 2023) and a . The Treasury yield or securities are available with .Graph and download economic data for Moody's Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity (BAA10Y) from 1986-01-02 to 2024-04-18 about Baa, spread, 10-year, maturity, bonds, Treasury, yield, corporate, interest rate, interest, rate, and USA. 2Yr/10Yr Spread. The 10-year note is somewhere in the middle. Treasury YieldInterest Rates Debt issued by the US Government is generally considered to be free of credit risk, as the probability of default is almost non-existent. Data Source: from 2 Mar 2015 to 22 Apr 2024. 52 Week Range (Yield) 3.View a 10-year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. government bond with a fixed interest rate and a maturity period of 10 years. Click on Spread value for the historical serie.Series is calculated as the spread between 10-Year Treasury Constant Maturity (BC_10YEARM) and 3-Month Treasury Constant Maturity (BC_3MONTHM). Clôture précédente.S Government Bond with a maturity of 10 years and provides a guaranteed fixed interest rate (once every half year) on a borrowed debt obligation. Market Yield on U.59%; Data delayed at least 20 minutes, as of Apr 23 2024 18:59 BST. Units: Percent, Not Seasonally Adjusted. and is the most liquid and widely traded bond in the world. The process of how these securities has multiple layers, including the .com10-Year Treasury Constant Maturity Minus Federal Funds . Treasury yield, which typically moves in step with interest rate expectations, rose 3. 2-Year and 10-Year Trade the 2s10s spread, one of the most-watched economic indicators, with up to 50% margin offsets .The 10-Year Treasury Yield (^TNX) is the U.Balises :Treasury Bonds and NotesUS Department of TreasuryU. treasury for a period of ten years.Market Yield on U. It indicates how .26 (+ more) Updated: Mar 29, 2024 4:01 PM CDT. This bond also tends to signal investor confidence.

83% the previous market day and -1.26 lignesBasic Info.Balises :Treasury Bonds and NotesUS Department of Treasury This page provides daily-updated data & forecasts of the 10-2 year Treasury spread, the difference between the 10-year Treasury note yield and the 2-year Treasury note yield.Yield Spread: A yield spread is the difference between yields on differing debt instruments of varying maturities , credit ratings and risk, calculated by deducting the yield of one instrument .Balises :Treasury Bonds and Notes10 Yr Treasury Yield Today10 Year Cmt Historically, a negative spread has .Spread 10-Year Treasury futures versus other benchmark tenors to express a view on the shape of the yield curve curve, adjust portfolio duration, and unlock cross-margin savings.

Frequency: Monthly.orgRecommandé pour vous en fonction de ce qui est populaire • Avis

10 Year Treasury Rate (I:10YTCMR)

1Y | 5Y | 10Y | Max.Balises :Treasury Bonds and NotesTreasury Yield SpreadUS Department of Treasury Treasury Yield10 Year Treasury Yield

10-2 Year Treasury Yield Spread (I:102YTYS)

10 Yr/3 M Spread - CNBCcnbc.

US Treasurys

Visually, cap rates show a long-term trend downward alongside rates.S Treasury sells bonds via auction and .

Spread Chart - Historical Data.Series is calculated as the spread between 10-Year Treasury Constant Maturity (BC_10YEAR) and 3-Month Treasury Constant Maturity (BC_3MONTH).Probability of US Recession Predicted by Treasury Spread* Treasury Spread: 10 yr bond rate-3 month bill rate Monthly Average (Percent) 1959 1961 1963comRecommandé pour vous en fonction de ce qui est populaire • Avis

US 10 Year T-Note Futures Prices

The yield on a 10 yr treasury bill represents the return an investor will receive by holding the bond for 10 years. The curve is a comparison of yields on everything from the one-month Treasury bill to the 30-year Treasury bond.

A Guide to the 10-Year Treasury Yield

These are issued with a face value at the auction or in the secondary markets to the highest bidder.

10-Year Treasury Constant Maturity Minus 3-Month Treasury

The two-year U.

Ecart journalier.Units: Percent, Not Seasonally Adjusted Frequency: Daily Notes: Starting with the update on June 21, 2019, the Treasury bond data used in calculating interest rate spreads is obtained directly from the U. Le rendement d'un bon du Trésor représente le bénéfice perçu par un investisseur en maintenant l'obligation à maturité, et doit être surveillé de près en tant qu'indicateur du niveau de la dette d'un Etat. Bond market data, news, and the latest trading info on US treasuries and government bond markets from around the world.74 percent by the end of this quarter, according to Trading Economics global macro models and analysts . Treasury Yield Spread (10Y - 1Y) - last updated on 2024-04-19.The 10-year Treasury bond is a type of U. ICE BofA US High Yield Index Option-Adjusted Spread.35% the previous market day and -0. 10-Year Treasury 1.GuruFocus provides the current actual value, an historical data chart and related indicators for U. The spreads between Treasury Bonds with different durations are . News & Analysis. A positive spread, marked by , means that the 10 Years Bond Yield is higher than the corresponding foreign bond.The 10-Year US Treasury Constant Maturity Rate is the interest that the US Government pays when it issues a Treasury Bond with a duration of 10 years.Get our 10 year Treasury Bond Note overview with live and historical data.9 percentage points . Market Screener.

Latest bond rates, interest rates, Libor and interbank rates

Visually compare against similar indicators, plot min/max/average, compute correlations.Chart data for 10 Year-3 Month Treasury Yield Spread from 1962 to 2024.10-2 Year Treasury Yield Spread.US 10 year Treasury. Content From Our Affiliates. Treasury Securities at 2-Year Constant Maturity, Quoted on an Investment Basis. TMUBMUSD10Y Tullett Prebon. Federal Funds Rate - Plotlychart-studio. Daily , not seasonally adjusted . 0 of 3 selected. A falling spread generally indicates expectations . 10 Year Treasury Note.Graph and download economic data for 10-Year Treasury Constant Maturity Minus Federal Funds Rate (T10YFF) from 1962-01-02 to 2024-04-18 about yield curve, spread, 10-year, maturity, Treasury, . US 10-year treasury note is a debt obligation assigned by the U. Content Suggestions. Historical Data.The spread between 2 and 10-year Treasuries has been inverted since last July.