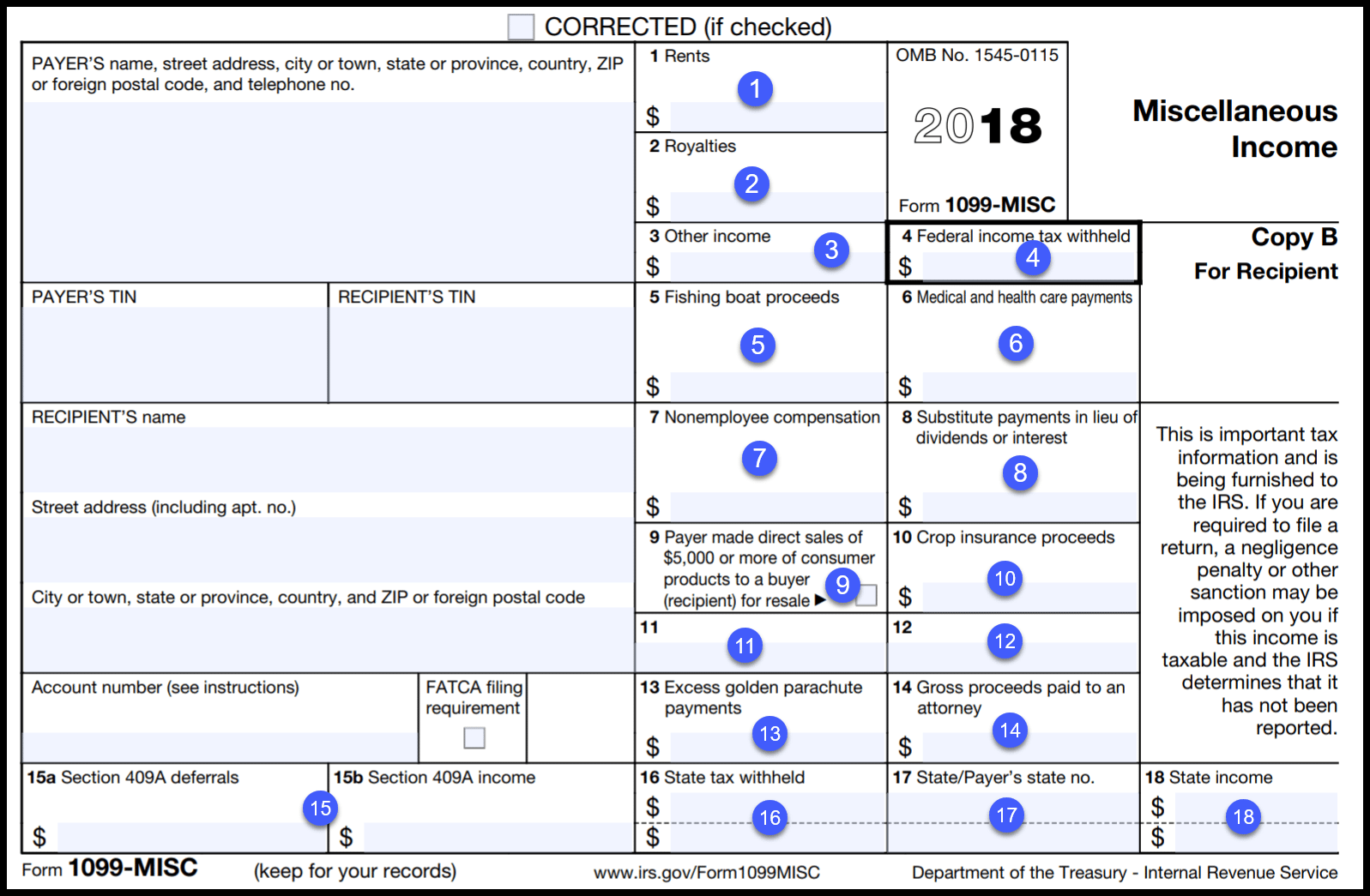

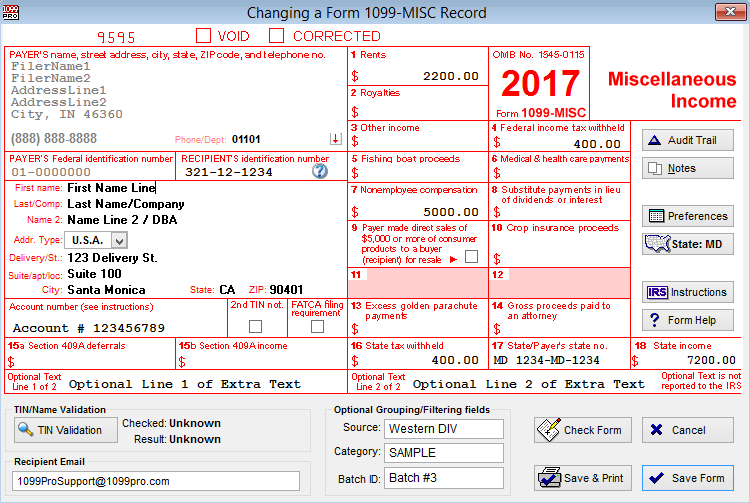

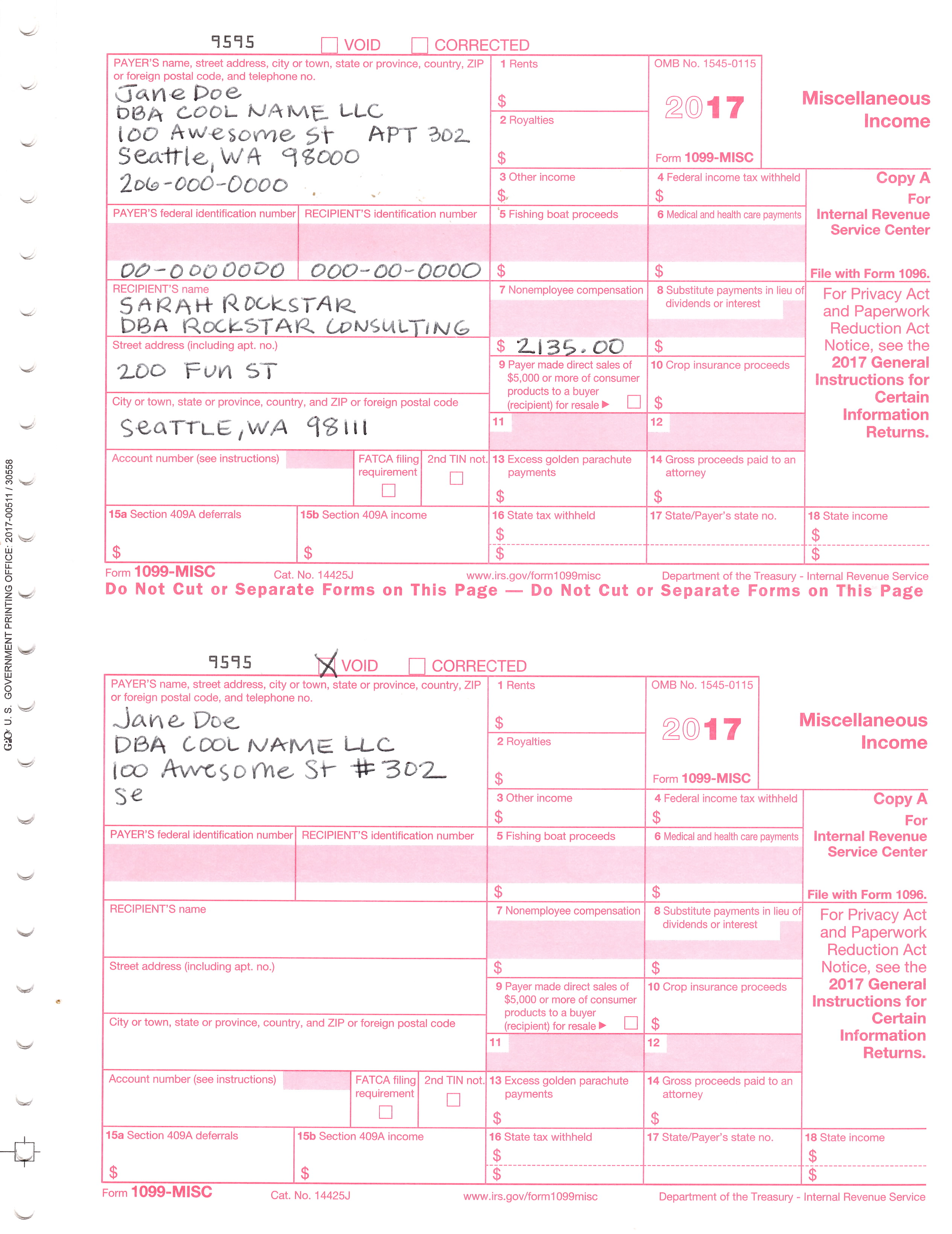

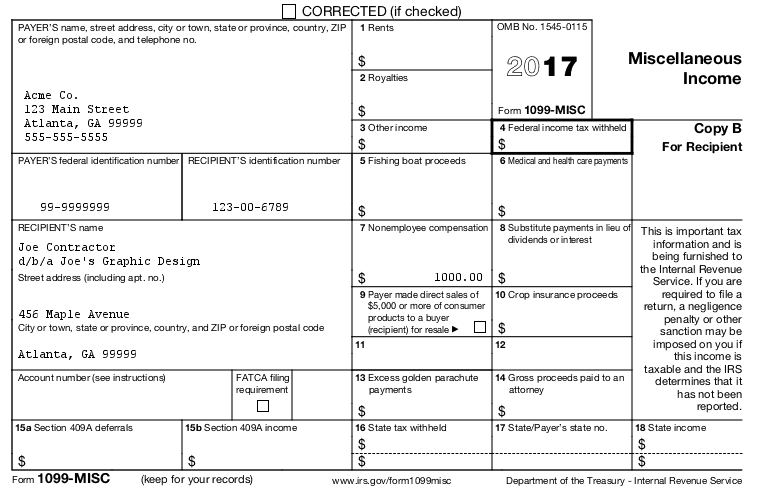

1099 example form filled out

This form is filled out by a payer – typically a business or an employer – to report payments made to individuals or entities who are not their employees. Copy 2: This copy should be filed (by the recipient) with the recipient’s . Form 1099-MISC.TABLE OF CONTENTS. Medical and health care payments. How to Fill Out a 1099 Form: Overview and Guide. The IRS says, “Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.Online fillable copies.

How to Fill Out the New Form 1099-NEC (Updated)

gov/Form1099NEC. At least $600 in: Rents. This will help you determine .Where To Get Form 1099-NEC .Larry and Debbie (CPAs) walk through how to fill out the new form 1099-NEC (Non-Employee Compensation) for 2021. Here, we explain how to fill it out, its example, who must file it, and comparison with form 1040.Form 1099-MISC is used to report miscellaneous compensation such as rents, prizes, and awards, medical and healthcare payments, and payments to an attorney. If you are selling a home, finding the cost basis is a little more involved. By . Starting tax year 2023, if you .

How to Fill Out a 1099 & Not Mess it Up

Form 1099: Reporting Non-Employment Income

Read on to answer all your questions regarding filling out a 1099 and .

What Is a 1099-MISC, and Who Gets One?

Avoidance Strategy: Mark your calendar with the filing deadlines—January 31st to send forms to recipients and the IRS (if reporting non-employee compensation on Form 1099-NEC) and February 28th (or March 31st if filing . If you’re getting started as a freelancer or your small business is contracting outside help, you’ve probably heard of IRS Form 1099.How to Fill Out a 1099 Form Step by Step. Getting a 1099 form doesn't mean you necessarily owe .

2020 Form 8889

A 1099 is a type of form that shows income you received that wasn't from your employer.The 1099-NEC lets you check a box for direct sales of $5,000 or more of consumer goods to a recipient for resale (Box 2) that aren’t reported instead on 1099-MISC.I'm going to show you how to fill out a 1099 form for independent contractors in 2023. Form 1099-NEC for non-employee compensation.The new Form 1099-NEC has replaced 1099-MISC to report nonemployee compensation. Paper Filing of 1099-MISC Forms in 2024. The handwriting must be completely legible using black ink block letters to avoid processing errors.Pitfall: Late filing of Form 1099 can result in penalties ranging from $50 to $270 per form, depending on how late the form is filed. Changes for eFiling vs. Form 1099-MISC used to be a self-employed person's best friend at tax .Learn to file and issue IRS 1099-MISC form for rents, royalties, and healthcare payments, including instructions and thresholds. Self-employed individuals must fill out a 1099-MISC form if they earned over $3000 in one year.A W-9 is a form filled out by independent contractors to provide tax information to the business employing them as long as they are paid $600 or more. Understanding the Different Types of 1099s First and foremost, you need to know the different types of 1099s.There are five different copies of the 1099-R Tax Form that both payers and their recipients should be aware of: Copy A: This is the red copy that is submitted to the IRS.

1099-MISC Form Template

You must use the official form. Copy B: This copy is for the recipient.on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code.

Filing out the IRS Form W-9 is not as straightforward as it may seem on first glance.The only catch? Filling out a 1099 tax form can be tricky, especially considering the rule changes in 2020.Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. What Is a 1099 Form, and How to Fill Out? Tax Preparation | Updated On February 1st, . Before you begin filling out the form, make sure you have all the required . CORRECTEDPAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Did you make payments to independent contractors during the year? If so, . You may also have a filing requirement. 1099-G for money received from government sources. You can get 1099-NEC forms from office supply stores, directly from the IRS, from your accountant, or using business tax software programs. This guide will answer all of your ‘How to fill out a . When the 1099 form is filled out, it serves as a crucial . Tax Preparation. To ease statement furnishing requirements, Copies B, 1, and 2 have been made fillable online in a PDF format available at IRS. What Is 1099 Form How To Fill Out A 1099 Form. One major change is a .Critiques : 153,5K

1099-MISC Form: What It Is and What It's Used For

gov/Form1099MISC and IRS.

Rachel Blakely-Gray | Feb 11, 2021.2020 Form 8889 instructions and example; Changes to 2020 Form 8889 tax form. Copy 1: This is submitted to the State Tax Department. 1099-LTC for receipt of.Payments through third-party networks—including credit card payments—are reported on Form 1099-K.Examples include: Form 1099-PATR for cooperative distributions.File Form 1099-MISC for each person to whom you have paid during the year: At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest. May 22, 2023 • 8 min read. The due date for furnishing copies of Form 1099 .Money reported on a 1099 form is generally taxable, but not always – for example, you’ll receive a 1099 reporting withdrawals from 529s and HSAs but the money may not be taxable if you used it .Filling out a 1099 tax form can be tricky, especially considering the rule changes in 2020.Who Gets A 1099?

How to Fill Out Form 1099-MISC

IRS 1099-MISC Form: Filing Instructions, Usage, & Online Submission

Filling out a 1099 form accurately is essential for both payers and recipients to ensure compliance with IRS regulations.

Form 1099

Along with paystubs or invoices, you should receive this form in the mail from each employer you worked for during the year.

Form 1099-MISC Explained: Instructions and Uses

If you choose to paper-file Form 1099-NEC, here are the steps you need to follow: Download and print Form 1099-NEC from the IRS website.

What Is a 1099 Form, and How Do I Fill It Out?

While this article does not detail every entity structure one may find themselves in, it will explore some of the most common entity structures. This article is Tax Professional approved .Am I Required to File a Form 1099 or Other Information Return? | Internal Revenue Service.Except as expressly permitted in your license agreement or allowed by law, you may not use, copy, reproduce, translate, broadcast, modify, license, transmit, distribute, exhibit, perform, publish, or display any part, in any form, or by any means. January 2024) Nonemployee Compensation. Reverse engineering, disassembly, or decompilation of this software, unless required by law for interoperability, .The 1099 form is a tax document used in the United States to report various types of income other than salaries, wages, and tips. The 1099-MISC is an 8 page document, but there’s only one form that needs be filled out (the document includes several copies of the same form, which are filed in the Payer’s records, sent to the Payee, and submitted to both the IRS and your state’s tax department.

If box 2 is checked on Form(s) 1099-DA and NO adjustment is required, see the instructions for your Schedule D (Form 1040), as you may be able to report your .FORM SSA-1099 - SOCIAL SECURITY BENEFIT STATEMENT 2020 • PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 5 MAY BE TAXABLE INCOME.Filling out Form 8949 may take a little time, but it isn’t a complex form to fill out. These are examples of 1099-MISC forms for 2023: These are examples of 1099-MISC forms for 2023: Skip to Content; Skip to Search; .Simply fill out the form, review and transmit it to the IRS, and share the recipient copy. But what is it, exactly? Here’s everything you need to .

Fill Out A 1099-MISC Form

Crop insurance proceeds.Investing fundamentals. Bryce Warnes-Reviewed by.

How to fill out a 1099 form

If you have stocks, your broker’s 1099 should provide all of the necessary information. 10 or more returns: E-filing now required.How to Fill Out a 1099-NEC: Your Complete Guide. Fill out the recipient's name, address, TIN, and compensation amount in the required boxes. This guide will answer all of your ‘How to fill out a 1099’ questions and help you stay in the IRS’s good books.Updated on January 12, 2022. These are examples of 1099-MISC forms for 2023: These are examples of 1099-MISC forms for . Cash payments for fish (or other aquatic life) you purchase .These are examples of 1099-MISC forms for 2023: Previous Next JavaScript must be enabled to correctly display this content 1099 Year-End Processing Guide; 1099-MISC Form Sample; 1099-MISC Form Sample.Find out about what the 1099-NEC form is, why you received it, what to do with a 1099-NEC form, and how to report and pay taxes on 1099-NEC income. Complete your personal details in the box in the top-left corner, including your full names, home address, . If, for example, a business pays an independent contractor through PayPal, the contractor may receive a Form 1099-K from PayPal for those direct sales. In this case, paper filers file Form 1099-MISC with the IRS by February 28, 2024. The following is an example basis calculation on a real estate sale: Purchase price: $250,000 If your someone who's been paying independent contractors, you'll want. No longer, they have . The IRS Form 1099 is a critical instrument . Beneficiary's Scial Security Number Box 5.

1099-MISC Instructions and How to Read the Tax Form

Benefits Paid in 2020 4.

See the Instructions for Form . Until 2020, it also was used to . The form requires an individual to provide their name, address, tax qualification, and withholding requirements. Here’s a step-by-step guide to help you navigate the process: Step 1: Gather Necessary Information. Prizes and awards.For example, a 1090-MISC for 2023 calendar year payments has a due date in 2024. In a prior year, non-employee compensation was reported on Form 1099-MISC. 1545-0116 For calendar year.Nerdy takeaways.Small business owners must submit a yearly 1099-MISC tax form for each independent contractor paid over $600 in that year. What Is Form 1099-NEC? Who Receives Form 1099-NEC? When Is Form 1099-NEC Due? Where To Get Form 1099 .Step One: Enter your information in the 'payer' section.Temps de Lecture Estimé: 7 minThese are examples of 1099-MISC forms for 2023: . Other income payments. Use the IRS’s online Tax Withholding Estimator and include the estimate in step 4 (explained below) when applicable. January 25, 2023.Questions Answered:Is the 1099-NEC only for b. Department of the Treasury - Internal Revenue Service.The 1099-MISC is a common type of IRS Form 1099, which is a record that an entity or person — not your employer — gave or paid you money.Step 1: Identifying the Recipient and Payer.These are examples of 1099-MISC forms for 2023: Previous Next JavaScript must be enabled to correctly display this content 1099 Year-End Processing Guide; 1099-MISC Form Sample ; 1099-MISC Form Sample.

Form 1099-R Instructions For 2023

Box 2: Royalties. Electronic filers file Form 1099-MISC with the IRS by April 1, 2024. The major change to the 2020 Form 8889 is that the IRS has gone “green” and reduced the form to 1 page.