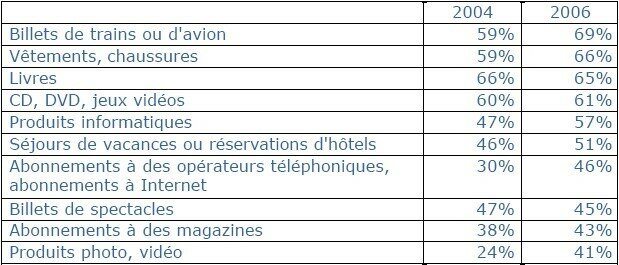

2017 irs tax tables 1040

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

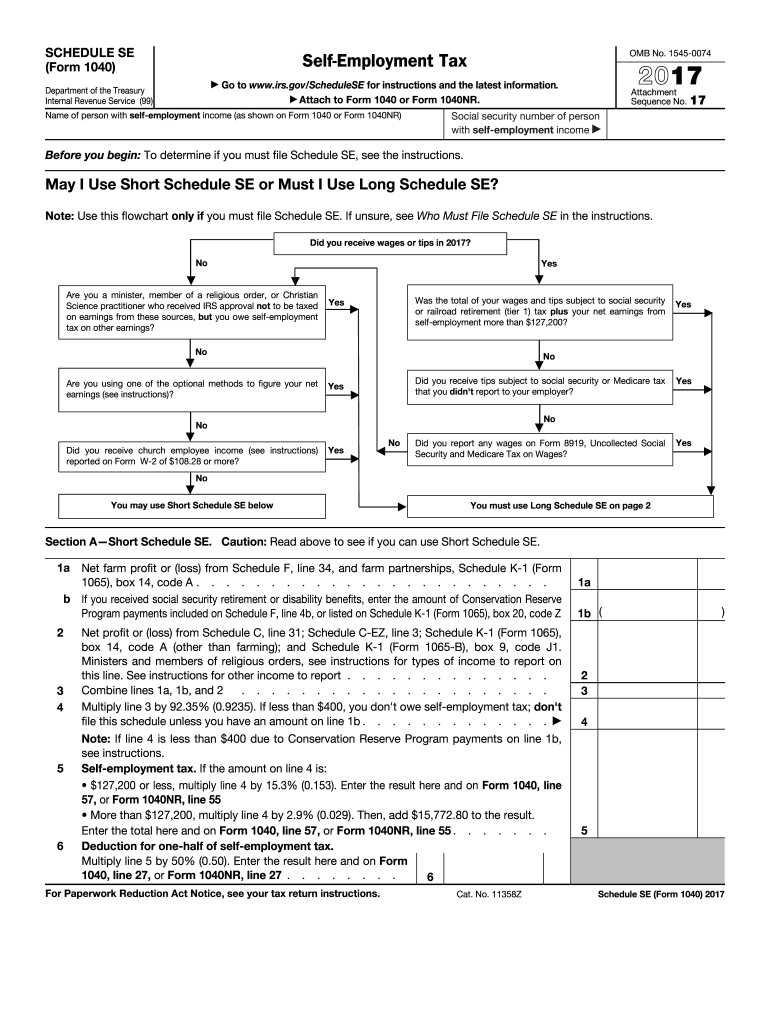

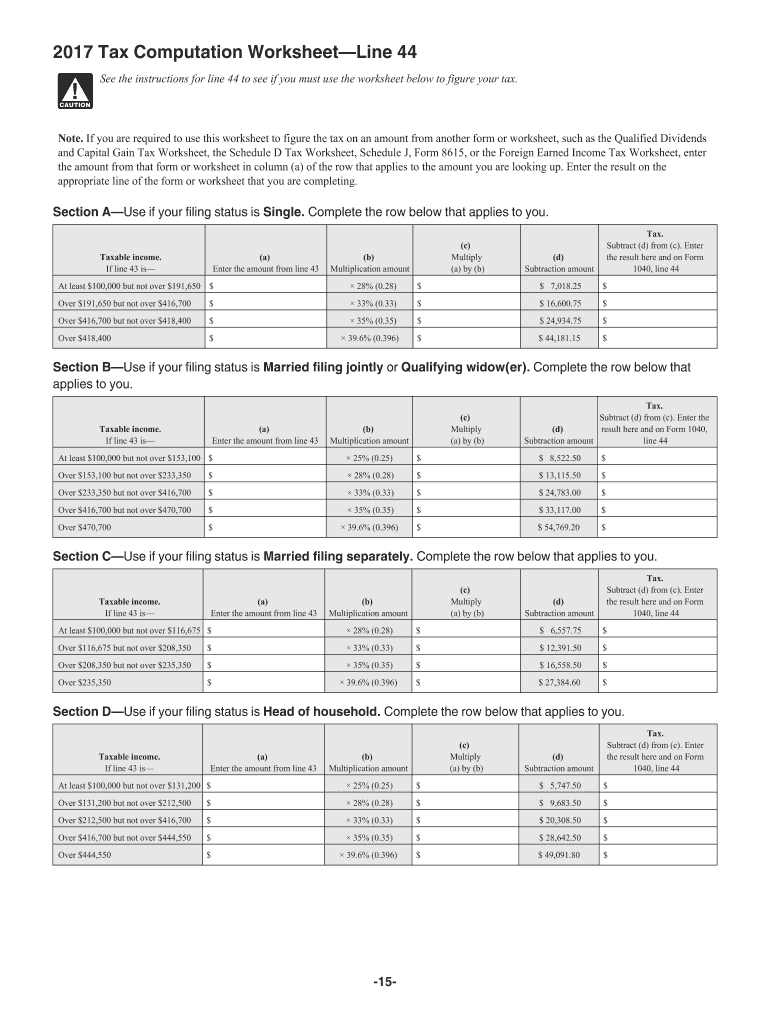

2018 Individual Tax Rate Table If your filing status is Single: If your . On the dotted line next to line 36 or line 34, (depending on which form is filed), enter the amount . This is the tax amount they should enter on Form 1040, line 44.

Capital Gains and Losses

Next, they find the column for married filing jointly and read down the column.

2017 Instruction 1040A

Individual Income Tax Return 2023 Department of the Treasury—Internal Revenue Service .2017 Tax Table k! See the instructions for line 44 to see if you must use the Tax Table below to figure your tax.Taille du fichier : 5MB Download the 2017 Tax Forms on this Page and Mail Your 2017 Tax Return.

US Tax Tables 2017 [for 2018 Tax Returns]

The tax bill is now $5,226. Alternative Minimum Tax The Alternative Minimum Tax (AMT) was created . IRS Use Only—Do not write or staple in this .gov/Forms, and for the latest information about developments related to Forms 1040 .

2022 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

Taille du fichier : 182KB

2017 Tax Brackets

2017 withholding tables.

2017 Form 6251

Visit our Get Transcript frequently asked . A citation to Your Federal Income Tax (2023) would be appropriate. 1545-0074 IRS Use Only—Do not write or staple in . Last name Your social security .

2018 Tax Brackets, Rates & Credits

If you have any troubles, use the Wizard Tool.2017 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions.The 2017 Tax Calculator uses the 2017 Federal Tax Tables and 2017 Federal Tax Tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.Tax Saver's Glossary; Helpful IRS Publications; Share. These instructions cover both Forms 1040 and 1040-SR.gov/ScheduleA for instructions and the latest .50) and add that to the existing 5,226.

Formore information on IRS Free File and e- le, seeFree Software Options for Doing Your Taxes . 2017 Personal Exemption Phaseout Filing Status Phaseout Begins Phaseout Complete Single $261,500 $384,000 Married Filing Jointly $313,800 $436,300 Head of Household $287,650 $410,150 Married Filing Separately $156,900 $218,150 Source: IRS. Married Individuals . NOTE: THIS BOOKLET DOES NOT CONTAIN ANY TAX FORMS. The IRS will begin processing paper and electronically filed federal income tax forms on January 29, 2018. The personal exemption amount for 2017 . You'll find the 2017 tax rates, standard deductions, personal exemptions, and .2017 Tax Table. Check only one box. The next $53,949 in taxable income is subject to a 25% tax rate.You Can no Longer e-File 2017 Federal IRS Income Tax Forms and Schedules. Insert images, crosses, check and text boxes, if it is supposed. Get transcript by mail. Instructions for Form 1040 PDF Tax Table from Instructions for Form 1040 PDF Schedules for Form 1040 Form 1040-SR PDF Form W-4 Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax .

Transcripts arrive in 5 to 10 calendar days at the address we have on file for you. File Form 1040 or 1040-SR . The amount shown where the taxable income .Fill in all the info required in IRS 1040 Tax Table, utilizing fillable fields. See instructions .During 2017, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? If “Yes,” you may have to file Form 3520. See separate instructions.Their taxable income on Form 1040, line 43, is $25,300.6% only on income above $418,401 (above $470,001 for married filing jointly); the lower tax rates are levied .1040A INSTRUCTIONS IRS Departmentofthe Treasury InternalRevenue Service IRS. (You can t claim the premium tax credit on Form 1040EZ. November 10, 20165 min read By: Kyle Pomerleau. In order to file a 2017 IRS Tax Return, follow these simple steps to fill out your 2017 Tax Forms online for free: Start with the 2017 Calculators to get an idea of your 2017 Taxes. First, they find the $25,300–25,350 taxable income line. Single Married filing jointly.

2017 Schedule A (Form 1040)

You can print, fill-in, and mail your 2017 Form 1040 before . The amount shown where the taxable income line and filing status column meet is $2,929.2017 tax table to use with Form 1040. Repeating info will be added automatically after the first input.The Internal Revenue Service (IRS) has announced the updated numbers for 2017. Withholding allowance. You will receive some tips for much easier finalization.1040 INSTRUCTIONS 2017 Geta fasterrefund, reduce errors, and save paper.This page provides detail of the Federal Tax Tables for 2017, has links to historic Federal Tax Tables which are used within the 2017 Federal Tax Calculator and has supporting .1040 Department of the Treasury—Internal Revenue Service (99) U.

2021 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

(IRS) of: • Tax laws enacted by Congress, • Treasury regulations, and • Court decisions.Credit Tables from the Instructions for Form 1040 (and 1040-SR). Our online Annual tax calculator will automatically work .Find out your 2017 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married . Individual Income Tax Return 2021 Department of the Treasury—Internal Revenue Service (99) OMB No.taxable income on Form 1040, line 43, is $25,300.Access IRS forms, instructions and publications in electronic and print media.

2017 Form 1040

Qualified small business payroll tax credit for inUS Tax Calculator 2017 [for 2018 Tax Return] This tool is designed to assist with calculations for the 2018 Tax Return and benchmarking for the 2017 Tax Year. The remaining $11,650 of taxable is moved onto the next tax bracket. Individual Income Tax Return 2017 OMB No. Department f ohe trTeasury ntIernal evR enue Service . Schedule B (Form 1040A or 1040) 2017 In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. First, they find the $25,300-25,350 taxable income line.gov 2017 Geta fasterrefund, reduce errors, and save paper.

INDIVIDUAL TAX RATE TABLE 2018

The maximum Earned Income Tax Credit in 2018 for single and joint filers is $520, if the filer has no children (Table 9). For tax year 2018, an excess deduction for IRC section 67(e) expenses is reported as a write-in on Schedule 1 (Form 1040), line 36, or Form 1040-NR, line 34. Form 1040-SR, a new form, is available for use by taxpayers age 65 and older.Tax Rates, 2017 1 For Tax Years 1988 through 1990, the tax rate schedules provided only two basic rates: 15 percent and 28 percent. Find out your 2017 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate returns, and estates and trusts. To see if you were impacted by one of the Presidentially declared disasters eligible for this re-lief or to get more information about disaster tax relief, see The total tax bill is now $8,138.

Get Transcript

If you did not complete either worksheet for the regular tax, enter the amount from Form 1040, line 43; if zero or less, enter -0-.

Prepare, print, and e-file your federal tax return for free!

Every year, the IRS adjusts more than 40 tax provisions for inflation .Form 1040 Department of the Treasury—Internal Revenue Service (99) U.For information about any additional changes to the 2023 tax law or any other developments affecting Form 1040 or 1040-SR or the instructions, go to IRS.As the calendar turns to 2017, taxpayers across the nation are turning their attention to the IRS Tax Tables 1040.Include the amount of the adjustment in the total amount reported on line 22 or line 34.

SCHEDULE A (Form 1040) Department of the Treasury Internal Revenue Service (99) Itemized Deductions Go to www.Credit Tables from the Instructions for Forms 1040 and 1040-SR.

2017 Instruction 1040EZ

Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) If you checked .

2017 Publication 17

Tax return or tax account transcript types delivered by mail.

2023 Form 1040

The credit is $3,468 . Formore information on IRS Free . Select the applicable forms below and open them in the editor.2017 Tax Brackets. However, we only have $11,650 left. IRS Use Only—Do not write or staple in this space. 2017 Personal Exemption Phaseout Filing Status Phaseout Begins Phaseout Complete Single $261,500 $384,000 Married Filing Jointly $313,800 $436,300 .and wish to claim the premium tax credit on Form 1040, 1040A, or 1040NR. 2017 Federal Income Tax Brackets. iCalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. 31, 2023, or other tax year beginning , 2023, ending , 20 . See Latest Version Download PDF. For the year Jan. These tables provide important answers to questions about how much you owe in taxes and, more importantly, how much you will get back in refunds. This publication includes the 2017 Percentage Method Tables and Wage Bracket Ta-bles for Income Tax Withholding.

Individual Income Tax Rates, 2017

2017 Federal Tax Information This guide includes the Internal Revenue Service (IRS) declared tax rate schedules, tax tables and cost of living adjustments for certain tax . At Least But Less Than SingleMarried ling jointly* Married ling sepa-rately Head of a house-hold Your taxis 25,200 25,250 25,300 25,350 3,318 3,325 3,333 3,340 Sample Table 25,250 25,300 25,350 25,400 2,851 2,859 2,866 2,874 3,318 . The amount shown where the taxable income line and filing status column meet is $2,906. File your tax return by April . Due date of return. For Paperwork Reduction Act Notice, see your tax return instructions.253 2017 Tax Computation Worksheet. Your first name and middle initial .265 2017 Tax Rate .Earned Income Tax Credit. However, taxable income over certain levels .Taxpayers over the age of 65 could use the 7.