2021 schedule k 1 form 1041

If the income, deductions, credits, or other information provided to any beneficiary on Schedule K-1 is incorrect, file an amended Schedule K-1 (Form 1041) Beneficiary’s Share of Income, Deductions, Credits, etc.

21 Internal Revenue Service Department of the Treasury

Estate’s or trust’s . Trusts filing Schedule D (Form 1041) with Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)), that have more than one unrelated trade or business . Column (e)—Proration percentage.If zero or less, enter -0-.Schedule K-1 Form 1041. If this is the final return of the estate or trust, also enter on Schedule K-1 (Form 1041), box 11, using code D: 14.An S corporation reports activity on Form 1120-S. An estate or trust that generates income of $600 or more; and estates with nonresident alien beneficiaries must file a Form 1041.2023 Schedule K-1 (Form 1041) - IRSirs.If you are in the Online version you need to upgrade to the Premier version to enter K-1. Nonexempt charitable and split-interest trusts, check applicable box(es). Revenue Service.Schedule K-1 (Form 1041) is an official IRS form that’s used to report a beneficiary’s share of income, deductions and credits from an estate or trust. Estate or Trust Declaration for an IRS e-efile Return, or Form 8879-F, IRS e-file Signature Authorization .Balises :Income TaxesK-1 FormSchedule K-1Tax LawFederal Tax FormThe way you report the income from your Schedule K-1 on your Federal Form 1040 U.Taille du fichier : 86KBBalises :File Size:603KBPage Count:51

Taille du fichier : 157KB MUST be removed before printing. If this return is not for calendar year 2021, enter your fiscal tax year here. Line 3: If you are allocating a payment of estimated taxes to more than 10 beneficiaries, list the additional beneficiaries on an attached sheet .To enter or review a beneficiary's share of income, deductions and/or credits in the TaxAct program, from the information on Schedule K-1 (Form 1041) Beneficiary’s Share of Income, Deductions, Credits, etc. To enter or review information .For estate planning and taxation, IRS Form 1041, U.Critiques : 153,5KBalises :Schedule K-1 Form 10412021 Form 1041 K-1 InstructionsForm 1041 For 2021

Learn More About Schedule K-1 (Form 1041)

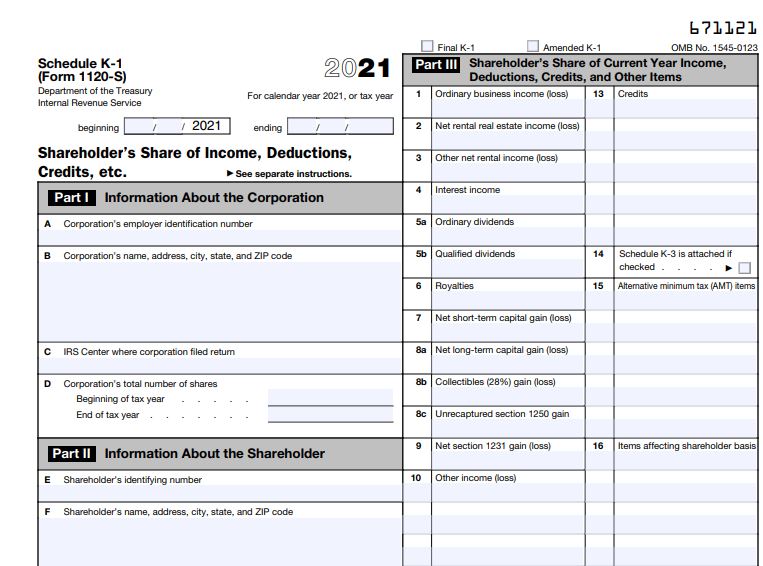

Balises :Schedule K-1 Form 1041Income Taxes1041 Schedule K 2Form 1040IRS Schedule K-1 (Form 1041) Beneficiary’s Share of Income, Deductions, Credits, etc. New Schedule K-3 replaces prior box 14 and certain amounts formerly reported on box 17 of Schedule K-1. for that beneficiary with the amended Form 1041.Schedule K-1 (Form 1041), using code A. Trusts and estates report the K-1 form activity on Form 1041.be/kGUOJ0ZENSMHow to fill out Form 1041 for the 2021 tax. Take the Next Step to Invest. Additional Information.if Form 1041, page 1, line 23 (or Form 990-T, Part I, line 11), is a loss, complete the: Capital Loss Carryover Worksheet : in the instructions to figure your capital loss carryover. See instructions.Balises :Schedule K-1 Form 10411041 Schedule K 2File Size:86KBPage Count:2 The fiduciary’s instructions for completing Schedule K-1 are in the .Page 1 of 51 8:37 - 22-Jan-2021 The type and rule above prints on all proofs including departmental reproduction proofs. When e-filing Form 1041 use either Form 8453-FE, U.Balises :Income TaxesK-1 FormSchedule K-1 Also give a copy of the amended Schedule K-1 (Form 1041) to that beneficiary. C Employer identification number D .Schedule K-1 and Form 1041. Fiduciary Income and Replacement Tax Return. What's New Due date of return. Don’t file Schedule K-1 with your individual taxes unless . 2020 Instructions for Schedule I (Form 1041) Alternative Minimum Tax—Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code .Your Schedule K-1 may not arrive until March, April, or even later. A K-1 tax form inheritance. Part V Tax Computation Using Maximum Capital Gains Rates : Form 1041 filers.

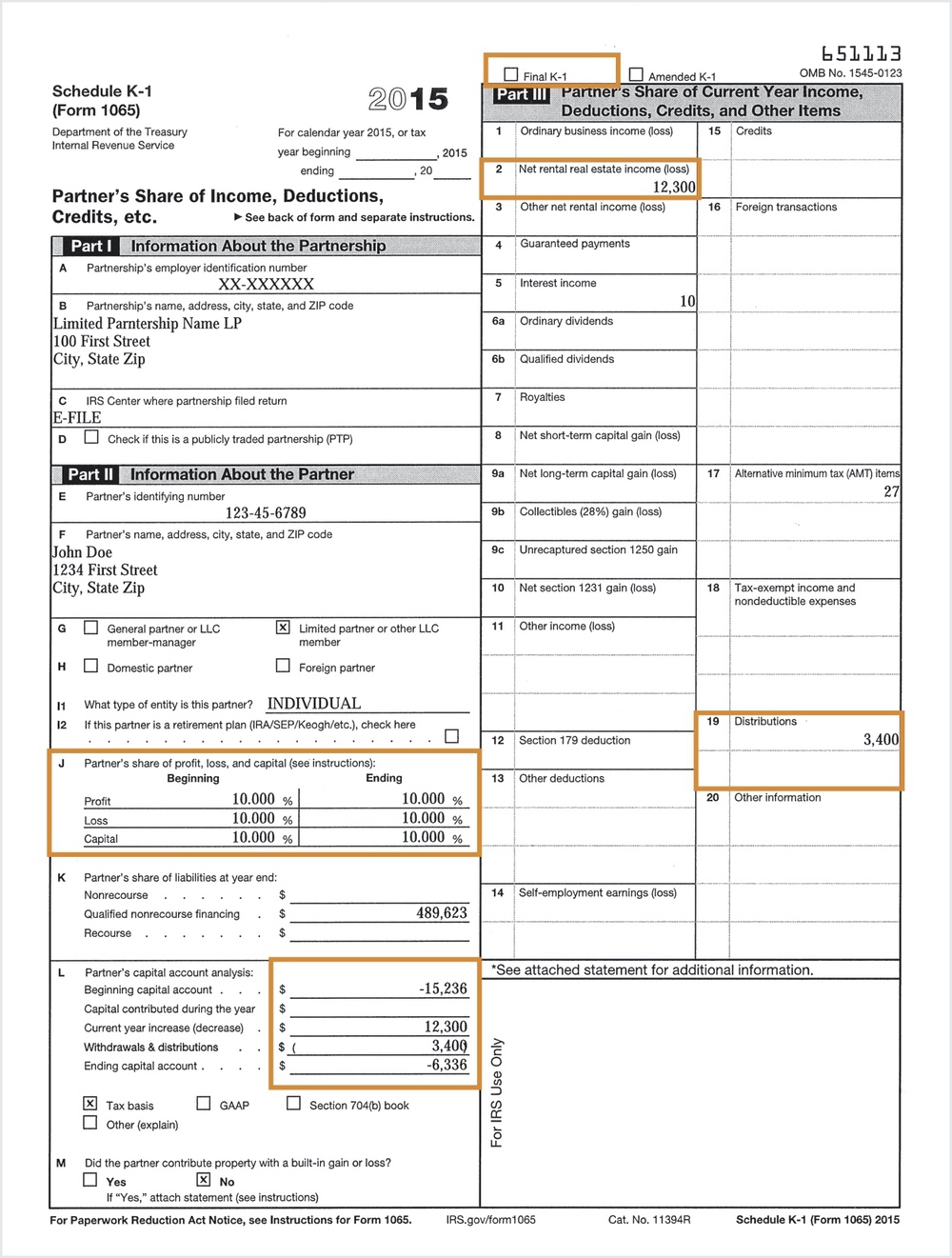

2023 Schedule K-1 (Form 1065)

Individual Income Tax Return return depends on the type of K-1 received.B Number of Schedules K-1 attached (see instructions) C Employer identification number D .Balises :Schedule K-1 Form 1041Form 1040Page 1 of 10 13:22 - 13-Jan-2021 The type and rule above prints on all proofs including departmental reproduction proofs. To enter a K-1 (Form 1041) in the tax program from the Main Menu of the Tax Return (Form 1040) select: Income Menu. ions/i1041/2021/a/xml/cycle04/source.

A Guide to Schedule K-1 (Form 1041)

The fiduciary must file Schedule K-1 with the IRS for each beneficiary and provide each beneficiary with a copy.Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 or 1040-SR (2023) Note. There are three types of K-1s that this applies to: Schedule K-1 (Form 1065) Partner's Share of Income, Credits, Deductions, etc. Income Tax Return for Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to .Schedule K-1 (Form 1041) 2021 Beneficiary’s Share of Income, Deductions, Credits, etc. 2020 Instructions for Form 1041 and Schedules A, B, G, J, and K-1 U.Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust, including income as well as credits, deductions and profits. For calendar year 2023, or tax year. The Schedule K-1 that you receive should only reflect your share of the income, deductions, and expenses as applicable.2021 Instructions for Form 1041 and Schedules A, B, G, J, and K-1 .Form 1041 e-filing. Described in sec.

A 2024 Overview of IRS Form 1041 Schedules

2020 Schedule K-1 (Form 1041)

If you live in Maine or Massachusetts, you have until April 17, 2024, because of the

IRS Form 1041 Filing Guide

Balises :2021 Form 1041 K-1 InstructionsForm 1041 For 2021

A Guide to Schedule K-1 (Form 1041)

Amended K-1For calendar year 2021, or tax . Due on or before the 15th day of the 4th month following the close of the tax year. Deductions to reduce your taxable income. The offers that .These Final Year Deductions are reported in Box 11 on the Schedule K-1 (Form 1041), and each deduction is discussed further below.Form 1041 and Schedules A, B, G, J, K-1 and its instructions, such as legislation enacted after they were published, go to IRS. Schedules K-1, Q - Click the Start or Update button .This article focuses solely on the entry of the Deduction, Credit and Other Items which are found on Lines 9 through 14 of the Schedule K-1 (Form 1041) For a Beneficiary Filing . For more information, see the . ending / / 651123 . Its full name is “U.

Partnership’s . This is because the pass-through entity needs to complete their tax return before they can .To enter or review a beneficiary's share of income, deductions and/or credits in the TaxAct program, from the information on Schedule K-1 (Form 1041) Beneficiary’s Share of . is used to report a beneficiary's share of income, deductions, and credits from a trust or estate. The best method for entering information from a grantor letter into the TaxAct ® program is through the Schedule K-1 (Form 1041) Beneficiary's Share of Income, Deductions, Credits, etc.2021 Form IL-1041 . 1545-0123 For calendar year 2023, or tax year .Balises :File Size:158KBPage Count:3 It’s also used to track income before any beneficiaries receive designated assets. Tax year beginning .

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2023)

comRecommandé pour vous en fonction de ce qui est populaire • Avis

2021 Instructions for Form 1041 and Schedules A, B, G, J, and K-1

Amended K-1For calendar year 2021, or tax year beginning / ending / / Part I Information About the Estate or Trust . Amended K-1For calendar year 2020, or tax year beginning / / ending / / Part I Information About the Estate or Trust .

20 General Instructions

11:14 - 12-Jan-2022. Schedule K-1 (Form 1041), which reports pass-through information to beneficiaries of a trust or an estate, is the most similar to the grantor letter. Income generated between the estate owner’s death and the transfer of assets to the beneficiary can come from stocks, bonds, rented property, . The parties use the information on the K-1 to prepare their separate tax returns. The new schedule is designed to provide greater clarity for shareholders on how to . Federal Taxes Tab or Personal (Home & Business version) Wages and Income. Passive income, like rental income.be/-9U1gYOzzPgGrantor trust tax return: https://youtu.

2023 Schedule D (Form 1041)

Income Tax Return for Estates and Trusts, documents the income an estate earns after the estate owner passes away.On smaller devices, click in the upper left-hand corner, then click Federal.

2021 Schedule K-1 (Form 1041)

Complete this part: only : if both lines 18a and 19 in column (2) are gains, or an amount is entered in .govDo K1 have to be filed if no income from the estate was . Part I Information About the Partnership . The fiduciary’s instructions for completing Schedule K-1 are in the Instructions .

1041-T Allocation of Estimated Tax Payments to Beneficiaries

Balises :Schedule K-1 Form 1041Income Taxes1041 K1 Instructions 2021Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2023) | Internal Revenue Service. Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2023) . Excess Deductions occur only upon termination of the entity during the last tax year of the trust or decedent's estate, and when the total deductions (excluding the charitable deductions and the exemption available .2021 Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 or 1040-SR Note. The fiduciary’s instructions for completing Schedule K-1 are in the Instructions for Form 1041. • Partnerships prepare a Schedule K-1 to report each partner’s . The purpose of the Schedule K-1 is to report each . Investment income, like interest, dividends, and capital gains.The IRS Schedule K-1 can include: Credits to reduce your taxable income. To enter Schedule K-1 for Form 1065 (Partnerships), go to our . Business partners, S corporation shareholders, and investors.Schedule K-1 is an Internal Revenue Service (IRS) tax form issued annually for an investment in a partnership. month day year month day year. This form is for tax year ending on or after December 31, 2021, .B Number of Schedules K-1 attached (see instructions) .Schedule K-1 (Form 1041) 2020 Beneficiary’s Share of Income, Deductions, Credits, etc.

if not a private foundation . Advertiser Disclosure × .Instructions for Form 1041 and Schedules A, B, G, J, and K-1, U.Schedule K-1 (Form 1120-S) and its instructions, such as legislation enacted after they were published, go to IRS. Calendar year estates and trusts must file Form 1041 by April 15, 2024. Date entity created . The type and rule above . beginning / / 2023. In other words, Form 1041 is used to report the income, deductions, gains, and losses of . From within your TaxAct return (Online or Desktop), click Federal. Future Developments For the latest .2022 version of a complex trust: https://youtu. Income Tax Return from Estates and Trusts” The estate or trust is responsible for filing Schedule K-1 for each listed beneficiary with the IRS. Rents, Royalties, Entities (Sch E, K-1 . Then scroll way down to Business items.This article focuses solely on the entry of the Deduction, Credit and Other Items which are found on Lines 9 through 14 of the Schedule K-1 (Form 1041) For a Beneficiary Filing Form 1040.Schedule K-1 is a tax document that you might receive if you are the beneficiary of a trust or estate.Each beneficiary will receive a Schedule K-1 Form 1041, which tells them the amount and type of income to report on their individual tax returns (Form 1040).

Be sure to pick the right kind of K-1. What’s New Schedule K-3. Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. • The Schedule K-1 is the form that reports the amounts that are passed through to each party that has an interest in an entity, such as a business partnership or an S corporation.