2024 mortgage refinance options

20% in 2024 and 0.If you're interested in refinancing your mortgage to get a lower rate or achieve another financial goal, check out our list of some of the best refinance lenders. Summary of Top Lenders. But they could drop later in 2024.What mortgage relief options are available in 2024? Best Mortgage Refinance Lenders 2024. Not ideal for lenders with poor credit.Streamline Refinance Loan Option In Early 2024.05) 10-year fixed refinance.

Mortgage Refinance Options Apr 2024

Lastly, these days there's a better than ever chance that . PNC Bank: Best for Medical Professionals.

Cash-Out Refinance Guide

Rate-and-term refinancing is the most straightforward form of refinancing.

Best for a credit union: PenFed .Bank of America is the best bank for mortgage refinances in many situations as you can apply online or at one of its many branch locations nationwide. This institution . The current 30-year, fixed-rate mortgage refinance rate is averaging 7.Best for no lender fees: Ally Bank. The average 15-year fixed refinance APR is 6. Best for Customer Service: AmeriSave . Navy Federal (NLMS# 399807) has mortgage refinancing options with flexible loan terms ranging from 10 to 30 years.A 20-year fixed-rate mortgage refinance of $100,000 with today’s interest rate of 7. Mortgage Refinance Options . With current interest rates well above that mark, there is little motivation to sell and then finance a new home at a higher interest rate. What is Mortgage Refinancing? Reasons for Refinancing. Refi options include VA loans, interest rate reduction refinance loans (IRRRL), conventional mortgages, and fixed loans.Here are the average annual percentage rates (APR) on 30- and 15-year fixed mortgage refinances and 5/1 ARM refinances: Featured Partner Offers.14% and the 52-week low was 6. March 1, 2024, 2:30 AM UTC 11 MIN.

Refinancing A Mortgage: How It Works

If interest rates begin to drop closer to 6% or below in 2024, we would expect more homes for sale to hit the market. In their April housing market forecast, Fannie Mae researchers maintained their . Mortgage loan interest rates are too high at press time to consider using an FHA streamline refinance option. Table of Contents. If you need extra cash to cover expenses, a cash .When you refinance your mortgage, you must pay closing costs to the lender.For the most part, though, it’s probably best to wait until after the start of 2024 to refinance.Advertiser Disclosure.

Mortgage Interest Rates Today, April 23, 2024

Rate-And-Term Refinance.

Current Mortgage Rates: Compare Today's Rates

30-Year Refinance Rates

Updated April 25, 2024 at 9:48 am.No, the USDA refinance program does not offer a cash-out option. low closing cost mortgage, no cost refinance mortgage, low cost refinance mortgage, adverse market refinance fee, smart refinance us bank, refinance mortgage without closing costs, refinance without appraisal and closing costs, low closing cost refinance mortgage Yes, I inspired my family will . 24, 2024, compared with one week . by Tim Lucas in Home Loans. If the Fed moves forward with interest rate cuts, mortgage rates could follow suit later in the year.Cash-out refinances give you access to lower interest rates than most other lending options, including credit cards.

Should You Refinance Your Mortgage In 2024?

80% of all mortgages that were outstanding as of March 2022 will come up for renewal in 2024.05) Today’s average mortgage rates on Apr.Refinance Mortgage Maine 🏢 Apr 2024.Today's national 30-year refinance rate trends.

Today’s 30-Year Refinance Rates

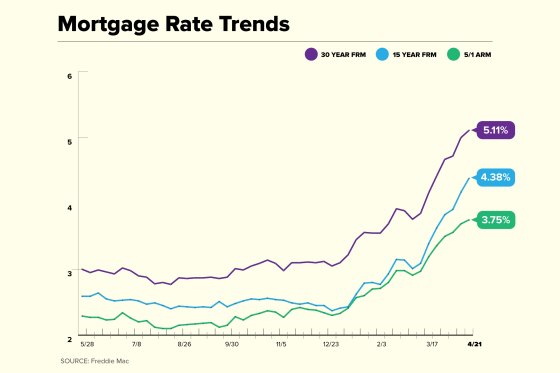

However, with lower monthly payments you improve your personal finances and may thus have more disposable income to pay off debts or spend however you want.Both fixed and variable mortgage rates have increased significantly since early 2022 due to rate hikes and a volatile bond market. On Thursday, April 25, 2024, the national average 30-year refinance interest rate is 7. Rocket Mortgage is known for its streamlined online mortgage process.

Second Mortgage Refinancing: Your Options

Zillow Home Loans offers a convenient online mortgage experience, including a speedy pre-qualification process with only a .

How to Refinance Your Mortgage: Complete Guide

64% will cost $814 per month in principal and interest. You might not be thinking about refinancing your mortgage right now, but with a Federal Reserve rate cut on the table for some time this year, you could be . Organizations like the Mortgage Bankers Association, along with prominent economists, often offer their predictions based on market trends, financial data, and historical patterns. Refinance Options Aren’t Great for Homeowners: Mortgage Refinance Rates for April .The lender is accredited by the BBB with an A+ rating and slightly shy of a 5-star rating from over 1,200 customer reviews as of August 2020. Rate-and-Term Refinance.10% increase in 2024 and .Compare today’s refinance rates.Under Mutual of Omaha’s mortgage umbrella are several options, including conventional, jumbo, FHA, VA and USDA mortgages. Best Overall: Quicken Loans (Rocket Mortgage) Best All-in-One Service: Nationwide Home Loans.The current average 30-year fixed mortgage rate is 6.

Best Mortgage Refinance Lenders Of April 2024

Best for Customer Service: AmeriSave Mortgage.

Types Of Mortgage Refinance: Top 9 Options

9 stars - 1442 reviews.Get a free quote. Which refinance loan is best for your situation? To help you compare refinance options, here are some of the latest average rates for the most common types of fixed-rate refinance home loans, including ones insured . Best for saving money: SoFi. Second Mortgage Refinance Options.While it’s challenging to predict mortgage rates with absolute certainty, some general trends and expectations can be outlined for 2024: 1.Zero Closing Cost Mortgage Refinance 🏢 Apr 2024. When to Consider Refinancing. You also need to know how refinancing differs from other mortgage options, like loan . It is primarily designed to reduce loan rates and monthly payments on the original loan amount.

Considering a mortgage refinance or home equity loan? Refinancing your mortgage or get a home equity loan offers you the opportunity to save money or pull out equity and improve your financial situation. It’s a good idea to use a mortgage refinance calculator to figure out your break-even point after accounting for refinancing expenses. With physician mortgage lenders frequently changing eligibility requirements and program offerings, it can make it difficult to track down your options.30-Year Refinance Rates Chart. RefinancingA