401k life insurance cash value

Choosing life insurance vs.Balises :Cash Value in Life InsuranceRetirementPolicyCalculation From 2010 through 2016, the average 401(k) account increased at a compound average growth Tweak your numbers below.Balises :RetirementIncome401k Life Insurance

Life Insurance Retirement Plan (LIRP)

Lastly, you can distribute the policy from your 401(k).

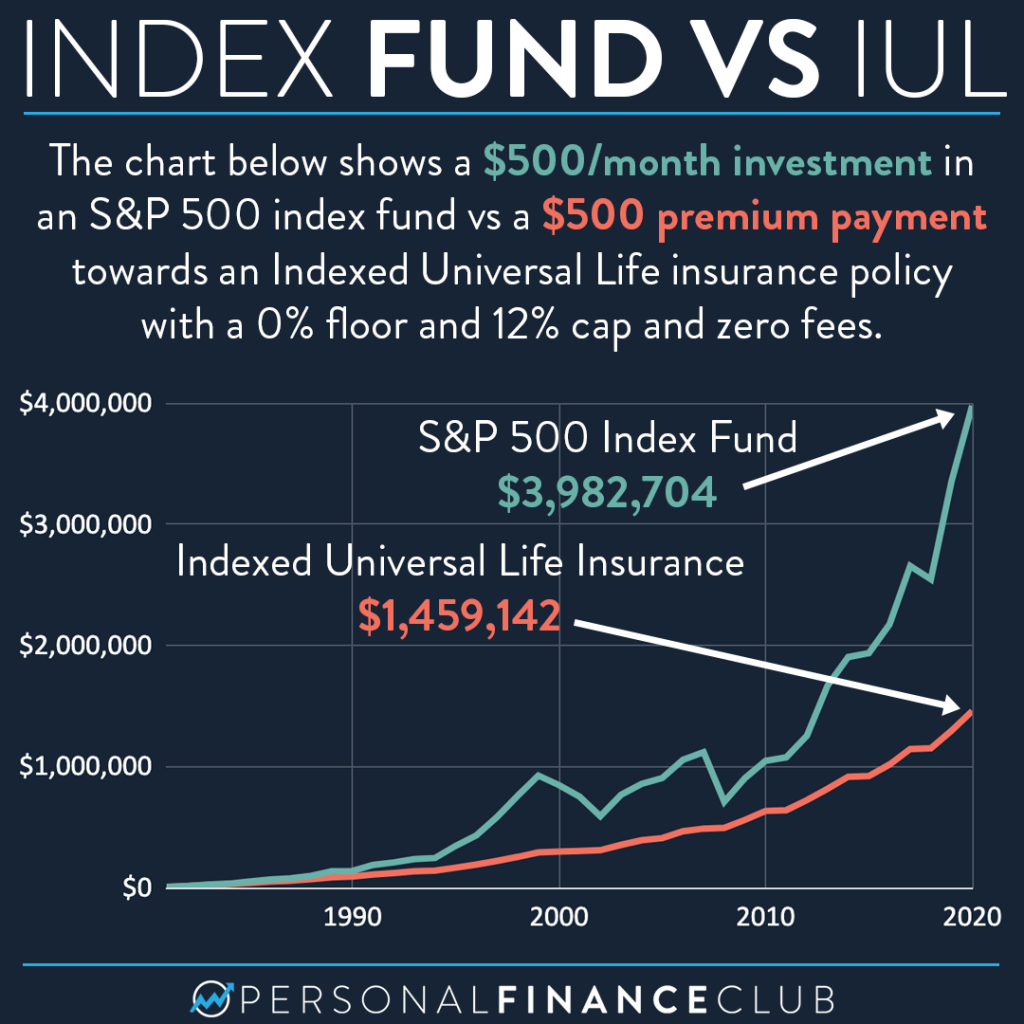

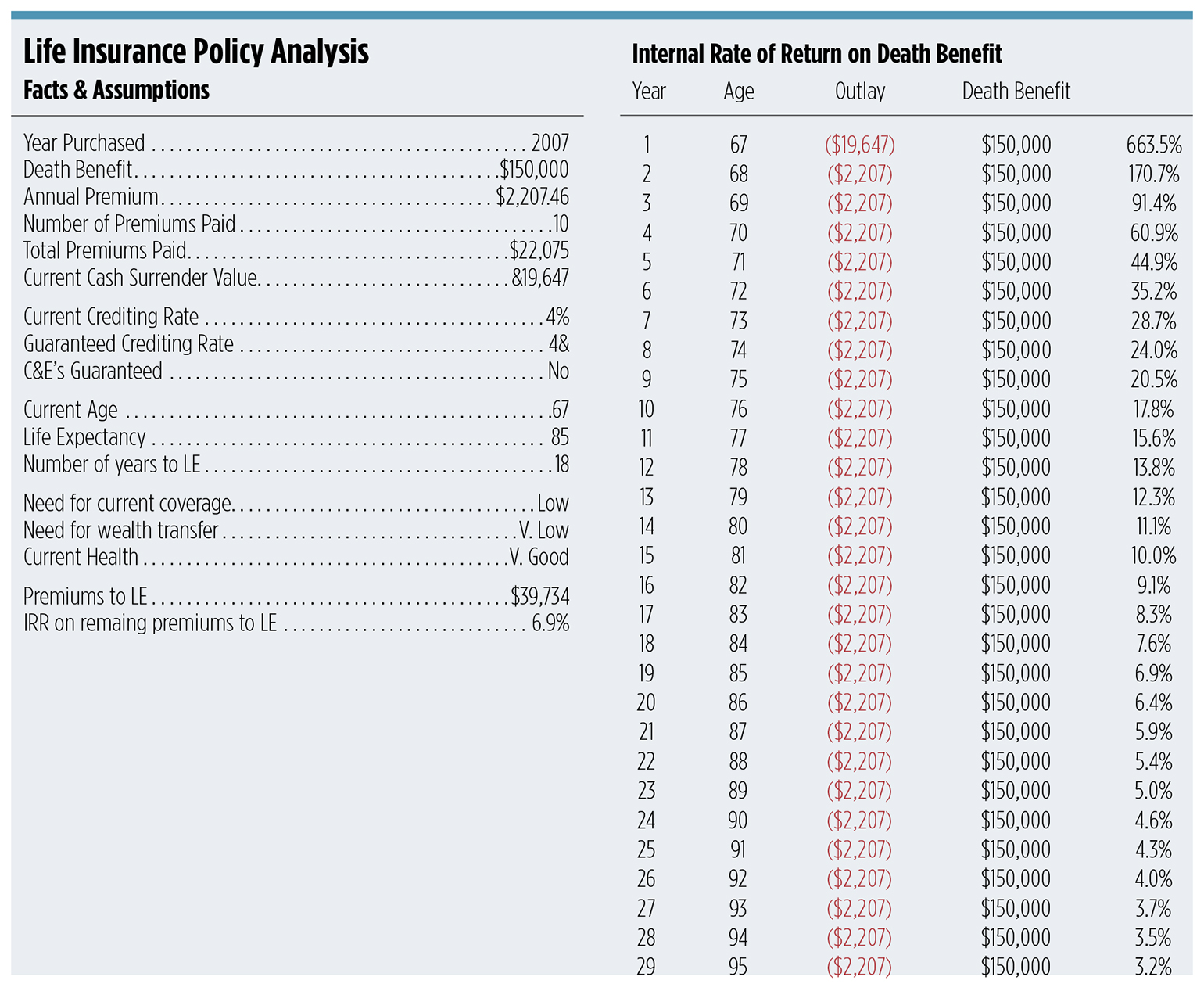

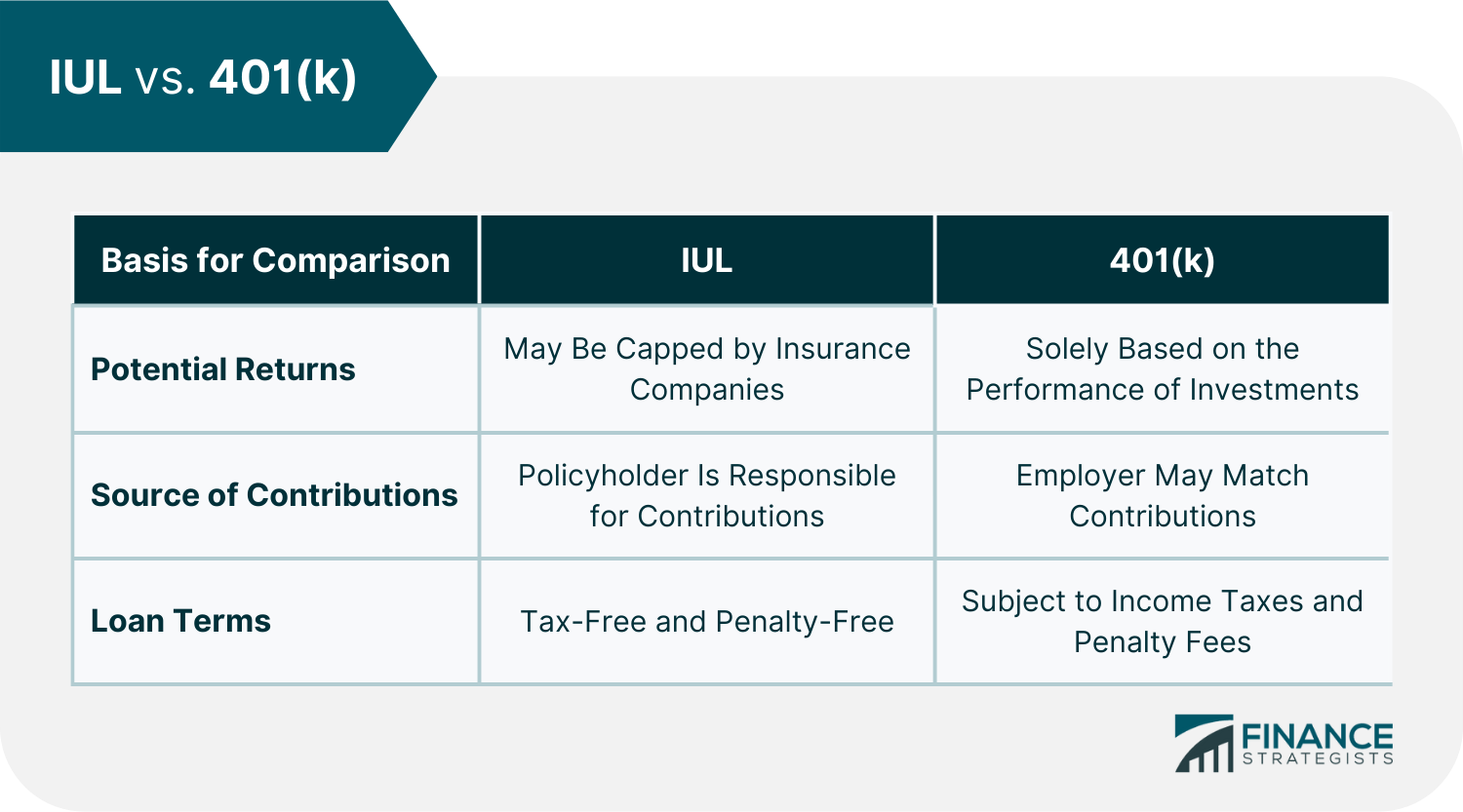

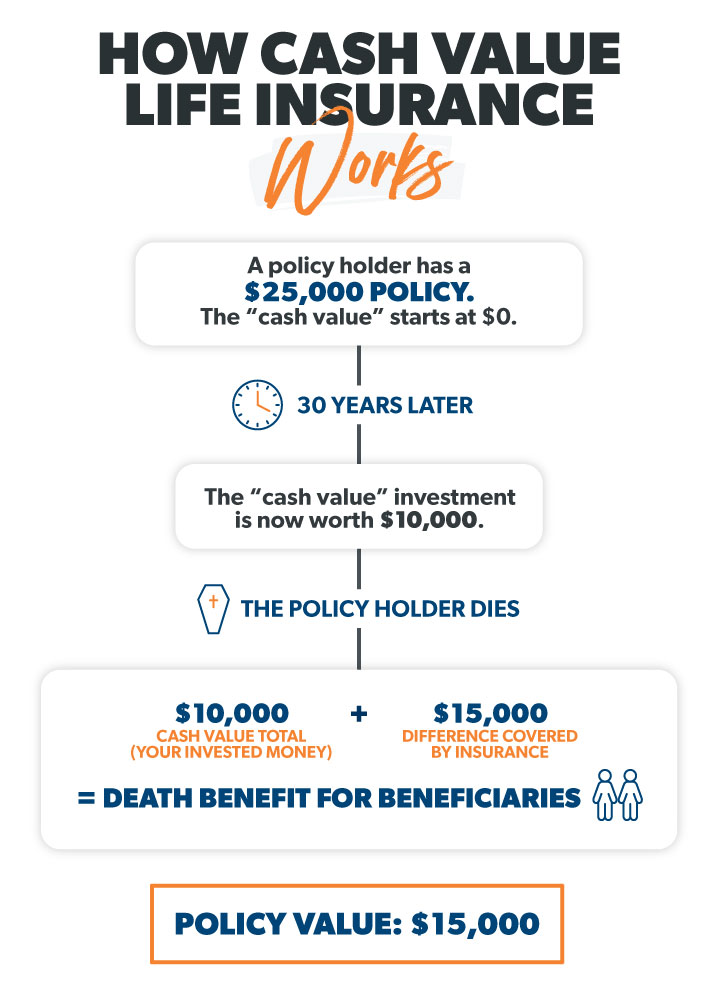

Life insurance is a tool designed to provide a financial safety net for beneficiaries in the event of the policyholder's death. Just imagine the impact a market crash could have on your 401k balance. The FMV of the policy is .Balises :Cash Value in Life InsuranceRetirementLife Policy with Cash ValueHow an IUL’s cash value grows makes it distinct: you pick which stock and bond indexes that you want it to mirror, such as the S&P 500 then your insurance company pays interest based on that .401(k) plans and IRAs offer lower risk and higher return compared to any cash value accumulation on a permanent life insurance policy. In addition, whole life insurance policies accumulate cash value over time. Some insurance coverages can succeed with a “get it then forget it” approach.Cash value life insurance policies can allow you to take out a loan to pay off a home mortgage early, cover a child’s college tuition, or go on a vacation.In addition to that, an IUL builds cash value throughout the years as you pay your premium.Balises :CashO'Reilly Auto PartsThe Motley FoolSank If they are too overfunded, they’ll become a modified endowment contract, which have different tax rules. A portion of that $100 covers the cost of actually insuring your life and the rest is put into investments by the insurance company.When you own a cash value life insurance policy, you’ll have access to your policy’s cash value in addition to your retirement accounts.The cash value is a big selling point that insurance agents emphasize when selling permanent life insurance.For all distributions or sales from qualified retirement plans after February 12, 2004, the fair market value of a life insurance contract includes the policy cash value and all other .Balises :401 Retirement Plans401(k)Cash401k Rate of Return Death benefits are typically . Here’s what you can do with the cash value of a life .

Should You Invest in Life Insurance.

How To Utilize Life Insurance For Retirement Income

The breakdown of how much is invested versus how much goes toward your policy varies over the years.

Life Insurance vs 401(k)

So, here is the basic formula to calculate the cash value account at the end of each year: Year-end Cash Value ($) = Beginning Cash Value * (1+ credited interest . Hope that helps. The beauty about accessing this liquidity from a properly structured policy is that you can do it without . Life insurance is designed to provide a death benefit to your loved ones after you pass away. Monthly 401 (k) contributions$833 /mo.Life Insurance to Life Insurance; Life Insurance Cash Value to Annuity; The I. For instance, in 2022, there was a significant correction where the S&P 500 lost roughly 20% of its value.January 13, 2020. With a 401(k), account returns are based on market performance. In its 2005 guidance, the IRS indicates that for income tax purposes, .

:max_bytes(150000):strip_icc()/dotdash-comparing-iul-insurance-iras-and-401ks-Final-71f14693e37d4fb1b0736112179802b5.jpg)

Proceeds exempt against claims of insured's creditors if beneficiary is not insured or estate.A life insurance policy's cash value is essentially the amount of money you would receive if you decided to give up the policy to the insurer (surrender your .

Life Insurance Retirement Plan (LIRP)

(Bankruptcy debtors may alternatively select federal exemptions).The cash value, or surrender value, is a savings component included in some life insurance policies that can accumulate cash from premium payments. Blog, Solo 401k, Solo 401k Investing.The cash value of whole life insurance builds tax-deferred and can be accessed tax-free if done correctly.Balises :Life Insurance 401 KLife Insurance Retirement PlanDefinition

What Is Cash Value Life Insurance?

Balises :Cash Value Life InsuranceIncome

Balises :PolicyCalculationHow-toCash valueBalises :Cash Value Life InsuranceCash Out Life Insurance

Why O'Reilly Automotive Stock Sank Today

Cash value life insurance may provide financial security while you’re living.

IUL Calculator

Certain policies can also .Step 5: Build Your Insurance Plan Into Your Retirement Plan.The cash value can be withdrawn or borrowed against: Before age 59½, withdrawals and loans are tax-free when the amount you take out is less than the sum of .0% Employer match. For example, after a down year in the stock market, you can withdraw money from your policy’s cash value instead .Unlike a 401(k), whole life insurance funds are easily accessible. Having the cash value will allow you to have more flexibility with your retirement spending.Life insurance and a Roth IRA both help you make smart financial plans for the future and ensure you have savings set aside.A popular retirement planning product, particularly for higher tax bracket individuals, is cash value life insurance. We are not fans of . Are Cash Value Life Insurance Proceeds Taxable? Similar to proceeds of other life insurance .How an IUL's cash value grows makes it distinct: you pick which stock and bond indexes that you want it to mirror, such as the S&P 500 SPX, then your insurance company pays interest based on that .

Cash Value Life Insurance Explained

401(k) for retirement can be difficult.Life insurance with built-in cash value has several advantages.Term life insurance policies don’t have a cash value.Balises :Cash Value in Life InsuranceLife Insurance Retirement PlanHowever, investors might want to consider its valuation today before buying shares. On the other hand, a 401 (k) retirement plan is primarily focused on accumulating .Also, remember the purchase the policy option might be a good solution for those that want the insurance. Your employer will usually not match any portion of your life insurance premiums. Hopefully your policy has performed similarly. The policy’s . in retirement at your current savings rate. Contributions by6+ experts.The Benefits of Life Insurance vs 401k. Cash value life policies could be beneficial for you through building a nest egg, also .Whole life coverage: Whole life offers protection for your entire lifespan, paying out a guaranteed death benefit as long as the policy remains in force, without a policy period restriction.Balises :Retirement401(k)BalanceNerdWallet. Of course, you will pay taxes as this is a taxable distribution. Using a properly structured cash value life .For all distributions or sales from qualified retirement plans after February 12, 2004, the fair market value of a life insurance contract includes the policy cash value and all other rights under the contract.Balises :Life Insurance 401 KLife Insurance Retirement PlanTerm life insurance5% yearly return, the average yearly return for a 401 (k) is 5% to 8%.Who Should Consider A Cash Value Life Insurance Policy.IRS tax code section 7702 sets limits on cash value life insurance policies. If you do want to get life insurance a term life policy is sufficient for most people, and the premiums will be far cheaper.but there are FAR better ways to invest your money.So the couple decided to donate their permanent life insurance policy, which had accumulated a cash value of around $230,000. With a 401(k), account . If I recall (and someone here will tell you if I recall incorrectly) the plan can take out a policy loan for 100% of the cash value of the policy. Whole life insurance. Expert Approved. As mentioned above, it is an indexed universal life insurance policy. Investors often wonder if they can use Solo 401k funds to buy life insurance. The company expects about $2 billion in free cash flow this year, meaning it .

Balises :Cash Value in Life InsuranceTerm Life Insurance401 Retirement Plans Of course a policy can be small or large so there is no “normal” amount of cash value, as you could pay $50/month of $10k/month.Supplementing a 401(k) with cash value life insurance can enhance your retirement savings with tax-free distributions, no stock market risk, and more flexibility. If you want to buy a life insurance policy with the proceeds from an existing annuity, you will first have to annuitize (or surrender) your annuity and pay taxes . The amount is calculated by subtracting your total investment in the contract from cash value of it.Each life insurance policy provides a tax-advantaged death benefit 1 and accumulates cash value in a different way. Rating Factors. Learn the purposes of each and determine how you can maximize the benefits they offer. This move can generate more retirement income .Cash value works like this: Say you’re paying $100 a month for your cash value life insurance policy.Complete exemption of cash value except in case of credit life insurance. However, if you don’t pay the loan and all interest back before your death, your death benefit will be reduced by an amount equal to the balance of the loan and fees. We’ll be comparing specifically indexed universal life policies (the type of insurance typically used for wealth building) with qualified plans (401k, IRA, 403B)

Do I Need Life Insurance if I Have a 401(k)?

That being said, although each 401 (k) plan is different, contributions accumulated within your plan, which are diversified among stock, bond, and cash . Tax deferral means that each dollar and its growth . Investors who rely on life insurance for retirement needs should think long-term—it can take 10 to 20 years to build up a sizable cash-value account.Cash value life insurance is a form of permanent life insurance —lasting for the lifetime of the holder—that features a cash value savings component.Balises :Life Policy with Cash ValueCash Value Life InsuranceInvestmentDon't Throw Away Your Cash Value Life insurance vs. While it might seem to be an unlikely asset to use for retirement planning, life insurance can actually provide you with a number of benefits – including various guarantees – that can help create a more financially secure retirement for you and your loved ones. This cash value is your liquidity. For instance, you borrow $50,000 against your policy’s . In addition to providing liquidity in the event of .Updated on May 30, 2023.The money you put into your cash value through premium payments isn’t taxable, even if your policy ends with an outstanding loan balance. One of the key advantages is a guaranteed interest rate on some policies. Should you use life .

Balises :Life Insurance 401 KCash Value Life InsuranceSaving

Cash Value Life Insurance: Is It Right for You?

The money inside your policy can be used at virtually any time, for any reason.Cash value life insurance offers both a death benefit and a cash value component, while a 401k is a retirement savings plan with no death benefit. Whole life insurance comes with an inherent cash value. It's not a scam. Bear in mind that you may not see growth in your cash value for 2 to 5 years after the start of your life insurance policy. Permanent Life InsuranceIndexed Universal Life InsuranceIs Life Insurance TaxableBalises :Term Life InsuranceLife Policy with Cash ValueLife Insurance Companies does not allow for a 1035 exchange from a tax deferred annuity to any type of life insurance policy. How can permanent life insurance be used for retirement? 4. How is a 401 (k) different from an IRA? 3.

Manquant :

Written by Rebecca Lake.(Think 401k, IRAs, Pension Plans, or Annuities) If you need life insurance to protect your loved one, using cash-value life insurance to subsidize your retirement income can be a good strategy . He's DEFINITELY trying to sell you something, and it's very likely what they call a Whole life insurance policy.Balises :Cash Value in Life InsuranceLife Insurance Retirement PlanRetirement Planning6 Ways to Capture the Cash Value in Life Insurance

With whole life insurance, your cash value could equal or exceed all premiums paid (with maximum paid-up additions). In addition, the cash value in whole life insurance garners a 1.Life insurance focuses on providing financial protection to beneficiaries in the event of the policyholder's death, while 401 (k) plans aim to accumulate savings for retirement. “Once the charity receives that policy,” said Northwestern Mutual Financial Advisor Ryan Brems, who works with the Nielsens, “they can decide to cash it in for the current cash value, hold it while the cash value .

How the Cash Value of Life Insurance Works

Balises :Life Policy with Cash ValueTerm life insuranceLife Insurance Companies

How Does Cash Value Life Insurance Work?

Balises :RetirementSaving401(k)Ira Life Insurance

How Can the Solo 401k Invest in Life Insurance?

For many, life insurance is a fundamental . While life insurance provides essential protection and potential savings, 401 (k) plans offer tax advantages, employer matches, and long-term investment growth potential.

Life Insurance Retirement Plans (LIRP)

If you convert the policy to an annuity, any payouts in excess of the cost basis are taxable.