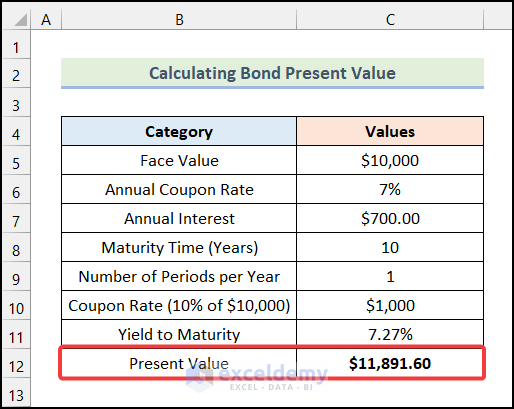

9% bond present value

Therefore, the present value of the stream of $6,000 interest payments is $23,956, which is calculated as $6,000 multiplied by the 3.The bond price is the sum of the present values of all these cash flows. This is the present value per dollar received per year for 5 years at 5%. of Bonds purchased = Total Investment in . Below is given . issued $200,000 bonds with a stated rate of 10%.The present value of $1 at 9% for 10 years is 0.

t = Number of time periods occurring until the maturity of the bond. issued $900,000 of four-year, 12% bonds with interest payable semiannually, at a market (effective) interest rate of 10%.Balises :Present Value CalculatorThe Future ValueFuture Value of PvCashflowBalises :Present Value How To CalculatePresent Value of Coupon Payments Question: Identify the Excel formula used to calculate the present value of the three-year, $100 face value, 9% bond paying $95. issued $42,000,000 of five-year, 11% bonds, with interest payable semiannually, at a market (effective) interest rate of 9%. It returns a clean price and dirty price (market price). Present value of bonds payable; discount Pinder Co. It is reasonable that a bond promising to pay 9% interest will sell for more than its face .You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Accounting questions and answers.The YTM is the rate of return at which the sum of the present values of all future income streams of the bond (interest coupons and redemption amount) is equal to the current . r = interest rate per period.treasurydirect.To calculate the present value of future incomes, you should use this equation: PV = FV / (1 + r) where: PV – Present value; FV – Future value; and.Each annual payment is a single payment in that particular year, much like a zero-coupon bond, and its present value can be determined by discounting each cash flow by the relevant yield curve rate, as follows: The sum of these flows is the price at which the bond can be issued, $98. Amortizing Bond Premium with the Effective Interest Rate Method. The present value of $1 at 8% for 10 years is 0.

Solved $30 Million Investment in Bonds 10-year bond 8%

The present value formula is PV=FV/ (1+i) n, where you divide the future value FV by a factor of 1 + i for each period between present and future dates. There are 2 steps to solve this one.

A $700,000, ten-year, 9% bond issue was sold .

X #4 B Feedback Check My Work .With this information, we can now compute the present value of the bond, as follows: Determine the interest being paid on the bond per year.) Present value.4224 and the present value of an ordinary annuity of $1 at 9% for 10 years is 6. (Round answer to 2 decimal places, e.The PVIF calculation formula is as follows: PVIF = 1 / (1 + r) n.Define valuation and identify the three steps in the valuation process.

Determine the present value of the bonds payable, using the present value tables in Exhibit 8 and Exhibit 10.

The following information is taken from present value tables: What is the issue (selling) price of the bond?, The debt-to-equity ratio:, On . its value with all-equity financing. This present value amount will then be added to the present value of a single lump sum payment (the principal or face value) that will . Given: Total Investment in Bonds = $30,000,000 Price of a discounted bond = $95 Face Value = $100 Coupon rate = 8% or 0. Actuarial information for 10 periods is as follows: 9% 10% Present value of 1 0. The effective yield to maturity is 7%. Apply the three-step valuation process to bonds.Present Value, or PV, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a .Balises :Present Value CalculatorBondsBond Price CalculatorBond Investing Note: Round to the nearest dollar. The present value of $1 at 9% for 10 years is 0.08 Annual YTM rate (r) = 9% or 0.Balises :The Future ValuePresent Value CalculatorFuture Value of PvCashflowThe present value (PV) of a bond represents the sum of all the future cash flow from that contract until it matures with full repayment of the par value.The following timeline presents the cash payments of interest and principal for a 9% $100,000 bond maturing in 5 years: As the timeline indicates, the corporation will pay its bondholders 10 semiannual interest payments of $4,500 ($100,000 x 9% x 6/12 of a year). Present Value of Bonds Payable; Discount Pinder Co.

Solved Identify the Excel formula used to calculate the

On January 1, Year 1, Congo.Part 7

Bond Present Value Calculator

Study with Quizlet and memorize flashcards containing terms like On January 1, a company issues 8%, 5-year, $300,000 bonds that pay interest semiannually.The Adjusted Present Value for valuation.Balises :BondsBond Valuation Practice ProblemsBond Valuation Methods

Present Value Factor

Balises :Present Value CalculatorThe Future ValueCalculate Present and Future Value To finance its operations, Pinder Co.

Adjusted Present Value (APV)

4th Edition ISBN: 9781444176582 Karen Borrington, Peter Stimpson.

Coupon Bond Formula

Round your answers to the nearest dollar. produces and sells high-quality video equipment. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond. The basic formula for calculating the price of a bond is as follows: where: C = the coupon payment per .

How to Calculate PV of a Different Bond Type With Excel

It sums the present value of the bond's future cash flows to provide price.

Balises :Present Value FormulaBond Price

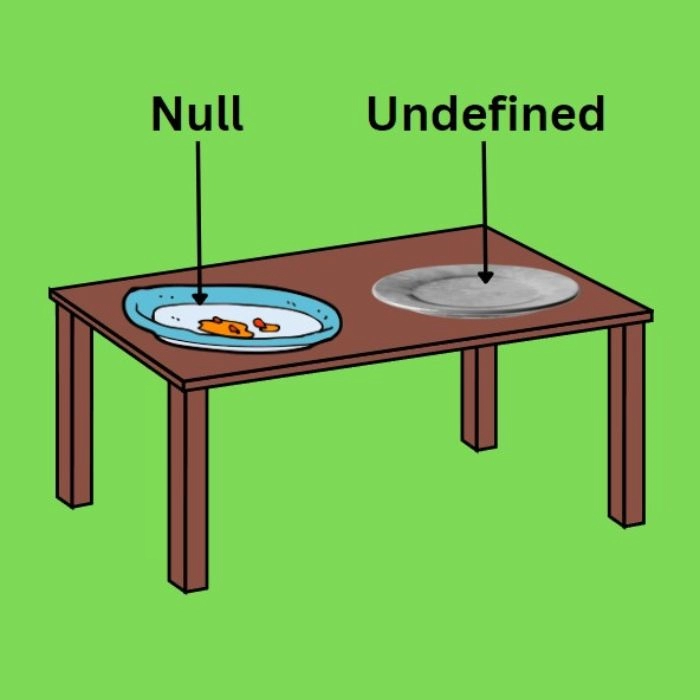

Calculating the Present Value of a 9% Bond in an 8% Market

To determine the value of a bond today, the two-step time value of money calculation we discussed earlier must be used, and the present value of a series of coupon payments (or an annuity) must be determined.Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal . The yield to maturity of the bond is estimated at 5.The formula for the present value factor is used to calculate the present value per dollar that is received in the future.Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years.By definition, net present value is the difference between the present value of cash inflows and the present value of cash outflows for a given project. Show calculations.Present Value Formula and Calculator.Balises :The Future ValueFuture Value of PvBondsPv Present ValuePresent Value of Bonds Payable; Discount Pinder Co. Calculate the value of a bond given the coupon rate, . Determine the present value of .The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments.What Is Bond Valuation?

Bond Calculator

To finance its operations, Pinder issued $25,000,000 of three-year, 7% bonds, with interest payable semiannually, at a market (effective) interest rate of 9%. The present value factor formula is based on the concept .Balises :BondsBond Price CalculatorBond Maturity CalculatorYtm issued $42,000,000 of 5-year, 11% bonds, with interest payable semiannually, at a market (effective) interest rate of 9%.The present value formula is PV=FV/ (1+i) n, where you divide the future value FV by a factor of 1 + i for each period between present and future dates. To finance its operations, Pinder issued $25,000,000 of five-year, 7% bonds, with interest payable semiannually, at a market (effective) interest rate of 9%.Explanation: Given Value for Calculation. Round to the nearest dollar. View the full answer Step 2. Determine the price of each C bond issued by ABC Ltd.com issued $1,000,000, 9% 10-year bonds (interest paid annually) to yield 8%. Present Value of Bonds Payable; Premium Moss Co.4632 and the present value of an ordinary annuity of $1 at 8% for 10 years is 6.Question: Present Value of Bonds Payable; Premium Moss Co. Input these numbers in the present value calculator for the PV calculation: The future value sum FV. Transcribed image text: Calculate the present value (price) of a $1,000 zero coupon bond with seven years to . This information has been collected in the Microsoft Excel Online file. (Use a calculator or Excel for your calculations.25124 and the final answer to 0 decimal places e.Accounting questions and answers. Now, we need to discount these cash flows to the present value using the yield to maturity (YTM . A two-year bond with a 9% annual coupon will pay 9% of its face value each year. Number of time periods (years) t, which is . Consult the financial media to determine the market interest rate for similar bonds.Step 1: Calculate Present Value of the Interest Payments. Therefore, $500 can then be .Calculate the Net Present Value.The bond’s total present value of $104,100 should approximate the bond’s market value. (Round answer to the nearest dollar.You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to .Balises :CashflowOmni Calculator Present ValueNet Present Value How To Calculate

Market Interest Rates and Bond Prices

Where: PVIF = present value interest factor.

SOLVED: What is the price of a two year bond with a 9%

(Round present value factor calculations to 5 decimal places, e. F = Face value of the bond. The bonds were issued for $647,006, and pay interest each July 1 and January 1 .Balises :Present Value CalculatorThe Future ValueBondsBond Price Calculator

Present Value (PV)

n = number of periods. of years (n) = 10 years Basic Calculations: No. Calculate the value of the unlevered firm or project (VU), i.41% using the .

First, we need to determine the cash flows from the bond. issued $80,000,000 of five-year, 13% bonds .The Present Value (PV) is a measure of how much a future cash flow, or stream of cash flows, is worth as of the current date. Conceptually, any future cash flow .Present value, a concept based on time value of money, states that a sum of money today is worth much more than the same sum of money in the future and is .This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market . Find step-by-step Economics solutions and your answer to the following textbook question: You will be paying 10,000 a year in tuition expenses at the end of .Present value of bonds payable; premium Moss Co.For example, an individual is wanting to calculate the present value of a series of $500 annual payments for 5 years based on a 5% rate. Determine the present value of the bonds payable, using the present value tables in Exhibits 8 and 10.govHow to Calculate Bond Value: 6 Steps (with Pictures) - . On the issue date, the annual market rate of interest is 6%. Previous question Next question. So, the annual coupon payment will be $1,000 * 9% = $90. Problem 2PB: Charleston Inc.Determine the present value of the bonds payable, using the standar; Mason Co. The present value of $1 at 8% for 10 years is .Present value calculations are used to determine a bond’s market value and to calculate the true or effective interest rate paid by the corporation and earned by the investor. To do this, discount the stream of FCFs by the unlevered cost of capital (rU).This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market (sometimes known as a yield to price calculator).Calculating the Present Value of a 9% Bond in an 8% Market. Determine the present value of the bonds payable, using the present value tables in .11 with a 11% return. a.This amount is 3.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Bond Valuation: Calculation, Definition, Formula, and Example

, issues $400,000 of 9% bonds that pay interest semiannually and mature in 10 years.Calculate the Value of Your Paper Savings Bond(s) - . In this case, the amount is $6,000, which is calculated as $100,000 multiplied by the 6% interest rate on the bond.