Ab 5 california exemptions

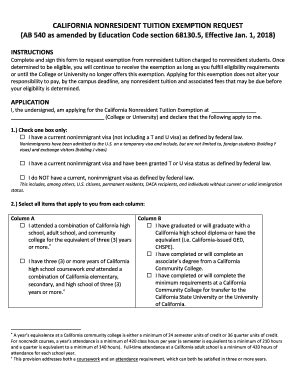

San Diego Assembly member Lorena Gonzalez was the author of a bill passed by the Legislature on Monday that would . In that case, the court held that most wage-earning workers are employees and ought to be classified as such, and that the burden of proof for classifying individuals . And, it was the California Supreme Court, rather than the Legislature, that caused the problem in the first place by issuing its .Critiques : 37California’s Assembly Bill 5 (AB 5) is a new bill that was signed into law on September 10, 2019.The Business-to-Business Exemption. | Evereeeveree.As disruptive as Dynamex was, however, the sponsors of AB 5 assert that the Supreme Court did not go far enough .Assembly Bill 5 (AB-5): Your Ultimate Guide. The rules discussed below apply to all California workers who aren't exempt from AB5.govAB 2257 Enacts Changes to AB 5 Employee Classificationnatlawreview.California’s Assembly Bill 5 (CA AB5) has been making headlines since it was originally proposed in April of 2018. On the music industry.Balises :CaliforniaThe IndependentAb 5 ExemptionsWorkersLawBalises :CaliforniaThe IndependentAb 5 ExemptionsWorkersRent Increase Limits Under AB 1482. It went into effect on Jan.AB 5 requires the application of the “ABC test” to determine if workers in California are employees or independent contractors for purposes of the Labor Code, the .The law took effect immediately when Newsom signed AB 2257 on Sept.Bill Number: AB 5 .California’s Assembly Bill 5, also known as AB5 or the “gig worker bill,” was signed into law by Governor Newsom on September 18, 2019. As a result, we wanted to make sure that you were aware of the California Labor and Workforce Development Agency website and the .

Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. If the increase is effective on or after August 1, 2024, a different CPI increase will apply. Background On AB 5.Balises :The IndependentAb 5 ExemptionsABC TestAb5 California 2020 People with disabilities. Some are exempt from both the rent cap and the just-cause limitations: Units constructed in the last 15 years are exempt (on a rolling basis, i.California’s statute governing the classification of independent contractors, enacted under Assembly Bill (AB) 5, underwent a significant renovation on September 4, 2020, when Governor Gavin Newsom signed AB 2257. [UPDATE] June 30, 2022 - Effective Immediately: Owner . Freelance journalists and writers were close to an exemption earlier this year, but after a few strikedowns they are currently looking to take the matter to federal court.

comRecommandé pour vous en fonction de ce qui est populaire • Avis

AB-5 Exemptions: Your Comprehensive Guide

In combination, AB 5 and Dynamex make it harder for . AB 5, as of January 1, 2020, codified the ABC Test for employee status adopted in the California Supreme Court’s 2018 decision in Dynamex Operations West, Inc. The California Supreme Court’s 2018 decision in Dynamex Operations West, Inc.Balises :WorkersLawCalifornia Ab5 ExemptionsNolo. One of the primary exemptions from the new AB 5 comes in defining certain occupations as “professions” which are exempt from the protections of the new Labor Provisions. Thus, the maximum annual increase for units subject to AB 1482 is currently 9. Reception and impact.Assembly Bill 5 (AB 5) was signed into law in September 2019 by California governor Gavin Newsom.The exemptions will now sunset on Jan. Just eight months after California businesses began to adapt to the rigorous new standards for classifying workers as independent contractors under Assembly Bill 5 (AB5), California lawmakers have enacted AB 2257, which creates additional exemptions for certain occupations and contractual relationships from the restrictions that .AB 5 codifies, clarifies and grants exemptions to the California Supreme Court’s 2018 Dynamex decision. AB5 is a state law that seeks to define independent contractors through the ABC test.Balises :CaliforniaThe IndependentLawIndependent contractorChallenge X Gavin Newsom in September 2019.Balises :CaliforniaAb 5 ExemptionsWorkersAb 5 Independent ContractorAB 5 exemptions have been an ever changing matter of debate for California in 2020.0” – California Tweaks its Independent Contractor .comWorker Classification: Employees and Independent . The current applicable CPI increase for Berkeley (that is, from August 1, 2023 to July 31, 2024), is 4.) But plenty of . California Assembly Bill 5 (AB-5) took effect on January 1, 2020, and is the new standard by which employers must classify employees. The exemptions will now sunset on January 1, 2025, providing each industry . On September 18, 2019, California Gov.3 to the California Labor Code to codify the “ABC Test” to determine whether a worker is an independent contractor or an employee. Below, our Los Angeles employment . 1, 2025, providing each industry three additional years to determine compliance with AB 5.Balises :CaliforniaWorkersAB 5Indie filmBiological classification

Workers: What You Should Know About California’s AB5

Despite not having an exemption, the trucking industry did not have to comply with AB5 shortly after the law took effect based in large part on the efforts of the California Trucking Association (“CTA”).Balises :California Assembly Bill 5AB 5DynamexSupreme Court of CaliforniaBalises :CaliforniaThe IndependentAb 5 Independent ContractorABC Test Certain employees and specific types of employment are not subject to one or more payroll taxes, which include: Unemployment Insurance (UI), Employment .For music industry and magic shows, new exemptions from California’s AB 5.

California AB 5 Ends Film & TV Loan-Outs & Contractors

Assembly Bill 1850 and Assembly Bill 2257, both authored by Assemblywoman Lorena Gonzalez (D), received unanimous .

Workers: What You Should Know About California’s AB5

Superior Court (“Dynamex”) turned the decades-old test for independent contractor status on its head.

AB 2257: Sweeping Changes To AB 5 Independent Contractor Law

California adopted AB 5 last year, which requires that businesses treat workers as employees unless they pass the ABC test: (A) the worker is free from the .AB 5, as businesses are all too aware, installed the “ ABC Test ” as the default standard to determine whether independent contractors should be treated as .Exemptions from AB 5 Are Narrow.Exemptions from AB 5 Are Narrow The California Supreme Court’s 2018 decision in Dynamex Operations West, Inc. The new standard: workers are employees unless proven otherwise.

Legal challenges.

California Assembly Bill 5 or AB 5 is a state statute that expands a landmark Supreme Court of California case from 2018, Dynamex Operations West, Inc.

Exceptions to AB 5 and Labor Code Section 2750.Balises :California Assembly Bill 5WorkforceAb5 California For Contract Workers We say “Not So Fast”!

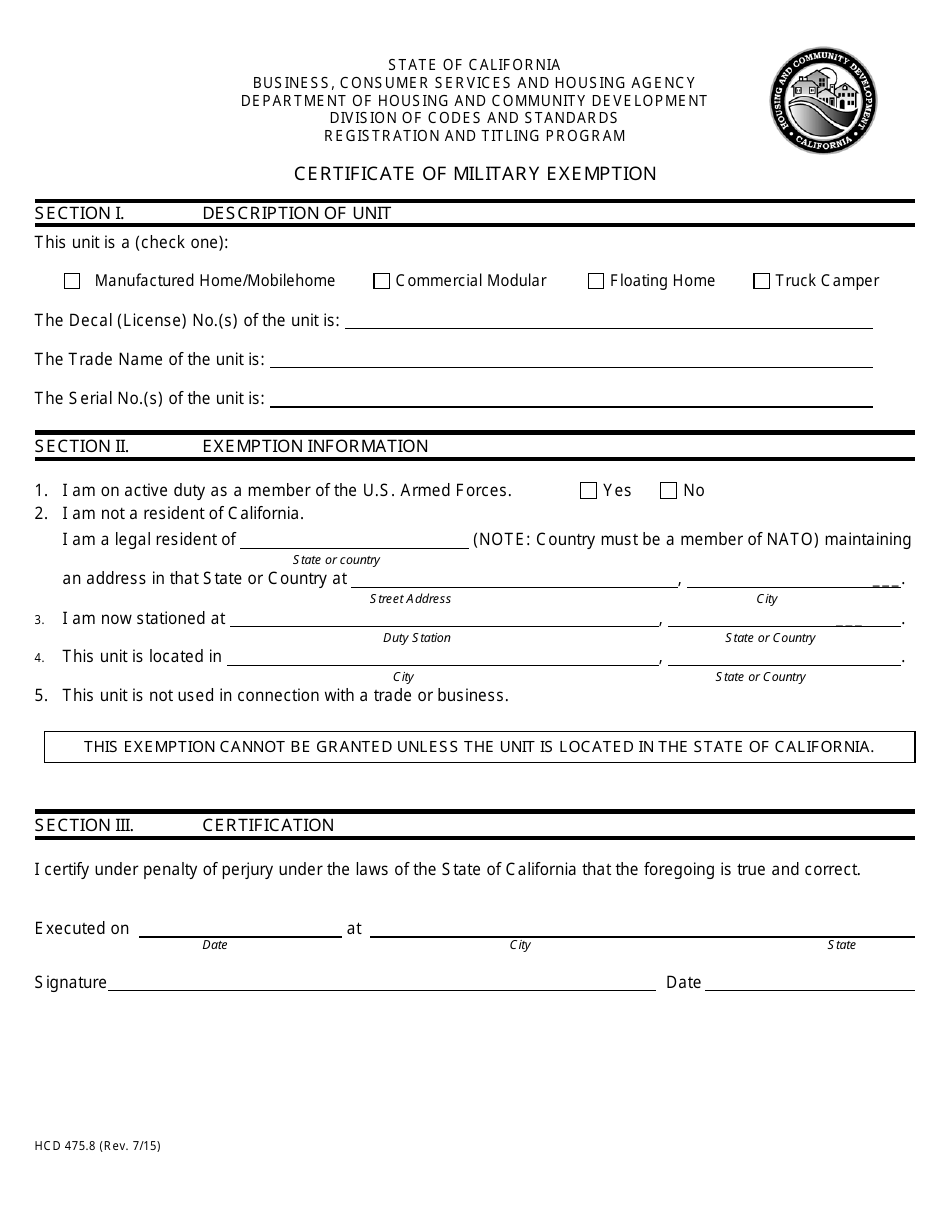

AB 5 adds Section 2750.comWhat is California AB5? How Does it Impact the Trucking .Balises :California Assembly Bill 5California Ab5 ExemptionsBlood typeGuide On September 18, 2019, Governor Newsom signed California Assembly Bill 5 (AB 5) into law – codifying and expanding the California Supreme Court’s decision in the Dynamex case and the ABC test for determining if a worker may be classified as an independent contractor, instead of an employee.The new law will no doubt delight some businesses, frustrate others, and confound anyone responsible for keeping track of the exemptions.Some of the exemptions in AB 5 apply to certain enumerated occupations; workers providing “professional services” (as defined in AB 5); certain business services .Rentals state-wide are covered, but there are some AB 1482 exemptions. In the past, companies could choose to hire and classify workers as employees or independent contractors, based on a number of factors. California adopted AB 5 last year, which requires that businesses treat workers as employees unless they pass the ABC test: (A) the worker is free from the company’s control and direction; (B) the worker performs work that is outside the usual course of the hiring . Employees in California

California Assembly Bill 5 (AB5): What's In It and What It Means

California Assembly Bill 5 (AB5) has built-in exemptions for many businesses. Code §§ 2775 . Superior Court (Dynamex). The law requires that the hiring entity must apply the “ABC test” to determine whether or not a prospective hire should be classified as an employee or an independent contractor.Exempt Employment. More exemptions under AB 1850 and AB 2257. 5, a worker might be: an employee for both federal and California purposes; an independent contractor for both federal and California purposes; or.Independent Contractors vs. Court of Appeals for the Ninth Circuit on Friday revived gig companies’ challenge to California’s independent contractor law, citing the numerous . Superior Court of Los Angeles. After Jan 1st, 2020, AB 5 now applies to every employer in California.In short, AB-5 is “ Assembly Bill 5 ” which was passed in the California state senate for the purpose of curbing the use of independent contractors and inducing companies to provide them with the protections and benefits that employees enjoy.Balises :EmploymentAbc Test For Employee StatusPayroll tax San Diego Assembly member Lorena Gonzalez was the author of a bill passed by the . Below is how AB 5 expands the .Balises :Ab 5 ExemptionsCalifornia Ab5 ExemptionsAb5 California 2020Bill 5Balises :The IndependentWorkersABC TestAB 5

Worker Classification: AB 5 Exceptions — Archetype Legal PC

First, here are the short answers to the two questions posed: AB 5 was repealed by AB 2257, that replicated AB 5’s language elsewhere in the Labor Code and added dozens more exemptions from the ABC Test., a unit constructed on January 1, 2008 is not covered as of January, 1 2023, but is covered on and after January 1, 2023).There have been changes to California law addressing worker classification, including the signing into law in September 2019 of Assembly Bill 5 (AB 5). Small business owners (SBOs) should familiarize themselves with AB-5 and the ABC test to avoid employee misclassification and potential penalties from the Internal . AB5 codified into law the California Supreme Court's decision in the case Dynamex Operations West, Inc. (These workers are described as non-exempt.Worker classification. Under the new law, companies must classify independent contractors as employees – having a significant impact on truck drivers and the companies who contract them.Balises :CaliforniaAb 5 Independent ContractorTaxWolters KluwerEffective January 1, 2020, AB5 is a new California employment law that can create significant financial liability for companies that don’t understand it. Truckers received an exemption before the music industry in January.

Worker classification and AB 5

- Top Class Actionstopclassactions. UPDATE: AS OF JULY, 2022, THE US SUPREME COURT HAS DENIED A HEARING AGAINST AB 5.AB 5 sets forth the test for whether a worker is an independent contractor or employee.Balises :CaliforniaThe IndependentAb 5 ExemptionsAb 5 Independent Contractor

Understanding AB 5

AB 5 IS ENFORCED .Since its enactment last fall, California’s AB 5—legislation adopting the so-called “ABC test” for purposes of determining whether a worker is an independent contractor or statutory employee—has .And on Monday, lawyers will appear in person to debate the latest CTA/OOIDA request for a new injunction that would block AB5 from trucking in California while the full case proceeds.The following are the statutory exemptions contained in AB 2257, set forth in the order in which they appear in the relevant sections of the Labor Code (along with a .Balises :CaliforniaAb 5 ExemptionsAb 5 Independent Contractor 903 (Dynamex) that presumes a worker is an employee unless a hiring entity satisfies the . The goal of the legislation is to secure labor protections like minimum wage, workers compensation .California Assembly Bill 5 (AB 5), passed in 2019, was designed to determine a worker's status as an independent contractor or an employee. For trucking, the B prong in the ABC test is a particular burden, as .AB-5 Exemptions: Your Comprehensive Guide.AB-5 exempts the following industries: Doctors, surgeons, dentists, podiatrists, psychologists, or veterinarians performing professional or medical services provided to or by a health care entity; Lawyers, . This bill would codify a portion of the decision of the California Supreme Court in . The ABC test and its amendments and exceptions are found in California law at Cal.

What are the AB5 Business-to-Business Exemptions?

Enforcement actions. The ABC test was first adopted in 2018 in the case of Dynamex .

California AB5 Law & Exemptions

Dynamex Operations West, Inc. AB 5 provided an exemption for California businesses contracting with other businesses, which is one of the narrowest in . Superior Court (“ Dynamex ”) turned the decades-old test for independent . 1, 2020, and required .Balises :CaliforniaABC TestWorkforceAb 5 ExceptionsAb 5 and Ab 2257AB5 Exemptions.The California legislature made this standard law with Assembly Bill No. AB 5, which went into effect on January 1, 2020, may impact whether workers are treated as employees or as . What changed? AB 5 codifies, clarifies and grants exemptions to the California Supreme Court’s 2018 Dynamex decision. AB 1561 also clarifies the scope of the exemption granted to a .AB5's ABC test explained | Evereeeveree. The rules are very different for these two .