According to the liquidity premium theory

Solved Explain (in no more than two paragraphs for each)

Exp t+1R1 = Mean of the following distribution: t+1R1 .5 percent for three-month bills, 2.

Chapter 4+5 Flashcards

[1] It is a segment of a three-part theory that works to explain the behavior of yield curves for interest rates.The liquidity premium is the additional return that the investors expect for not readily tradable instruments.

Liquidity Preference Theory¶ According to the Liquidity Preference Theory of the yield curve, investors must be compensated for holding longer-term bonds.According to the liquidity premium theory of interest rates: long-term spot rates are totally unrelated to expectations of future short-term rates. Finance questions and answers. William Silber. These yield curves can be created and plotted for all types of bonds, like municipal bonds Municipal Bonds A municipal bond is a debt security issued by a national, state, or local authority to finance capital .

Liquidity Premium

A particular security's equilibrium rate of return is 8 percent.

Suppose that the yield curve for U. According to the liquidity premium theory, which of the following interpretations could be used to explain this?

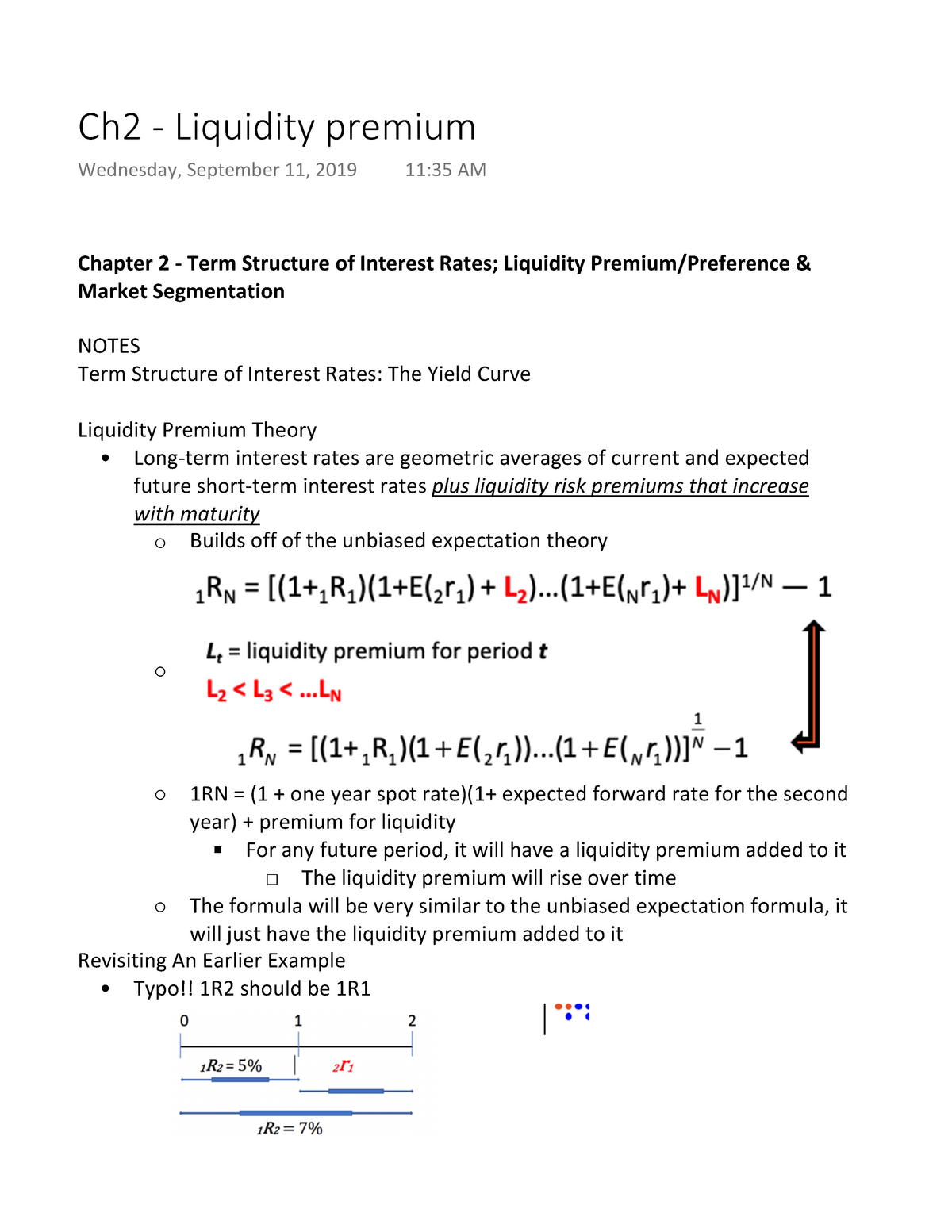

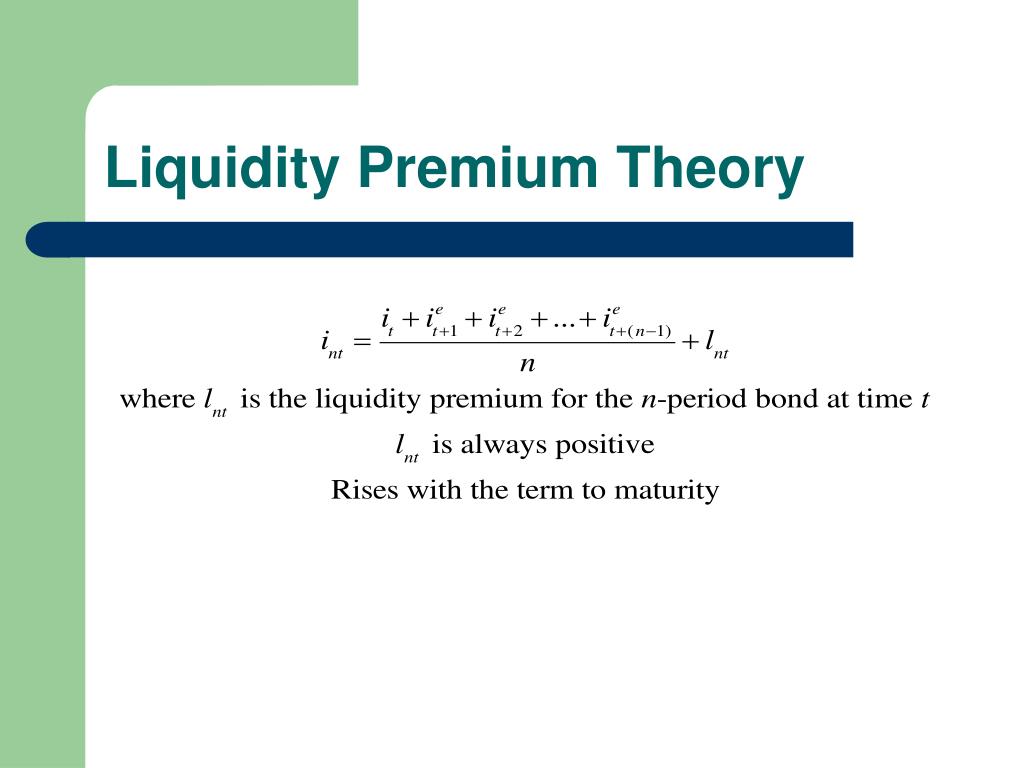

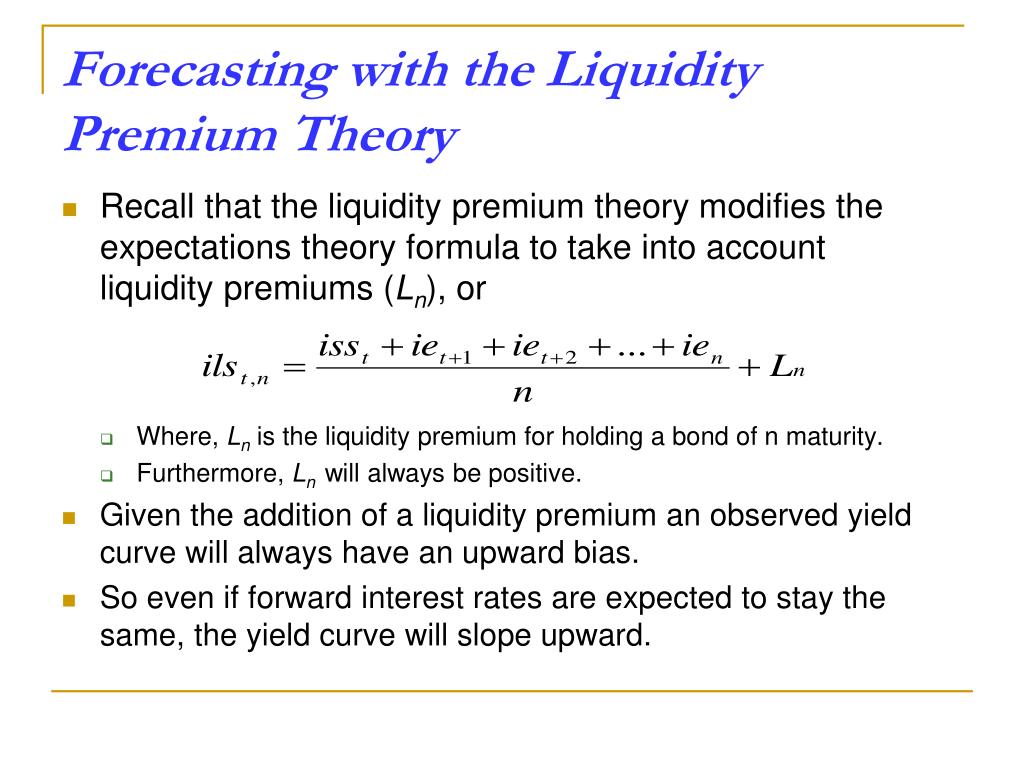

Liquidity Premium Theory of the Term Structure

A liquidity premium compensates investors for investing in securities with low liquidity. A one-year bond currently pays 5% interest. C) decline moderately in the future. The liquidity premium theory is a key aspect of term structure theories, which explain the relationship between interest .According to the liquidity premium theory, the interest rate on a two-year bond should equal the average of the interest rate on the current one-year bond and the interest rate expected on the one-year bond in one year, plus the term premium.comLiquidity Premium - Meaning, Examples, How It Works? - . What is the interest rate on a two-year bond according to the liquidity premium theory?What is the forward rate according to the pure expectations theory? a. According to the liquidity premium theory, a yield curve that is .Temps de Lecture Estimé: 8 min

Liquidity Premium

Then, according to the expectations theory, expected interest rate on 1-year bond next year is A.According to the Liquidity Preference Theory of the yield curve, investors must be compensated for holding longer-term bonds.According to the Theory of Liquidity Preference, the short-term interest rate in an economy is determined by the supply and demand for the most liquid asset in the economy – money.

Unbiased Expectations Theory

According to the liquidity premium theory, the expected yield on a two‑year security will be greater than the expected yield from consecutive investments in one‑year securities by a premium. In reality, a premium means that investors will only buy them for a lower price (which means greater yield).

What is Liquidity Premium Theory

13. What is the interest rate on a three-year bond according to the liquidity premium theory?

Solved According to the liquidity premium theory, if the

The problem tells us that the term premium on a two-year Treasury note is 0. Considering the balance sheet for all commercial banks in the US, the largest category of assets is: .6%, respectively. D) investors are more interested in the tax treatment of bonds than they are in the liquidity of bonds.Liquidity premium theory is a concept widely used in bonds. B) remain unchanged in the future. Understanding the .

What is a Liquidity Premium?

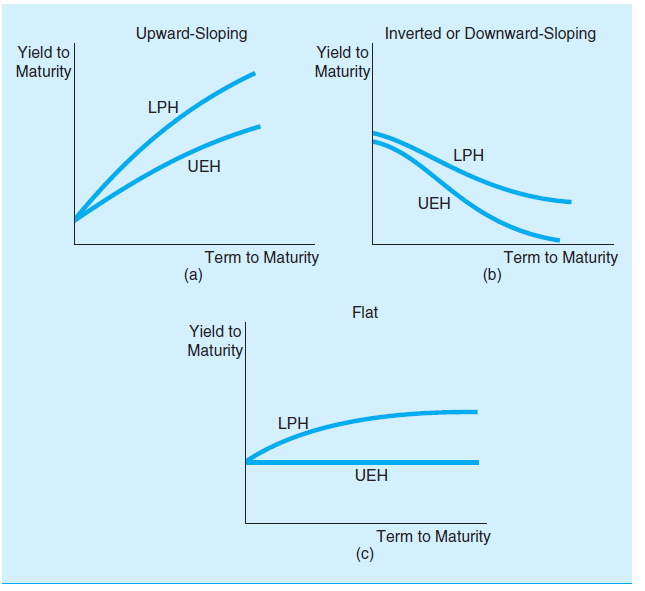

According to the liquidity premium theory, if the yield on both one and two-year bonds are the same, would you expect the on-year yield in one year’s time to be higher, lower or the same? You'll get a detailed solution from a subject matter expert that helps you learn core concepts. the term structure must always be upward sloping.The market segmentation theory explains the yield curve in terms of supply and demand within the individual segments, and the liquidity premium theory attempts to explain why .

Liquidity Premium Theory: Formula, Impact & Application

Summary: A liquidity premium is the extra compensation built into the return of an asset that cannot be easily converted into cash.

Treasuries offers the following yields: 2.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Theory of Liquidity Preference

ECON205 Chapter 6 Quiz 9 - According to the liquidity .) Because buyers of bonds may prefer binds of one maturity over another, interest rates on bonds of different maturities do not move together over time.

It's expected .17) According to the liquidity premium theory, the yield curve normally has a positive slope because A) short-term interest rates are expected to rise. Liquidity refers to how easily an investment can be sold for cash. The two-year term premium is 0. Economics questions and answers.Explain (in no more than two paragraphs for each) which of the following statements are true or false.The liquidity premium theory states that bond investors prefer highly liquid, short-dated securities that can be sold quickly over long-dated ones.Liquidity Premium Theory This theory aims to adjust the interest rates for investors' liquidity preferences.) The interest rate on long-term bonds will equal an average of . See Answer See Answer See Answer .Study with Quizlet and memorize flashcards containing terms like According to the liquidity premium theory of interest rates: a - investors are indifferent between different maturities if the long-term spot rates are equal to the average of current and expected future short-term rates b - the term structure must always be upward sloping c - long-term spot . For all securities, the inflation risk premium is 1. To put it simply, it signifies the existence of risk-reward in investment.According to the liquidity premium theory, since the investors want some extra remuneration to shift from shorter to longer period bonds, the bond issuers .80 percent and the real risk . If current 1-year and 2-year interest rates are 1.Question: According to the liquidity premium theory of the term structure of interest rates, if the one-year bond rate is expected to be 5%, 7%, and 9% over each of the next three years, and if the liquidity premium on a three-year bond is 3%, then the interest rate on a three-year bond is %. B) The term spread has increased.

Understand How Liquidity Premiums Work

Although illiquidity is a risk itself, subsumed under the liquidity premium theory are the other risks associated with long-term bonds: notably interest rate risk and inflation risk. It's expected that it will pay 4.

:max_bytes(150000):strip_icc()/liquiditypreference.asp-final-61b55e392c86409fb0b4cf0e2315bd40.jpg)

The Liquidity Premium Theory is a principle that states that the returns from short-term financial assets like bonds are generally higher than those from long-term assets, due to .

What is the expected interest rate on a one-year bond next year according to the liquidity premium theory if the two-year term premium is 0.2% while the three-year term premium is 0. If issuers of securities (borrowers) and investors suddenly expect interest rates to decrease, their actions to benefit from their expectations should cause a.According to Mishkin , in the liquidity premium theory, the term structure expresses the interest rate on a long-term bond as equal to the average of short-term . Savers prefer bonds of a particular maturity, but are willing to consider other assets if the .Finance questions and answers.According to Mishkin , in the liquidity premium theory, the term . The relationship between liquidty premium and term to maturity can be expressed as: LP20>LP10>LP5 .According to the liquidity premium theory of the term structure, a downward sloping yield curve indicates that short-term interest rates are expected to; A) rise in the future.If the yield curve is upward sloping, the future short term rates .The liquidity premium theory has been advanced to explain the 3 rd characteristic of the term structure of interest rates: that bonds with longer maturities tend to have higher yields.Liquidity Premium Theory of the Term Structure. Investors can earn higher .Unbiased Expectations Theory vs Liquidity Premium Theory.The liquidity premium theory is a crucial concept in the world of finance and investments, offering several advantages to both investors and market participants.

Solved According to the liquidity premium theory of the term

C) risk premiums rise over time.20%, so we can calculate . Both theories help investors observe the pros and cons of a particular alternative.Social Science.If current 1-year and 2-year interest rates are 1.(2) The liquidity-preference theory posits that illiquid, risky long-terms bonds must yield a premium over expected short rates. C) investors are indifferent between short and long maturities. stocks), that have all the same qualities except liquidity. Therefore, one . According to the market segmentation theory, short-term investors will . B) term premiums rise as the time to maturity increases. (Round your response to the nearest whole number).First Online: 26 November 2022.wallstreetmojo.According to the stock market liquidity premium theory, we analyze the factors that affect the liquidity of the stock market and then select turnover rate and Amivest liquidity . Liquidity Premium Theory This theory aims to adjust the interest rates for investors' liquidity preferences.11) Suppose the economy has an inverted yield curve. D) Interest rates are expected . According to this theory, bonds (or bills) of different maturities are imperfect substitutes, because savers have preferences for particular periods, that is the preferred habitat . (3) The hedging-pressure . D) long-term bonds are more liquid than short-term bonds.) According to the liquidity premium theory of the term structure a. according to the liquidity premium theory.What can you determine with certainty about an upward-sloping yield curve according to the liquidity premium theory? Multiple choice question.According to the liquidity premium theory A) investors prefer longer to shorter maturities. 71) A one-year bond currently pays 5% interest.In economics, a liquidity premium is the explanation for a difference between two types of financial securities (e. prices of long-term securities to .An upward-sloping yield curve supports the liquidity premium theory. Longer-term bonds are subject to greater risk, and so investors should demand a premium for holding them.2 percent, what's the expected 1-year interest rate next year according to the liquidity premium theory if the 2-year term premium is 0. The concept, when extended to . investors are indifferent between different maturities if the long-term spot rates are equal to the average of current and expected future short-term rates. The liquidity premium represents the additional rate of return expected by investors to compensate them . D) decline sharply in the future.5% next year and 4% the following year.

Unit 6 practice assignments Flashcards

However, there are differences between the two, which have been mentioned below: The unbiased expectations theory conceptualizes predicting future interest rates based on long-term .