Accounting for reserve funds

From there, select New.A reserve fund enhances financial security by providing a safety net against unexpected financial shocks or downturns.That said, reserve fund accounting is not complex.Navigating the Amazon Account Level Reserve is integral to your journey as an Amazon seller.comRecommandé pour vous en fonction de ce qui est populaire • Avis

What Is Reserve Accounting?

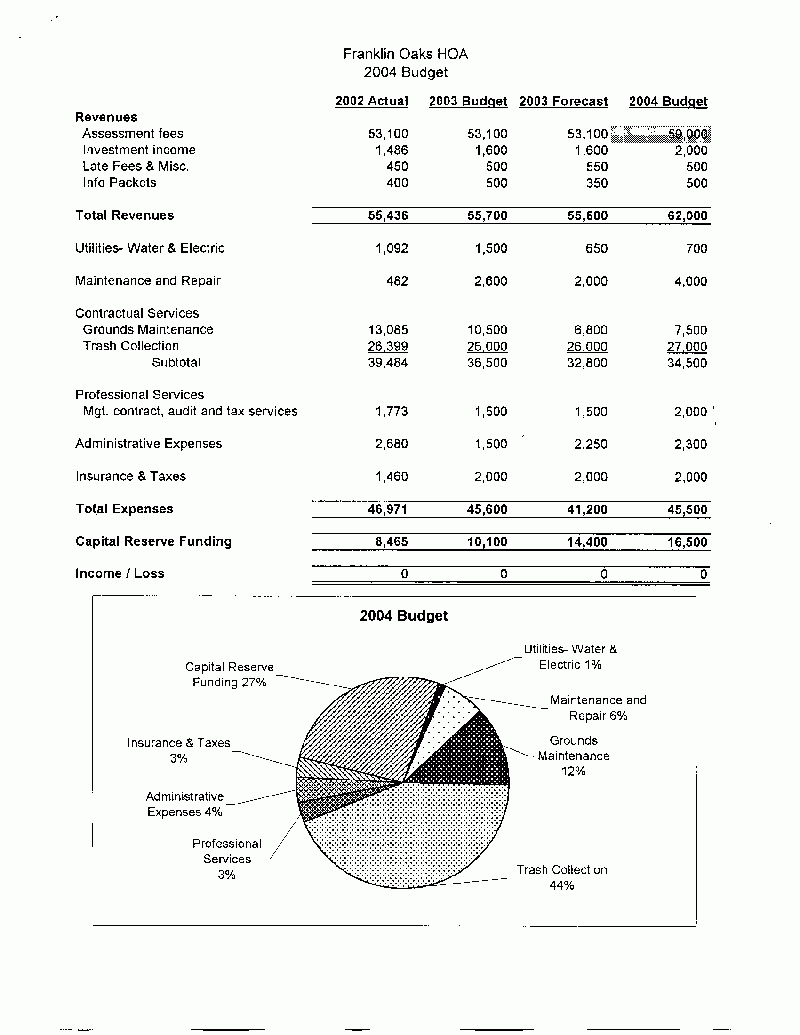

Responsibilities for reporting reserve fund amounts and use of reserve funds; Any specific policies, if needed, about investment of reserve funds; Developing and Approving a Policy.While commercial businesses will rely on a single general ledger, non-profits that use fund accounting will have multiple funds. This is very important for two reasons. Proper budgeting and allocation of HOA reserve funds can often leave you feeling confused about when you should (and shouldn’t) use them. It ensures that funds are readily available to cover emergencies or unforeseen expenses. In accounting, this process is referred to as appropriation.

Reserve Fund

As opposed to reserve and sinking funds, those monies received in advance are not placed in a separate account, but rather in accounts specifically to fund the service charges which occur in each accounting period. In a separate bank account, the IRS does not view reserve funds as .

HOA Reserve Funds: How Wise HOA Boards Avoid Surprises

To maintain FDIC coverage for all of your funds, you must open and manage multiple different accounts with less than $250,000 in each. It’s about understanding that every decision you make, every dollar you set aside, contributes to a harmonious community.What Are Balance Sheet Reserves? Balance sheet reserves, also known as claims reserves, are accounting entries that show money set aside to pay future . Common challenges include underfunded .Most banks offer nonprofits FDIC coverage only up to $250,000 across all types of accounts.Reserve funds are to be used for the maintenance and repair of all the major assets of the Association. The process of setting aside funding for . Generally, you debit retained earnings and credit the reserve fund (also an equity account).Reserve Fund Accounting.When it comes to community management, there are two major areas of spending: (1) daily or recurring expenses and (2) large-scale repairs and replacements as well as unexpected expenses.Reserves are like savings accounts – an accumulation of funds for a future purpose. Co-mingling funds or using reserves . What is the definition of reserves? Reserves can be defined as the portions of business profits .HOA reserve funds are important to boost property values as well as homeowners’ satisfaction levels. Your community should always prepare for both expected and unexpected expenses.Standard recommended practice is that a nonprofit should seek to have 9 -12 months of operational reserves set aside.

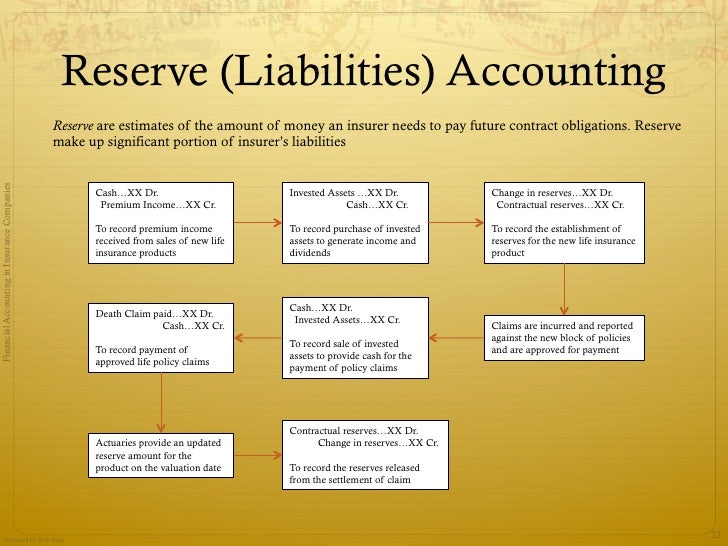

The AICPA Guidelines for accounting for community associations recommend reporting on a .The Ins and Outs of HOA Reserve Fund Accounting. Written by CFI Team. Next, click Chart of Accounts.The accounting process for reserves involves a systematic approach to recognize, record, and disclose funds set aside by a company for specific purposes. This reserve ensures that bonuses can be paid without affecting the regular cash flow or hindering day-to-day operations.HOA reserve funds provide financial resources to address unexpected costs and maintain the quality of community assets. If all fees collected from HOA members are kept in one checking account, the board will need to move money that is allocated for reserves into its own separate account where the reserve funds are kept on deposit. A good example of this is using the sinking fund for periodic maintenance such as painting or roof repairs that are needed every 5 years or 10 years.Reserve Accounting Explained

Accounting for Reserves

HOA Reserve Funds: How To Properly Fund Reserves

A homeowners association doesn't always have the best stories to tell when it . This article includes two examples of reserve policies. How Funds Are Reserved.Easy access to funds in an emergency: Reserve funds are liquid, making it easy to access that cash when necessary. Both are funded by the association fees that homeowners .

Reserve funds

HOA Reserve Fund Accounting: Best Practices. All this does is set the funds aside . In the Account Type field, choose Equity.

Nonprofit Reserve Funds: How to Manage Operating Reserves

(b) Reserve fund line item means the . If a nonprofit is able to save more than 12 months, then those funds can be used to start new ventures.HOA Reserve Funds: How Wise HOA Boards Avoid Surprises – 2021. (1) As used in this section: (a) Reserve analysis means an analysis to determine: (i) the need for a reserve fund to accumulate reserve funds; and. 2/3 for the portion of . As we mentioned before, reserve funds are held in a separate account from operating and other funds. Regular monitoring, adjusting contributions, investment strategies and adhering to legal requirements are essential for effective management of HOA reserve funds. The use of the term reserve shall be limited to an amount . Name it as Accumulated Reserves. To account for reserves, a simple journal entry is made. By staying informed, proactive, and customer-focused, you can successfully . adjust to seasonal variances in revenue. A reserve account is simply a part of a company’s net worth. Otherwise, the financial stress and burden will be placed on the residents’ shoulders.

Reserve (accounting)

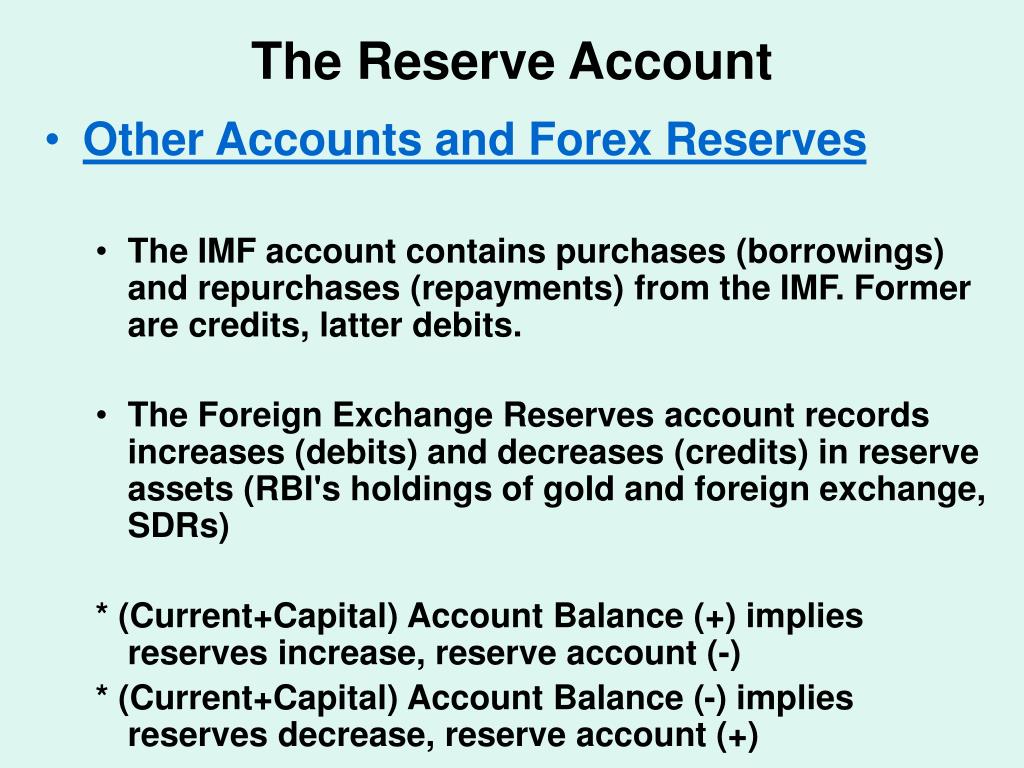

What you can do if funds aren't available in the budget. Reserve analysis -- Reserve fund. What are Cash Reserves? Cash reserves are funds that companies set aside for use in emergency situations. Because of this, the amount appears on the liability side of the .The Institute of Certified Public Accountants now requires their auditors to disclose information in their reports regarding reserve funding.

What Is a Reserve in Accounting?

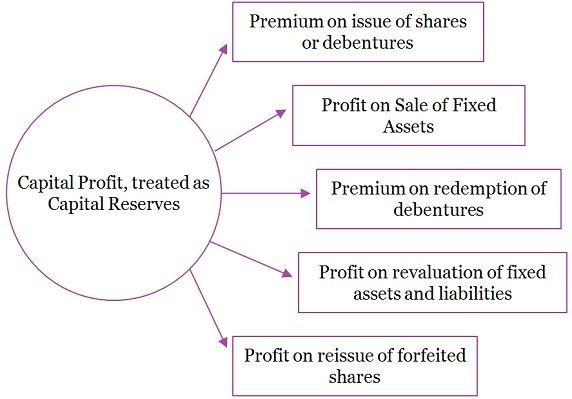

Under state HOA and condominium statutes, board members owe a “fiduciary duty” to the association. In some senses, reserve accounting is an anachronism.Reserve funds differ based on an organization’s needs and requirements. All the paragraphs have equal authority.Accounting for Reserves – Types, Explanation, and Classification - AUDITHOW. This is called reserve fund accounting.Reserve accounts are a vital component of any company’s financial planning strategy and help prevent setbacks or failure. Otherwise, use those funds to seed an endowment and create further organizational sustainability.85% of condo associations needed more than 10% of their budget for reserves.111(1); 765 ILCS 605/18.The budget proposes to increase the capital gains inclusion rate from 1/2 to: 2/3 for dispositions after June 24, 2024 for corporations and trusts, and. What is a Reserve in Accounting? A reserve is an allowance that is set aside for expected . Having a reserve fund can provide peace of mind, knowing that one is prepared for financial uncertainties.Here's how: Open your QBO company and select the Gear icon.Consciously building a reserves fund allows the organization to: be prepared for the inevitable rainy days. January 08, 2024. Reviewed By: Ian Wright (Managing Director) Start learning about the basics of reserves in . Endowment funds are an investment made by, or on behalf of, a nonprofit foundation like a hospital or university. The bank account receives deposits from the . Funds reservation is done automatically either when you submit a requisition or after the requisition . It allows an HOA to manage and allocate funds for specific uses and keep clear records of where every dollar goes.Whilst some leaseholders mistakenly believe that those monies are held in a reserve or sinking fund, this is incorrect. This Section establishes recognition and presentation standards in respect of accounting for reserves. Accounting for Reserves. Basically, it’s just good . Initially, identifying the need for reserves prompts a decision on the type of reserve to be created, whether general, contingency, or specific reserve. Endowment Funds.A 2021 study indicated that 99. What happens to reserved funds if the requisition isn't approved. Embracing the tools and rules of HOA reserve funding isn’t just about compliance.A reserve fund is a fund held by the landlord or manager on behalf of the leaseholders and is set aside to cover the cost of major works or other significant items of expenditure .Reserves as a Part of Fund Accounting For Community Associations.

Operating Reserves With Nonprofit Policy Examples

Practically speaking, there is no such a thing as a “roof fund” or a “paint .What Are Reserves in Accounting? If $50,000 is needed for a roof project that was budgeted at $45,000, the $50,000 should be spent. Accordingly, HOAs also have two accounts for these expenses — operating funds and reserve funds. HOAs must clearly segregate funds to differentiate between operating funds, reserve funds, and any other restricted accounts.Accounting Procedures.

What are Reserves in Accounting

For the most part, deciding just how much cash a community needs to hold in reserve is the responsibility of an association’s board. The use of the term reserve shall be limited to an amount that, though not required to meet a liability or contingency known or admitted or a decline in value that has already occurred as at the balance sheet date, has been appropriated . The first is for operating reserves only and will be useful for nonprofits with a single cash reserve that . What Is an HOA Reserve Fund? If you’re just starting off as a community association manager . This is called fund balance accounting.

Setup needed for funds reservation. The standard entry will debit the reserve account and credit the operating cash account.Reserve in accounting — AccountingTools.Boards and Reserve Accounts. Now that you know the basics of reserve funding, the HOA will be .What is a Reserve Fund? A reserve fund refers to a savings account or highly liquid assets set aside to meet unexpected costs or financial obligations.Reserve accounting can help you ensure that your business’s finances don’t need to take a hit if you ever need to deal with unplanned costs. A cyclical maintenance report done by a .Essentially however, the sinking fund differs from the reserve fund as a mean of collecting extra funds for specific costs that occur occasionally.

Reserve Fund Accounting for Community Associations

What are Reserves in Accounting?

Reserve Accounting

In some cases, a company may need to set up a bank account for the reserve account.

Condo association reserve fund guidelines

The below is not updated with new changes to the law after 2018! 57-8-7. How encumbrance accounting interacts with reserve on submit. Understanding how it works, its impact on your cash flow, and strategies to manage it effectively are crucial for maintaining a healthy, growing business on the platform. The retained earnings account is .Overview

Reserve in accounting — AccountingTools

Generates income on savings: Reserve funds generate interest income on the savings in the fund.

Reserve accounting stops these funds from being used for other purposes, such as paying dividends or buying back shares.In accounting, reserves are portions of a company's profits that are set aside for specific or general purposes. Accountants typically post journal entries to record the placement of cash into a reserve account. Statutory Board Financial Reporting Standard Guidance Note 1 Accounting and Disclosure for Funds, Grants, Accumulated Surplus and Reserves is set out in paragraphs 1-21. (ii) the appropriate amount of any reserve fund. Want to know more? The cash that is saved is used to cover costs or expenses .