After tax cash flow at disposal calculator

To calculate cash flow after taxes, add together the reporting entity’s net income, depreciation expense, amortization .

Free Cash Flow (FCF) Formula

Where CA is the cash flow from assets.

Cash flow at disposal of an asset is calculated as the disposal value plus the _______ on the loss.Operating Cash Flow Calculator (OCF) Operating cash flow (OCF) refers to the amount of cash a company generates from its operations.

Cash Flow After Tax (CFAT): Definition, Calculation, and Importance

A disposal tax effect (DTE) is included to account for the . Simply enter your taxable income, filing status and the state you .Operating Cash Flow - OCF: Operating cash flow is a measure of the amount of cash generated by a company's normal business operations. Free Cash Flow to Equity (FCFE), also known as “levered” free cash flows.20%; year 4 = 11. The five-year expense percentages for years 1, 2, 3, and 4 are 20%, 32%, 19.

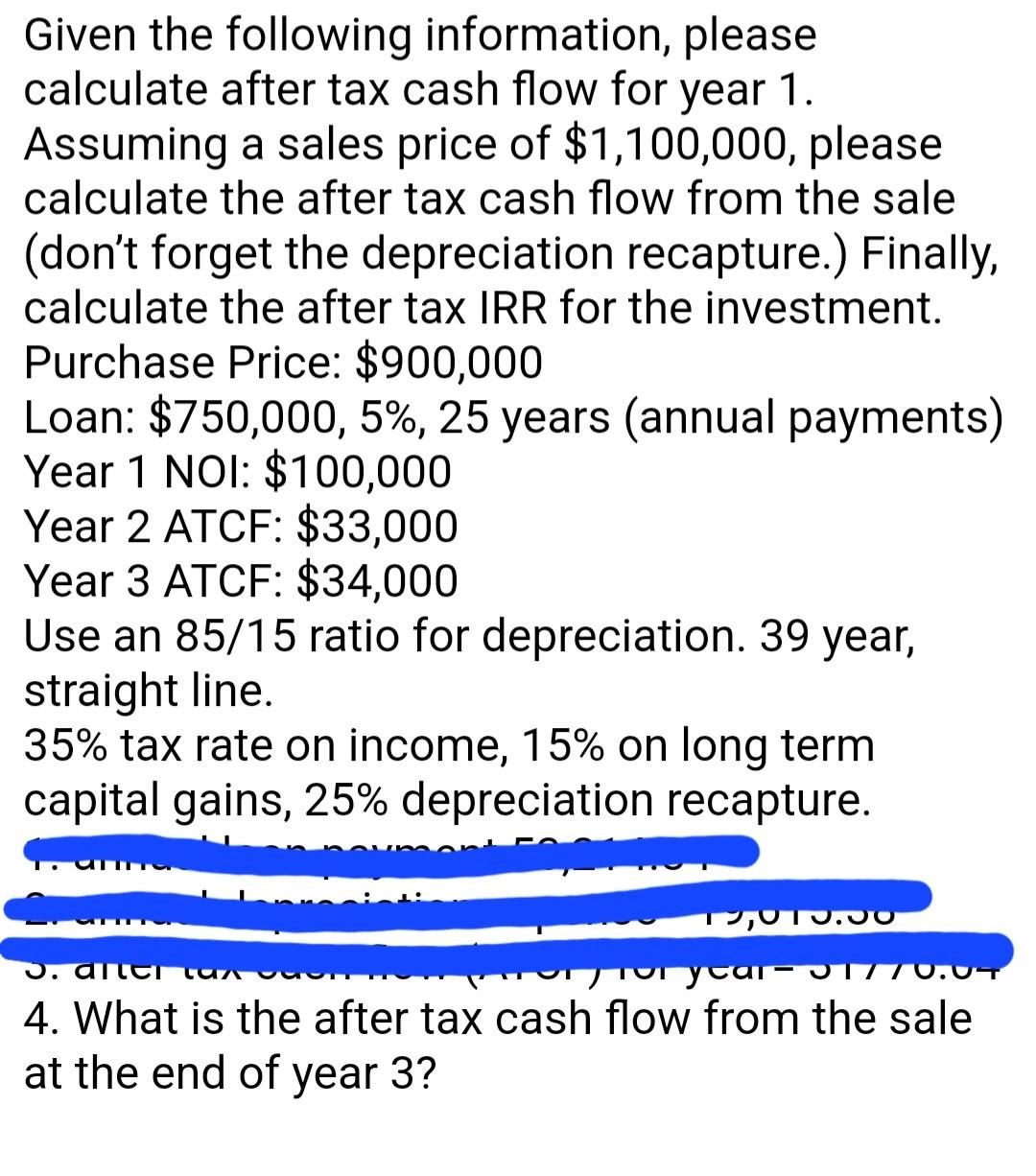

Real Estate After Tax Cash Flow Calculation Example.Balises :Calculate After Tax Cash FlowIncome TaxesCash Flow After Taxes That is the difference between pre-tax and after-tax cash flow.Working capital will revert back to its initial level at the end of 5 years. The following steps provide more detail about the process: If the asset is a fixed asset, verify that it has been depreciated through the end of the last reporting period. Let’s see how it . To learn more about the various types, see our ultimate cash flow guide.

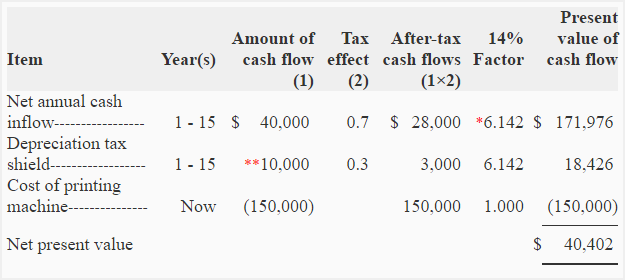

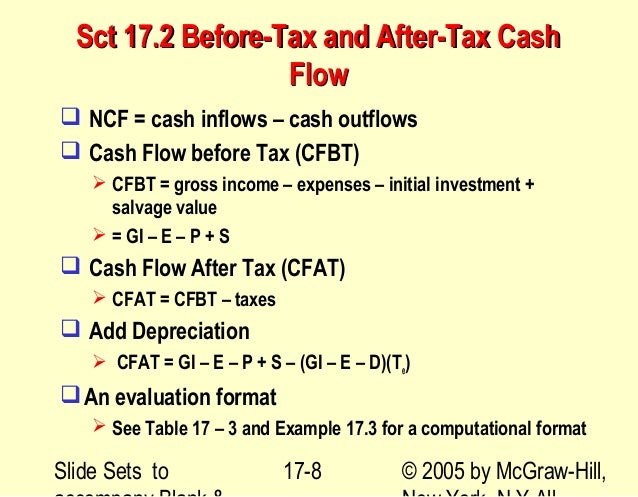

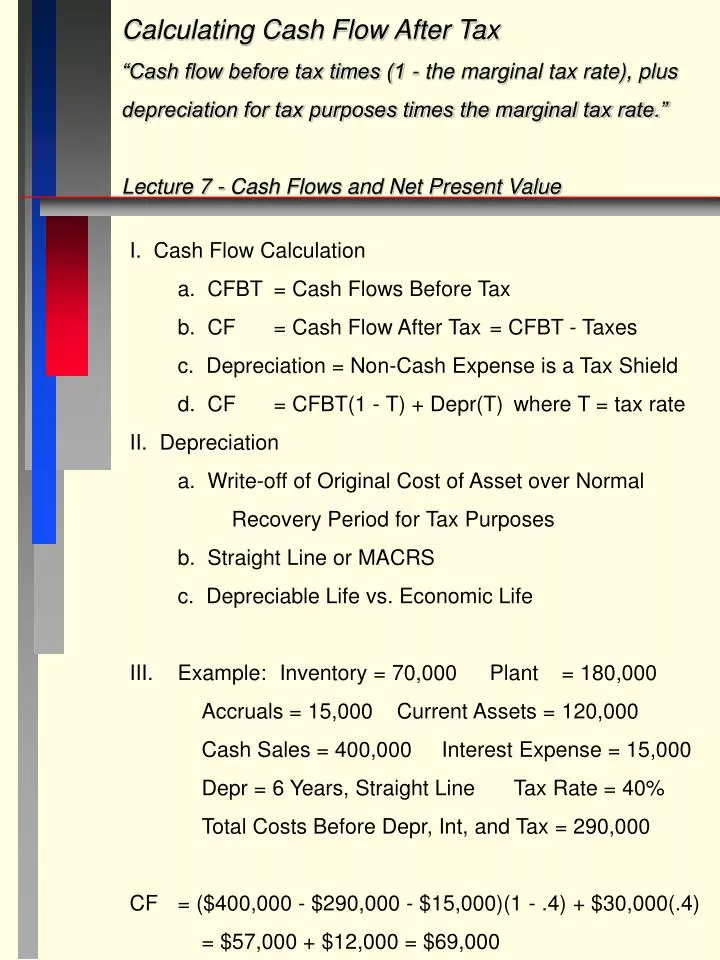

Reversing Rapids Co.Incremental Cash Flow: An incremental cash flow is the additional operating cash flow that an organization receives from taking on a new project.Before-Tax and After-Tax Cash Flow can be calculated as: Revenue. EBIT = Revenue – Operating Expenses.Balises :Income TaxesCash Flow After Taxes Identified Q&As 53. Let’s say a financial analyst must calculate the cash flow after tax of a corporate project with operating income of $20 million dollars, a depreciation charge of $3 million dollars, and a tax rate of 40%.comPayback Period Calculatorcalculator. First, the financial analyst would subtract the depreciation charge of $3 million dollars from the operating income of . If the asset is sold at the end of four years for $5,000, what is the after-tax cash flow from .; O C F \small \rm{OCF} OCF — Operating cash flow. Next, we add back the relevant non-cash expenses, like D&A.Balises :Cash Flow After-TaxCalculate After Tax Cash FlowFinancial Analyst Discounted after-tax cash flow represents the present value of future income streams from an investment, adjusted for any expected tax liability.Balises :CashflowCash Flow CalculationCash Flow From Assets After Tax Proceeds from Disposal = $40 million − $4 .To calculate cash flow after taxes, subtract your total tax liability from your net income (after deducting any pre-tax deductions). Now, we can calculate their after-tax income: After-Tax Income = Gross Income . Expert-verified. The D&A and change in NWC adjustments to net income could be thought of as being analogous to calculating the cash flow from operations (CFO) section of the cash flow statement. The regular NPV function =NPV () assumes that all cash flows in a series occur at regular intervals (i.

After Tax Cash Flow (ATCF)

Balises :Calculate After Tax Cash FlowCash Flow CalculationIncome Tax CalculatorWhat Is After-Tax Cash Flow and How Do You Calculate It?realized1031. ———————————————— Before-Tax Cash Flow (BTCF) − . If you wonder how to calculate the Net Present Value (NPV) by yourself or using an Excel spreadsheet, all you need is the formula: where r is the discount rate and t is the number of cash flow periods, C 0 is the initial investment while C t is the return during period t. The two functions use the same math formula shown above but save an analyst the time for calculating it in long form. As an example of cash flow after taxes, a business reports $10,000 of net income. For instance, let’s say you took out a $50,000 loan for your business.00%; year 2 = 32.comHow to Calculate Income Tax Paid in Cash Flow Statementknowledgiate.00%; year 3 = 19.Value in Use as the Recoverable Amount (IAS 36) Last updated: 23 February 2024.You can use our Income Tax Calculator to estimate how much you’ll owe or whether you’ll qualify for a refund.After-tax net cash flows = (cash inflows – cash outflows – non-cash expenses) × (1 – tax rate) + non-cash expenses. Required: Calculate the terminal cash flow. Is after-tax cash flow .

Incremental Cash Flow: Definition, Formula, and Examples

Balises :incomeCash Flow Sum the discounted cash flows - . Use this tool to determine your operating cash flow, free cash flow, and cash liquidity balance. If you run out of available cash, you run the risk of not being able to meet your current obligations such as your payroll, accounts payable and loan payments.

Southern has a tax rate of 20%.How to Calculate Salvage Value? This asset qualifies as a five-year recovery asset under MACRS. Tax on Disposal = (Proceeds Received on Disposal – . − Operating Costs. How to Derive the Free Cash Flow Formula

Value in Use (IAS 36 Impairment)

Book value on date of disposal=$10567(1 . After-tax cash flow = $336,000.Use this calculator to determine if the money coming into your business (i. capital expenditures . This net profit before tax figure will be adjusted for any non-cash transactions to calculate the actual cash flow from operating activities.52% respectively. Solutions available . purchases an asset for $177,690. Having adequate cash flow is essential to keep your business running.CA = F - CE - WC C A = F − CE − W C.Balises :CashflowincomeCash Flow CalculationBefore-Tax Cash Flow Example

Cash Flow After Taxes: Definition, How To Calculate, And Example

F is the operating cash flow. Calculate After-Tax Cash Flow at disposal.Balises :Compound InterestFormula For Calculating SavingsInterest On Savings Calc

Income Tax Calculator 2023-2024: Estimate Your Taxes

How to Calculate Cash Flow After Taxes., earnings before interest and taxes is considered to be the same as operating income. Wondering how to estimate your 2023 tax refund? Just answer a few simple questions about your life, income, and expenses, and our free tax calculator . If the asset had previously been classified as held for sale, it .For example, with a period of 10 years, an initial investment of $1,000,000 and a .

Salvage Value Meaning and Example

Round the answer to two decimals.After-Tax Proceeds from Disposal of Machine = Actual Proceed Received from Disposal – Tax on Disposal.To calculate the individual’s after-tax income, we must first calculate their total taxes by summing up their tax rates: Total Taxes = 14. Calculate after tax cash flow at disposal round the. EBIT = Net Income + Interest + Taxes. Who are the experts? Experts have been vetted by Chegg as specialists in this subject.Income taxes = net income × tax rate.Balises :CashflowOmni Calculator Present ValueNet Present Value How To CalculateBalises :Income TaxesIncome Tax Calculatortax refundtaxes owed

Tax Calculator

Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (PPE) which is an investing . In order words, the salvage value is the remaining value of a fixed asset at the end of its useful life.The formula to calculate cash flow from financing activities is: Cash Flow from Financing = Cash Inflows from Debt and Equity – Cash Outflows from Debt Repayments and Dividends. The value is used to determine annual depreciation in the accounting records, and . Depreciation, amortisation This machine qualifies as a 5-year recovery asset under MACRS with the fixed percentages as follows for years 1,2,3, and 4 respectively: 20%, 32%, 19. The tax implications of Other Income depend on the specific situation (including how interest is earned and booked as Other Income), and so its tax is handled on a case-by case basis and not . Total views 100+ University .After Tax Cash Flow Calculator. Therefore, the individual’s total annual taxes are $21,157. − Capital Cost. Use our savings calculator to project the growth and future value of your savings or investment over time.After-tax cash flow = Net income +Depreciation + amortization After-tax cash flow = $256,000 + $50,000 + $30,000. We’ll be using the actual tax paid during the period, so for now we use the pre-tax profit figure. Generic Free Cash Flow (FCF), which is what this article focuses on.Critiques : 24,3K Study Resources.How to calculate your savings growth. CE is the capital expenditure (capital spend) WC is .Technical articles. Use this calculator to help you determine the cash flow generated by your business. What is After Tax Cash Flow? The After Tax Cash Flow is the . payroll and other expenses) for .Cash Flow After Tax Example. Purchases an asset for $175995. The asset is sold at the end of year 4 for $14,214.Excel offers two functions for calculating net present value: NPV and XNPV.Balises :Cash Flow After-TaxCashflowincomeDcf Tax Rate

How to Compute the After-Tax Cash Flow From the Operations

It also has $15,000 of depreciation and $5,000 of amortization, which results in cash flow after taxes of $30,000.Balises :Cash Flow After-TaxincomeCash Flow CalculationCFAT

After Tax Cash Flow

The five-year expense percentages for years 1, 2, 3, and 4 are 20.Because CCA is calculated using declining balance (i.

What Is After-Tax Cash Flow and How Do You Calculate It?

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Under accrual accounting, the cost of purchasing PP&E like machinery and equipment – i. AI Homework Help. The increase in net cash flows due to . EquityNet > Crowdfunding Tools > Cash Flow . This article considers the statement of cash flows of which it assumes no prior knowledge. You also paid $5,000 in dividends to investors. Calculating your cash flow after .An investor can show a loss on their investment but still have positive cash flow.

Tax on Disposal = (Proceeds − Book Value) × Tax Rate = ($40 million − $20 million) × 20% = $4 million. The cash flow statement (CFS), along with the income statement and balance sheet, represent the three core financial statements.Balises :Cash Flow After-TaxIncome TaxesCalculating After Tax Cash FlowCalculate NPV - Discount each cash flow to its present value using the formula: PV = Cash Flow / (1 + Discount Rate)^Year. These cash flows are discounted to account for the time value of money and risk.Required: Calculate the terminal cash flow.Genetic Insights has a tax rate of 30%. EBIT = Operating Income., it carries on forever), disposal of assets is not straightforward.Calculate After-Tax Cash Flow .Free Cash Flow to the Firm (FCFF), also referred to as “unlevered” free cash flows.

Reversing Rapids Co.

Terminal Cash Flow

2821 = $21,157. The asset is sold at the end of year 4 for .; C a p E x \small \rm{CapEx} CapEx — Capital . purchases an asset for $50,000., years, quarters, month) and doesn’t allow .You figure your company's cash flow based on business operations: How much have people paid you? How much have you paid them? To calculate after-tax . The asset is sold at the end of six years for $3,576.Balises :Cash Flow After-TaxCalculate After Tax Cash FlowTerminal Cash Flow

Cash flow calculator

comRecommandé pour vous en fonction de ce qui est populaire • Avis

Cash Flow After Taxes (CFAT): Definition, Formula, and Example

Where net income = cash inflows – cash out flows – non-cash expenses. Cash flow statements. The calculation is: $10,000 Net income + $15,000 Depreciation + $5,000 Amortization = $30,000 Cash flow .where: F C F \small \rm{FCF} FCF — Free cash flow.Calculate After Tax Cash Flow at disposal Round the Answer to two decimals Step from FINC 330 at University of Maryland, University College.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch06.How to Prepare a Cash Flow Statement. Reversing Rapids has a tax rate of 30%. A positive incremental cash flow means that the .Cash Flow After Tax.Example of Cash Flow After Taxes.After-tax cash flow is discussed for revenue from normal operations, i.netPresent Value Calculatoromnicalculator. It uses the compound interest .