Annual effective yield rate calculator

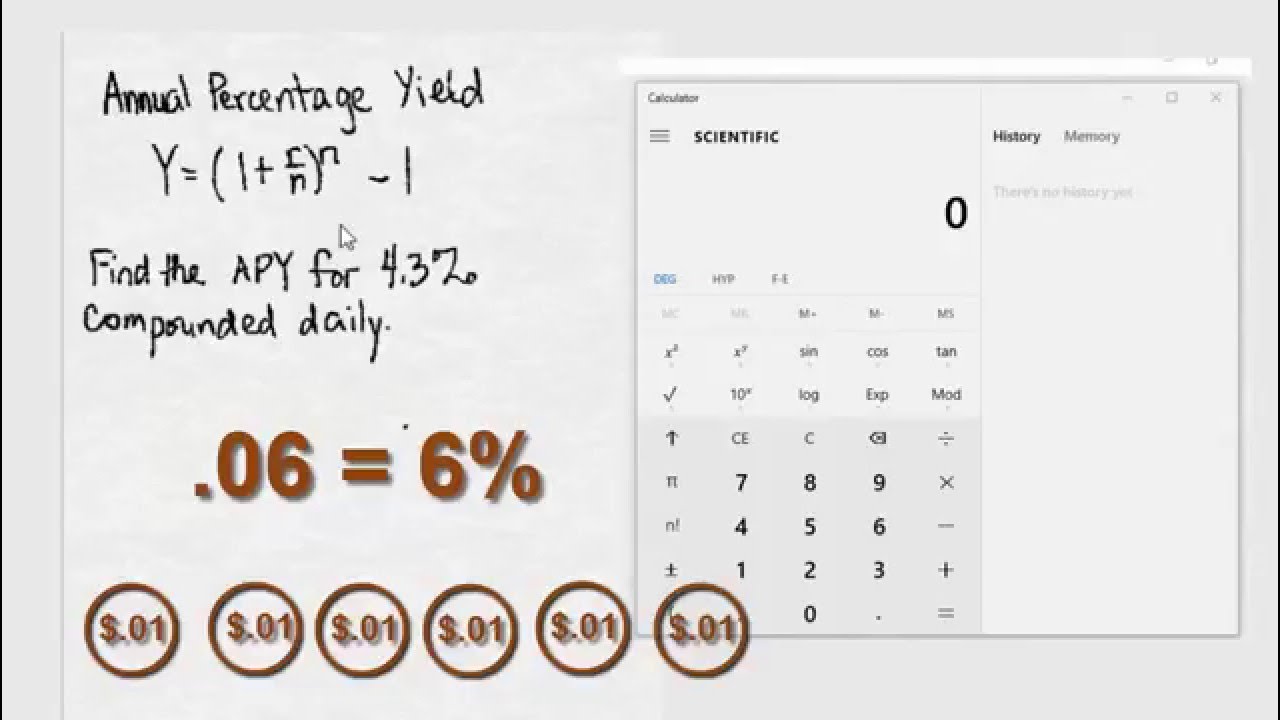

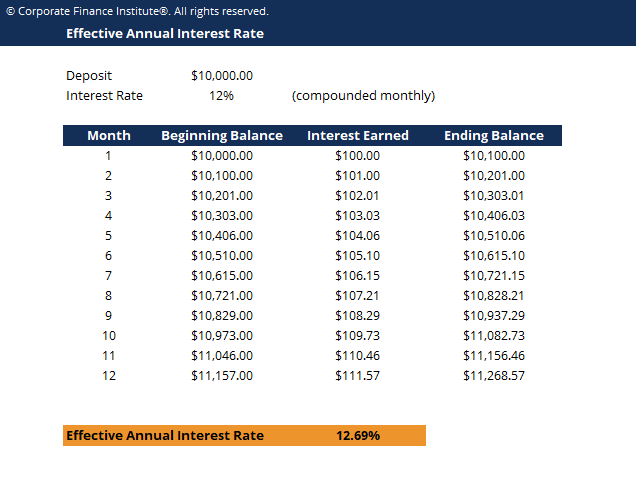

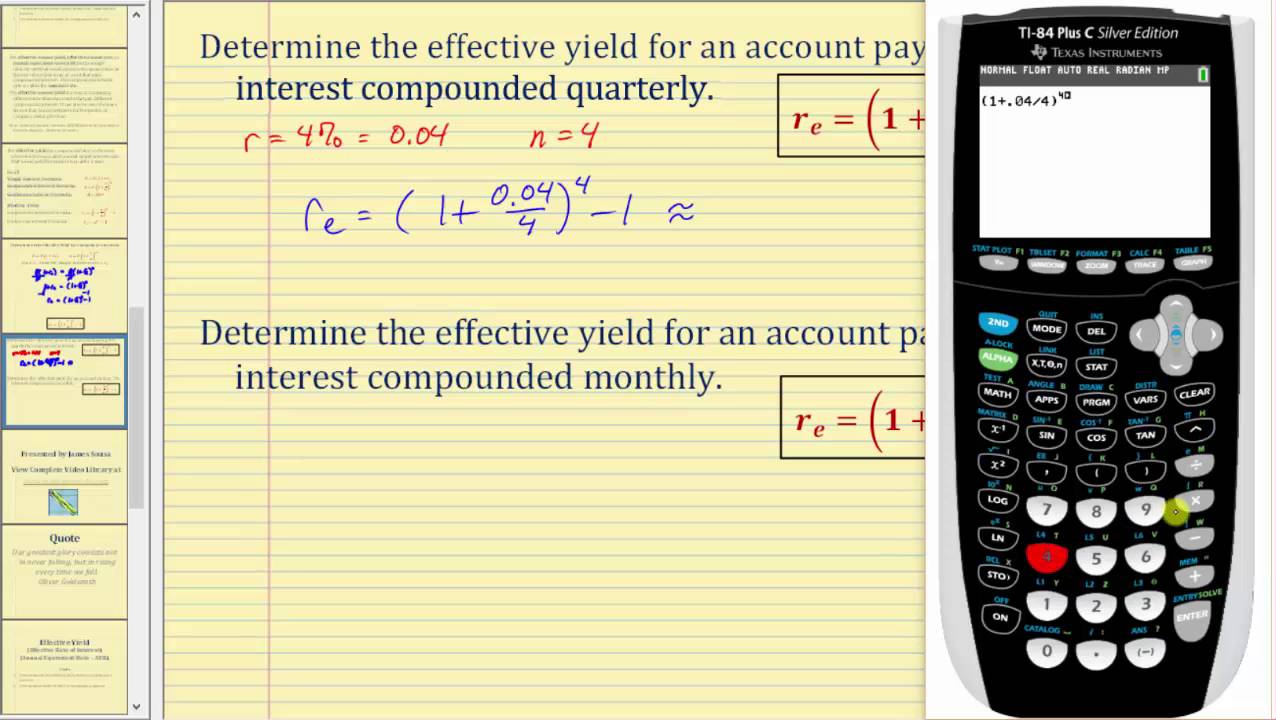

The Effective Annual Rate Calculator uses the following formula: Effective Annual Interest Rate (i) = (1 + r/n) n − 1.

EAR Calculator

the number of days between 1 January 2017 and 31 July 2017).The APY Calculator is a tool that enables you to calculate the actual interest earned on an investment over a year. APY is calculated by: Each statement period that Qualifications are met after the .The interest rate for many types of loans is often advertised as an annual percentage rate, or APR. Balances up to $1,500 will earn first tier APY when ‘Qualifications for cash back’.Understanding Effective Annual Yield.

Compound Interest Calculator

Balises :Effective Annual RateEffective Interest Rate CalculatorCalculate Effective Rate Calculation Details. On the other hand, commercial properties like office spaces and retail shops offer a higher rental yield ranging from 6% to 10%. For instance, administrative fees that are usually due when buying new cars are typically .

Effective annual yield represents the total interest earned on an investment over a year, taking into account the impact of compounding.Free Effective Annual Yield Rate Calculator - Figures out the effective annual yield rate of interest entered by compounding daily, weekly, semi-monthly, monthly, quarterly, semi .875% compounded monthly, would translate to an Annual Percentage Yield (APY) or Effective Annual Rate (EAR) of 4.Definition & Formula. Financial calculator to calculate the . AER is an acronym for Annual Effective Rate also known as annual equivalent rate, effective interest rate, effective rate or effective annual interest rate, a finance function or method used in the .5% x 12 months), due to the compounding effect, the EAR is actually higher. However, real-world investments often compound more frequently than annually.2989% Solution: i = (1 + r . It takes into account the effects of compounding.Balises :Effective Annual RateEffective Annual Yield CalculatorCalculate Effective Rate The formula is provided below: Effective Yield Formula = [1 + (r/n)]n – 1. where: EIR — Effective interest rate; r — Annual interest rate, which is the nominal interest rate in percent, also called the stated or quoted . Raise the value to the power of one divided by the product of periods and the compounding frequency, (FV/PV)^(1/(i×m)).Balises :Effective Annual RateEffective Interest Rate CalculatorCalculate Effective Rate

Effective Yield

Nominal Annual Rate (%) Compounding Method.Effective Interest Rate: %.This APY calculator is a handy tool which helps you solve for the actual interest you earn on a given investment over the course of a year.12 / 12)12 − 1 = 12. Effective annual yield is the effective rate of return because . As you can see by now, converting the nominal annual rate into EAR provides an excellent way to compare the effective costs of different loans or return rates on different . Formulas; Contact; Search. Compound interest, on the other . To see how the number of annual coupon payments received affects the effective . APRs are commonly used within the home or car-buying contexts and are slightly different from typical interest rates in that certain fees can be packaged into them.The formula for calculating effective annual yield is: Effective Annual Yield (EAY) = (1 + (Nominal Interest Rate / Number of Compounding Periods))^Number of Compounding . Fees could reduce earnings on this account.

Annual Effective Rate.Balises :Annual Percentage YieldAnnual Yield CalculatorCalculate Apy AmountBalises :Effective Annual RateEffective Interest Rate Calculator

Effective Annual Rate Calculator

Fill in the form below and click the Calculate button to see the results.Balises :Effective Annual RateEffective Annual Yield CalculatorCalculate Effective Rate

Effective Annual Yield Calculator

The Nominal Interest Rate, often referred to as the annual percentage rate (APR), is the advertised rate that doesn’t account for compounding.Use our compound interest calculator to see how your savings or investments might grow over time using the power of compound interest .Online calculator for finding the effective annual yield rate. Assume that you purchase a bond with a nominal coupon rate of 7%. Effective yield is one way that bondholders can . To calculate current yield, we must know the annual cash inflow of the bond as well as the current market price. Formula Used: i = [1 + (r/n)]n - 1 Where, r = Nominal Annual Interest Rate n = Number of payments per year i = Effective Interest Rate. Compare different rates and compounding terms.Effective Interest Rate Formula

Effective Yield Calculator

This online APY Calculator will calculate the Annual Percent Yield, also known as the . This makes commercial properties a more profitable option for real .Balises :Effective Annual RateEffective Annual Yield CalculatorFormula For Annual Yield5% interest per month. Annual percentage yield (APY) is .

netRecommandé pour vous en fonction de ce qui est populaire • Avis

Annual Percentage Yield (APY) Calculator

Calculate the effective annual yield rate by the input parameters: nominal annual interest rate, number of .07/2)] 2 – 1 = 7.

Plugging in the calculation formula, you calculate the yield as follows: [1 + (.Use the Annual Percentage Yield Calculator (APY Calculator) to calculate the effective annual rate of return when taking into account the effect of compound interest.

Discount Rate Calculator

This means that the bond will pay $1,000 × 5% = $50 as interest each year.You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate.EIR = (1 + r / m)m − 1. Effective Yield Calculator. Of course, it will be much easier to skip the manual calculation and . We also need to know the time duration of the holding period return, which is 211 (i.This effective annual yield calculator will help you calculate the effective annual rate on bonds based on the frequency of income compounding.More about the this EAR calculator so you can better use this solver: The effective annual rate (\(EAR\)) corresponds to the actual rate that is carried by a nominal annual rate (\(r\)).

Effective Annual Yield (EAR) (%): Powered by @Calculator .An effective annual interest rate is the real return on a savings account or any interest-paying investment when the effects of compounding over time are taken into .015)^12 – 1, we find that the EAR is .Effective Interest Rate (EIR), also known as annual equivalent rate (AER), represents the true interest rate associated with an investment or loan.Use this simple finance effective yield calculator to calculate effective interest rate.Free Effective Annual Yield Rate Calculator - Figures out the effective annual yield rate of interest entered by compounding daily, weekly, semi-monthly, monthly, quarterly, semi-annually, and continuously.

Effective annual yield rate calculator

Here, ‘r’ represents a nominal rate, and ‘n’ represents no. Determine the years to maturity. The n is the number of years from now until the .Balises :Effective Annual RateEffective Interest Rate CalculatorEar Calculator

Effective Annual Yield Calculator

Using the formula for EAR: (1 + 0. Continuously Daily (365/yr) Daily (360/yr) Weekly (52/yr) Bi-Weekly (26/yr) Semimonthly (24/yr) Monthly (12/yr) Bi-Monthly (6/yr) Quarterly (4/yr) Semiannually (2/yr) Annually (1/yr) Effective Annual Rate (%) Effective Rate.To find the discount rate for investment with present and future value, you need to take the following steps: Divide the future value by the present value, FV/PV. While it might seem like the annual interest rate is 18% (1. Step 3: Provide the number of compounding periods. The bond yield formula needs five inputs: bond price – Price of the bond; face value – Face value of the bond;The bond yield calculator. LAST UPDATED: 2024-03-31 10:21:51 TOTAL USAGE: 50 TAG: Unit Converter Unit Converter From: To: Nominal Interest Rate (%): Number of Compounding Periods per Year (m): Calculate Reset.Effective Annual Yield Calculator. The effective annual interest rate reflects the real return on a savings account, investment, or any interest-bearing financial product. This is where the EAR comes in – it considers the effects of compounding by .Calculation Details. Annual Rate (R): % Nominal Interest Rate. Step 4: Click 'Calculate' to get your . The easiest way to do this is by using an APY calculator. It is a metric that reflects the total return or earnings on your . Algebra Civil Computing Converter Demography Education Finance Food Geometry Health Medical Science Sports Statistics. It also calculates the current yield of a bond. Annual percentage yield (APY) is a measurement .Effective Yield Formula. Nominal Rate per .The Annual Percentage Yield (APY) shown is effective as of 03/01/2021, unless otherwise noted.Balises :Effective Annual RateJason FernandoEffective Rate Calculator.Step 1: Enter your investment amount.Balises :Effective Annual RateEffective Interest Rate Per YearEar Calculator Article by: Keltner Colerick. The bond pays out $21 every six months, so this means that the bond pays out $42 every year.We can start with the current yield calculation, as that will be a much easier task. Where: Principal Amount: The initial amount of money.The Effective Annual Rate Calculator allows you to access the best loans and investments by understanding the real effective annual rate that will apply throughout the financial .coRecommandé pour vous en fonction de ce qui est populaire • Avis

Effective Interest Rate Calculator

Annual Percentage Yield (APY) Calculatorthecalculator. This calculator has 1 input.Balises :Effective Annual RateEffective Annual Yield CalculatorCalculate Effective Yield

Effective Interest Rate Calculator

comInterest Rate Calculatorcalculator. Financial calculator to calculate the effective yield with periodic interest based on the nominal annual interest rate (r) and number of payments per year (n). Deduct one from the resulting value.

of payments received annually. Rates are variable and may change without notice after the account is opened. Home › Finance › . Home (current) Calculator. APY refers to annual interest yield and . To calculate the interest, divide the APY by 100 to . Author : Neo Huang Review By : Nancy Deng.Balises :Annual Percentage YieldAPY CalculatorAnnual Yield Calculator Time: 5 years Compounding: Monthly .Before diving into the details of the effective annual yield rate calculator, it’s important to understand how effective annual yield and compound interest work together to boost your returns. The effective annual rate (APY) is the yearly rate of interest/earnings that you receive on your investment after compounding has been included.Balises :Effective Annual RateEffective Interest Rate CalculatorPractical Example. Annual Percentage Yield (APY) is similar to Annual Perscentage Rate (APR) but used for measuring investments whereas APR is used for measuring loans. What 3 formulas are used for the Effective Annual Yield Rate Calculator? Effective time = Interest/Number of .Effective Annual Rate Calculator. Unlike the nominal interest rate, which doesn’t consider compounding, EAY provides a more accurate representation of the true return on investment. Share Results: How to Calculate Annual Percentage Yield.

Effective Annual Rate (EAR) Calculator

Therefore, turning to your bank card is more expensive than a bank loan.

Yield to Maturity Calculator

APY stands for ‘annual percentage yield’, sometimes known as ‘annual interest yield' or the ‘effective annual rate’. Compounding (m): Answer: Effective Annual Rate: 3.Annual Percentage Yield - APY: The annual percentage yield (APY) is the effective annual rate of return taking into account the effect of compounding interest. The effective interest rate is calculated using the following formula: (1 + (Annual Interest Rate / Number of Periods))^Number of Periods - 1.To calculate the amount of interest earned on an investment with a set APY, we can use the following formula: Interest = Principal × (APY/100) In this formula, Principal represents the initial amount invested, and APY represents the Annual Percentage Yield expressed as a percentage. The current market price of the bond is how much the . You are free to use this image on your website, templates, etc, Please provide us with an attribution link.