Annual minimum tax ohio cat

2015 2Q is due 8.

Information Releases

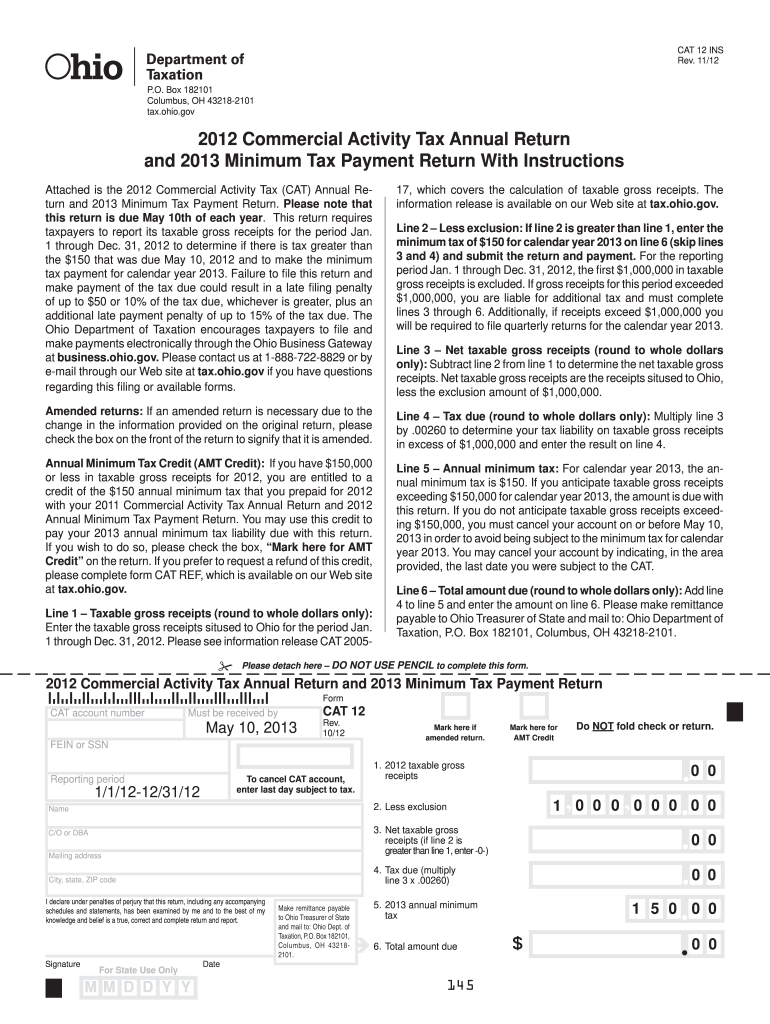

Individuals Resources for.CAT Annual Tax Return Instructions –Tax Years 2013 & 2014 Please note that this return is due May 10th of each year.Changes to the CAT Exclusion and Annual Minimum Tax: PDF: August 2023: CAT 2023-01 Aug 2023: 2014 Releases.Enter the taxable gross receipts sitused to Ohio for the period Jan. Taxpayers with taxable gross receipts of $3 million or less per calendar year will no longer be subject to the CAT.orgOhio Corporate Tax Rates - 2024tax-rates.

What is changing

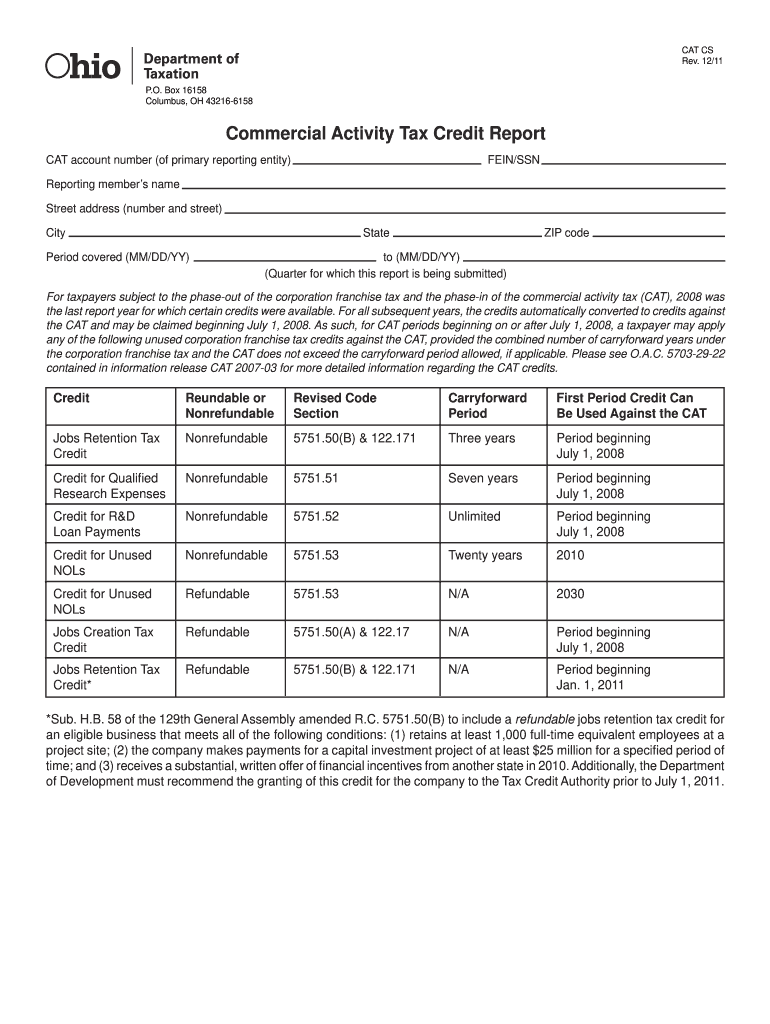

Prior to 2024, businesses with taxable Ohio sales above $150,000 would have to pay, at the very least, $150 of annual minimum tax.When is my CAT due? Annual Payers (less than $1 million in annual sales) the annual minimum tax of $150 is due 5. The minimum tax covers tax year 2007 (January 1, .Ohio Department of Taxation. 2015 3Q is due 11.2024 CAT Changes The Elimination of the Annual Minimum Tax.ORIGINS OF OHIO’S CAT. Beginning in 2007, all taxpayers are required to pay the $150 annual minimum tax on or before February 9th.All CAT taxpayers must make an annual minimum tax payment (“AMT”) of $150.For tax periods beginning on and after January 1, 2024, the CAT annual minimum tax is eliminated, and the exclusion amount is increased from $1 million to $3 million. This return requires taxpayers to report its taxable gross receipts for the period Jan.Attached is the 2012 Commercial Activity Tax (CAT) Annual Re-turn and 2013 Minimum Tax Payment Return. A summary of changes effective for tax periods beginning on and after January 1, 2024 are listed below: Annual exclusion amount increases from $1 million to $3 million for tax year 2024 and $6 million for .This information release is to provide notification to commercial activity tax (CAT) taxpayers of the recent legislative change in Am. The term “person” includes sole proprietors, partner ships and corporations. Annual and Quarterly Filers - Annual CAT taxpayers (those taxpayers with taxable gross receipts between $150,000 and $1 million in a calendar year) must pay an annual minimum tax.

(updated 12/21/23); CAT 2007-02 – Pre . Line 2 – Less exclusion: If line 2 is greater than line 1, enter the minimum tax .

CAT Changes Effective January 1, 2024.

Ohio CAT Changes: What Businesses Need to Know for 2024

legislation that, among other tax law changes, removes Ohio’s commercial activity tax (CAT) minimum tax and increases the taxable gross receipts exclusion from the current first $1 million to the first $3 million beginning in 2024 and to the first $6 million beginning in 2025 [see H. (updated 12/21/23).In order to file returns, a taxpayer must first register for the CAT with the Ohio Department of Taxation. (updated 12/21/23); CAT 2007-02 – Pre-Income Tax Trusts, Explained with Revocation Procedures, Ohio Dept. sections 5703-29-04, Proposed Revised Reg.The tax only applies to gross receipts situating in Ohio, therefore receipts received by purchasers located outside of Ohio are not considered part of the CAT. The Ohio Department of Taxation issued an updatedAnnual Minimum Tax Due Date Change. Since 2007, that tax has been due in February of each year for the privilege year.Ohio — Ohio Commercial Activity Tax (CAT) Instructions for .Annual and Quarterly Filers - Annual CAT taxpayers (those taxpayers with taxable gross receipts between $150,000 and $1 million in a calendar year) must pay an annual minimum tax. All CAT taxpayers are subject to the $150 annual minimum tax for the privilege of conducting business in Ohio. The exclusion will increase from $1 million of taxable gross receipts to $3 million in 2024. From 2005—2013, the annual minimum tax was $150.For more information, please refer to information release CAT 2013-05 – Commercial Activity Tax: Annual Minimum Tax Tiered Structure- Issued October, 2013.Commercial Activity Tax (CAT) Taxpayer . The annual minimum tax is due on May 10th of the current .

CAT 2013-05

Ohio CAT: Three key considerations.

Are You Confused by the Commercial Activity Tax (CAT)?

The annual minimum tax is due on May 10th of the current tax year.and Annual Minimum Tax . 33 eliminated the CAT’s alternative minimum tax and increased the annual exclusion from $1 million to $3 million for 2024 and $6 million for 2025. Therefore, in 2024 and 2025, CAT filers . The annual exclusion amount is increased to $3 million.commercial activity tax annual minimum tax liability.The Ohio Department of Taxation (Department) issued proposed draft rule changes reflecting recently enacted operating budget legislation that, among other tax law .In addition, the CAT minimum annual tax is eliminated starting in 2024. Ohio’s commercial activity tax (“CAT”) is an annual tax imposed on the privilege of doing business in Ohio, measured by gross receipts from business activities in Ohio. 2014 4Q is due 2. 33) significantly changed corporate activity tax (“CAT”) by increasing the annual exclusion beginning with the 2024 tax year. If the filing due date falls on a weekend or holiday, the return is due on the next business day. 1 When does this change take effect? 2 What is changing? 4 Are businesses with less than $150,000 now required to pay CAT? 5 So if my business generates $3M in receipts, is my entire CAT obligation $2,100? If authorized by statute, a taxpayer may carry forward to future years any 31, 2012 to determine if there is tax greater than the $150 that was due May 10 . sections 5703-29-21, Ohio Dept. Failure to file this return and make .Annual minimum tax eliminated. Title: Format: Last Revision Date: Release # Release . This minimum tax is eliminated as of January 1, 2024, so sales above the 3 million mark will be taxed at 0. For example, the 2007 annual minimum tax is due on or before February 9, 2007. The annual minimum tax is eliminated, for tax periods 2024 and thereafter. The Ohio Department of Taxation (Department) issued an information release summarizing and explaining recently enacted operating budget legislation [see H. The annual exclusion amount is . 33 (2023) and previously issued Multistate Tax Alert for . Quarterly Filers - Mandatory electronic filing via Ohio Business Gateway. Businesses Resources for. Taxpayers with annual taxable gross receipts in excess of $1 million must file returns on .

Commercial Activity Tax

Ohio Form CAT 1 Instructions (Ohio Commercial Activity Tax .98 of the Revised Code dictates the order in which such taxpayer must claim each credit.Commercial Activity Tax CAT 2005-12 – Request for Member of a Combined Taxpayer Group to File Separately, Ohio Dept.

commercial activity tax

legislation that, among other tax law changes, removes Ohio’s commercial activity tax (CAT) minimum tax and increases the taxable gross receipts exclusion from the current . It also applies to ser vice providers such as medical professionals, . Therefore, starting in 2024, .comRecommandé pour vous en fonction de ce qui est populaire • Avis Quarterly Payers (more than $1 million in annual sales). The General Assembly, in Am. Failure to file this . Any taxpayer with Receipts over $1 million must pay the AMT, as well as . The Ohio commercial activity tax (CAT), a state - level tax imposed on certain gross receipts in lieu of a state income tax, presents its own set of intricacies and regulatory requirements.• Effective for tax periods beginning on and after January 1, 2024, the CAT annual minimum tax is eliminated; • For calendar year 2024, the CAT exclusion amount is .CAT 2023-01 – Commercial Activity Tax: Changes to the CAT Exclusion and Annual Minimum Tax, Ohio Dept. For tax periods prior to December 31, 2013, the AMT was $150. The Ohio Department of Taxation has outlined the following changes: Annual Minimum Tax Elimination: One of the primary changes is the elimination of the CAT annual minimum tax for tax periods commencing on or after January 1, 2024.• Effective for tax periods beginning on and after January 1, 2024, the CAT annual minimum tax is eliminated.

Ohio: Proposed Draft CAT Rule Changes Reflect New Law on CAT Exclusion and Annual Minimum Tax .The tax changes affecting income taxes, sales/use taxes, the Commercial Activity Tax (CAT) and certain Ohio incentives programs are discussed next.For tax year 2006, the annual minimum tax was due May 10, 2006 because of the 2005 semi-annual period. 33 (2023) and previously issued Multistate Tax .

Ohio CAT: Three key considerations

31, to determine the tax due, if any, and to make the minimum tax payment for next calendar year. The exclusion rises further to $6 million in 2025. The 2023 annual return due May 10, 2024, is the final return required for annual filers. Filing Due Date. section 5703-29-08, Proposed New and Rescinded Regs.Generally, businesses with annual taxable gross receipts of $150,000 or less are not subject to the CAT. This change effectively eliminates the CAT for taxpayers under the gross receipts . The information release is available on our Web site at tax. This return requires taxpayers to report their taxable gross receipts for the period Jan.

Individual income tax . Professionals Resources for.

The Ohio Department of Taxation issued proposed rule changes reflecting recently enacted operating budget legislation that, among other tax law changes, removes Ohio’s .orgRecommandé pour vous en fonction de ce qui est populaire • Avis

Commercial Activity Tax (CAT)

The objective is to streamline the tax system and alleviate the burden on small businesses.Effective in 2024, Ohio will no longer impose a CAT annual reporting requirement nor a CAT annual minimum tax. Government Resources for. Code Section 5751 provides guidance on the taxability or exempt nature of various types of revenue.26% for each dollar .

CAT 2007-01

Before 2024, an annual minimum tax applied to CAT taxpayers. • For calendar year 2024, the exclusion amount is increased .The annual minimum tax is eliminated, for tax periods 2024 and thereafter.Ohio’s Budget Bill (H.orgWhat Is Ohio Cat Tax? - Law infobartleylawoffice. Commercial Activity Tax CAT 2005-12 – Request for Member of a Combined Taxpayer Group to File Separately, Ohio Dept. For more information regarding the CAT, please visit the Ohio .CAT Annual Return Tax Instructions –Tax Years Other Than 2013 & 2014 Please note that this return is due May 10th of each year.

Commercial Activity Tax (CAT): Table of Contents

(2) In the event a taxpayer is entitled to claim mo re than one credit against its commercial activity tax liability, section 5751.