Are trailing commissions tax deductible

A basic tenet of tax law is that expenses paid to generate taxable income are tax-deductible.

Common California Tax Deductions, 2024

Commissions, trailing commissions, management fees, brokerage fees and expenses may be associated with investments in mutual funds and ETFs. Suppose that you have invested $100,000 in a mutual fund product, and its MER includes a 1% trailer .You may have read or heard in the news about the Royal Commission’s recommendations relating to how mortgage brokers get paid.The question of whether real estate commissions are tax deductible is not straightforward, as there are specific guidelines set forth by the Internal Revenue Service .And yes, RESP over-contributions are definitely taxable. If the employer is paying commissions plus a wage and there is no option that includes expenses then the calculations for tax purposes are fairly simply.

Trailer Fee Definition, How It Works, Pros/Cons, Examples

However, certain conditions must be met for the expenses to be eligible. Standard deduction. It’s a long-recognized principle of tax law that in the process of taxing income, it’s appropriate to first reduce that income by any expenses that were necessary to produce it. We understand that during the period from June 1, 2022 to a later date . The standard deduction may be chosen instead of filing an itemized . Total fees paid to Scotia Securities Inc.A taxpayer may also deduct the applicable sales tax: Goods and Services Tax (GST), Harmonized Sales Tax (HST) and Quebec Sales Tax (QST). The Canada Revenue Agency has an extensive list of carrying charges .Deducting Financial Advisor Fees As Section 212 Expenses. If you are required to be away from the office for over 12 hours at a time, you can also claim food and beverage costs. Is the Trailing Commission / Service Fee tax-deductible? When it is embedded in the mutual fund, the Trailing Commission / Service Fee is not tax deductible. You can use capital . received from the Fund Managers for the access, service and advice provided on your account.Temps de Lecture Estimé: 4 min

Which investment fees qualify as tax deductions?

caRecommandé pour vous en fonction de ce qui est populaire • Avis

Solved: Are Trailing Commissions on Mutual Funds tax deductible?

Deductibility of investment management fees

Management fees on mutual fund investments, such as .Most of the fees you pay are used to cover the cost of managing the fund. ARTICLE CONTINUES BELOW.

Are mutual fund fees tax deductible?

The receipt of allocations from a . Their values change frequently, . 503, Deductible taxes.Any time you are hosting a client at an event, you can deduct 50 percent of the amounts you spend on food, beverages, tickets, and entrance fees for an event as Entertainment Expenses. Examples include rental income or dividends on investments. Did you know you can pay the management . This applies to losses as well, so if you bought shares of stock for $3,000 sold them for $2,000, and paid two $50 commissions, you'd have an $1,100 loss. The stealthy expense of ‘trailing commissions’ collected by online discount brokers from mutual-fund investors may be one reason why your portfolio . Trailing commissions can be a good way to keep an advisor incentivized to manage your money and earn strong returns, though it's . Management Expense Ratio (MER) The main cost for holding a mutual fund is the management expense ratio (MER). These include portfolio management fees and trailing commissions.

Are investment fees tax deductible?

This was done through an amendment to National Instrument 81-105 Mutual Fund Sales Practices.25 per cent per year for equity funds and 0. GST, HST, PST, QST) collected on those fees this year.The California standard deduction is $5,202. Property taxes.A trailing commission is an annual payment stream paid to an advisor by a mutual fund company, as a percentage of the client’s holding in the fund, typically about 1%. However, that .00 for individuals and $10,404. Trailing commissions are automatically withheld from the income generated in your account and are, therefore, not reported to you and cannot be deducted.Capital Losses. Generally, you may take an itemized deduction, subject to limitations, for certain state, local, and foreign taxes you pay even if . – cannot be deducted. Student loan interest deduction.If the CRA then reassessed your return and you repaid any of the refund interest in 2023, you can claim, on line 22100 of your return, a deduction for the amount you repaid up to . CRA’s website outlines amounts you can deduct from your personal income tax return. If these changes are passed as legislation, a mortgage broker’s home loan service will no longer be at no cost to you, and instead you may need to pay a multi-thousand dollar fee to arrange your home loan .Trailing fees are not tax deductible.

You may be wondering if there are tax deductions when .

What carrying charges and interest fees can be claimed?

You may be able to deduct certain expenses related to your loan. Mutual funds and ETFs are not guaranteed. In short, interest and financial expenses on a loan may be tax deductible when they result in taxable income. This is because any income or capital gains earned in a TFSA are tax-free, as are withdrawals.

Trailing Commission: Definition, Percentage Range, Ways To Avoid

Are fees to complete my income tax return tax . Home improvements and repairs. One investment expense that used to be tax-deductible is safety deposit fees. For investment management fees to be tax deductible, they must meet the criteria set out in the ITA and be paid on investments held in taxable accounts. Please read the mutual fund’s or ETF’s prospectus, which contains detailed investment information, before investing. Trailing commissions can be a good way to keep an advisor incentivized to manage your money and earn strong .

Tax Insights: Canada Revenue Agency confirms that trailer fees

However, these commissions have a role in the calculation of capital gains or losses from the sale of a property, and it is here where their tax-deductibility comes into context. Trailer fees are usually high, and you can expect them to account for up to 1% or more of the total MER.

You can deduct your broker commission as an allowable expense from your tax return.

![The Master List of All Types of Tax Deductions [INFOGRAPHIC] | Business ...](https://i.pinimg.com/originals/15/a6/2e/15a62e57e3086db232425ae452a797e3.jpg)

15 per cent annually for bond funds.

Line 22100

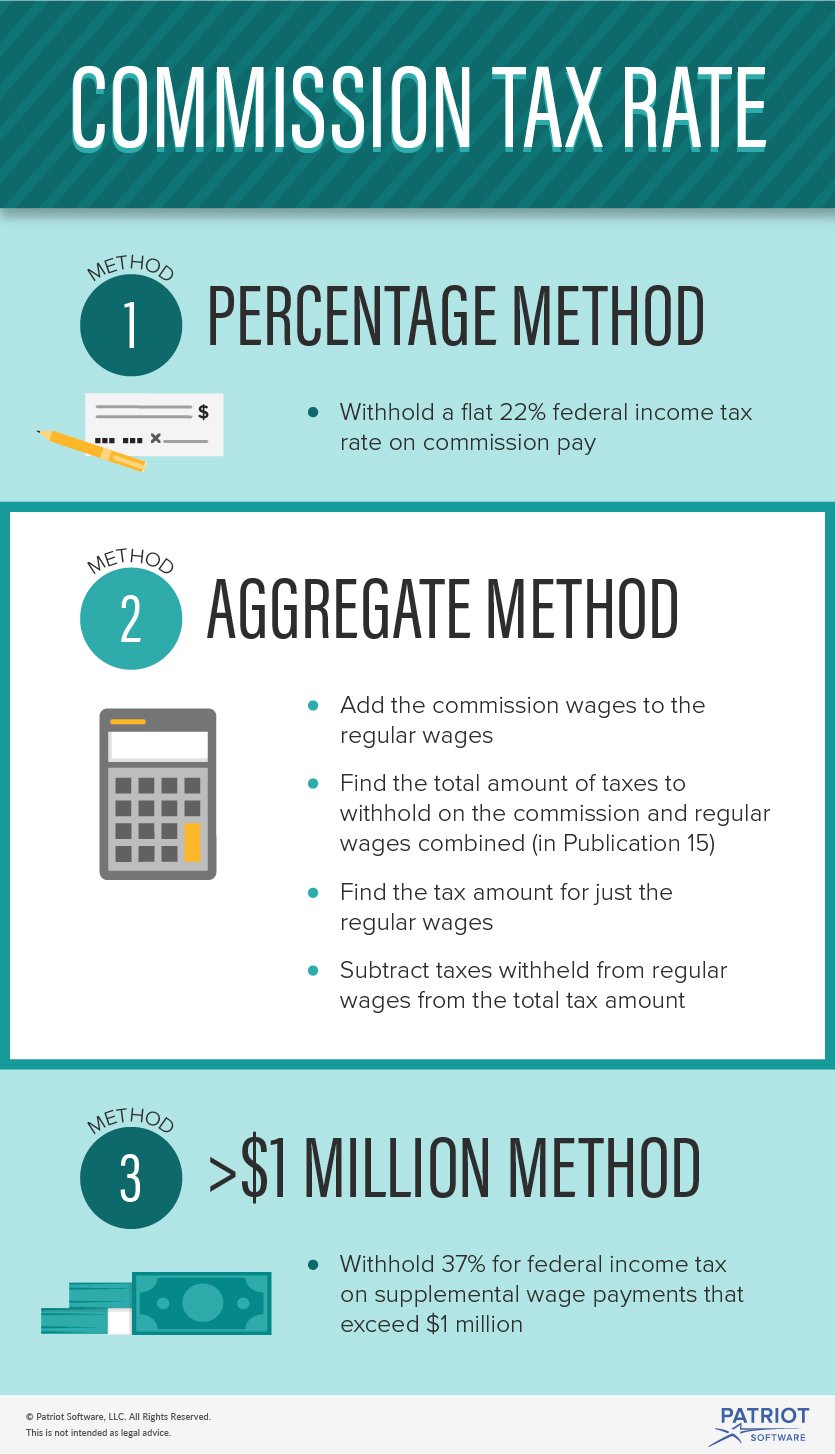

Gambling losses are deductible to the extent of gambling winnings. Thus businesses only pay taxes on their “net” income after expenses under IRC Section 162.So to summarize the answer to James’ question, TFSA fees of any kind are not tax-deductible.Employees who earn commissions with expenses.

Mutual fund management fees are tax deductible in non-registered accounts, but commissions or trading fees to buy stocks and other investments are not tax deductible.

Tax-Deductible Expenses for Commission Employees

Trailing Commissions TDB8150 | Canadian Money Forumcanadianmoneyforum. If contributions exceed the lifetime contribution limit of $50,000, the excess contribution is taxed at 1% per month until it’s . ($45,000 + $5,000 = $50,000) Advertising and promotion + travelling expenses + capital cost allowance + interest on car loan = total expenses. Fees paid to an investment advisor who manages your investments, excluding commissions paid to buy . Note that mutual fund management fees are different from management expense ratios (MERs), which are not tax deductible. Please read the fund facts as well as the prospectus before investing. The commission amount gets added to the regular wage and then the employer can use the . If you borrowed money to invest in .

Understanding the Cost of Mutual Fund

If you buy a GIC through an agent—whether an online brokerage, a GIC broker, or a financial advisor—the issuer of the GIC pays a commission to that agent. The trailer fee pays the salesperson for . Plus, because these .Trailing commissions are paid by a fund manager out of the fund’s management fee for as long as the investment is held.

Ask us: When are my TFSA fees tax deductible?

These costs refer to meals for . The Bottom Line .

WHAT ARE FEE-BASED MUTUAL FUNDS?

Only flat fees are paid directly by consumers, with the other fees paid by lenders.

2023-0987091I7 Trailing Commissions and Dealer Rebates

Educator expense deduction. Capital gains tax. Included in the cost are the management fees, operating costs and taxes. What’s not deductible? .Carrying Charges and Interest Expenses You Cannot Claim.The fee report for mutual funds only includes the trailing commission that goes directly to the Wealth Advisor — it does not include the embedded fees also paid, . An upfront commission is the payment the broker receives from a lender in return for directing your business to them.Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments.This means that transaction fees to buy and sell investments – commissions, sales charges, etc.

Claiming Carrying Charges and Interest Expenses

Trailing commissions are not tax-deductible. Portfolio management, paid to the investment management firm, includes research, investment and professional .caLine 8871 – Management and administration fees - .However, to answer your question, John, mutual fund fees cannot be deducted on your tax return.comClass action suit against TD for trailing commissions to . Bad debt deduction.

Trailing commissions are paid to advisors through the management expense ratio (MER) of mutual/segregated funds. A front-end load is an up-front commission paid to the advisor on the sale of a fund to a client, again as a percentage of the value sold to the client.00 for married couples filing jointly.You cannot deduct commission and sales charges on investments in registered nor non-registered accounts.Most of these so-called above-the-line deductions have no income limits, so anybody can claim them on Schedule 1 of their Form 1040. The MER consists of various expenses including management fees, . The amount is typically 0. The CSA had examined, by way of public consultations and commissioned studies, the option of discontinuing all forms of embedded commissions, but determined that only trailing commissions to brokers, . Itemized deductions.Accordingly, the CRA confirmed that both an upfront commission and an ongoing trailing commission should be exempt unless the same “exceptional .