Arizona state tax estimator 2022

If you need to access the calculator for the 2021 Tax Year and the 2022 Tax Return, you can find it here.

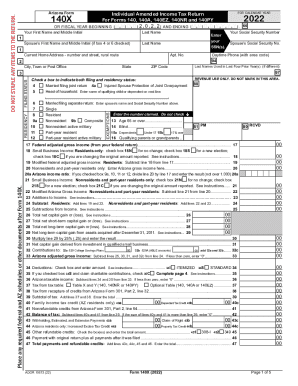

Arizona Form FOR CALENDAR YEAR Individual Estimated Income Tax Payment 140ES This estimated payment is for tax year ending December 31, 2024, or for tax year ending: Your First Name and Middle Initial Last Name Spouse’s First Name and Middle Initial (if filing joint) Last Name 1 Apt.Updated on Apr 17 2024.

Arizona Tax Tables 2022

In 2022, those brackets were downsized to two, with rates of 2. New York state tax $3,413. Corporate and Pass-Through Entity Estimated Tax Payment.140ES Individual Estimated Income Tax Payment 2022.

USA Tax Calculator 2022

Also enter the Arizona income tax withheld shown on your Form(s) 1099R (distributions from - withheld for another state.Arizona income tax rates.5%, which applies .

Arizona State Income Tax Rates for 2023 and 2024

Use this 2023 Tax Calculator to estimate your 2023 Taxes to be . Employees in Arizona to calculate their annual salary after tax. If you don’t have a tax advisor, you can look at your last year’s return. The federal income tax system is progressive, so the rate of taxation increases as income increases.

Arizona Paycheck Calculator

Your liability can be found on Line 48 of your Arizona Form 140 and Line 58 for both your Arizona 140PY (Part Year Resident) and Arizona 140NR (Non-Resident) forms. Disclaimer: Calculations are . Options for deductions, investors, & self-employed. Once you have a good idea of your taxes or if you just want to get your taxes done with, start with a free Taxpert account and file federal and state taxes online by April 15, 2023.2% that you pay only applies to income up to the Social Security tax cap, which for 2023 is $160,200 ($168,600 for 2024). Rules: These can be read online at the Arizona Secretary of State .

CHECK YOUR REFUND STATUS. It’s a great way to dictate where your tax money goes even if you are not eligible for a federal .

IRS & State Tax Calculator

If your income is the same .

Federal Income Tax Calculator (2023-2024)

If you make $55,000 a year living in the region of Arizona, USA, you will be taxed $10,561.Our state tax calculator (income tax calculator by state) helps you to estimate the state tax on your income and see how state tax brackets are applied.Arizona collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. However, the 6. Individual Estimated Tax Payment Booklet. This marginal tax rate means that your immediate additional income will be taxed at this rate. This marginal . This calculator is for 2022 Tax Returns due in 2023.3 Arizona estimated tax payments for 2022 . The withholding formula helps you identify your tax withholding to . 2 City, Town or Post Office State M M D D 2 0 Y Y .Related Calculators. Please provide a rating, it takes seconds and helps us to keep this resource free .

Arizona Tax Calculator 2024

Designed for more complicated tax situations. The Federal or IRS Taxes Are Listed.

Arizona Income Tax Calculator

5% of their taxable income.FICA contributions are shared between the employee and the employer. Get help from a live expert & our AI Tax Assist NEW.2022 Tax Return and Refund Estimator.94% and your marginal tax rate is 22%. You still receive a dollar-for-dollar tax credit for Arizona purposes. Select a Tax Year.What You Need to Know About Arizona State Taxes

2022 Arizona State Tax Calculator for 2023 tax return

Like the Federal Income Tax, Arizona's income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.The Arizona Department of Revenue is pleased to inform you that, as a result of Governor Hobbs’ 2023 bipartisan budget, you may be eligible for a one-time Arizona Families Tax Rebate. Calculate your income tax, social security and .The best way to determine your liability is to talk with your tax advisor.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6. Average tax rate is the effective tax rate that you incur on . However, users occasionally notify us about issues that .98% — that applied to . For tax year 2023, Arizonans at all income levels pay 2. Payments for Individuals Total income tax -$11,074. With this tool, you can calculate state tax wherever you live in the US and check the applicable state tax brackets for 2021 or 2022.Arizona Individual Income Tax Refund Inquiry. Worksheet for Computing Estimated . Your average tax rate is 19. Arizona State Income Tax Tables in 2022.Most individuals deduct the amount of income tax withheld, as shown on Form W-2, plus any Arizona estimated tax payments they made during the year. That means that your net pay will be $44,440 per year, or $3,703 per month.

Arizona Tax Calculator

Welcome to the 2022 Income Tax Calculator for Arizona which allows you to calculate Income Tax Due, the Effective Tax Rate and the Marginal Tax Rate based on your . Taxpayers can call .2022 Arizona Tax Tables X and Y. You can use your 2022tax to figure the amount of payments that you must make during only if you were required to 2023 file and did file a 2022 Arizona income tax return. Estimate your tax liability based on your income, location and other conditions. Your 2022 Arizona tax liability is less than $1,000. After-Tax Income $58,926. Arizona Withholding Rules & Statutes. For tax year 2022, there were two tax rates — 2. In this article, you can not only check how the . The Income tax rates and personal allowances in Arizona are updated annually with new tax tables published for . Subtract line 5 from line 4 .

2022 Tax Return and Refund Estimator

How to Calculate Withholding.

Arizona State Tax Calculator

This calculator computes federal income taxes, state income taxes, social security taxes, medicare taxes, self-employment tax, capital gains tax, and the net investment tax.

140ES Individual Estimated Income Tax Payment 2022

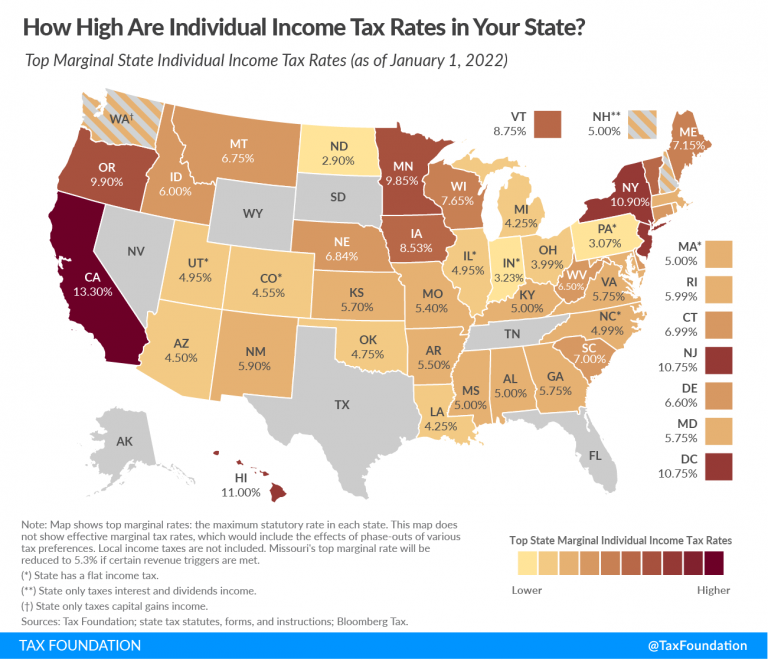

when added to your Arizona withholding, must total either 90% of the tax due for 2023, or 100% of the tax due for 2022.For tax year 2023 and beyond, the tax rate for Arizona taxable income is 2. + $49 per state filed.Enter tax credits claimed on your 2022 income tax return.You are able to use our Arizona State Tax Calculator to calculate your total tax costs in the tax year 2023/24. For additional information, see Arizona Form 309, Credit for Taxes Paid to Another State or Country.The Arizona Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.98% The Arizona Tax Calculator. Marginal tax rate 5. Start with Deluxe. Refund status can be also obtained by using the automated phone system.Income in America is taxed by the federal government, most state governments and many local governments.

Arizona Families Tax Rebate

Make Income Tax Payments Here. $ Self Employment tax.59% on the first $27,272 of taxable income.State of Arizona; Login; Make an Individual or Small Business Income Payment. Individual Payment Type options include: 140V: Payment Voucher 204: Extension Payments .Welcome to the 2022 Income Tax Calculator for Arizona which allows you to calculate Income Tax Due, the Effective Tax Rate and the Marginal Tax Rate based on your taxable income in Arizona in 2022.

Payment Individual

You can quickly estimate your Arizona State Tax and Federal Tax by selecting the tax year, your filing status, Gross Income and Gross Expenses, this is a great way to . Since this deduction . Gross income $70,000.

Full-Year Residents: If your taxable income is less than $50,000, you may use the Optional Tax Tables or Tax Tables X and Y to figure your tax. Calculate your Arizona state income taxes.Starting at $55. In 2023, the state transitioned to its current flat tax rate of 2. Effective tax rate 4. Use Direct File.Allowed to claim a tax credit against your Arizona tax for taxes paid to your state of residence on Arizona Form 140NR filed for the year.2% and your marginal tax rate is 32. Household Income.

Receive email updates from the Arizona Department of Revenue.

2022 Arizona Individual Tax Credits

Our calculator has recently been updated to include both the latest . Your average tax rate is 10.Click on your state or use the table below to access the eFile. 2021 2022 2023 2024 2025* Select Your Filing Status. Calculate your income tax, social security .

Income Tax Calculator

If you had to make Arizona estimated payments during 2022, you must complete this form unless one of the following applies. Answer each question by either clicking on the options shown or by entering dollar ($) amounts or other values.

Form is used by individual taxpayers mailing a voluntary or mandatory . Here is a complete overview of all state-related income tax returns. The provided information does not constitute financial, tax, or legal advice.

Arizona Tax Calculator 2023-2024: Estimate Your Taxes

For more help, click on the question mark symbol at the end of each question. This includes calculations for.

Arizona Individual Estimated Tax Payment Booklet

Enter the Arizona income tax withheld shown on the Form(s) W-2 from your employer.

Louisiana Income Tax Calculator 2023-2024.

Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and .

Access My 1099-MISC .

Individual Income Tax Forms

Subtract line 3 from line 2.