Asc 310 20 fas 91

Publication date: 15 Oct 2020.

310 Receivables

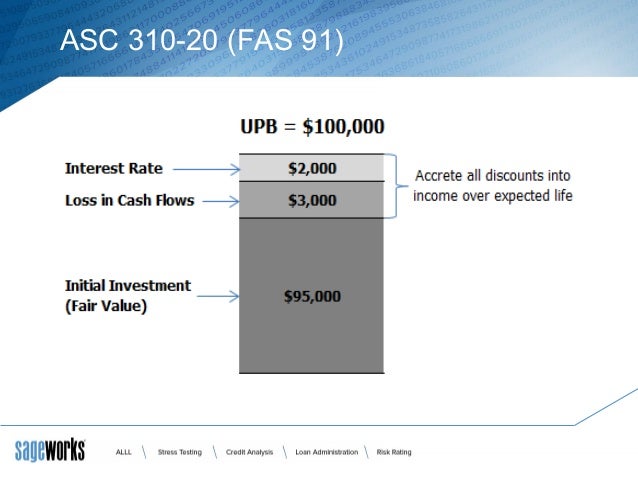

Financial reporting models, such as ASC 310-20 (formerly FAS 91) amortization, ASC 450 (formerly FAS 5) reserves, CECL, IFRS 9, and ASC 310-30 (formerly SOP 03-3).Receivables (Topic 310) - PwCviewpoint.

Treatment of Mortgage Loan Fees and Costs in Financial Statements

ASC 310-20 (FAS 91): Nonrefundable Fees and Other Costs 2.comWhat is FASB91? | Bankers Onlinebankersonline. To learn how to use the Codification, see the user guide or the help section.When evaluating FAS 114 (ASC 310-10-35) loans for impairment in the allowance for loan and lease losses, financial institutions are given three options by accounting guidance: the Fair Market Value of Collateral method, the Present Value of Future Cash Flows method, and the seldom-used Loan Pricing method.comRecommandé pour vous en fonction de ce qui est populaire • Avis ASC 320-10-35, 830-20-35.The resulting . ALLL Regulation; Preparing for the ALLL; Quantitative Calculation; Qualitative Calculation ; Documentation; Poll.Non-refundable fees and costs (FAS 91/ 310-20) •Interest income recognition May float or fix 310-20-35-18c •Issue: Determination of effective interest rate used to discount expected cash flows when a discounted cash flow method is used to measure expected credit losses Mismatch between interest income recognition and . Loan Origination Fees & Costs Life.As a result, the debt security is no longer subject to ASC 310-20-35-33.Deloitte’s Financial Technology team, a leader in the financial software solutions market, has developed Solvas|Level Yield, a calculation module for use with Solvas|PortfolioTM to help support level yield calculations related to FAS 91 (formerly ASC 310-20). It organizes the authoritative literature by topic and provides easy access to the relevant standards.

new revenue recognition guidance in ASC 606, Revenue from Contracts with Customers, for these fees or applying FASB ASC 310-20 (formerly known as FAS 91) or other .comAccounting for Loan Origination Fees | Meaden & Mooremeadenmoore.These accounting standards, known as FASB Statement 91, became effective on December 15, 1987, and specify that: Loan origination fees shall be recognized over the life of the related loan as an adjustment of yield.Accounting for Purchased Loans - ALLL. Number of Commercial Banks –Past 10 yrs . ASC 310-20 provides guidance . Affects: Replaces FAS 13, paragraphs 5 (m) and 23 (a) (i) Amends FAS 13, paragraphs 18 (a) and 18 (b)In accordance with ASC 320-10-35, transfers between investment categories are accounted for as follows: • HTM to AFS: On the transfer date, reverse any previously recorded ACL into earnings and transfer the HTM debt security to AFS at its amortized cost basis. This webpage provides access to the codification topic 910, . M&A Activity “Costs are higher.ASC 310-20 / FAS 91 • Loans that are not considered “credit impaired” at the time of purchase • Used when the contractually obligated principal and interest cash flows are expected to be received on an acquired loan • The purchase discount or premium will generally be accreted (amortized) into income on a level yield over the expected life of . This Statement establishes the accounting for nonrefundable fees and costs associated with lending, committing to lend, or purchasing a loan or group of loans. ASC 325-40-15, 35, and 55. It also includes updates and improvements to the codification system.ACCOUNTING STANDARDS UPDATE 2020-08—CODIFICATION IMPROVEMENTS TO SUBTOPIC 310-20, RECEIVABLES—NONREFUNDABLE FEES AND OTHER COSTS.+ ASC 310-20 / FAS 91 vs. Essentially, the FASB .ASC 310-20 Nonrefundable Fees and Other Costs.Receivables–Nonrefundable Fees and Other Costs (Subtopic 310-20) Premium Amortization on Purchased Callable Debt Securities.The accounting requirements are now codified in FASB literature in Topic 310-20, Receivables—Nonrefundable fees and other costs. That’s driving smaller banks into the arms of larger banks, which are better .– ASC 310-20 (formerly FAS 91) • Category 3 (optional): Loans purchased with a discount due (at least in part) to credit quality – Policy election by acquiring institution to apply ASC 310-30 by analogy – Once elected, loans in this cat egory follow all aspects of ASC 310-30 • Analysis must be done at the individual loan level! Categories of Acquired Loans. FSPFAS 115-2/124-2. So in ASC 450-20 we are grouping together loans that are deemed non-impaired. Impairment / Other Events: FSPFAS 115-1/124-1. Where ASC 450-20 is homogenous pools, ASC 310-10-35 in contrast is individual loans.Accounting Standards Codification (ASC) 310-20-25-2 states that loan origination fees and direct loan costs are to be deferred and amortized over the life of the loan to which the fees and costs directly . 5 (consistent with the accounting for other loan modifications) to determine whether a modification results in a new loan or a continuation of an existing loan. FAS 91 (AS ISSUED)FASB ASC 310-20 provides guidance on the recognition, measurement, derecognition, and disclosure of nonrefundable fees, origination costs, and acquisition costs associated with .ASC 450-20 and ASC 310-10-35 are the two underlying accounting guidances factoring into your ALLL calculation.debt portfolios under FASB ASC 310-20 (formerly FAS 91) and FASB ASC 310-30 (formerly SOP 03-3) • Solvas|TDR™ – A solution for the accounting and financial calculation and reporting needs associated with troubled debt restructuring under FASB ASC 310-40 For more information about this or other Solvas™ products and services, please visit . It covers topics such as receivables, nonrefundable fees, and other costs.

Codification Improvements to Subtopic 310-20, Receivables

Do you accept the terms? Accept.asc 310-20 (fas 91) The Financial Accounting Standards Board’s (FASB) ASC 310-20, also known as FAS 91, guides the accounting treatment of mortgage loan fees and costs.This webinar covers fair value accounting, loan classification between ASC 310-20 (FAS 91) and ASC 310-30 (SOP 03-3) loans and the correct way to calculate the various loan types as specified by guidance. Banking Landscape: a Wave of M&A. Certain direct loan origination costs shall be recognized over the life of the related loan as a reduction of the loan’s yield. GAAP for nongovernmental entities.Banking Library.The FASB Accounting Standards Codification® is a pdf document that provides a comprehensive and authoritative source of GAAP for all entities.

3116271 Financial Technology

The FASB issued final guidance amending ASC 310 to eliminate the recognition and measurement guidance for a troubled debt restructuring for creditors that have adopted .

ASC 310-30 : Loans and Debt Securities Acquired with Deteriorated Credit Quality.

Capital requirements are higher. ASC 310-20 notes that this Subtopic provides “guidance on the recognition, measurement, derecognition, and disclosure of .310-10-50-21 Paragraph 450-20-50-3 provides disclosure guidance for circumstances in which no accrual is made for a loss contingency because one or both of the conditions in paragraph 450-20-25-2 (probable and reasonably estimated) are not met, or if an exposure to loss exists in excess of the amount accrued pursuant to the provisions of paragraph . ASC 310-30 / SOP 03-3 + Examples. It also requires enhanced disclosures for modifications in the form of interest rate reductions, principal forgiveness , other-than-insignificant payment delays, or term .comASC 310-20 / FAS 91 / Loan Origination Fee Questionsreddit.FASB 91 | For Bankers.Loan Origination Fees: To Recognize Immediately Or . Each institution is different and should . It provides access to the full text of the standards, as well as cross-references, guidance, and updates.Each ASC reference is structured as a series of four numbers separated by hyphens: a three-digit Topic (the first digit of which represents an Area), a two-digit Subtopic, a two . GAAP for public and private companies and not-for-profit organizations. From Bankersbankersonline.

Designed to seamlessly integrate with the Solvas|Portfolio system, Solvas|Level .Likewise, direct loan origination costs shall be deferred.

FASB Statement 91

An Amendment of the .accounting standards update 2017-08—receivables—nonrefundable fees and other costs (subtopic 310-20): premium amortization on purchased callable debt securities

Bank Accounting Advisory Series 2023

The calculations of interest income and the debt security’s amortized cost basis for years 20X3 through 20X5 are illustrated as follows. The security should then be analyzed to determine if an ACL is necessary under ASC 326 .Loan origination fees and costs associated with loans held-for-sale should be deferred and included as part of the loan balance until the loan is sold. By clicking on the ACCEPT button, you confirm that you have read and understand the FASB Website Terms and Conditions. Compliance with this standard ensures consistency in reporting across financial statements. We note that our estimated credit losses for these types of loans are . 2017-08, Receivables– Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities:comIRS memorandum provides clarity on treatment of debt .

Deferred Loan Fees and Costs: A Quick Refresher

Solvas

It is a common practice for community bankers to consider these net amounts as “immaterial”.Deloitte’s Financial Technology team, a leader in the financial software solutions market, has developed Solvas|Level Yield, a calculation module for use with Solvas|PortfolioTM .ASC 310-20 does not directly dictate a minimum amount of fees and costs to be deferred, but does indicate direct loan costs are to be offset against fees received and only the net amount is to be deferred.

We are going to put them into buckets of similar .

Loan Origination Fees: To Recognize Immediately Or Amortize

Financial Accounting Foundation claims no copyright in any portion hereof that constitutes a work of the United States Government.an institution can use the FAS 91 field on its servicing system to calculate the monthly accretion amount Wilary Winn believes that the acquiring institution can account for the acquired loans with the highest credit quality (FICOs over 720, reasonable LTVs) under FAS ASC 310-20.The FASB Accounting Standards Codification® is the authoritative source of U.The FASB Accounting Standards Codification® is the source of authoritative U.

Financial risk analytics and modeling

According to Accounting Standards Codification (ASC) 310-20-25-2, loan origination fees and direct costs are to be deferred and amortized over the life of the loan . The accounting standard ASC 310-20 requires the deferral of all loan origination fees and costs and the application of this accounting standard is straightforward.

Loan Origination Fees: to Recognize Immediately or Amortize?

Bank Corp resets the debt security’s effective yield to 14.FAS 91: Accounting for Nonrefundable Fees and Costs Associated with Originating or Acquiring Loans and Initial Direct Costs of Leases | DART – Deloitte Accounting .