Barra global multifactor risk model

This project refers to the BARRA’s Multiple-Factor Model (MFM).widely recognized multiple-factor risk model developed at BARRA, Grinold and Kahn emphasize the importance of identifying key fundamental factors that are relatively easy .

ESG Fund Ratings and Climate Search Tool Attributed.Analyze risk from a truly global perspective: the Barra Integrated Model covers equities, fixed income, cur-rencies and more for over 56 developed and emerging markets.Barra's multi-factor risk models compute an asset's sensitivities to intuitive factors such as industry groups, market characteristics and fundamental data. The models are .

To learn more about the Barra US Sector Equity Model family, please review the factsheet.

Chapter 15 Global Equity Risk Modeling

Tier 4 provides much . “Until now it has not been possible to measure and compare the . Video - Client Only »

barra

The Barra US Sector Model family is created to align with the investment strategy and investment universe to deliver insights into drivers of risk and return. The methodology aims to appropriately represent an investor’s participation in an event based on relevant deal terms and pre-event weighting of the index constituents that are involved. For example, a security with a value-at-risk .

Barra's Risk Models

This number addresses a percentile rank somewhere in the range of 0 and 100, with 0 being the least unpredictable and 100 being the most volatile, relative to the U.Tier 4 provides a consistent, global factor framework across asset classes, including the familiar Barra Global Equity Model (GEMLT) factors for equities.What Is the Barra Risk Factor Analysis?

Global Equity Model (GEM) Handbook

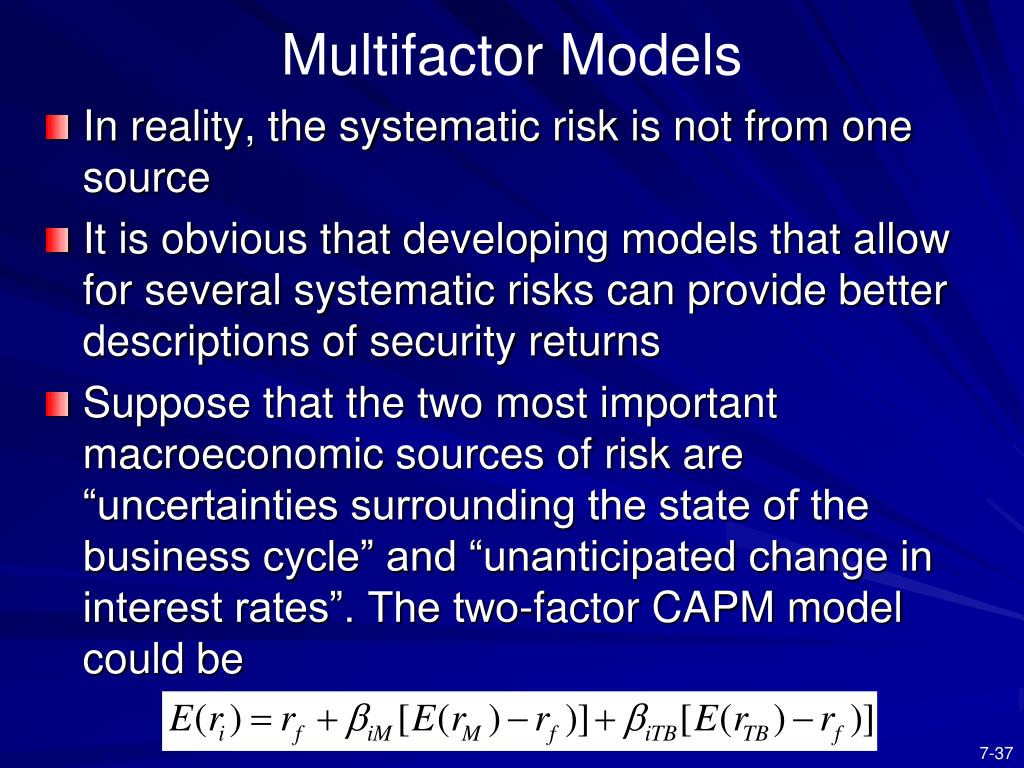

This model encompasses over 40 data metrics, which encompass a wide array of factors such as .Short-Term Model would be used as the risk model for the optimization.This model was estimated via monthly cross-sectional regres-sions using countries, industries, and styles as explanatory factors, as described by Grinold et al.Factor models help investors classify and estimate equity risk and assess the relationships between securities and returns to help guide investment decisions.

Barra risk models are products of a thorough and exacting model estimation process.

Equity Factor Models

Investigate prior risk management strategies you or your firm have tried.John Blin, John Guerard, and Andrew Mark.Accurate characterization of portfolio risk requires .According to the research ideas of constructing the MFM, in total 48 factors from the respective 5 aspects including technical indices, fundamental economy, market access .We will focus on Barra's approach to estimating factor models, and contrast it with other approaches.

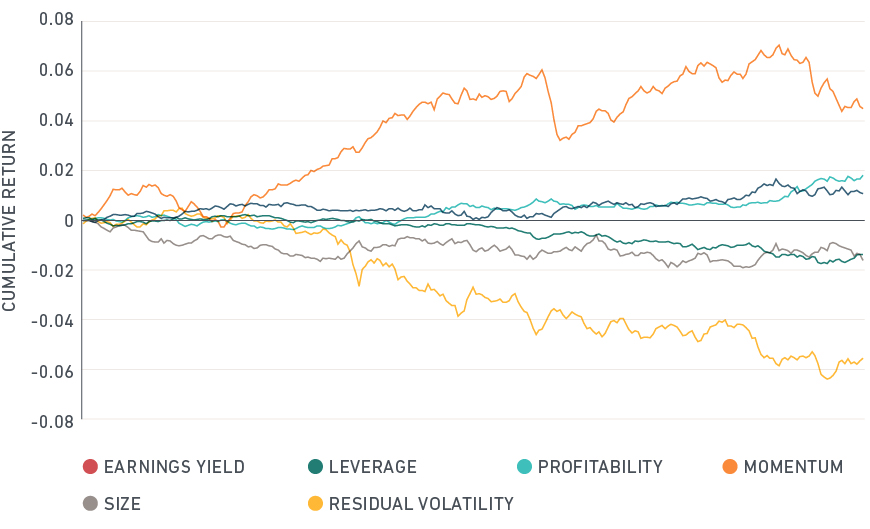

MSCI Barra Analytics Research

GEM2 extends these concepts to the international equity markets, setting new standards for global equity multi-factor models. CNE6 模型是 Barra 的面向中国股票市场的多因子模型。. These local market risk models, both equity and . Key Features & Benefits. The development of the Barra Integrated Model begins with an analysis of individual assets from 56 countries to uncover the local factors that contribute to their risk.In this article, we build a multi-factor risk model based on Barra multi-factor risk model. to quantify and analyze the overall risk associated with a security concerning the broader market.Barra risk factor analysis, often referred to as the Barra multi-factor model, is a sophisticated framework developed by Barra Inc. Beginning with Barra in 1976, MSCI has researched factors to determine their effects on long-term equity performance. The identification of systematic strategies in equities, fixed income, commodities, and currencies. Analytics Research at MSCI Barra investigates issues in risk management, transaction analytics, portfolio construction, VaR simulation, and asset allocation.

Multifactor Risk Models and Portfolio Construction and

(NYSE: MSCI), a leading provider of investment decision support tools worldwide, today announced the launch of the new Barra Private Real Estate Model (PRE2), the industry’s first global private real estate multi-factor risk model.The risk model powering BarraOne gives you a clear and detailed view of risk exposures across markets, asset classes, and currencies. ESG and Clime Funds in Priority The integration into the EDS Investment Process Management platform will provide our clients with seamless access to Axioma models, combined with our powerful risk management tools.

Introducing the Barra US Sector Equity Model Family

categories: Fact Sheet, Equity Risk Models, general

MSCI Multi-Asset Class Factor Model Tier 4 Factsheet

The Barra Risk Factor Analysis is a multi-factor model that embodies over 40 factors that predict the risk associated with a security or investment and also . This model incorporates several advances and innovations over previous Barra global equity risk .The MSCI Multi-Asset Class Factor Model provides: Factor-based asset allocation to target key drivers of risk and return.The Multiple-Horizon Equity Models incorporate daily returns and investment horizon into the proven factor structure of Barra's industry-leading risk models, providing short-term . There’s no sense in choosing a model which mimics what you have not had success with formerly.

:max_bytes(150000):strip_icc()/Multi-FactorModel_Final_4192607-893ee4d3244c4b7c8506e8dc0f4e81b2.png)

Barra Global Equity Model (GEM2 S/L)

Barra Risk Factor Analysis: Definition, How It's Used, and History

The work of Barr Rosenberg led to the creation of Barra, the first major commercially available portfolio selection software.

MSCI Barra Factor Indexes Methodology

Barra Global Equity Model (GEM3)

Co-founder and .Accurate characterization of portfolio risk requires an accurate .In investing, a factor is any characteristic that can explain the risk and return performance of an asset.

BARRA ® GLOBAL TOTAL MARKET EQUITY MODEL SUITE

MSCI Barra employs one of the largest research teams in the index and analytics business, dedicated to building the world’s fi nest index, portfolio construction and risk management tools. Our factor indexes and models, developed in consultation with the world’s largest investors, are backed by research . BIM, combined with .Multiple-factor-risk-model. 该模型考虑了 . This model was estimated via monthly cross-sectional regressions using countries, industries, and styles as explanatory factors, as described by Grinold, Rudd, and Stefek (1989).In the 1970s, multi-factor risk models were developed and estimated by Barr Rosenberg, Andrew Rudd, and their colleagues at Barra; John Blin and Steve Bender at .

MSCI Launches First Ever Global Private Real Estate Risk Model

ESG Fund Ratings and Climate Search Tool Featured. 本文构建的 Barra 模型以 CNE6 模型为准。. Improved communication of portfolio exposures at different levels of granularity for different audiences.

The optimization relies on the factor exposures for all the securities in the Parent Index and the factor co .The Axioma Equity Factor Risk Model Suite offers comprehensive data that can be used in investment decision-making.1 Barra 多因子模型.and risk models for the global equity investor. Key Features & Benefits Depth and Breadth—Get global perspective and local detail for 56 emerging and developed equity markets, 39 fixed income markets, 27 commodity markets, 69 currencies, and hedge .factor Barra risk models 1976 Stephen Ross introduced the Arbitrage Pricing Theory (APT) Rosenberg & Marathe Academic Asset Pricing Literature and Practitioner risk factor modeling research 1986 Chen, Ross, Roll suggested that macroeconomic factors can systematically affect stock market returns 1989 GEM model 1st gen First generation .

Barra Portfolio Manager

Also, we examine the properties as well as the performance of this new factor by applying it to the China's stock market.The general treatment of corporate events in the MSCI Barra Factor Indexes aims to minimize turnover outside of Index Reviews. Empirical evidence regarding the accuracy of Barra's risk . Rosenberg and McKibben (), Rosenberg (), Rosenberg and Marathe and Rudd and Clasing created the academic support for the creation of the Barra risk model, the primary institutional risk model of the 1975–2005 time period. In this paper, we present the latest Barra global equity risk model, GEM2. The model carries the assumption that the portfolio risk and return can be decomposed along 2 dimensions: that which is due to . We choose appropriate and valid common factors, regresses them to calculate and .Multifactor Models The Complex Challenge of Matching an Attribution Model to your Multi-Asset Class Portfolio 15. BARRA risk models .Barra Global Equity Model GEM2. More Equity Analytics: Risk and Performance in One Platform. Through rigorous research and enhanced data management processes, .The layout and design of Barra Portfolio Manager helps users to quickly and easily analyze risk and return, monitor portfolios and conduct pre-trade ‘what if’ analysis across a number of scenarios before making edits to a portfolio’s trade list or rebalancing a portfolio. Multi-factor risk models have been used in portfolio selection since the 1960s and early 1970s.The Multiple-Horizon Equity Models incorporate daily returns and investment horizon into the proven factor structure of Barra's industry-leading risk models, providing short-term and long-term investors with more responsive and accurate risk forecasts.The resulting unified model - BIM - provides a structure for detailed risk decomposition of any type of portfolio, whether equity, fixed income or balanced.Barra Global Equity Model (GEM3) categories: Fact Sheet, Equity Risk Models, general Download file Barra Global Equity Model (GEM3)The Barra Risk Factor Analysis model measures a security's relative risk with a single value-at-risk (VaR) number. According to the research ideas of constructing the MFM, in total 48 factors from the respective 5 aspects including technical indices, fundamental economy, market access return, industry allocation as well as firm characteristic factors are used to .We propose a different way of constructing an idiosyncratic momentum factor using the Barra Global Multi-factor Risk Model. The model introduces Systematic Equity Strategies for the first time in a Barra global equity model, in addition to delivering rich global datasets, point-in-time fundamental data and factor structures aligned to different investment horizons.