Basis swap definition

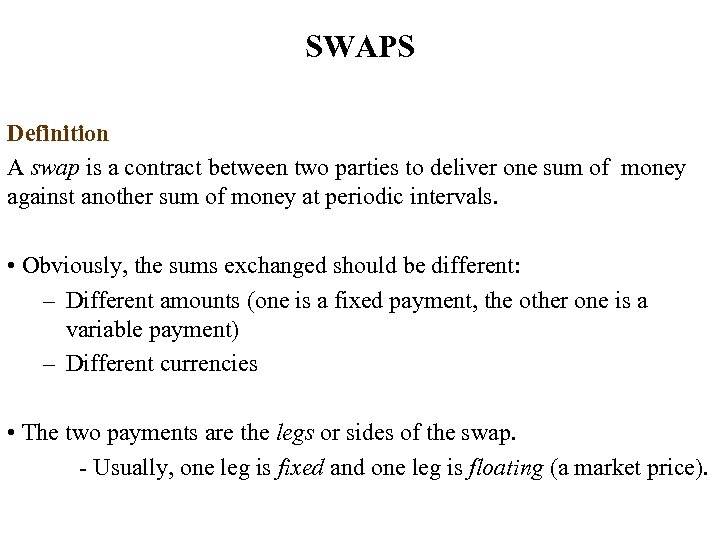

CCP basis is a price differential that reflects the margin costs for dealers of clearing a swap at one central counterparty (CCP) versus another.Un basis swap es un swap en el que dos partes se intercambian los flujos de capital provenientes de una inversión o una deuda, de forma que ambas partes están indexadas a un tipo variable. An interest rate swap in which both legs (the interest rates that are swapped) are both floating rates. Similarly, we can say that an interest rate swap . If a dealer enters a cleared swap at one CCP but can only find liquidity to hedge it at a second CCP, it creates two directional positions at the clearing houses. This means the swap is unaffected by fluctuations in the EURUSD exchange rate .A swap is a derivative contract between two parties that involves the exchange of pre-agreed cash flows of two financial instruments. The premium or discount reflected in .

Equity Swap: Definition, How It Works, Example

A basis rate swap, commonly referred to as a basis swap, is a sophisticated financial arrangement between two parties aimed at exchanging variable interest rates based on distinct money market reference rates. Un swap de taux d’intérêt et de devises (« cross currency swap » en anglais) est un accord bilatéral via lequel deux contreparties s’échangent des intérêts et des capitaux, dans des devises différentes. Mit einem Swap begründen zwei Parteien ein Tauschgeschäft.Le basis swap, d’emploi usuel. Updated December 26, 2020.

Cross-Currency Swap: Definition, How It Works, Uses, and Example

on a daily basis (=daily) quotidiennement.

Swap de taux d'intérêt — Wikipédia

A basis rate swap, also known as a floating-to-floating interest rate swap, is a financial contract between two parties to exchange or “swap” interest payments based on different reference rates.Swap: A swap is a derivative contract through which two parties exchange financial instruments. Swap de change : échange les intérêts et la valeur d’un sous-jacent dans une devise contre sa valeur dans une autre devise. This imperfect correlation .A cross-currency basis swap agreement is a contract in which one party borrows one currency from another party and simultaneously lends the same value, at current spot rates, of a second currency to that party. on a part-time basis à temps partiel. Un Asset swap ou Swap d’actifs est une opération financière de gré à gré conclue entre deux contreparties, qui consiste à échanger un taux d’intérêt flottant contre un taux d’intérêt fixe correspondant à celui d’une obligation, en plus d’un versement ajustant l’obligation au pair.

Traduction basis en Français

Cap: Contract which has a .Basis risk is the financial risk that offsetting investments in a hedging strategy will not experience price changes in entirely opposite directions from each other.

basis swap Definition, Meaning & Usage

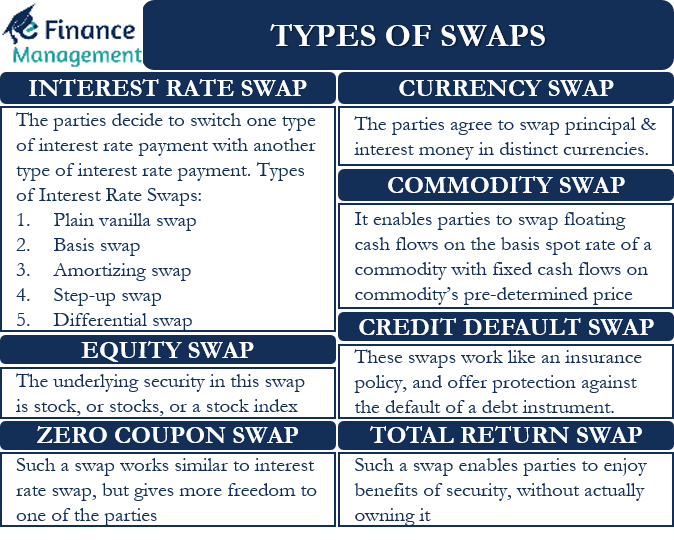

Inflation Swap: An inflation swap is a derivative used to transfer inflation risk from one party to another through an exchange of cash flows . In a basis swap, the two floating legs can also be in different currencies.

A commodity swap is usually . In basic terms, the cross currency basis is a measure of the relative shortage of a certain currency in the market relative to its demand. Michael J Boyle. Les autres catégories de . A contract in which two parties exchange cash flows linked to the difference between the price of a specific quantity of commodities at a particular physical location or quality / grade and the price of the same quantity of commodities on an organized exchange at a different physical location or of a different quality/grade.The FX Basis swap represents the premium or discount associated with borrowing a currency through the USD FX swap (a negative basis means that it is relatively cheaper to borrow through the swap while more expensive to borrow USD). By understanding the fundamentals of basis rate swaps, businesses and investors can .

Definition, Types, and How It Works

Commodity Swap: A commodity swap is a contract where two sides of the deal agree to exchange cash flows , which are dependent on the price of an underlying commodity.

Overview

Basis swap (ou swap de base) : Définition

The cross-currency basis swap will convert the lump sum that the bank borrowed in euro into a lump sum in dollars.Definition of basis swap A financial agreement that settles in cash, calculated by the difference between a futures contract value and the spot price of the related or underlying commodity at a particular time ; How to use basis swap in a sentence.

![Swap • Was sind Swap Geschäfte und wie funktionieren sie? · [mit Video]](https://d1g9li960vagp7.cloudfront.net/wp-content/uploads/2022/09/WP-Bilder_Swap-5-1024x576.png)

What Is Basis Risk? Basis risk is the financial risk that offsetting investments in a hedging strategy.Swap de taux d’intérêt : Exemple de flux.A basis rate swap (or basis swap) is a type of swap agreement in which two parties swap variable interest rates based on different money market reference rates, usually to limit the interest-rate risk that a company faces as a result of having differing lending . Principe ? Un basis swap est une opération dans laquelle 2 contreparties contractent simultanément un prêt .Usually, basis is defined as cash price minus futures price, however, the alternative definition, future price minus cash, is also used.For the third time in less than five years euro cross-currency basis swaps spreads are falling concurrently with the EUR/USD.

Asset Swaps werden von Anlegern in Arbitragestrategien, Tradingstrategien und zum Hedging verwendet und können, wie in der Abbildung „Asset .

Cross currency basis swaps reflect this relative shortage and work as a type of currency hedge, or a type of hedge on a broader global portfolio .

Currency swaps are a type of basis swaps, except that the basis swaps involve only one currency. Commodity swaps can be used to hedge a market position and create a stable price . Soit un swap conclu entre une entreprise A et une entreprise B, sur une période de 2 ans et un nominal de EUR 2 millions.

Inflation Swap: Definition, How It Works, Benefits, Example

Swap : Définition.A basis swaps is an interest rate swap that involves the exchange of two floating rates, where the floating rate payments are referenced to different bases. These instruments can be almost anything, but most swaps involve cash flows based on a notional . This type of swap is commonly used to manage interest rate risk, particularly when there is a difference between two related floating rates. One basis point is equal to 1/100th of 1%, or 0.Plain Vanilla Swap: A plain vanilla swap is one of the simplest financial instruments contracted in the over-the-counter market between two private parties, both of which are usually firms or . The floating rates are calculated over different bases; for example, one might be linked the LIBOR and the other to the fed funds rate.

Interest Rate Swap: Definition, Types, and Real-World Example

One such derivative is the basis rate swap, which allows entities to exchange cash flows based on the difference between two different interest rates.

Commodity Swap

L’une des contreparties déclenche .Un swap est un contrat par lequel des contreparties (généralement des banques ou des institutions financières) se mettent d’accord pour échanger un flux financier contre un autre, suivant des échéances et dans des conditions spécifiées à l'avance.A commodity swap is a type of derivative contract that allows two parties to exchange cash flows, dependent on the price of an underlying commodity. En échange, elle reçoit de celle-ci, tous les 3 mois, le taux EURIBOR 3 mois.Ausführliche Definition im Online-Lexikon.

Swap : Définition Bourse

Bien qu’un swap puisse théoriquement être construit à l’aide d’un seul échange, on s’intéressera ici aux swaps construit sur toute une série de flux.

FX Basis Swaps » ICMA

The cash flows are usually determined using the notional principal amount (a predetermined nominal value).Interest Rate Swap: An interest rate swap is an agreement between two counterparties in which one stream of future interest payments is exchanged for another based on a specified principal amount . What Is a Swap? LIBOR 1 month vs 3 month).

Both legs of a basis swap are floating but derived from different index rates (e. A basis trade profits from the closing of an unwarranted gap between the futures contract and the associated cash market instrument. In an inflation swap, one party pays a fixed rate on . L’entreprise A s’est engagée à payer trimestriellement un taux swap de 2% à l’entreprise B. Each stream of the . En anglais ces swaps sont . Swap de taux d’intérêt et de devises : Définition.0001, and is used to denote the . The mining company and the investor entered into a basis swap to hedge risks. Im Ergebnis soll ein Zins- oder Renditevorteil erzielt werden. This type of swap is commonly used to manage .Cross-Currency Swap: A cross-currency swap is an over-the-counter derivative in a form of an agreement between two parties to exchange interest payments and principal on loans denominated in two .

An interest rate swap in which both legs are calculated on a floating rate, but based on different indexes. Asset-based Swap; Zinsswap, Währungsswap oder Equity Swap, der mit einem Asset (z. Les deux actifs deviennent souvent une .

Qu’est-ce qu’un swap et comment fonctionne-t-il ?

Basis swap

on a regular basis (=regularly) régulièrement. Cette forme d’échange d’actifs financiers peut être définie comme étant l’amalgame d’une partie des deux swaps précédemment mentionnés.

Basis Swap Pricing and Valuation

Equity Swap: An equity swap is an exchange of future cash flows between two parties that allows each party to diversify its income for a specified period of time while still holding its original . Swap par lequel on échange deux taux variables indexés sur des taux à court terme, dans la même devise ou dans deux devises différentes.Swap Basis : Les 2 entreprises empruntes à taux variable dans une ou plusieurs devises et s’échangent les flux. Fact checked by.A basis swap is a type of swap in which two parties exchange the interest payments based on two floating rates. L’on peut ainsi distinguer le basis swap de taux et le basis swap de devises.

Definition, Example & Basis Risk

Il s'agit d'un contrat d'échange de flux financiers entre deux parties, qui sont généralement des banques ou des institutions financières.

Basis Rate Swap Definition

Un swap (“échange”) est un contrat établi entre deux parties afin d'échanger un flux financier contre un autre flux, selon un échéancier fixé à.

Le fonctionnement d’un Swap

Le swap de devises (ou swap de taux d’intérêt et de devises) est un accord conclu entre deux parties qui s’échangent un montant déterminé de devises étrangères et s’engagent mutuellement à effectuer régulièrement des paiements correspondant aux intérêts ainsi qu’à se rendre le montant échangé à une échéance déterminée. → I started off working for them on a part-time basis. This would require two initial margin payments, which .