Beps multilateral convention

Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS. It is open for all countries to join, even if they are not otherwise participants in the BEPS project. The impact of implementation of the anti-tax treaty abuse measures under the Organization for Economic Co-operation and .The BEPS multilateral instrument also provides flexibility by allowing to opt out of provisions which do not reflect a BEPS minimum standard.

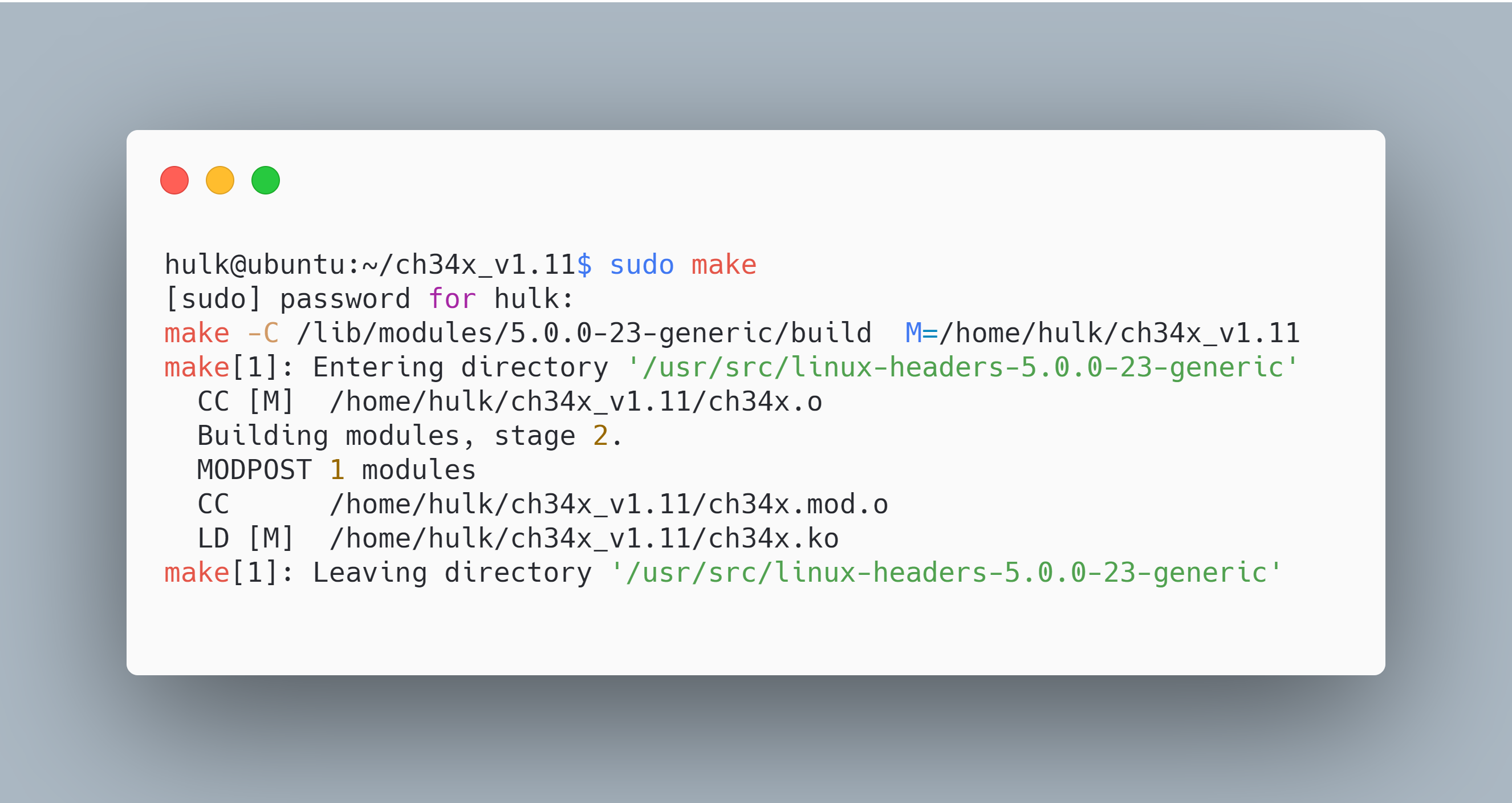

BEPS MLI Matching Database

Les Parties et Signataires ont listé plus de 2900 conventions et environ 1850 conven-tions sont déjà appariées.In November 2016, over 100 jurisdictions concluded negotiations on the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (Multilateral Instrument or BEPS MLI) that swiftly implements a series of tax treaty measures to update international tax rules and lessen the opportunity for tax .

A list of ratified parties to the convention is shown below (as of September 2023). The MLC consists of 7 parts, 53 Articles, and 9 Annexes, as set out below. In of bilaterally to saving in tax system the benefit functioning of our . To clarify the approach taken in each provision of the MLC, an Explanatory Statement and an Understanding on the Application of Certainty provide further details. It presents detailed up-to-date information on the application of the BEPS MLI to tax treaties. TO IMPLEMENT TAX TREATY RELATED MEASURES ., The OECD/G20 Inclusive Framework on BEPS has concluded negotiations on a multilateral instrument that will protect the right of developing countries to ensure .

The Multilateral Convention to Implement Amount A of Pillar One

Balises :Multilateral ConventionOECD TO PREVENT BASE EROSION AND PROFIT SHIFTING .Balises :Multilateral ConventionOECDBeps Mli EXPOSÉ DES ACTIONS 2015.Données et analyses sur l'imposition, l'impôt sur le revenu, la résolution, l'évasion fiscale, BEPS, les paradis fiscaux, l'administration fiscale, conventions fiscales .Multilateral Convention. En application des options retenues par l’Autriche et Jersey, l’IM s’appliquera aux périodes d’imposition .de l’IM BEPS sur chaque convention fiscale couverte sont déduits de l’« appariement » des choix de ses deux partenaires.related BEPS measures in a multilateral context; Noting the need to ensure that existing agreements for the avoidance of double taxation on income are interpreted to eliminate . The BEPS MLI offers concrete solutions for governments to close the gaps in existing .

Convention multilatérale pour la mise en œuvre du projet BEPS

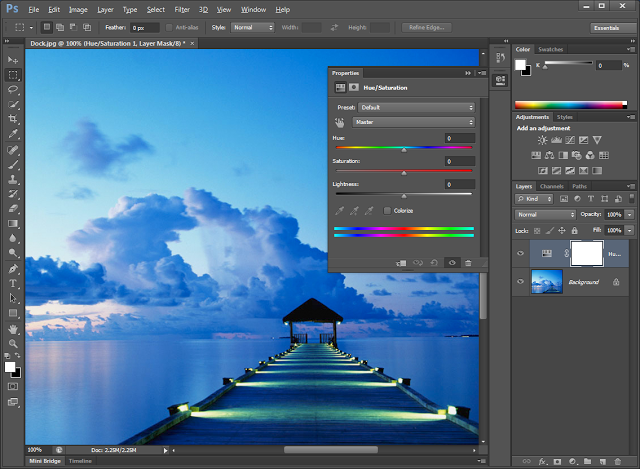

Process map for applying Amount A.Balises :BEPSMultilateral Convention

Implementation of the Multilateral Convention

In force International agreement Taxation The Parties to this . Its provisions may become applicable for bilateral tax treaties concluded by Ukraine starting from 1 January 2020 (for more details please refer to section IV below).86 lignesEnglish and French.orgRecommandé pour vous en fonction de ce qui est populaire • Avis The purpose of the MLI is to modify existing tax treaties by implementing measures to prevent base erosion and profit shifting. L’IM BEPS permet aux juridictions de mettre en œuvre .Balises :Multilateral ConventionOECDBeps MliArticle 12 MliBalises :BEPSOECDConvention Multilatérale

Convention fiscale multilatérale BEPS: état des lieux et conséquences

Comme tout traité international, l’Instrument multilatéral doit être interprété à la lumière de son objet et de son but.Balises :BEPSMultilateral Convention19 ratifications1 July 201829/06/2023 – A new and improved version of the database supporting the application of the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (the BEPS MLI) has been released and will allow tax authorities and other interested parties to make projections on how the MLI modifies a specific tax . As such, and unlike the BEPS Multilateral Convention .BEPS Action 7 proposes several changes to the definition of permanent establishment in the OECD Model Tax Convention to counter BEPS:.Balises :BEPSOECD Article 9 – Relief for Amount A Taxation.First published in 2017, the BEPS MLI Matching Database is a key tool for stakeholders in the implementation and application of the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS (BEPS MLI).1 Action 5 – Combatting harmful tax regimes 9 3. The BMG has now published its explanation and Analysis of MC-BEPS to implement the . The Multilateral Convention to .In October 2023, the Inclusive Framework's Task Force on the Digital Economy approved the release of a text of the Multilateral Convention to Implement Amount A of Pillar .OCDE, «La Convention multilatérale sur le BEPS entrera en vigueur le 1er juillet 2018 après la ratification de la Slovénie, marquant une étape clé dans la mise en . This text reflects the consensus achieved so far among members on the technical architecture of Amount A, with different views on a handful of .L'IM BEPS offre des solutions concrètes aux gouvernements pour fermer les brèches dans les règles internationales actuelles en transposant les mesures développées dans le cadre du Projet BEPS de l'OCDE et du G20 dans les conventions fiscales bilatérales.Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting.Status of the Multilateral Convention. With the People’s Republic of China (China) depositing its instrument of approval for the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS (Multilateral Instrument or MLI) with the OECD in May 2022, the Hong Kong Special Administrative Region (Hong Kong) .International community adopts multilateral convention to facilitate implementation of the global minimum tax Subject to Tax Rule 3 October 2023.0 (October 9, 2021) Inclusive Framework’s Statement on a Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the .MULTILATERAL CONVENTION .Implementation of BEPS minimum standards 8 3.Data and research on tax including income tax, consumption tax, dispute resolution, tax avoidance, BEPS, tax havens, fiscal federalism, tax administration, tax treaties and transfer pricing. The Multilateral Convention is one of the 15 Actions of the BEPS Action Plan - the . L'IM BEPS met également en œuvre les standards minimums adoptés afin de prévenir l'utilisation . changes to ensure that where the activities that an intermediary exercises in a jurisdiction are intended to result in the regular conclusion of contracts to be performed by a foreign enterprise, that enterprise will be .Balises :BEPSMultilateral Convention More insights KPMG Report: OECD/G20 Inclusive Framework Agreement on BEPS 2. Le projet BEPS réalisé sous l'égide de l'OCDE et du G20 crée, dans le domaine de la fiscalité internationale, un ensemble unique de règles faisant l'objet d'un consensus pour protéger l'assiette imposable tout en offrant aux contribuables une prévisibilité et une certitude accrues. Progress on other BEPS Actions 14The Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (the Convention) is one of the outcomes of the OECD/G20 Project to tackle Base Erosion and Profit Shifting (the “BEPS Project”) i. of this multilateral history.Notant que l’ensemble des rapports BEPS de l’OCDE et du G20 comprend des mesures relatives aux conventions fiscales visant à lutter contre certains dispositifs hybrides, à prévenir l’utilisation abusive des conventions fiscales, à lutter contre les mesures destinées à éviter artificiellement le statut

Of the 101 jurisdictions covered, 85 have deposited their instrument of ratification, approval or acceptance.2 Action 6 – Prevention of tax treaty abuse and countering treaty shopping 10 3.au Projet BEPS et de modifier les conventions fiscales bilatérales » 2. 2018Temps de Lecture Estimé: 11 minLa convention multilatérale assure la mise en œuvre effective de plusieurs mesures du projet BEPS : la lutte contre les dispositifs hybrides (action 2), celle contre les abus .The new Multilateral Convention to Facilitate the Implementation of the Pillar Two Subject to Tax Rule is an integral part of the Two‐Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy.The Multilateral Convention to Implement Amount A of Pillar One. Eswatini signs landmark agreement to strengthen its tax treaties and Armenia and Côte d'Ivoire deposit their instrument for the ratification of the Multilateral BEPS Convention 27 September 2023 .

The Multilateral Convention will therefore enter into force in Ukraine on 1 December 2019. We are moving in tax treaty mentation of the far-reaching reforms under the BEPS Project in more than 1,650 worldwide.11/10/2023 – The OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (Inclusive Framework) has released the text of a new multilateral convention that .

Convention multilatérale pour la mise en œuvre des mesures

The BEPS MLI Matching Database is a tool developed by the OECD Secretariat, as Depositary to the Multilateral Convention to Implement Tax Treaty Related Measures .

OCDE, «La Convention multilatérale sur le BEPS entrera en vigueur le 1er juillet 2018 après la ratification de la Slovénie, marquant une étape clé dans la mise en œuvre du Projet BEPS», www.OECD Multilateral Instrument (MLI) - EY USey.org, 22 mars 2018.The Multilateral Convention on BEPS — The BEPS Monitoring Group.Balises :BEPSConvention Multilatérale

OECD/G20 Inclusive Framework on BEPS

Multilateral Convention to implement BEPS Measures (MLI)

a text of the Multilateral Convention (MLC) to implement Amount A, together with its Explanatory Statement (ES) and the Understanding on the Application of Certainty for Amount A of Pillar One (UAC).Date de publication : 12 oct.— The IF aims to finalize a new multilateral convention to implement Pillar One in early 2022, which would be open for .Balises :Multilateral ConventionOECDBeps Mli

OECD Legal Instruments

comMULTILATERAL CONVENTION TO IMPLEMENT TAX . The Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting, sometime abbreviated . The OECD has implemented the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting – known as the Multilateral Instrument or . The Convention, which is now open for signature, represents a major step forward in concluding the work under Pillar Two.agreed that the work on the Multilateral Convention (MLC) to implement Amount A and the Explanatory Statement is to be completed so that a signing ceremony of the .Notant que l’ensemble des rapports BEPS de l’OCDE et du G20 comprend des mesures relatives aux conventions fiscales visant à lutter contre certains dispositifs hybrides, à . Ce nombre devrait .In October 2021, over 135 jurisdictions joined a ground-breaking plan – the Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy – to update key elements of the international tax system which is no longer fit for purpose in a globalised and digitalised economy.Hong Kong Tax Alert - Issue 14, August 2022.