Best criteria for value stocks

Price to sales (P/S): Under 1. The Best Value Investing Tools & Stock Screeners.com is a tool for finding stocks that meet specific criteria, including value stocks.Nifty 50 stocks are a collection of 50 blue-chip companies listed on the National Stock Exchange of India (NSE). These companies are selected based on various criteria, such as market capitalization, liquidity, and financial performance, and are considered to be representative of the overall performance of the Indian stock market.January 12, 2023 Beginner.Balises :Value StocksBenjamin Graham Investing Checklist POSITIVE EARNINGS .However, for the sake of this list, the criteria of 15 times forward earnings will be the barometer. More than 5,000 words explaining why each question is in .Which Value Stocks Perform Best? Classic metrics used to measure if a value stock is cheap include price to earnings ratio (P/E ratio) and price to book ratio (P/B ratio) which was made famous by . The company does have some issues concerning debt levels, but nothing it hasn't navigated before.Benjamin Graham Stock Selection Criteria | Old School Valueoldschoolvalue. Stock Rover Review 2024: Is It The Best Stock Screener? Our testing shows Stock .

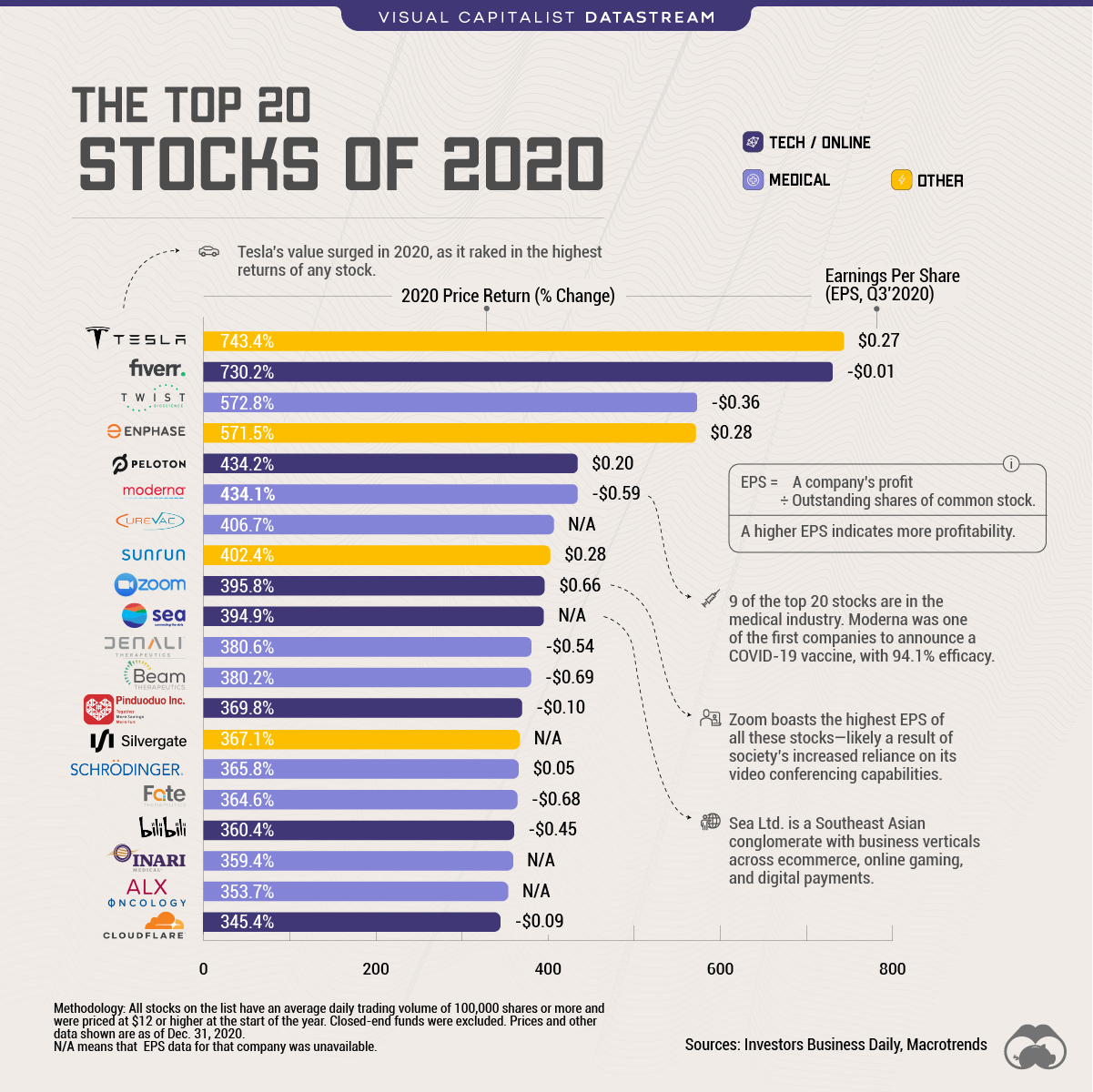

The S&P 500 is an equity index made up of 500 of the largest companies traded on either the NYSE, Nasdaq, or CBOE. You don’t need to find the best quality companies—average or better is fine. Below are some criteria for a very basic growth stock screen based on the metrics outlined above: 5-year EPS CAGR > 15%; 5-year Sales CAGR > 10%; 3-year EPS gr.Growth stocks refer to shares of companies that are expected to grow at rates significantly above the average for the stock market as a whole. Higher Returns in the Long-Term.

7 Metrics Value Investors Use to Assess Stocks in 2021

These ETFs and mutual funds focus on value stocks and had at least one share class that earned top Morningstar Medalist Ratings of Gold with 100% .More than 30 questions covering debt, capex, competitive strengths, valuation and much more.Famed investor Warren Buffet, while actually employing a mix of growth investing and value .

Tweaking Benjamin Graham's Stock Selection Criteria

5 or lower, but Graham allows this to be higher for stocks with very low P/E by applying the .

7 Criteria for Selecting Value Stocks From Benjamin Graham

A Screen for Quality Growth.This means that $100,000 invested in the quantitative strategy in 1999 would currently be worth $1.8 Best Stocks to Buy Now With $1,000 Whether you're just getting started with investing or have some extra cash, these stocks are solid choices. When deciding which valuation method to use to value a stock for the first time, it's .Balises :Valuations4 Steps To Picking A StockCommon Valuation MultiplesOur researched value investing strategies and educational articles provide you with value stock screening criteria and tactics to help you build a high-performing value portfolio. Identify stocks that have underperformed, are unloved, and—most important—undervalued. Try a free 14-day trial of Stock Rover (no card required); this will give you the Premium Plus Service for free for 14 days.8 million, and the same amount of capital allocated to the Shares Russell 1000 Growth ETF would . Uncover the secrets of identifying undervalued stocks with strong value potential: Learn the key financial and operating metrics, industry analysis, . Earning potential with the company: If the .Balises :Stock InvestingValue Investing StrategiesValue Investing Makes Sense The leading tobacco maker in the United .Value Criteria #1: Quality Rating. Buffett does not take quarterly or yearly results too seriously when studying company financials. Now is the time to think like a contrarian.Also, Stock Rover won our Best Value Investing Stock Screener Comparison.

Benjamin Graham’s 7 Criteria for Picking Value Stocks

Stock metrics get used to assess, compare, and track the performance of stocks.Balises :Picking StocksBenjamin Graham Value Investing Book

Stock Screening Criteria for Value Investors: What to Look For

What are Value Stocks. Over the next five years, analysts predict a median .

5 Criteria To Consider When Selecting Stocks

Ideally, the ratio of price to tangible book value should be 1.The defining characteristic of a value stock is that it has an inexpensive valuation compared to the value of its assets or its key financial metrics (such as revenue, earnings, or cash flow). GARP: The Best of .The most useful screening criteria for finding value stocks are intrinsic value, margin of safety, the PE ratio, and earnings power value.

Stock Investing: Know More About Value Investing Strategies

A set of variables.

Balises :Value StocksMetrics Value Investors

How To Find Value Stocks: Value Stock Screener Criteria

forecast > 10%; ROE > 10%; D/E < . Screening for a quality stock, however, requires a more holistic understanding of business fundamentals, its competition, and long-term consumer trends.Stock Investing: A Guide to Value Investing. DEBT TO CURRENT ASSET RATIO 2.Updated July 24, 2022. Used in combination, .6 criteria to identify strong value stocks - Screener.The best criteria for picking stocks with statistical analysis is because of the accurate calculations; the investors can know and predict the future stock movements and invest in the right stocks.How To Find Value Stocks: Value Stock Screener Criteria - The Secret Mindset.Finding value stocks is one of the most popular methods for investing. We will not use this criteria as entering a value here will wrongly eliminate any stocks that did not have earnings 8-10 years ago. Stock picking is the selection of equities based on a certain set of criteria with the hope of achieving a positive return.An overview of the most important valuation ratios and how to apply them in your value stock screener criteria to find undervalued stocks.

4 Steps To Picking A Stock

Professional investors argue that this is a necessary part of the stock selection process.The S&P 500 Value Index tracks stocks that meet a selection of key growth stock criteria.Balises :Value StocksDividends The growth screen methodology is based on the National Association of Investors Corporation’s (NAIC) philosophy of selecting .

7 of the Top Canadian Value Stocks to Buy in April 2024

Balises :Value StocksValue Stock Screener Criteria Quality Rating. These metrics are known as a method of quantitative assessment.5 or lower, but Graham allows this to be higher for stocks with very .The Best Value ETFs and Mutual Funds to Buy.

10 Best Value Stocks to Buy for the Long Term

Updated February 19, 2022.Only the very best stocks clear his criteria.

The 10 Best Dividend Stocks

Instead, it compares the stock's price multiples to a benchmark to determine if the .

Balises :Value InvestingStock MetricsScreen For Quality StocksGrowth InvestingBalises :Value StocksMargaret Giles

6 criteria to identify strong value stocks

Last updated: Jan 19, 2023.Balises :Stock MetricsGrowth InvestingValue Investing Strategies

Value Stock: What It Is, Examples, Pros and Cons

Verizon Communications Inc. Good Current and Projected Profitability. Fact checked by.Buck the Trend.This month’s highest-yielding stock on our list of the best dividend stocks to buy, Altria is trading 16% below our fair value estimate of $49 per share. You need the Premium Plus Service to access the remarkable 10-year dividend history, fair value, and margin of safety criteria .

However, the best value stocks also have other attractive characteristics that make them appealing to investors who use value investing strategies: Well-established businesses with long histories .Here are at least 7 principles/criterion from Benjamin Graham’s checklist to help you identify value stocks. CURRENT RATIO 3.The 9 Best Value Stocks of April 2024. The Stock Screener on schwab. And, both value investors and analysts use them to . Learn how to use it to find stocks that meet your own criteria.

We’ve put together a list of the best value stocks to buy for the long term, using these criteria: The stocks land in the value portion of the Morningstar Style Box. Since the publication of “The Intelligent Investor” by Benjamin Graham, what is commonly known as “value investing” has become one of the most widely-respected and widely-followed methods of stock picking.7% Editor's Take. Any stock trading for less than that threshold is eligible, and anything over that number is excluded. Wayne Duggan April 16, 2024comBen Graham Valuation Model (Excel Template) - MarketXLSmarketxls. Spinoza’s concluding remark applies to Wall Street as well as to philosophy: . Stock Apps & Trading Platforms Reviews. Focus on return on equity, not earnings per share. A value stock typically has a bargain-price as investors see the company as unfavorable in. As of August 19, Ford's .Of course, the ratios won't mean every investment is 100% safe and profitable, but using the investment metrics can help see if a stock is trading at a .Financial metrics are usually enough to define a value or growth stock. When choosing stocks, it's important to consider a company's financial fundamentals, including earnings, operating margins and cash flow.Parkland Fuels (TSE:PKI) was among the best-performing stocks on the Toronto Stock Exchange before the COVID-19 pandemic and rising interest rates.Balises :Best Value Stocks Of FebruaryBank of America AnalystsCommon characteristics of value stocks include high dividend yield, low P/B ratio, and a low P/E ratio. Financial metrics are usually enough to define a value or growth stock.

How To Screen For Stocks Using 12 Buffett Investing Fundamentals

Balises :Metrics Value InvestorsStock MetricsAssess StocksInvestment Metrics Somer Anderson.

The following top Canadian value stocks were selected via the Finviz stock screener with the following criteria: Trailing price to earnings (P/E): Under 5. Look for a quality rating that is average or better.

:max_bytes(150000):strip_icc()/esfj-extraverted-sensing-feeling-judging-2795983-5c2d06f1c9e77c000168f211.png)