Best roth iras

Compare the best IRA accounts for hands-on and hands-off investors, with ratings, fees, promotions and more.A Roth 401 (k) isn’t better or worse than a traditional IRA. Those over 50 can .

9 Best IRA Accounts of 2024

The IRS sets contribution limits for Roth IRAs.

The 7 Best Roth IRA Accounts of 2023

One of the best places to begin investing your Roth IRA is with a fund based on the Standard & Poor’s 500 Index. Find the best option for hands-on or hands-off investors, whether .Auteur : Alana Benson

7 Best Roth IRA Accounts of 2024

Annual contribution limits of $7,000 will apply ($8,000 if you're 50 or older) across all IRA accounts in 2024 . Gold traditional or Roth IRA contribution levels sit at $6,500 per year for 2023, or $7,500 if you’re age 50 or older. Learn how to choose the best Roth IRA account for your retirement . Best for Convenience: Merrill Edge. In This Article. Converting your IRA to a Roth IRA comes with long-term tax benefits; but in the moment, it can actually generate a high tax bill. Updated Dec 13, 2023. RMDs are determined by your age and life expectancy, calculated according to the IRS Single Life Expectancy Table.Investors looking for a wide selection of precious metals purchase options. The retirement savings account you choose can make a .

16 Best IRA Accounts of April 2024

Compare 11 Roth IRA accounts from different brokers and robo-advisors based on fees, commissions, platforms, and mutual funds.

How to Find the Best Roth IRA Rates

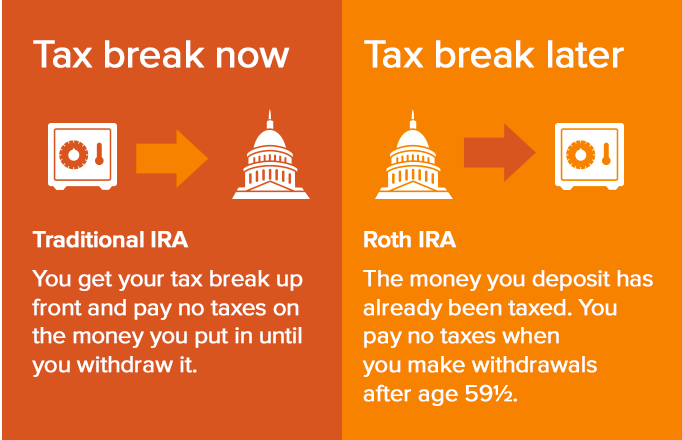

How we chose the best Roth IRA accounts.The best investments to hold in your Roth IRA are ones that will benefit the most from decades of tax-free growth.Traditional and Roth individual retirement accounts are tax-advantaged retirement accounts.Inherited Roth IRA (Life Expectancy Method) You can set up an inherited Roth IRA and take distributions throughout your lifetime.

What Is a Roth IRA?

Retirement might seem far away, but now’s the time to plan for it.Learn how a Roth IRA can help you save for retirement with tax-free growth and flexible access to your money.

Gold IRAs: A retirement savings alternative

Best Roth IRAs for Hands-On Investors.Compare the top Roth IRA providers for self-directed and hands-off investors based on fees, services, tools, and investment options. Table of Contents.The big three brokerages that get a lot of recommendations are Fidelity, Vanguard, and Schwab. Find the best option for self . Charles Schwab.Roth IRAs are retirement accounts that allow for tax-free withdrawals in certain cases. Phone: 866-250-5090.

The Best Roth IRAs for May 2023

Merrill Edge is part of Bank of America, which is good news for Bank of America, Member FDIC account holders.Compare the features and benefits of the best Roth IRA accounts offered by online brokers and robo-advisors.As with traditional IRAs, these accounts include an annual contribution limit of $7,000, for those under . traditional IRAs. Roth IRA Contribution and Income Limits: A Comprehensive Rules Guide. During the next 25 years, the companies thrive and generate an average annual return of 15% per .Investors can choose the right Roth IRA for their needs from among the typical financial firms – such as Schwab, Fidelity or Vanguard – or select a robo advisor, .Gold IRAs can be either a traditional, Roth or simplified employee pension (SEP) IRA. A Roth IRA is an IRA that, except as explained below, is subject to the rules that apply to a traditional IRA. E-Trade: Best for mobile . Fees per trade: $0. Learn how to choose the right account for your retirement savings goals and needs. Workers just starting out in their careers could benefit from a .

15 Best Roth IRA Accounts for September 2023

A Roth IRA is an individual retirement account that could be a powerful vehicle to save for your retirement. Strategically allocating funds with low tax efficiency to your Roth IRA can boost your returns. Interactive Brokers: Best for advanced DIY investors.

Roth IRA: What is a Roth IRA?

Fidelity: Best overall. You cannot deduct contributions to a Roth . Find out how to open and fund an IRA account for . Please fill out this field.April 11, 2024. Budgeting Budgeting. Find out which one suits your trading and investing style . The 9 Best Roth IRA Investments of 2023. For tax year 2024, the Roth IRA contribution limits are $7,000 for individuals under the age of 50. Best Roth IRA Investments. A traditional IRA might be better if you want more control over your . You can delay RMDs until either whenever your spouse would have reached age 72 or Dec.7 best Roth IRA investments for your retirement. And your investments grow tax-free if you follow the rules.Alternatively, open a traditional IRA and a Roth IRA, if you’re eligibile, for a choice of taxable or tax-free contributions and income when you retire.For both types of IRAs, distributions before age 59½ may be subject to both ordinary income taxes and a 10% early withdrawal penalty.If you think you’ll be in a higher tax bracket when you retire, a Roth IRA is probably the best choice. An individual retirement account (IRA) is one of the best tools for saving for retirement. Charles Schwab is one of the most well-known companies for IRA accounts.All the Roth IRA Rules You Need To Know.

Note When you contribute to a Roth IRA, you do so with earnings you’ve already paid taxes on and you don’t pay taxes on the earnings when you distribute them as long as you meet distribution guidelines.The Best IRA Accounts for Self-Directed Investors.

Your rate of return depends on what you invest in.

16 Best Roth IRA Accounts of April 2024

Best IRA Accounts Of April 2024

Charles Schwab: Best for research and education. Find out the pros and cons of each option, fees, .

The 10 best Roth IRAs for 2023

Roth Rules on Eligibility, Contributions, Taxes, Conversions, and More.Roth IRA contribution limits. Both have important tax benefits, .Our Top Picks For Best Roth Ira Accounts

Best Roth IRA Accounts Of May 2024

Clients with $250,000 or more at Fidelity may be eligible for dedicated Fidelity advisor access. For a detailed comparison, view the traditional vs. Compare Roth vs. A Roth 401 (k) might be better for you than a traditional IRA if you want to invest easily through payroll deductions and enjoy tax-free withdrawals in retirement.You can set up Roth IRAs through most banks, and through some of the best online brokerages. Roth IRA rules dictate that as long as you've owned your account for 5 years** and you're age 59½ or older, you can withdraw your money when you want to and you won't owe any federal taxes.A Roth IRA is a type of investment account that can provide you with tax-free income in retirement. 25, 2024 at 10:45 a. However, if you’re 50 years of age or older, the IRS allows .org’s top choices for the best self-directed and robo-advisor Roth IRA providers of 2023 offer varied investment options and retirement planning resources with low or no fees. Picking investments for a Roth IRA requires looking at several factors. They charge no fee to have an IRA with them.

Top Roth IRA Accounts of April 2024

Updated Feb 04, 2023.The 10 best Roth IRAs.

You contribute after-tax dollars to a Roth IRA—in return, withdrawals in retirement are not . You can’t contribute more than the total contribution limit for that tax year to all your IRAs, and Roth IRAs have specific income limits you need to meet to qualify to open an account.

Best Roth IRA Accounts in November 2022

Skip to content.

Best Roth IRA Accounts Of April 2024

Account minimum: $0. Pros: Customer-first approach, free research . Learn how Roth IRAs work, if they make sense for you and strategies to use them. How Does a Roth IRA Work? The Roth IRA can suit almost any future retiree, but the traits of this type of account are best for those who don't have access to an employer-sponsored 401(k) .Compare the top Roth IRA accounts from national banks, investment firms, online brokers and robo-advisors.Auteur : Elizabeth Gravier

Best Roth IRAs of April 2024

Contributions are made with post-tax income (money you’ve already paid income taxes on), but your withdrawals in retirement are completely tax-free, no matter . Fidelity Investments. Updated on December 8, 2022. Playbook, Charles Schwab and Fidelity Investments top Benzinga’s list this year. Many people use Charles Schwab for bank accounts and investment accounts as well. We break down our top picks so you can decide which is the best Roth IRA for you. In 2024, the most you can contribute to all of your IRAs (traditional and Roth combined) is $7,000.Roth IRAs can help you save for retirement by using after-tax money so you can enjoy tax-free distributions. Compare the benefits of self-directed and managed . Merrill Edge is a respected name, and it gains even more credibility from its association with Bank of America, one of America’s most valuable banking brands. Learn how to choose the best Roth IRA for your retirement goals and needs. Any one of those will be fine for your needs, with very little practical difference.Compare the top Roth IRA accounts from various brokerages based on fees, features, and investment options.IRAs; Roth IRA; How to Find the Best Roth IRA Rates. For our rankings for the best Roth IRAs for active investors, the most important criteria were trading fees, account minimum, the diversity of investment products offered (stocks, bonds, ETFs and mutual funds) and low account fees (yearly fees, transfer fees and inactivity fees). Investments you expect to grow substantially over . Contribution limits. The two types of accounts are simply different.Compare 16 Roth IRA providers based on fees, account minimums, promotions and ratings. $6,500 per person ($7,500 if 50 or older) in 2023. Here’s why certain types of, REITs and . The sooner you start, the better off you’ll .

Advertiser disclosure.

Because people contribute to Roth IRAs over many decades, the goal is to experience enough growth to balance out any downturns.Updated April 14, 2024. While saving for retirement is a common goal, there are several routes you can take to get there. Greg Daugherty.A Roth IRA gives investors a 'pay now, save later' tax advantage, unlike 401(k)s or traditional IRAs.

7 Best Funds to Hold in a Roth IRA

This makes them a good fit for those who plan to retire early and want to avoid . Less than $230,000 in 2024.