Bitcoin bull market cycles

By mid-April 2021, bitcoin had rallied 4. According to its creator, popular analyst CryptoCon, the .

Historical patterns. De fait, au-delà des analyses de prix et de tendances pour interpréter un bull run, la tendance haussière repose sur un aspect . Only the initiation of a new bull market .Cours pour BTC aujourd’hui.At the current cycle’s MVRV peak, 286 days after the halving (21 Feb 2021), the bitcoin price reached $57,501 and an MVRV value of 3. I analised every Bitcoin Bull Run . By the second half of 2021, it seemed that the current bull market – and by extension the entire cycle – would be longer than previous ones. According to leading cryptocurrency .The analyst noted that Bitcoin’s price still moved in line with the cycle when it tapped its low of $15,500 in November 2022.Parmi les quatre phases qui composent le cycle des cryptomonnaies, la phase n°1 est celle qui dure le plus longtemps. Steve explains that the confirmation of entering Phase 2 of the bull market in Bitcoin is dependent on these two key indicators mentioned – the Rank .48 EUR avec un volume .16% in trading volume to record approximately $31.The index has previously indicated that the crypto market will enter a bull cycle in 2024.

Bitcoin’s Market Cycles — Everything You Need to Know

Bitcoin is down 15% from its 2023 highs, but $40,000 may be closer than you think due to several important factors.Bitcoin community.

Analysts Cosmo Jiang and Erik Lowe in an attempt to answer how tokens are co-related in a bull market took cognizance of the last two cycles when Bitcoin had a “sizable market share.

Hidden Fortune-Making Patterns in Bitcoin 4-Year Cycle

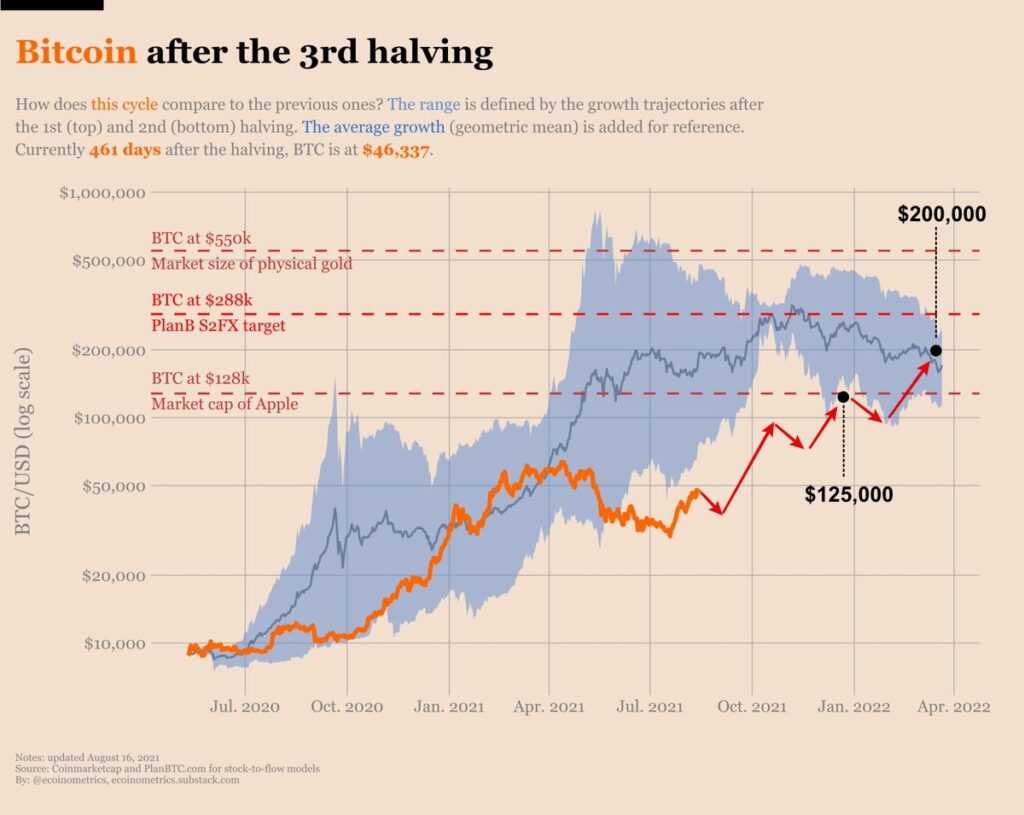

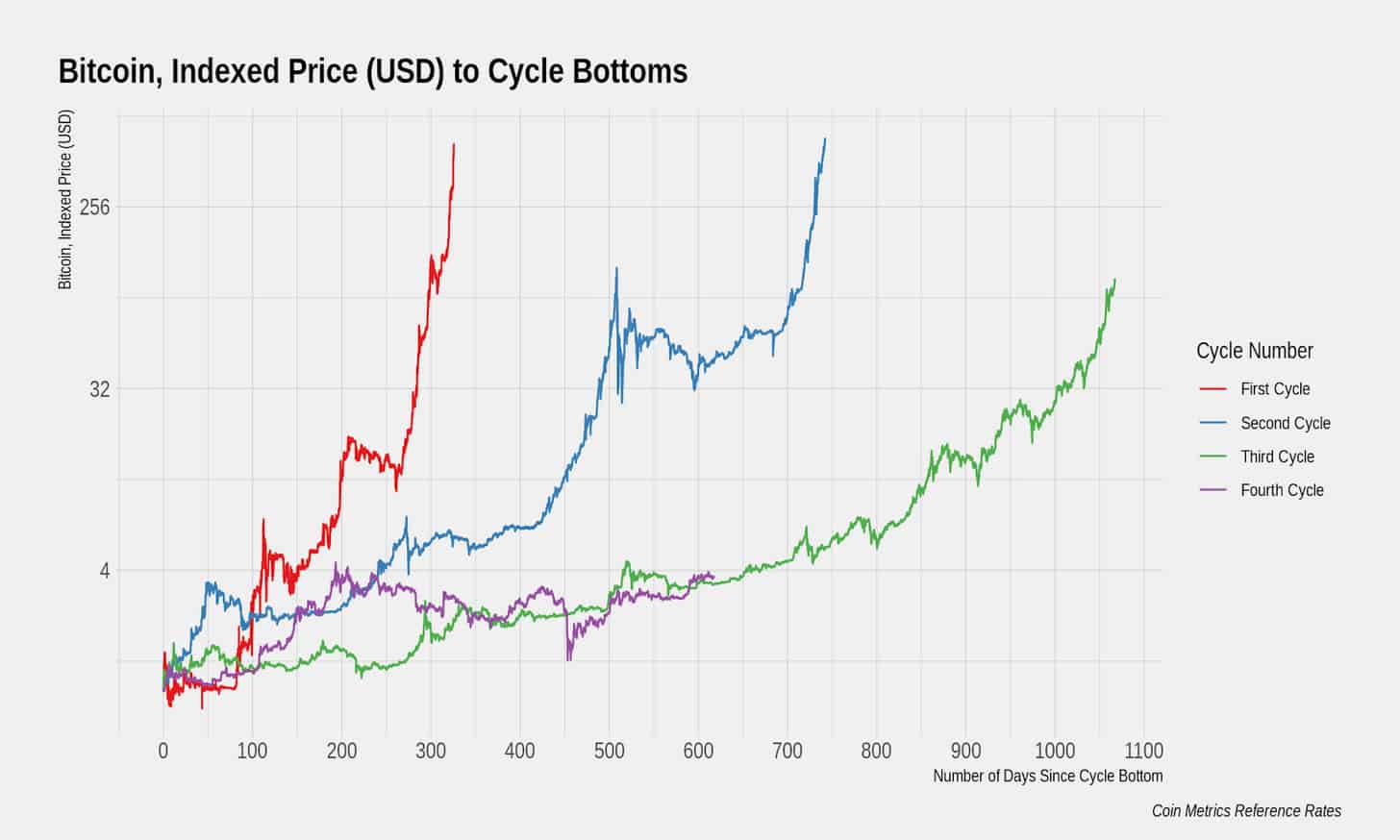

Bitcoin lengthening cycles assumed that successive cycles in the cryptocurrency market lasted longer, and that they produced diminishing returns measured in return on investment (ROI).

Bitcoin Price is Poised for a Prolonged Bull Market: Here is Why

thecurrencyanalytics. This seems highly improbable given that the market has matured to a certain degree and also the volatility .Date de publication : 25 mars 2024Temps de Lecture Estimé: 16 minThe current bull cycle in Bitcoin seems to be propelled by a mix of technical drivers, such as spot Bitcoin ETF inflows, and strong fundamental factors like positive stablecoin . Such projections fuel the enthusiasm of investors, driving renewed interest and investment in the cryptocurrency space.Critiques : 570Bitcoin moves from bull to bear market, or vice versa, when: There is a price change greater than 20% The price does not return within 90 days to the high or low that .89 billion over the past 24 hours.Historical Bitcoin ( BTC) market cycle indicators show that the crypto market is “presently in the middle of the bull run,” backed by a mix of strong fundamental and technical factors . 2nd cycle – 106 weeks. The ratio compares Bitcoin’s market cap to “ realized cap ”—the sum value of . We see similarities in the chart of realized capitalization going back to the first Bitcoin cycle.Final thoughts. Bull and bear crypto markets are driven by many factors. 30, popular social media commentator Ali eyed history . Le cours en direct pour Bitcoin est de $ 63,918.This gave rise to the popular lengthening cycles theory which predicted that Bitcoin’s bull market cycles were lengthening and that each subsequent bull market would take longer and longer to reach its peak.Why a 30-50% Correction is Likely to Happen. 2nd cycle – 58,457%. Le prix du Bitcoin aujourd'hui est de €58,870.That is, it cycles from from fear, uncertainty, and doubt to greed, over-exuberance, and euphoria.

When Is The Next Crypto Bull Run?

Analyses Bitcoin. Each crypto market cycle lasts four years on average. All 4 bear markets to date have led to a slight decline in realized capitalization and its several-year sideways trend. Depuis sa création en 2009 par un pseudonyme connu sous le nom de Satoshi Nakamoto, le Bitcoin a connu des périodes de volatilité et de croissance exponentielle. “The table below shows these cycles. Bitcoin and the Predictability of Crypto Market Cycles.Gauging the Cycle with New Interest in Bitcoin.

Brief History of Bitcoin Bull & Bear Markets (2008

This is historically lower .📈 Sign up to my newsletter for FREE: https://newsletter.Bitcoin Long-Term Holder Pattern Could Suggest Bull Market Isn’t Over Yet In a new post on X, IntoTheBlock discussed a pattern that the total holdings of Bitcoin long-term holders have generally followed during bull markets in the past.

5%, the coin has seen an increase of 3. Miners accumulate Bitcoin when it is profitable during bull markets and are forced to sell during bear markets. Total crypto market capitalization is down 2.

Le meilleur outil gratuit pour bien investir. Even though a new all-time high price for Bitcoin came .5 times to $63,800. For beginners: Halving is an algorithmic . History shows there's likely a bright year ahead for BTC's price. 4 things that can spark the next Bitcoin bull cycle.The supply and demand balance of the bitcoin market is an extremely dynamic system, despite being cyclical in nature. Occurring about every four years or every 210,000 blocks, these events cut the Bitcoin mining reward in half, thus reducing the rate of new bitcoin generation.Miner Influence: A Diminishing Force in Bitcoin 4-Year Cycle.The Biggest Crypto Bull Cycle Is Upon Us: Bernstein.In a post on X on Jan. Then a bearish period ensued that lasted for 427 days or 14 months, upon the end of which a bull market of 1,004 days or 33 months began.

L'historique des bull run qu'a connu le bitcoin depuis 2009

And this is crucial to know, cause it holds a secret to understand current market state and Bitcoin market cycles clearly.The cycle low is in. Woo says he sees Bitcoin as being in its ‘last cycle’, before entering a new era where Bitcoin no longer has obvious bull and bear markets.Bitcoin’s Remarkable Bull Run: What History Tells Us About the Current Cycle. Nevertheless, it has gained more .

4 signs Bitcoin is starting its next bull run

3 Les éléments caractéristiques d'un bull run crypto.

Comprendre le cycle des cryptomonnaies

Cours du Bitcoin (BTC), Graphiques, Capitalisation

The first stage of the bull market is well and truly underway, and this is pretty much where things get a little bit interesting because the masses are still thinking of further collapse to the downside, whereas we’re looking at this potentially being the disbelief rally which will then catch people out again. dan saada March 26, 2024.Bitcoin’s Remarkable Bull Run: What History Tells Us About . From this top, Bitcoin corrected by almost 76% to touch a low of $65.Future Price Predictions

Anatomy of a Bitcoin Bull Market

Monday witnessed a notable surge in Bitcoin’s price, climbing over 4% to surpass $70,000 once again.Crypto Prices CoinDesk 20 Index.Après près d’un an de tentatives infructueuses, le prix du Bitcoin (BTC) a finalement franchi le pivot bull/bear du cycle 2020 – 2023, situé au niveau des 30 000 .He says the rules of Bitcoin’s halving, when miners’ rewards are slashed in half roughly every four years, have created pronounced cyclicality which has created a pattern that suggests that the current bull market will last until about November 1, 2025, just under two years from now.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Bitcoin and the Predictability of Crypto Market Cycles

Bitcoin ( BTC) is about to test hodlers with a “mid cycle lull” before starting a bull run in late 2024, a new BTC price model states. The on-chain analytics platform relies on Bitcoin’s MVRV ratio as an effective metric for gauging Bitcoin bull and bear markets. Let’s look at the numbers and first compare the ROI from bottom to peak for each cycle: 1st cycle – 64,468%.Cycle 4: Bull run. If the accelerated perspective holds, the next bull market peak is estimated to occur within 266-315 days from this breakout, landing somewhere between December 2024 and February 2025, according to the analysis provided by Rekt.To understand where are we in the cycle we need to bring historical data to the table. Peak interest in Bitcoin, as measured by Google search activity, was reached in December 2017 in tandem with a bull market run up to an all-time high. Macro catalysts are lining up for bitcoin, a new report from the brokerage firm said.Bitcoin is primed for a “surge” as it channels classic bull market signals from the past, the latest research says. When normalising . While the programmatic halving cycles may make it seem “obvious,” it remains difficult to pinpoint which stage of the bull market we are in.If the accelerated perspective holds, the next bull market peak is estimated to occur within 266-315 days from this breakout, landing somewhere between December 2024 and February 2025, according to the analysis provided by Rekt.Turning away from geopolitics, this brief article will take a look at the latest in on-chain spending behavior and Bitcoin derivative markets, to analyze whether the .comBITCOIN BULL MARKET IS BACK #bitcoin #bullrun . In 2021, if BItcoin corrects from its high of $65,800, by 76%, we’ll reach at around $15,800.Reporting a market dominance of 53.Similarly, Bitcoin’s historical bull runs tend to follow four-year cycles, often spurred by events like the halving, which reduces the rate at which new BTC is created and earned by miners. 3rd cycle – 11,951%. Ce qui est un peu plus logique, car elle .

However, altcoins, which usually lag their big brother Bitcoin, are also showing strength in patterns that mirror previous bull market cycles. As we discussed, the cryptocurrency market has fewer investors and is more volatile than the stock market, so there are a . À propos de Bitcoin. The rhythm is .96 par (BTC/USD) avec une capitalisation actuelle de $ 1,258. 4 Comment maximiser ses gains lors d’un . Every halving takes 210,000 blocks, which is around 4 years.In this cycle, Bitcoin recently broke to new all-time highs, indicating a potential milestone in the market.La Rédaction ZoneBitcoin.

Qu'est-ce qu'un bull run dans le monde des cryptomonnaies

Roughly every four years, Bitcoin’s halving events have historically played a crucial role in shaping market .

Bitcoin Market Cycles Explained

However, this theory was proven incorrect by the 2019-2021 bull cycle which did not lengthen in size compared to the prior cycle.