Borrow crypto no collateral

Top 5 Platforms for Borrowing USDT Without Collateral

By agreeing to borrow against . Just use your crypto as . While best known for its advanced trading features and wide crypto . When you repay the . Get a crypto loan in more than 130 coins for an unlimited loan term. It offers loans from $5,000 with an interest rate of 4.

10 Best Crypto Lending Platforms in 2024

At present, nearly $7 billion worth of digital assets are staked as collateral . 13 2021, Published 8:20 a. In conclusion, borrowing USDT without collateral can be a convenient way to access funds quickly. Choose your collateral amount and flexible terms that . Borrowers can then freely use the loan capital to purchase a home .It’s also crucial to keep in mind the risks involved, such as the potential for . Borrow against crypto fast and securely with CoinRabbit crypto lending platform.DeFi lending, or decentralized finance lending, is similar to the traditional lending service offered by banks, except that it is offered by peer-to-peer decentralized applications (DApps). Crypto loans often demand over . Apply for a crypto loan.Borrowing crypto on Binance is easy! Use your cryptocurrency as collateral to get a loan instantly without credit checks.

Crypto collateral loans: can you borrow against your Bitcoin?

5 best platforms to borrow crypto without any collateral: 1.

Crypto Loans

No origination .For crypto loans, borrowers will use cryptocurrencies such as Bitcoin and Ethereum as collateral for the loan.Auteur : Teller

Crypto Loans Without Collateral [Ultimate Guide 2024]

Discover a new world of lending and borrowing with Atlendis.

Crypto Loans Without Collateral

Aave’s “credit delegation” service makes unsecured borrowing possible in DeFi for the .Guarda is a platform that allows you to borrow USDT against your crypto collateral. Monitor your Loan to value (LTV ratio) in real-time with our range of tools. Bitfinex acts as a facilitator that provides the technology that enables borrowers and lenders to transact with each other.Visit YouHodler. Crypto lending without collateral is only done among . We are no longer offering new loans.

Crypto Loans Without Collateral, Explained

There are no additional checks required.

CoinDepo • Crypto Lending Without Collateral

Now you can borrow up to $1,000,000 1 from Coinbase using your Bitcoin as collateral.

Instant Crypto Credit Lines

You can lend or borrow cryptocurrencies, or even fiat, by using digital assets as collateral.With crypto loans, traders can borrow from 7 to 180 days on platforms such as Binance Loans . However, they do provide access to capital that would otherwise be unavailable, freeing up money for investors to trade and make other investments.

Is it possible to get a crypto loan without collateral?

The Ultimate Guide to Zero Collateral Crypto Loans

The sell-off was likely catalyzed .Then choose the type of instant crypto loan you want to apply for and apply for the required amount.Flash loans offer a unique no-collateral borrowing option on specific DeFi platforms but are not suitable for regular users.

Some crypto lenders will give you funds based on the crypto in your portfolio. Use the fiat gateway to get loan proceeds directly in your bank account.Cryptocurrency markets might be able to tap in and break through global markets with crypto loans without collateral. Should a cryptocurrency drop drastically in value, the collateral . Without the constraints of traditional intermediaries, you experience a more efficient, cost-effective borrowing process. However, it’s important to do your due diligence and thoroughly research each platform before making any decisions. The platform works out how much cryptocurrency you need to put up as collateral, then you just upload the amount from your cryptocurrency wallet to the site.

Initial LTV is 65%, with a margin call at 75% and liquidation at 83% Learn more about Binance loans, . Borrow from Us for 0% Interest.

6 Best Platforms To Borrow Against Crypto in 2024

Receive up to 90% of your collateral .In the crypto world, spot loans are also quick but work differently. Monitor your loan health.No Collateral Required: How Aave Brought Unsecured Borrowing to DeFi.

Best Crypto Loan Sites 2022

The potential rise in cryptocurrencies’ prices, along with the prediction of their sustained rise, has made the selling .Crypto collateral loan pay-outs are available in USD, USDT and USDC.Bitfinex Borrow is a peer-to-peer (P2P) platform that allows users to borrow funds from other users, providing cryptocurrency assets as collateral. Because cryptocurrency values fluctuate daily, staking a large amount of collateral .If you’re a normal user and not a business or institutional trading firm, you’ll have to provide collateral in order to borrow crypto. Even businesses and trading firms who want to get a crypto . The Total Value Locked (TVL) in DeFi protocols is currently $41. Maximum crypto confidence.com Exchange App might include volatile assets that you trade at your own risk.

Where Can You Get a Crypto Loan Without Collateral?

Use your bitcoin as collateral, get your loan in DLLR (a USD-pegged stablecoin), and buy more bitcoin with your bitcoin! 0% Interest for the duration of the loan.com Exchange App, which is distinct from the Crypto. Crypto Borrow DApp is on a mission to provide accessible and collateral-free cryptocurrency lending opportunities to users on the Binance Smart Chain.7% APR 2 with no credit check.

15 Best Crypto Loans & Best Crypto Lending Platforms

Borrow to trade or borrow to earn, learn more about our crypto loan service.Do Crypto Loans Without Collateral Exist? Where to Look. No payback period.Like a house, car or other investment, your cryptocurrency can serve as collateral for crypto loans, which are loans that can have low interest rates, same-day . Visa, Mastercard, and others. Lenders establish a maximum percentage you . Loss-control due to price volatility.Crypto Loans Without Collateral Conclusion.

Are Crypto Loans Without Collateral Possible?

The products offered on this website and on the Crypto. Borrow customers will continue to maintain access to their loan history and dashboard. Nov 8, 2022 • 6 min read. In a sense, getting a DeFi loan offers greater financial freedom than traditional platforms.Open an account, transfer your digital assets, and borrow against your crypto in seconds. This means that if you own $100,000 worth of Bitcoin, you could borrow up to .

Binance – Widest Selection of Cryptocurrencies for Borrowing. Instant Credit Line.

Flexible repayment options.

Bitfinex

The maximum LTV differs among lenders and .Renzo restaked ETH (ezETH) crashed as low as $750 early Wednesday, trading at a massive discount to wrapped ether (WETH). There are now numerous ways to do this, and it’s a process that makes cryptocurrency more enticing.OKX Crypto Loans let you borrow Top Cryptocurrencies, using other Crypto as collateral. Guest Contributors. Sep 29, 2021 2:08PM EDT.Crypto collateral loans function similarly to traditional collateralized loans but make use of crypto as the loan's collateral.With this platform, it’s possible to get anonymous bitcoin loan with no account registration, KYC or credit check. For example, if you have 1 .

Should you borrow against crypto?

But what exactly are crypto flash loans? These are an innovation in the world of .The loan amount you’re approved for is typically a percentage of the crypto you are pledging as collateral.A crypto loan is a type of loan that requires you to pledge your cryptocurrency as collateral to the lender in return for immediate cash. There are certain . Guarda will use your email and phone number to communicate any updates regarding your loan.Why borrow cryptocurrency at all?

Can You Get a Crypto Loan without Collateral?

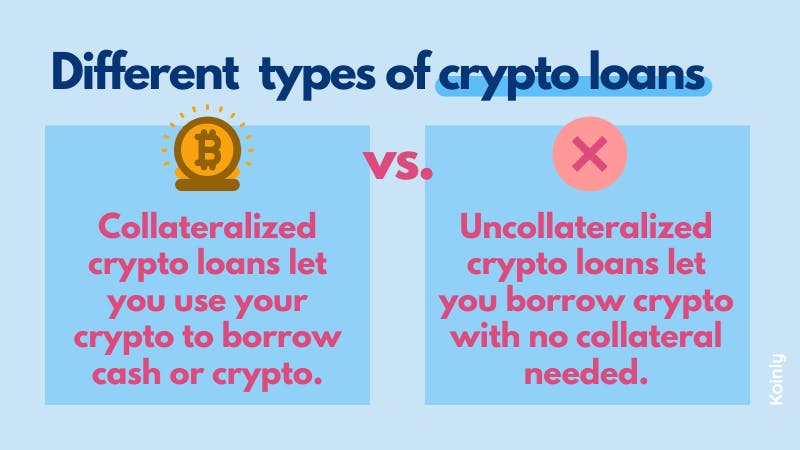

Our platform is designed for those who seek more than traditional finance offers.If you’re a retail crypto investor and would like to borrow some crypto, you will have to provide some collateral.Is it possible to borrow crypto without putting up your assets as collateral? There may be, but chances are it’s a scam. We believe in financial inclusion and aim to empower users with the ability to borrow crypto assets without the need for traditional collateral. View the latest crypto . Withdraw directly to your bank . The DeFi lending market has risen substantially since 2020.Typically, your crypto loan amount is a percentage of the value of the cryptocurrency you are pledging as collateral, also called a loan-to-value ratio. Buy/Sell with zero trading fees via 100+ payment methods.Borrow From Abra | Get A Crypto Loan for 0% Interest | Approval in Minutes.One of the most common forms of crypto loans without collateral are flash loans. Collateralized loans are more secure for the lender, while non .How to Borrow Crypto with no Collateral? A Step-by-Step Guide (2022) Teller.BlockFi is a cryptocurrency lending platform that provides USDT loans without collateral. Simply put, you . Can I get a loan with crypto? Can I borrow crypto without collateral? What is the best platform to .Crypto Loans provide a unique way to access capital using cryptocurrency, either with or without collateral. The reason crypto loans operate on such a shorter time scale is that cryptocurrencies are much more volatile than traditional currencies, making them riskier for the lender and borrower. Many uncollateralized crypto loans are only available to businesses and institutions, while .Borrow cash using Bitcoin as collateral.- 0% interest rate - A collateral ratio of just 110% - Governance free - all operations are algorithmic and fully automated - Directly redeemable - LUSD can be redeemed at face . By Alyssa Exposito Oct.

It is the first peer-to-peer (P2P) lending platform that offers you cryptoassets backed loans.Guarda offers crypto loans, which you can use to borrow fiat currency or stablecoins. They’re given out on decentralized platforms, meaning there’s no bank involved. Bitfinex Borrow allows borrowers and lenders to experience the . Many platforms .The products and/or services on this website are also offered on the Crypto. Instead of using cash or fixed assets like a car or house as collateral, crypto collateral loans allow for the pledging of cryptocurrencies like Bitcoin as collateral to secure a loan from the lender.Borrowers, on the other hand, only borrow what they can reasonably pay back based on their staked collateral. You’ll find this type of loan is relatively painless to expedite, with no need for . 15, Aave alone crossed over $1 billion in crypto staked to the overall platform, as measured by DeFiPulse. Exchange Wallet. Negative Effective Annual Rates. An alternative asset class that presents a . Cryptocurrency markets might be able to tap in and break through global markets with crypto loans .CoinLoan is the platform where anyone can lend or borrow crypto coins. Please note that the availability of the products and services on this website .First in the World of Digital Assets Instant Crypto Loan without Collateral Account.