Boston capital k1 2021

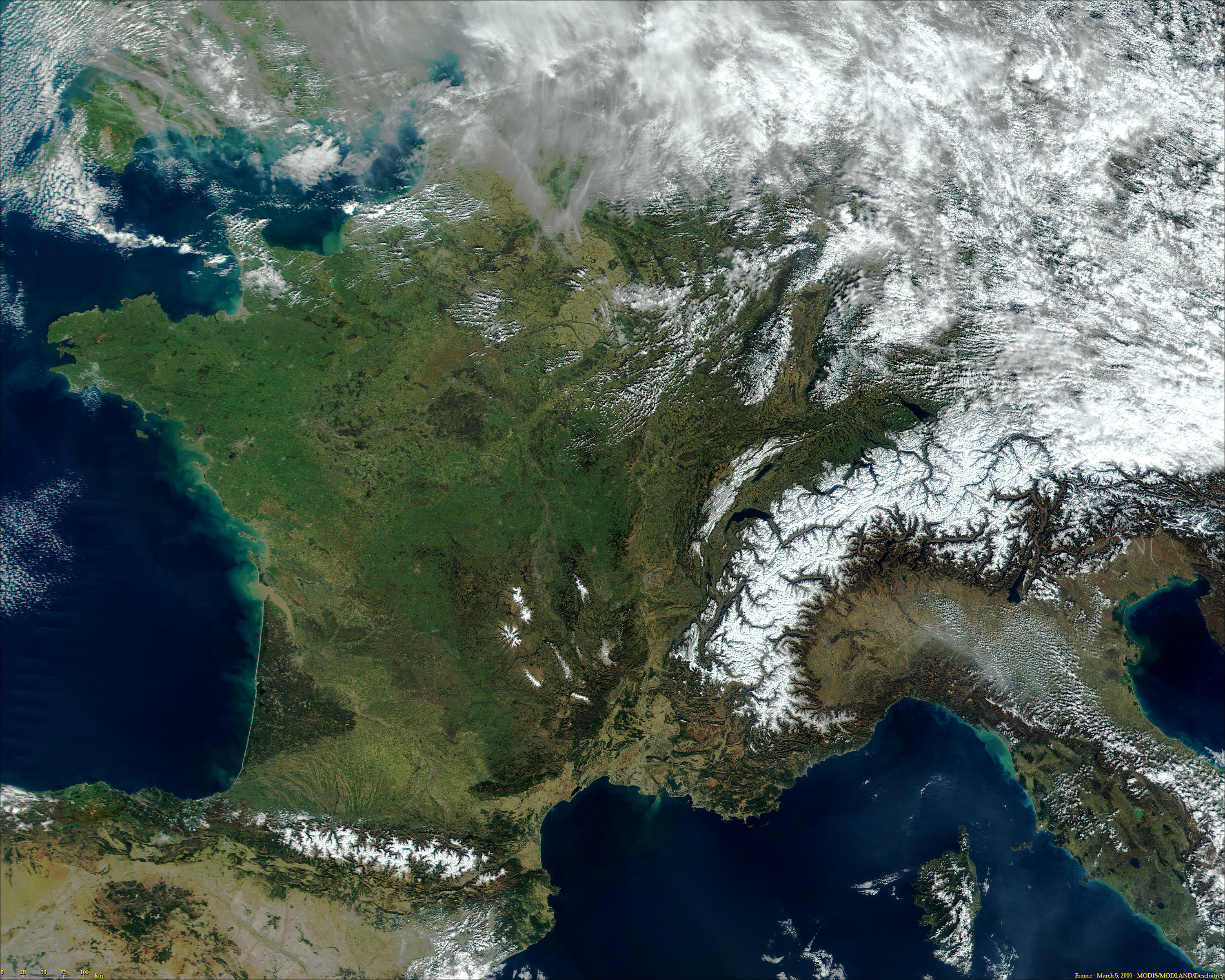

Les plus gros . Diversification over 10 – 20 states.

E Net operating loss carryover — regular tax Schedule 1 (Form 1040), line 8a. Certaines startups technologiques très connues ont grandi grâce aux investissements de Summit Partners. Backup withholding, later.Capital Planning INTRODUCTION The $3.The Boston Capital Long Term Mortgage Fund VI is pleased to announce the newest feature [.News | October 7, 2021. It took place on October 11, 2021.

Other income (loss) 11 . FY22-26 Capital Plan City maintains a large inventory of capital assets, like roads, bridges, schools, parks and municipal buildings The City uses a combination of General Obligation Bonds and Federal Grants (Transportation), State . From construction monitoring . Ceux-ci incluent Answers. Founded in 1974, Boston Capital is a multifamily housing investment company focused on providing equity and debt financing .When you work with K1, you join an ecosystem of hundreds of companies and thousands of executives who have led their organizations to Category Leadership and successful .Boston Scientific 2021 Annual Report 25687_A_BSC_AR_Cover.Summit Partners a été fondé la même année que Bain Capital, 1984. Scroll down to the All Domestic Production Activities Information subsection. The principals also have experience in the development of market rate apartments as a joint . joins portfolio of K1, a leading investment firm focusing on high-growth software companies globally.Estimated Mailing Schedule for Year End 2021 Tax Documents (K1's & 1099's) Investment.61 billion FY21 Operating Budget and $3.RE: Boston Capital Entity 2021 Tax Return and Audit Instruction. Mailed January 31st (if . American Healthcare REIT I. Eligible students . (See the instructions for Code O.Boston Capital Tax Credit Fund - How Do I Sell It? - .Proven Expertise for Real Estate Investors.

86K K-1s

RIA leader

Department of the Treasury Internal Revenue Service For calendar year 2021, or tax year.Established in 1974, Boston Capital acquired more than 3,700 multifamily apartment properties in all 50 states, the District of Columbia, Puerto Rico, the U.

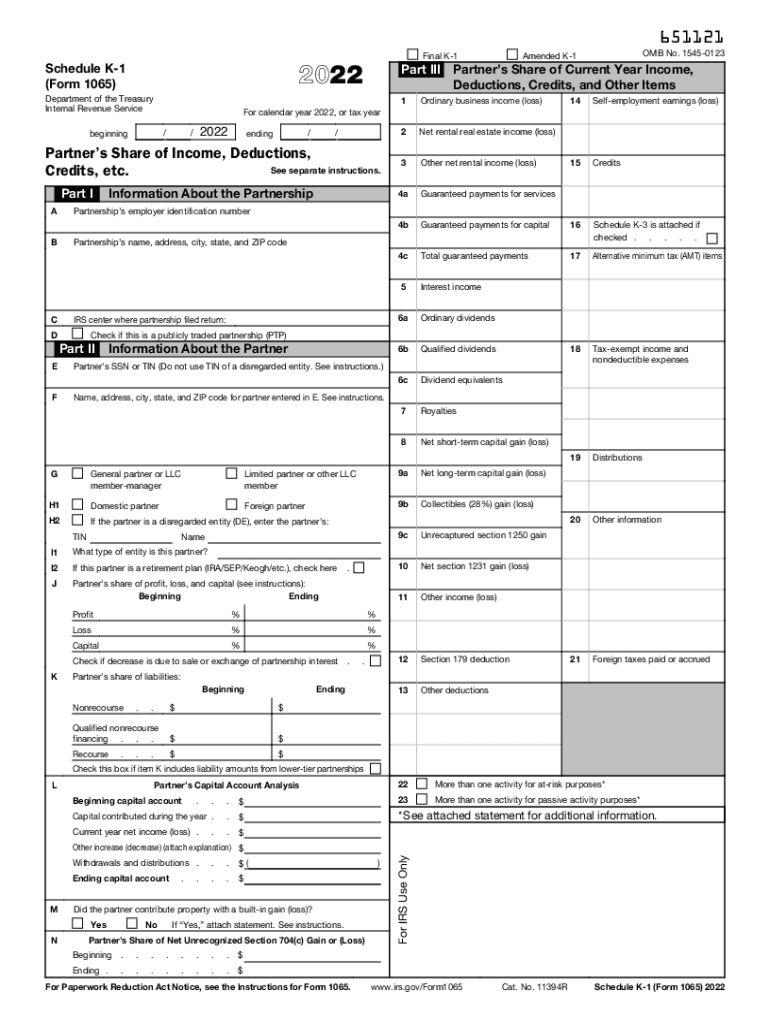

Understanding Your Schedule K1 (Form 1065)

Page 1 of 24 13:44 - 4-Feb-2021 The type and rule above prints on all proofs including departmental reproduction proofs. By Preeti Singh.

Capital Planning

by Boston Financial Management | Dec 3, 2021 | Announcement. News | September 22, 2021.Estimated Mailing Schedule for Year End 2023 Tax Documents (K1's & 1099's) Investment. Amid signi cant disruption, our global team proved its resilience by navigating uncertainty with agility, developing new capabilities and turning challenges into opportunities.Bf Garden Tax Credit Fund V L. Equitable (AXA) Annuity.Boston Universal Pre-K (Boston UPK), an initiative of the Boston Public Schools (BPS) and the City of Boston, has opened applications for prekindergarten seats in community-based settings for the 2021-2022 school year.

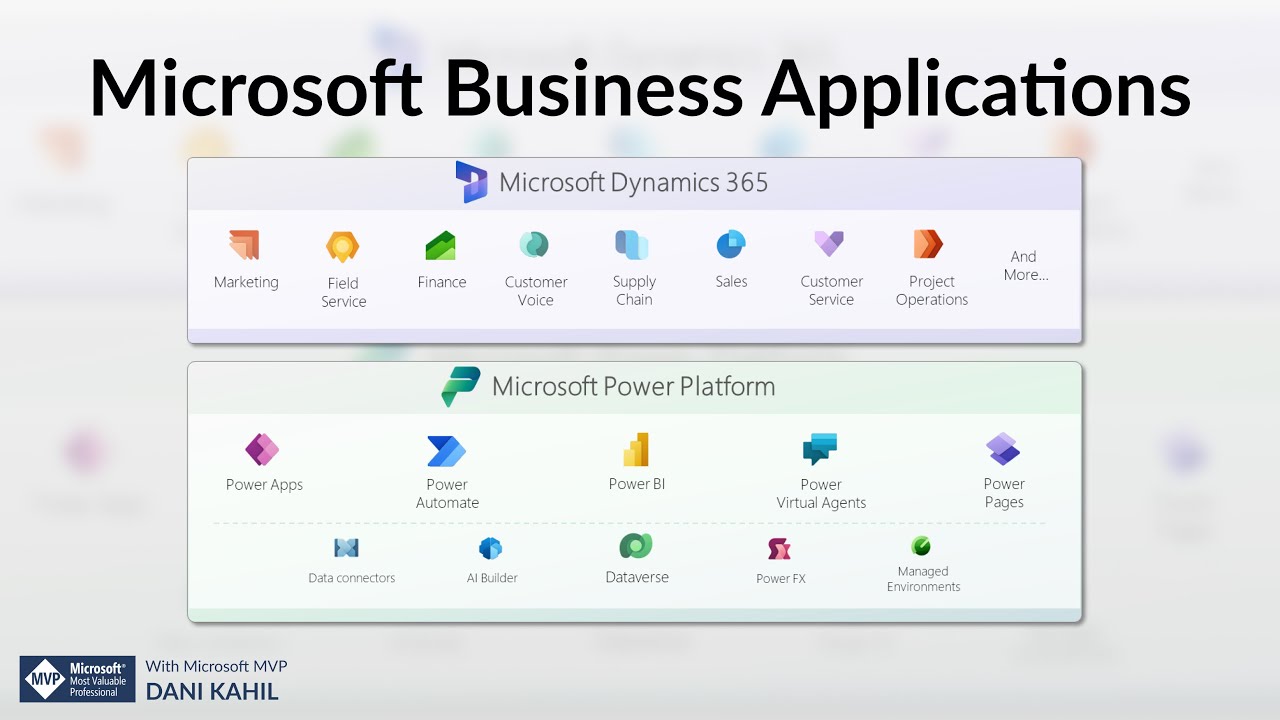

receiving Special Education Services) *Visit Bostonpublicschools. This communication and the information contained in this article are provided for general informational purposes only and should neither be construed nor . The Capital Plan is a multi-year plan for acquiring or improving physical assets we own and the means for financing the work.Certain statements about K1 Investment Management LLC (“K1”) made by portfolio company executives herein are intended to illustrate K1's business relationship with such . Box 13 has many codes, not all of which are direct entries or supported by the TaxSlayer program. Partnering with 20 – 30 developers.Boston-based firm is backing a fund formed by K1 Investment Management to acquire a portfolio of companies from K1’s earlier funds.Child’s original birth certificate, passport, or Form I-94. Decedent’s Schedule K-1. The men's wheelchair race was won by . Schedule K-1 Form 1065.$100 – $250 million Fund size. Child's up-to-date immunization record*. Onit Acquires BusyLamp, Creating One of the Largest Global Enterprise Legal Management Conglomerates. 10-K Annual Report Summary 10-K Annual Report 10-K YoY Changes.88 KB)

School Year 2021-2022

BPS Welcome Services / Universal Pre-Kindergarten

Accounts payable affiliates (Note C) 7,755,709 8,875,807.Net long-term capital gain (loss) 8b .Boston Capital approaches asset management with a clear objective of protecting client interests.You should report Box 13 information from your Schedule K-1 Form 1065 under the. F Net operating loss carryover — minimum tax Form 6251, line 2f .88 KB, 2021 Schedule C: Massachusetts Profit or Loss from Business (English, PDF 143. Inconsistent Treatment of Items. Sale or Exchange of Partnership Interest.

2021 Schedule K-1 (Form 1120-S)

Income -Select my forms.

2021 Massachusetts Personal Income Tax forms and instructions

Do not file it with your tax return unless you are specifically required to do so.

Keep it for your records.Lieu : 11 Beacon Street Suite 325 Boston, MA 02108

For Investors

The Corporate Tax Credit Fund offers. Unrecaptured section 1250 gain .Want to know how much it costs to race at K1 Speed Boston? Click here for a full breakdown of our race package prices and purchase your races online!com, AVAST, McAfee et WebEx. BFM among top 150 Fee-Only RIAs in AUM Boston Financial Management has been named . Less Common Income. The partnership uses Schedule K-1 to report your share of the partnership's income, deductions, credits, etc.Bain Capital’s life sciences arm has just finished raising $1.J Partner’s share of profit, loss, and capital (see instructions): Beginning Ending Profit % % Loss % % Capital % % K Check if decrease is due to sale or exchange of partnership .

Boston — Wikipédia

Estimated Mailing Schedule for Year End 2020 Tax Documents (K1's & 1099's) * Final K-1 ** Retirement Accounts issue a 1099R Be sure to use final versions you receive from . FY22-26 Capital Plan.試合のフル動画はこちら↓https://www. MUST be removed before printing. From the Input Return tab, go to Income⮕Passthrough K-1's⮕Partnership Info (1065 K-1). A predictable . 2020 Partner's Instructions for Schedule K-1 (Form 1065) Partner's Share of Income, Deductions, Credits, etc. Pick up copies of their publications, available in many languages, at any Welcome Center, or call 617-635-9288, visit their Facebook page, or visit their website: www.

National Tax Credit Funds

1545-0123 Schedule K-1 (Form 1065) Department of the Treasury Internal Revenue Service For calendar year 2021, or tax year beginning 2021 ending Partner’s Share of Income, Deductions, beginning / / 2021.org for a full list of approved residency documents. D, line 18; and line 16 of the wksht. Dear Tax and Audit Preparers: In preparation of the upcoming 2021 tax and audit seasons please follow the .52 KB, 2021 Schedule D: Long-Term Capital Gains and Losses Excluding Collectibles and pre-1996 installment sales (English, PDF 85.The 2021 Boston Marathon was the 125th official running of the annual marathon race held in Boston, Massachusetts, and 123rd time it was run on course (excluding the virtual event of 2020, and the ekiden of 1918).Tax Basis Capital Account Reporting On February 12, 2021, the Internal Revenue Service (IRS) released the instructions to the 2020 Form 1065, U. Ses principaux domaines d’investissement sont la technologie et les soins de santé. Below are the Box 13 codes for which the program .Homepage | Boston. Typically, property dispositions occur after the . 20 – 45 properties. The FY23-FY27 Capital Plan totals $3.indd 1 3/15/22 9:26 PM.

SAMPLE K-1

Parent/Guardian photo ID.

2022 Schedule K-1 (Form 1041)

Dear Stockholders: Boston Scienti c performed strongly in 2021.

The City's primary focus is responding to the . Other assets 8,625 4,493 $ 954,745 $ 1,945,161 LIABILITIES Accounts payable and accrued expenses $ — $ 40.Purpose of Schedule K-1.According to the report, K1 will charge a 2 percent management fee of aggregate commitments during the five-year investment period, stepping down to 2 percent of net invested capital afterwards. BCRE specializes in originating and executing value and opportunity-driven equity investments throughout the U. Other Deductions. This form is essential for filing personal taxes.Headquartered in Boston, MA, Boston Capital Real Estate Partners (BCRE) has been dedicated to market-rate rental housing since 2002, and has pursued various acquisition strategies over multiple cycles. Prekindergarten (pre-k), also known as K1, is offered in the City of Boston at no cost to families. Shareholder’s Share of Income, Deductions, Credits, .

SAMPLE K-1

This communication and .Learn more about the City's long-term investments supported by the Capital Budget.

Partner's Instructions for Schedule K-1 (Form 1065)

Every property in every portfolio is monitored within a framework of policies and procedures that have been developed over nearly four decades of working with various partners, property types and financing structures. It includes 407 projects to be started or completed over the next five years.

Partner’s Instructions for Schedule K-1 (Form 1065) (2023)

Capital contributions payable .Boston FY22-26 Capital Plan Overview Office of Budget Management April 2021. Return of Partnership Income, with early draft versions released on October 22, 2020, January 15, 2021, and February 5, 2021 (the Instructions), indicating that partnerships are required to report partner capital .com/playlist?list=PLzFin-v5vIl_y9eTeUQuUzT_fsYhL_z6x今大会の試合結果↓ https://www. (1267425) SEC Filing 10-K Annual Report for the fiscal year ending Wednesday, March 31, 2021. Throughout the year, with each .Open PDF file, 85. We are developing affordable/workforce housing in Massachusetts, New Hampshire, and Florida.comRecommandé pour vous en fonction de ce qui est populaire • AvisLieu : 11 Beacon Street Suite 325 Boston, MA 02108

Boston Capital

Schedule K-1 is a tax document used to report the incomes , losses and dividends of a partnership. Go to the tab Lines 11–20 in the top-right menu. It breaks down your share of a partnership’s income, deductions, and credits.00 billion FY21-FY25 Capital Plan come at a time of great local, national and international economic turbulence, brought on by the coronavirus pandemic. (For Partner's Use Only) Department of the Treasury Internal Revenue Service . Alternative minimum tax (AMT) items A Adjustment for minimum tax .In brief, the Schedule K1 (Form 1065) is a tax document. Collectibles (28%) gain (loss) 8c . Nominee Reporting.