Business borrowing rates

Finance Providers we Compare.Average business loan interest rates range from 7 percent to 99 percent depending on the type of loan and the lender. Unsecured overdrafts of up to £50,000 available to help . The Start Up Loan scheme from the government aims to help small businesses via a loan of £500 to £25,000. for licensed moneylenders. The amount you can borrow and the interest rate will depend on the creditworthiness of you and your business. Via Ondeck's Website. Several crowdfunding options include: debt crowdfunding that you repay; equity crowdfunding where you .

In 2022, the average interest rate of new business loans to small and medium enterprises (SMEs) in France was 1. Request a call back.But it also offers higher borrowing limits — up to $250,000 — and a potentially lower interest rate. for banks and 5 to 15% p. Convenient borrowing for everyday expenses. You’ll know how much you’ll pay in interest and how much your monthly repayments will be from the get-go.

13 Types of Business Loans: Find The Best Loan

A small-business loan is a source of capital that can help you stock your shelves, buy new equipment or expand your footprint.Barclaycard for business. Transaction fee: 200 free transactions a month.Unless otherwise advised to you, the following fees apply to the ANZ Business Current Account and ANZ Business Premium Current Account: Monthly account fee: $8.

Interest rate of business loans SMEs France 2022

Minimum fee $75.

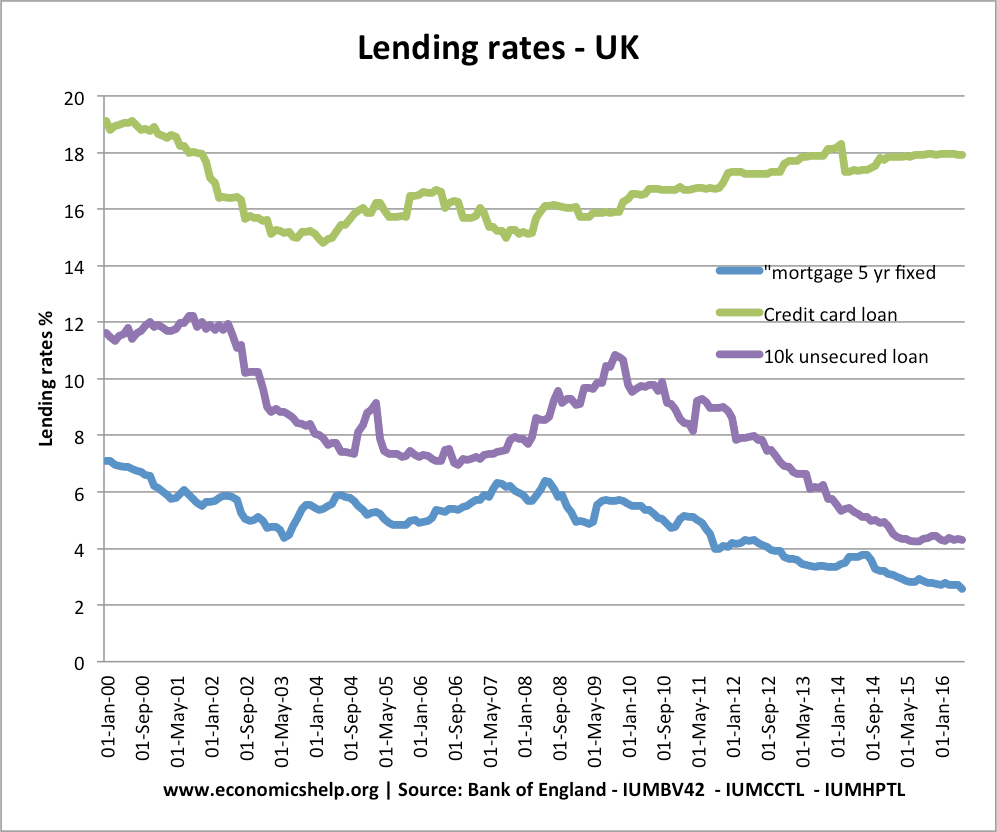

2% in 2019 to 3. Or fill out our form and we'll be in touch shortly. Secured business loans have lower interest rates due to the reduced risk to the lender. Find out more about the Start Up Loan Scheme. Commercial loan rates are currently in between 5.24 – Principal-and-interest: 5. Estimated SBA loan rates as of July 2022. Best Lender Comparison Site : .

Best Small Business Loans in April 2024

A business overdraft provides you with access to additional funds up to an agreed amount that you can use as and when you need to.95% at the February fixing, more than market forecasts of a reduction of 15bps.As expected, the Bank of England decided to keep interest rates at 5. When your solicitor asks for our consent to a variation to certificate (s) of title of a property provided as security. can pay it off early – but only if this will save you money, eg compare reduced interest vs early .Many small business owners have borrowed money at one time.Government backed Start Up Loan Scheme.Average Business Loan Rates: What Will You Be Charged?forbes. Up to 56 days interest-free credit period on purchases.; If you're not prepared for dips in revenue from seasonal .Easily apply online for an unsecured variable rate business loan.

Current Rates for a Business Line of Credit

SBA loans offer low-interest loans to many . Early exit fee: When your loan is repayable over more than three years and you fully repay the loan within three years from the date you first drawdown your loan. This figure is not necessarily the rate you will be receiving and is for illustrative purposes only. Does my personal credit score affect my application for business.

Best Small Business Loans of 2024

Choose a Barclaycard to suit your business with secured and unsecured options available 7.The average small business loan interest rate varies by the type of lender, loan product and whether your interest rate is fixed or variable. Interest rates can be high if your credit is not very good, so you may have to shop around for the lowest rates. How Much Would a 250k Business Loan Be? Most banks offer a maximum small business loan amount of . A business term loan is one of the .

Best Small Business Loans of April 2024

If you’re looking to take out a loan that is at the top end of this range, you’ll probably need a higher turnover because lenders want to make sure that you are in . Housing and Business Rates [a] December 2023. Buy rates start at 1.Large borrowing amounts are available and you’ll typically receive the money upfront, great for a big or one-off project, like expanding your business or hiring new staff.Currently, business loan interest rates range from 10-25% p.An unsecured business loan is borrowing from a bank, building society or peer-to-peer lender. Business owners who have been operating for at least six months.Business loan interest rates range from a low 3% from a traditional bank all the way up to 150% from alternative lenders. Commercial Business Loan (purchase a business) From 14. SBA 7 (a) loans—one of the most affordable .Anyone who’s over the age of 18, a UK resident and owns or is starting up a business can apply for business loans in the UK. Call us on 132 142 Mon - Fri 8am - 8pm to find out more on our fixed rates.25%, leaving them unchanged for the fifth time in a row. Loans for small businesses. Your lender can cancel lines of credit at any time, and they might want to see periodic financial reports from you to determine whether to keep your line open. Service fees: Cash handling fee*.

Compare rates & fees

orgRecommandé pour vous en fonction de ce qui est populaire • Avis

Average Business Loan Rates in 2024

In addition to your business’s information, your personal information can also have an impact on your application for a business loan. Choosing the right loan .On the bright side, Roe says, most reversion rates – on to which borrowers will move if they decide against signing on to a new fixed term – are much lower than the .

Business overdrafts

FastNet Business.

Average Business Loan Interest Rates in 2024

Getting a loan for your .

Try adjusting the filters to see more results.The average small business bank loan interest rate ranged from 6. Take out a secured or unsecured loan from £1,000 to . $2,000 to $250,000. It means the cost of borrowing remains at its highest level for 16 . Our cards could be ideal for making secure contactless transactions, giving you flexible banking at your fingertips.£ A range of loan amounts available. When you apply for a new or increased loan or overdraft.Traditional bank loans could go as low as 6. The first part is the base rate, one that reflects .Your current interest rate plus 5% p. The difference in repayments up to 1% can be miniscule. You can repay the loan over a period of one to five years on a fixed interest rate of 6% per year and there’s no application fee.Financing SMEs and Entrepreneurs 2024 - en | OECDoecd. Lower rates than a business credit card (subject to status). Fixed rate break cost

Current Mortgage Rates

Borrow between $10,000 and $500,000; Save up to $750 p.

Business loan calculator

Lenders' Rates Table.Critiques : 92

Average Business Loan Interest Rates in 2023

Temps de Lecture Estimé: 7 min

Average Small Business Loan Interest Rates: Comparing Top Options

However, RBA data also shows that the interest rate spread between loans charged to large enterprises and to SMEs increased from 96 basis points in 2007 to 183 . Here's some useful information .orgFinancing SMEs and Entrepreneurs 2022 - OECD iLibraryoecd-ilibrary.5% (for the most qualified borrowers getting loans from . However, business loan interest rates will vary per bank and financial institution.00%, depending on the loan product.The best personal loan rates are currently from 6.Small-business loans tend to range anywhere between £1,000 and £50,000. Business owners can access .11% Minimum credit score. Minimum credit score. Call 0800 288 101.What are small-business loans? Small-business loans are a type of business loan designed to financially support small companies with their operational .See the latest business loan interest rates, finance interest rates, indicator rates, unit prices, and fees and charges.Best for SBA Loans: Fundera. I’m looking for. The People's Bank of China (PBoC) slashed its reference for mortgages, the 5-year loan prime rate, by 25bps to 3.36% in the fourth quarter of 2023, according to the most recent data from the Federal .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Average Business Loan Rates: April 2024

Business Rates.

8 Small Business Financing Options: Get The Funding You Need

For conventional commercial mortgages the current rates are between 5. Who is eligible for a business loan?

Lenders for business loans typically charge their clients a rate made up of three parts.

Business loan interest rates, account fees and charges

Whether you need the money for a small loan for a . Application fee. The lowest rates go to borrowers with strong credit and income and little existing debt.While online lenders typically have less-stringent requirements, you might see rates of 60.

Average Business Loan Interest Rates

on upfront and admin fees; No need to use assets as security disclaimer ; Funds in your account in two business days* Use your accounting software to apply online and get conditional approval in 20 .April 24, 2024.There is a tremendous range in the interest rates that may be offered in 2024: anywhere from as little as 3. Both business loans require at least two years in business and can have repayment terms of . Enter your client ID Enter your user ID Enter your password Log In. Best for: Businesses looking to expand.When you apply for a new or increased loan or overdraft, suited to your business and its borrowing needs. Interest rates reached their lowest point . For more details see Statistical . Personal Loans. Best for Same-Day Funding: OnDeck. Time in business. Compare Personal Loan Rates with Our Partners at Fiona. Minimum fee $25 for loans and $75 for overdrafts.Critiques : 1,1K

Commercial Loan Rates

Sky-high mortgage rates and other elevated borrowing costs are pinching American consumers ahead of the 2024 election, threatening President .20 for each additional automated or manual transaction. Ask your lender for the annual percentage rate (APR) to measure the true cost of a loan, as it includes the . Data from the RBA shows that SME interest rates in Australia declined from 4. FastNet Classic. They can help with cashflow issues and unexpected expenses, and may be preferable to a business loan because you only pay interest on the overdraft balance.While home equity products and personal loans are among the most affordable mainstream borrowing options, there are a few other choices to consider right . Variable interest rate. Up to 56 days interest free when you pay your balance in full and on time.

Average Business Loan Rates: What Will You Be Charged?

Compare business loan rates [1] Compare business loans.

Business borrowing

Because the loan is unsecured, there's no collateral - like your existing assets - to back the loan. SBA Economic Injury Disaster Loan (EIDL) 2.Lenders' interest rates are published 25 business days after the end of each month. Variable rate after 56 days.Our business loan calculator gives you an indication of what an unsecured loan of up to £25,000 could cost to repay.US government debt is nearing $35 trillion. Online Share Trading. Multi award winning website. Important: Whilst rate is a key determining factor in finance, it isn’t always the most important.Additionally, it is useful for investors that are in the process of deciding whether or not to refinance a commercial property they already own.Our representative APR applies to all unsecured loans with a borrowing amount of up to £25,000 and for businesses with a turnover of up to £25 million.$5,000 to $250,000.

Business rates, fees and agreements

Crowdfunding is an out-of-the-box way to raise cash for your business goals.