Ca state temporary disability insurance

Follow These Steps.

Temporary Disability FAQs

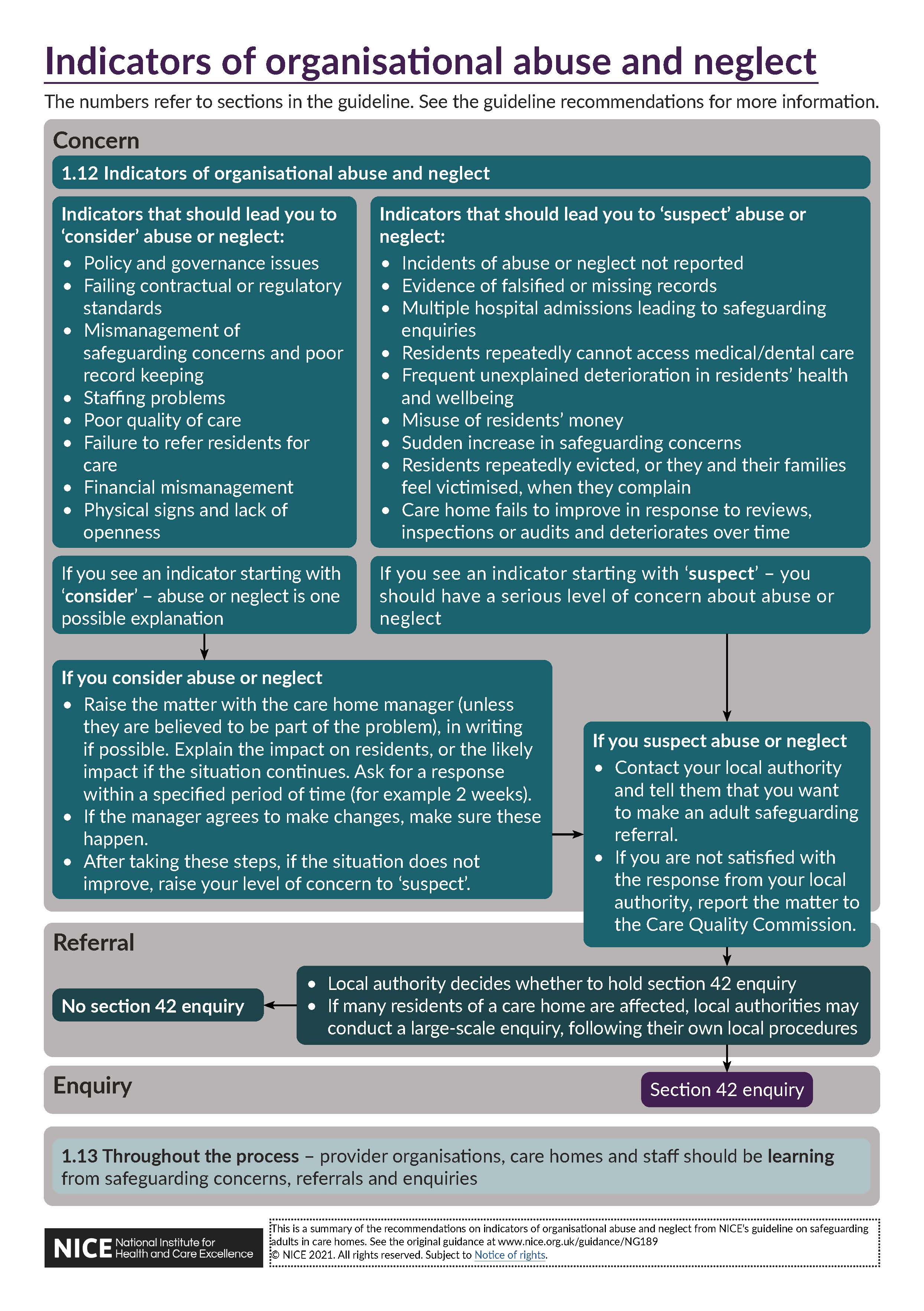

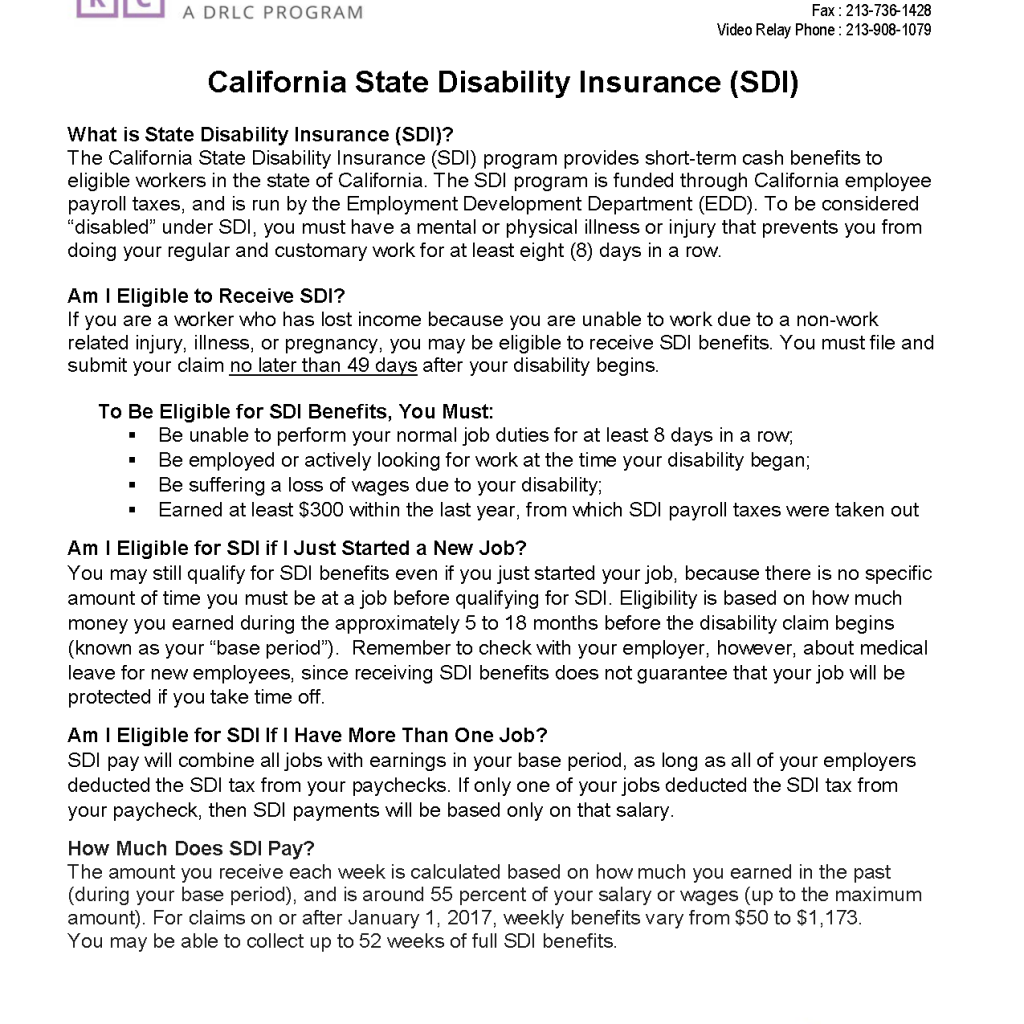

Review Your Eligibility.California is one of a handful of states that have a short-term disability insurance (SDI) program for employees.

Disability Insurance

SDI is a deduction from employees’ wages. The program has been in effect since 1946.The California State Disability Insurance (SDI) program provides short-term Disability Insurance (DI) benefits to eligible workers who need time off work. Launch Service Contact Us.Temporary disability insurance (TDI) in California provides partial wage replacement benefits to eligible workers who cannot work due to a non-work-related illness or injury.If you live in a state that offers temporary disability insurance, you’ll surely want to take advantage of it if the need arises, but it’s only a small band-aid for what could be a major fracture. These riders may be altered, changed or discontinued in the future. For example, in California, SDI benefits are provided through the Temporary Disability Insurance (TDI) program and can last for up to 52 weeks.An individual long-term disability insurance policy costs about 1% to 3% of your annual salary, according to Life Happens, an industry-funded group that focuses on insurance education. Employees may call a local office of the state Division of Workers' Compensation (DWC) and speak to the Information and . EDD Taxpayer Assistance Center at 1-888-745-3886.

You must have earned at least $300, from which state disability insurance deductions were withheld, during your base period (more on this .More than 18 million California workers are covered by the California State Disability Insurance (SDI) program.Additional TDI information is also available in the Frequently Asked Questions.You can also file a state disability insurance (SDI) claim with the Employment Development Department. You may be eligible . DIEC protects small business owners, entrepreneurs, independent contractors, or self-employed people who make up a large .You must have lost wages because of your disability.Disability Insurance Elective Coverage (DIEC) Program Fact Sheet (DE 8714CC) (PDF) California Unemployment Insurance Codes (Section: 701-713) DIEC forms and publications; DIEC FAQs; Contact DIEC Unit. View your DI claim status. You should file this claim even if your workers’ comp case is accepted. What are temporary disability benefits? If your injury prevents you from doing your usual job while recovering, you may be eligible for . You should report to the claims administrator all forms of income you receive from work, including wages, food, lodging, tips, commissions, overtime . Increases weekly benefit to 65% up to a maximum weekly benefit of $2,500. According to the State of California’s Employment Development Department ( EDD ), the California State Disability Insurance (SDI) program provides California residents “short-term disability insurance (DI),” for which you may be eligible “if you are unable to work due to non-related illness or injury, pregnancy or childbirth. View your payment history.Federal-State Extended Duration (FED-ED) You cannot appeal the end of federal unemployment benefits. This is usually shown as “CASDI” on your paystub.Temporary disability pays two-thirds of the gross (pre-tax) wages you lose while you are recovering from a job injury. On the other hand, SDI is a state program that . You may be eligible for DI if you are unable to work due to non-work-related illness or injury. Disability Insurance and Paid Family Leave Benefits. The Hawaii Temporary Disability Insurance (TDI) law was enacted in 1969, which requires employers to provide partial “wage replacement” insurance coverage to their eligible employees for nonwork-related injury or sickness, including pregnancy. If you can’t work due to a medically certified physical or mental illness or injury, it . SDI Online is the fastest, most convenient way to file a claim for disability benefits.

Disability Insurance Eligibility Requirements

The most you can receive is 52 weeks of DI benefits, for your own . To speak with a representative, call: DIEC Unit at 1-916-654-6288. The costs of the program are covered by contributions to the State Fund in the form of SDI tax paid by . View forms you submitted and their receipt numbers.Temporary Disability Benefits.No, your Disability Insurance (DI) benefits are not reportable for tax purposes. Oversees California Family Rights Act (CFRA).Permanent total disability benefits (based on permanent disability of 100%) are paid for life, at the temporary disability rate. File online to reduce your claim processing time. View your benefit details.

Everything To Know About Temporary Disability California

The online resource for Workers’ Compensation information provided by the Department of .Provides informational resources about programs and services available to people with disabilities. In addition to the FAQs below, employees may call 1-800-736-7401 during normal business hours to speak to a live representative at the Division of Workers' Compensation Information Services Center.State Disability Insurance.We offer an optional Disability Insurance Elective Coverage (DIEC) program for people who don’t pay into State Disability Insurance (SDI) but want to be covered by Disability Insurance (DI) and Paid Family Leave (PFL).

Temporary Disability Insurance (TDI): Can You Count On It?

The PI employee would have earned $2800.California State Disability Insurance (SDI) is a state program that provides short-term benefits (up to a year) if you can't work because of a non-job-related injury or illness.Disability Insurance (DI) provides short-term wage replacement benefits to eligible California workers.

A Clear Explanation

Employees pay into the system through SDI taxes that are taken out of their paychecks.00 supplementation gross.About Disability Insurance.Some states have their own specific programs which may have different maximum benefit periods. For injuries that occur on or after January 1, 2003, the benefit rate will be adjusted each year based on any increase in the state average weekly wage (SAWW). According to the State of California’s Employment Development Department ( EDD ), the California State Disability Insurance (SDI) program provides . The maximum duration for temporary disability payments varies from state to state but typically ranges from 26-52 weeks. What can I expect? .

Eligibility for California Short-Term Disability Insurance (SDI) To receive benefits through California's SDI program, you must meet all of the following .Unlike other 2024 rate changes — like the California minimum wage (including computer professionals and licensed physicians) and Social Security and California State Disability Insurance (SDI) withholding — the California Division of Workers’ Compensation (DWC) has announced that on January 1, 2024, the minimum . Provides information from the Children and Family Services Division of the Department of Social Services. The cost is an additional $0. Access your information 24 hours a day.Overview

About the State Disability Insurance Program

DIVISION OF ORKERS’ COM PENSATION

View and submit available forms to continue your claim. Employees fund the short-term disability .

Temporary Disability Allowance, Programs, and Leave Credits In order for the employee to receive an estimated TDA, he or she must elect to use available leave and/or participate in his or her current program, e. Temporary Disability Insurance provides cash benefits to workers who suffer an illness, injury, or other disability that prevents them from working, and wasn’t caused by their . SDI contributions are paid by California workers through employee payroll .Temporary disability (TD) benefits are payments you get if you lose wages because your injury prevents you from doing your usual job while recovering.Called Short-Term Disability (SDI) or Temporary Disability Insurance (TDI) depending on where you live, these programs are faster and easier to get than . General Information: 800-480-3287.

DWC workers' compensation benefits

When it comes to disability insurance in California, it is important to understand the differences between Social Security Disability Insurance (SSDI) and State Disability Insurance (SDI). Joel Palmer is a freelance writer and personal finance expert who focuses on the mortgage, insurance, financial services, and technology .Temporary disability payments typically are two-thirds of the pre-tax wages the employee will lose while recovering from the job-related injury, up to a statutory .

Disability Insurance Claim Process

If you are covered by SDI, the following benefits are .

Apply for Disability Insurance

California State Disability Insurance

This means that if an employee .

The SDI program is comprised of two separate partial wage replacement benefits: *Disability Insurance (DI) and Paid Family Leave (PFL).

Register and apply for disability insurance online with the California EDD. It provides partial wage replacement benefits to eligible California workers who are unable to work due to a non-work-related illness, injury, or pregnancy.

However, if you are receiving Unemployment Insurance (UI) benefits, become unable to work due to a disability, and begin receiving DI benefits, a portion of your DI benefits will be reported for tax purposes. In New Jersey, the TDI program offers benefits for up to 26 weeks. California State Disability Insurance (SDI) is a short-term public insurance program run by California's Employment Development Department (EDD). You may be eligible for DI if you are unable to work and are losing . This will allow you to get SDI payments after the 104 weeks of TD payments if you are still too sick or hurt to go back to work.00 (supplementation gross) . DI does not provide job protection, only monetary benefits; however, . SDI pays you about 60-70% of what you used to make at work because you: Have a non-work-related illness or injury.00 in April 2016, so. State Disability Insurance (SDI) is an employee-funded program that provides, if eligible, approximately 60 to 70 percent of your weekly salary based on income.Generally speaking, most states provide between 50-70% of an individual’s pre-disability wages up to a maximum weekly benefit amount.