Calculate ssi benefit

Unlike SSDI, SSI is a needs-based benefit.

Benefit Calculators

Maximum Federal Supplemental Security Income (SSI) payment amounts increase with the cost-of-living increases that apply to Social Security benefits.

How to Calculate a Child's Social Security Disability Benefits

The Supplemental Security Income (SSI) program provides monthly payments to adults and children with a disability or blindness who have income and resources below .00 Allocation for third child. The FBR is the maximum monthly benefit allotted to SSI recipients and varies depending on your living arrangement and marital status.To calculate SSI benefits, you need first to determine your countable income. Sign in to your Social Security account to see how much you or your family might get in .Who Is Eligible For Ssi?

Benefits for Spouses

Form approved OMB#: 0960-0818. For 2024, the COLA is 3. To apply for SSI for a child, you can start the process online. Published September 21, 2021.How are Social Security disability benefits calculated? By. This includes wages, pensions, and any support from others.Please note this calculator is for estimating only.00 Gross Monthly Wages (before taxes) + $0. The simplest way to do that is to create or sign in to your personal my Social Security account.How Is Social Security Calculated? There is a three-step process used to calculate the amount of Social Security benefits you will receive. For couples, the maximum monthly SSI payment amount rose from $1,371 to $1,415.00 Allocation for second child. Compare retirement benefit estimates based on your selected date or age to begin receiving benefits with retirement estimates for ages .

Social Security Benefit Amounts

How to Calculate SSI .

Social Security Calculator (2024)

Supplemental Security Income (SSI) is a needs-based program.Online Benefits Calculator.

Social Security Calculator 2024: Estimate Your Benefits

SSI benefits in New Jersey are determined by a Social Security Administration formula, considering the recipient's income and resources.SSI Benefit Check Step 3 $0. Compare retirement benefit estimates based on your . Supplemental Security Income, or SSI, helps parents who have children with disabilities. Though some people may also qualify for SSI .

How To Calculate Your Social Security Benefits

You can find out the amount by using a social security child benefits calculator or .How to Calculate SSI Benefits.While there is no specific child SSI calculator individuals can access to find out the amount of benefits paid out, the Social Security Administration (SSA) does provide a chart that helps individuals deem eligibility for children for SSI in 2022.Although the value of the rent-free house is $900 per month, we count $324. For couples, that figure is $2,827 per month.Supplemental Security Income (SSI) is for people who have little to no income.Determining SSI Benefit Amounts in New Jersey Calculation of Benefits. The other way is to answer a series of questions to prove your identity.Here’s how the Social Security Administration would figure out the amount of income to be deemed. Benefits also depend on how much money you’ve earned in life.

How Much Is SSI In New Jersey?

Your amount may be lower based on your income, certain family members’ .

SSDI and SSI benefits for people with disabilities

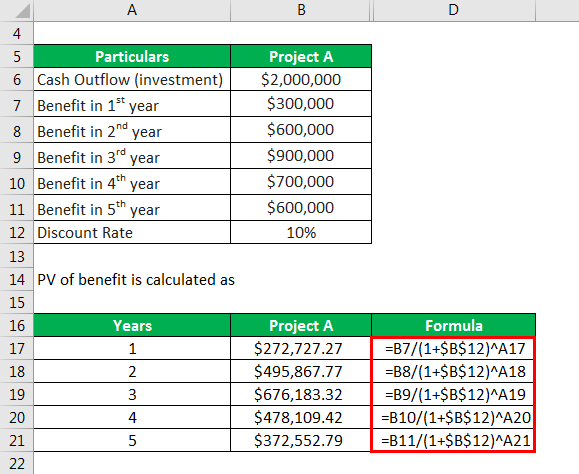

To use the Online Calculator, you need to enter all your earnings from your online Social Security Statement . So let’s jump in with calculating your AIME. Countable income includes: 1. In each case, the worker retires in 2024. SSI eligibility is based on financial need, and benefit amounts are set by the federal government, without regard to a recipient’s work history. When you work, it changes the . Click on one of the links below and you will be transferred to the calculator where you can enter your name, date and various income information.Our calculator estimates your monthly Social Security Disability Insurance (SSDI) benefits amount based on the earnings you report to us — but without your wage .After you enter the information required by the Quick Calculator, you will see your benefit estimates and the phrase See the earnings we used, located under your retirement benefit estimates. SSI amounts for 2024 The monthly maximum Federal amounts for 2024 are $943 for an . You must also either: Have a disability, or.00 Unreduced allocation for first child.For example, a person who had maximum-taxable earnings in each year since age 22, and who retires at age 62 in 2024, would have an AIME equal to $13,100.A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months.How are SSI payments calculated? What other benefits can I get with SSI? How to get SSI.00 Allocation for first child. And to that, we would add Bob’s own retirement benefit to find . Anyone who has some countable income, which in total is less than the FBR, will have their monthly SSI payments lowered by the amount of their countable income. Use this Social Security benefits calculator to .my Social Security Retirement Estimate. In this case, your child's SSI benefits would be $312. We illustrate the calculation of retirement benefits using two examples, labeled case A and case B. The current version of the Detailed Calculator is 2024.Estimate your retirement benefit based on your personal earnings with the my Social Security retirement calculator. These calculators will help in estimating the effects of income, like work earnings, on your SSI or SSDI.

Was this page helpful?

Survivors Benefits

Insert Emergency Text.Benefit Calculators.

How much you could get from SSI

The calculator will then total the amounts and provide you an estimate. If you are working and . Earned income: Any money earned from work, including wages, tips, . To change your earnings, and hence your benefit estimates, please follow the following steps. Multiply that by 12 and you get $58,476 in maximum annual benefits. This taxable portion goes up as your income rises, but it will never exceed 85%.Quick Calculator. Create account.The annual Social Security cost-of-living adjustment (COLA) also applies to SSI, so the maximum monthly benefit increases each year. The latest such increase, 3. To do this, you’ll need to get use a notepad or a tool like . Be 65 or older.Bob files for his retirement and spousal benefits at age 65 (i. Case A, born in 1962, retires at age 62. Step 1: Use your earnings history to calculate your Average .Any applicant for SSI with countable income that is over the federal benefit rate (FBR)—$943 for individuals in 2024—will not qualify for SSI.How Does the Social Security Administration Calculate Benefits? Photo credit: © iStock/KenTannenbaum. The maximum Social Security benefit changes each year. Even if your annual income is $1 million, at least 15% of your Social Security benefits will stay tax-free. We would determine your SSI benefit as follows: $943. Based on this AIME amount and the bend points $1,174 and $7,078, the PIA would equal $3,849.The latest SSI earned income data show that for 2023, an individual beneficiary cannot earn more than $1,913 per month.See estimates for various benefits based on your earnings and when you apply.The earnings-based benefit calculation does not apply to Supplemental Security Income (SSI), the other SSA-run benefit program serving people with disabilities.66 as in-kind support and maintenance.The calculator provides an estimate of your monthly Social Security retirement benefit, based on your earnings history and age. For 2024, it’s $4,873/month for those who retire at age 70 (up from $4,555/month in 2023). Click on See the earnings we used to see the estimated . Social Security will make the official determination when you report your wages.00 Child support. Use the Benefit Eligibility Screening Tool to see if you are eligible for SSI.00 (Social Security benefits) - $20. size of your monthly check—but no matter what, when you work you will have more money in your pocket than if you don’t work at all . As a result, his spousal benefit will be reduced by [24 x 25/36 of 1%] — or 16.Social Security calculates your benefits by tallying up the earned income you made in your top earning years and applying some simple arithmetic. If that's less than your anticipated annual .

Calculation of Children’s Allocation. The Basics About Survivors Benefits.

Calculator: How Much of My Social Security Benefits Is Taxable?

This calculator is made for individuals who: want to know how their Social Security benefit will be affected by . This example demonstrates the effect of .

Is There a Child SSI Calculator?

Benefit Calculation Examples for Workers Retiring in 2024.2 percent, becomes effective January 2024. Social Security Detailed Calculator .SSI payment standards, 1975 & later. You have options to apply online, by phone, or in person.00 (general exclusion) ----- = $280.Welcome to the automated SSI calculation worksheet! This tool, which was developed by the Yang-Tan Institute on Employment and Disability, provides a unique calculator and text companion that explains each step in the SSI benefits calculation process and provides proper calculations and results for your SSI clients attempting to make a return-to-work .

Benefit Calculators

Estimate your monthly Social Security retirement benefit using your age, income and when you want to retire. This page provides detailed information about survivors benefits and can help you understand what to expect from Social Security when you or a loved one dies. / Updated December 18, 2023.

SSI Benefits Calculator

The Social Security Administration takes . The final calculation of Bob’s spousal benefit will be 83. A person's benefit amount varies based on their financial situation; .

Social Security Calculation Step 1: Adjust all earnings for inflation. Office of the Chief Actuary ; Current version.

How the Social Security Benefits Calculation Works

This benefit is particularly important for young families with children. Amounts are based on: Whether there is a single-parent or two-parent household. Your family members may receive survivors benefits if you die. If you have a personal my Social Security account, you can get an .Retirement Benefit Calculation. This person would receive a reduced benefit based on the $3,849. You can also adjust expected future income to see how that impacts your retirement estimate.As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the rest of your Social Security income remains tax-free.

Future Benefit Calculator

How Is SSI Calculated and What Income Counts in 2024?

Nerdy takeaways.

50, your countable income, from $700 to calculate your child's monthly SSI benefit payment.

SSI Calculator Wages Only

This involves considering the EOD, deducting the obligatory five-month waiting period, and then ascertaining the back pay due from the conclusion of this waiting period up to the SSDI approval date.The maximum monthly SSI payment for 2024 is $943 for an individual and $1,415 for a couple.Yes, there is a limit to how much you can receive in Social Security benefits.To calculate the SSI benefit amount, subtract your adjusted countable income from the federal benefit rate (FBR): SSI Benefit Amount = FBR – Adjusted Countable Income. Disabled people who don’t have enough work credits for SSDI may still receive disability benefits through Supplemental Security Income (SSI).00 (SSI Federal benefit rate) That increase lifted the maximum monthly SSI benefit for individuals from $914 in 2023 to $943 in 2024.00 Total Gross Monthly Budget amount.

)