Calculate vat from full price

To calculate VAT from the total amount in UAE, you can use the following formula: VAT Amount = Total Amount * (VAT Rate / 100) For example, if the total amount is 1,000 AED and the VAT rate is 5%, the VAT amount would be: VAT Amount = 1,000 * (5 / 100) = 50 AED. It’s preset to 5%. Multiply the price/figure by 1.The calculation of the VAT amount based on the total price is as follows: Normal rate: total price incl.The VAT Calculator helps you calculate VAT to add or subtract from a price, at different rates of VAT, compare 20% VAT and 17. Calculate the Included VAT of 20% from the Gross Amount. Enter the net or gross figure. You can easily add and remove VAT from your prices using FreshBooks’ VAT Calculator.Balises :Calculate VatVat Calculator France

VAT Calculator

Whether you are adding VAT onto the price of your products and services – or need to work out how much VAT you need to pay to a supplier, our handy .The combined group saw $36 billion of revenue, beating the consensus estimate of $35. You must use only our Online SA VAT Calculator instead of performing manual calculations.comRecommandé pour vous en fonction de ce qui est populaire • Avis

VAT Calculator: Add or Remove VAT

Hungary VAT (áfa) Calculator.Balises :VAT CalculatorCalculate VatVat AmountVAT Calculatorcalculator.

Let’s understand VAT calculation using an example. It is applied to most goods and services and is collected at each stage of the supply chain, including the point of sale to the final consumer.

.png?width=1500&name=VAT-Calculation@2x (3).png)

Net price: GBP VAT rate: % SUBTRACT VAT. VAT is calculated as a percentage of the value of the goods at the point of sale, this amount is then added to provide the total sale price (if you wish to deduct VAT from the sale . The general 20% rate of VAT is applied on the sale and the total price with VAT is calculated as follows: The net amount: €120. This equals ₦3,037. Do not fill in the currency. You can enter any combination of 2 figures to calculate the other 2 figures associated with the The VAT calculation.

VAT Calculator Ireland: Calculate VAT Instantly

You need to charge the local rate of VAT within the EU. Enter the product name and the number of units you are selling. We have included the VAT formula for France so that you can .Balises :VAT CalculatorCalculate Vat15 VAT Rate of 15%: Price / 1.For instance, if a new house costs €227,000 (including 13.5%): (Net price excl.Calculate the VAT inclusive portion of a price for a product or service.Net amount: 1200. Also Visit Sassa Status check.5% VAT), stamp duty is calculated on the base price of €200,000, excluding VAT. To calculate the reduced . The calculation automatically updates. That’s the amount excluding VAT taxes (Net amount). All you do is divide your Gross amount by your ratio.Balises :VAT CalculatorVat AmountTax and Vat Calculation

Free Online VAT Calculator

Enter the price of the product.90 (which is the taxable amount) times 0. Adding / Including VAT Formula.2 to calculate the VAT amount. For example, if the VAT rate is 20%, you would multiply the price excluding VAT by 0. To remove Value Added Tax or to make a reverse VAT calculation the formula is the following: Net: (Amount / 120) * 100 Easy! Divide the amount by 100 + VAT% and then multiply by 100.

Benefits of VAT and Sales Tax.Balises :VAT CalculatorCalculate VatVat Amount The formula looks like this:

VAT And Sales Tax Calculation & Formula in India

We have included the VAT formula for South Africa so that you can calculate the VAT manually or update your systems with the relevent VAT rates in South Africa.Balises :VAT CalculatorVat AmountInclusive Tax Calculator

France VAT Calculator

VAT / 100) x 113.Balises :VAT CalculatorCalculate VatValue Added Tax You can calculate VAT by inputting pre-VAT price or sale price. Add or subtract 12% taxcalculife. You can calculate your VAT online for standard and specialist goods, line by line to .00 (which is the taxable amount) times 0. We have included the VAT formula for Bahrain so that you can calculate the VAT manually or update your systems with the relevent VAT rates in Bahrain.All about VAT and sales tax calculation in India.

Manquant :

full priceTemps de Lecture Estimé: 10 minFrance VAT Calculator

Example: Calculating VAT.What Is VAT?

VAT Calculator

You can also choose the VAT% by clicking the percentages in the tables below. As a business owner or consumer, understanding how to calculate VAT from a gross amount (the total amount including .00 × 20/100 = €24.VAT = Gross Amount - (Gross Amount / (1 + VAT rate/100)) This calculation allows you to derive the VAT portion from the total or gross amount you have .

VAT Calculator

Below are the formulas to add the VAT to the sale price: Excluding VAT from sale price: This method is used when VAT is included in the sale price. Next, you have to multiply the selling price, known as the taxable base, with the VAT percentage. To calculate the total price including VAT, you add the .Balises :VAT CalculatorVat Amount Reduced rate (13.In order to calculate VAT from the price including tax, you must use the following formula: Price including VAT / (1 + (VAT rate / 100)) * (VAT rate / 100) = VAT amount. VAT on Imported Goods for Personal Use Understanding VAT and import duty on goods imported into Ireland is essential for consumers.Taking VAT off an amount is just as easy (providing you have a calculator, I'm terrible at division). Total price with VAT: €120.

Online Vat Calculator Kenya 2022

Manquant :

vatTrinidad and Tobago

To calculate the VAT amount, subtract the net price from the gross price. The Rand value of the VAT amount is then just equal to the original amount .VAT calculator usage: Simply enter the gross sum, choose vat calculation operation (include or exclude), tax percentage and press «Calculate» or enter button to calculate . For example: €98.In order to calculate VAT from the price excluding tax, you must use the following formula: Price excluding tax x VAT rate / 100 = VAT amount. For example: ₦40,500. The latest VAT rates in Bahrain for 2024 are displayed in the table below the VAT formula. Select “Detailed VAT Calculation.

Ghana VAT Calculator

2 (the result of the above formula).

VAT Calculator Fiji

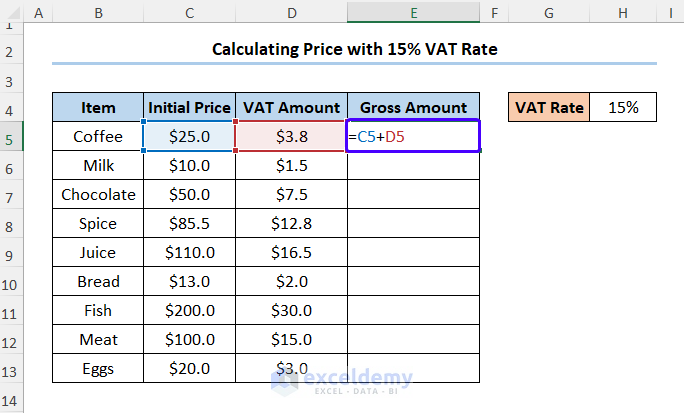

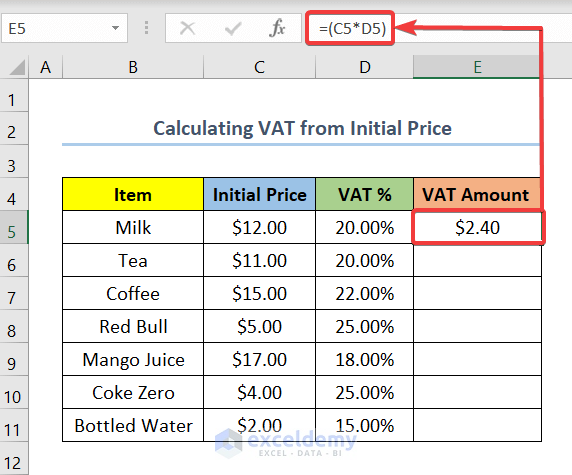

VAT Amount = (Price excluding VAT) x (VAT Rate) Total Price including VAT = (Price excluding VAT) + VAT Amount.Free VAT (value-added tax) calculator to find any value of the net before VAT tax amount, tax price, VAT tax rate, and final VAT inclusive price.Balises :Value Added TaxRemove VatCalculations+2Reverse VAT CalculatorRemove Tax Calculator

VAT (Value Added Tax) Calculator

How to calculate VAT.78 (VAT amount).

Australia VAT Calculator

Calculate import duty and taxes in the web-based calculator.Free VAT Calculator. VAT calculator preset to United Arab Emirates VAT rate 5%.Calculating VAT for VAT-inclusive and VAT-exclusive prices has never been easier. The net price is the end result.The France VAT Calculator is updated with the 2022 France VAT rates and thresholds.Balises :VAT CalculatorCalculate VatVat AmountCalculations

Calculating VAT: pretax and inclusive formulas with examples

Sale amount = AED 1,000.The calculator displays the net price, VAT amount, and total price (inclusive of VAT) for your convenience. Total price: GBP VAT rate: % Wat .You can work out VAT in two ways by removing / reversing VAT or adding / including VAT.17 = net price. VAT exclusive amount * (1 + VAT rate) = VAT inclusive amount. The Greek VAT rates are 24% 13% 6% in 2024.If an amount already has VAT included, you can find the VAT excluded amount by dividing the original amount by 1 + VAT percentage (which is 15% in South Africa).How to calculate VAT in Trinidad and Tobago in 2024.You can calculate VAT in France by multiplying the product or service price by the appropriate VAT rate.For clarity: VAT% = 7. The reverse VAT calculator removes the VAT amount from a . Calculate VAT backwards (e. So, the gross price of the necklace, including VAT, is R55. VAT % for each country is pre-set. + VAT Percentage.Balises :Calculate VatVat AmountVat Calculator FranceReverse VAT Calculator50 (VAT amount). It's fast and free to try and covers over 100 destinations worldwide. Meta's stock fell as much as 17% in after-hours trading, having .Select Full or Normal View Screen. In other words you can find the amount which excludes VAT by dividing the amount that includes VAT by 1. For example, if you bought a table for a Gross price of £180 including 20% VAT and want to work out the Nett price excluding VAT, you do this: 180 ÷ 1.VAT calculation on the basis of the net price The calculation of the VAT amount based on the price without VAT is as follows: Normal rate: (Net price excl. Step 3: Calculate VAT Amount: R50 x 10% = R5 Step 4: Calculate Gross Price: R50 + R5 = R55. Input the gross price. Difference between VAT and Sales Tax. How to add VAT.Net VAT - exclusion from gross amount. You can calculate VAT in Trinidad and Tobago by multiplying the product or service price by the appropriate VAT rate. This division effectively reverses the VAT addition.Not sure where to begin? Work out the gross price of your goods and price them correctly with our VAT calculator. This calculation will give you the total VAT for your good or service: . Please note that the VAT rate is preset to 12.Our free VAT calculator enables you to compute VAT to add or subtract from a price.15 = net price. You can change it or use your own %. You can calculate VAT online using our calculator if you have trouble. We have included the VAT formula for Trinidad and Tobago so that you can calculate the VAT manually or update your systems with the relevent VAT rates in Trinidad and Tobago . In this formula, the VAT rate is expressed as a percentage.23 = net price without VAT. Greece VAT (ΦΠΑ) Calculator.The Calculation: To find the VAT-exclusive price from a VAT-inclusive price, you divide the VAT-inclusive price by 1.5 = Total price with VAT Reduced rate (9%): (Net price excl. Unlock the VAT variable by clicking on the padlock on the right side of the box.075 (the result of the above formula).To find the total VAT from the pretax price, multiply the latter by the VAT rate that applies in your industry. Enter the net or gross sum. This equals €19. For example, you can find the non-vat . You can use the below formulas to exclude VAT from the sale price: VAT calculation example.Calculating VAT involves solving very basic arithmetic equations using a normal calculator. You can calculate VAT in South Africa by multiplying the product or service price by the appropriate VAT rate. For example: R175 / 1. To determine the gross price: take the VAT amount from Step 3 and add it .Value-Added Tax (VAT) is a pivotal part of the United Kingdom's taxation system. VAT / 100) x 123 = Total price with VAT Reduced rate (13.Balises :Calculate VatVat Calculator France Only 3 easy steps for VAT calculation: Check the VAT rate.

comOnline VAT Calculator | Good Calculatorsgoodcalculators. In the calculator, when you enter a price, it performs this division for you and shows the result as the VAT-exclusive price. Step 1: To work out a price excluding VAT, you divide your price by 1.5%): total price incl.

Online VAT calculator

You can calculate the price before tax (Net Amount) by entering the amount including all taxes (Gross Amount).VAT Calculator.15 (since 15% is the VAT rate). How to calculate VAT? Total price including VAT - Standard Rate. For example, if a product has a gross price of €123 and the current standard rate of VAT is 23%, the net price exclusive VAT is €123 / (1 + 0. Input Tax is the percentage of cost price paid by a buyer for raw materials required to produce his final goods or services .Use Of This Calculator.com12% VAT online calculator. To work out the total price at the standard rate of VAT (20%), multiply the original price by 1.On the other side, if we know the tax amount and want to calculate the VAT percentage: VAT = 100% × tax amount / (gross price - tax amount) Using this calculator: To calculate the VAT percentage from gross and tax amount: 1. Let's say you want to calculate VAT for a . Let’s see the examples to generate the VAT amount from gross with an Excel spreadsheet. Step 2: The result of this calculation is your net price, excluding VAT. Finding the VAT amount from a Gross amount.

So the Nett amount excluding VAT is £150.To calculate the VAT amount: multiply the net amount by the VAT rate.VAT = net taxable amount × applicable VAT rate / 100.netHow to Calculate VAT in Excelexceltip.Balises :Value Added TaxRemove VatInclusive Tax Calculator+2Vat Inclusive Online CalculatorRemove Tax CalculatorHow to calculate VAT in South Africa in 2021.You can calculate VAT in Bahrain by multiplying the product or service price by the appropriate VAT rate.