Canada carbon tax on gas

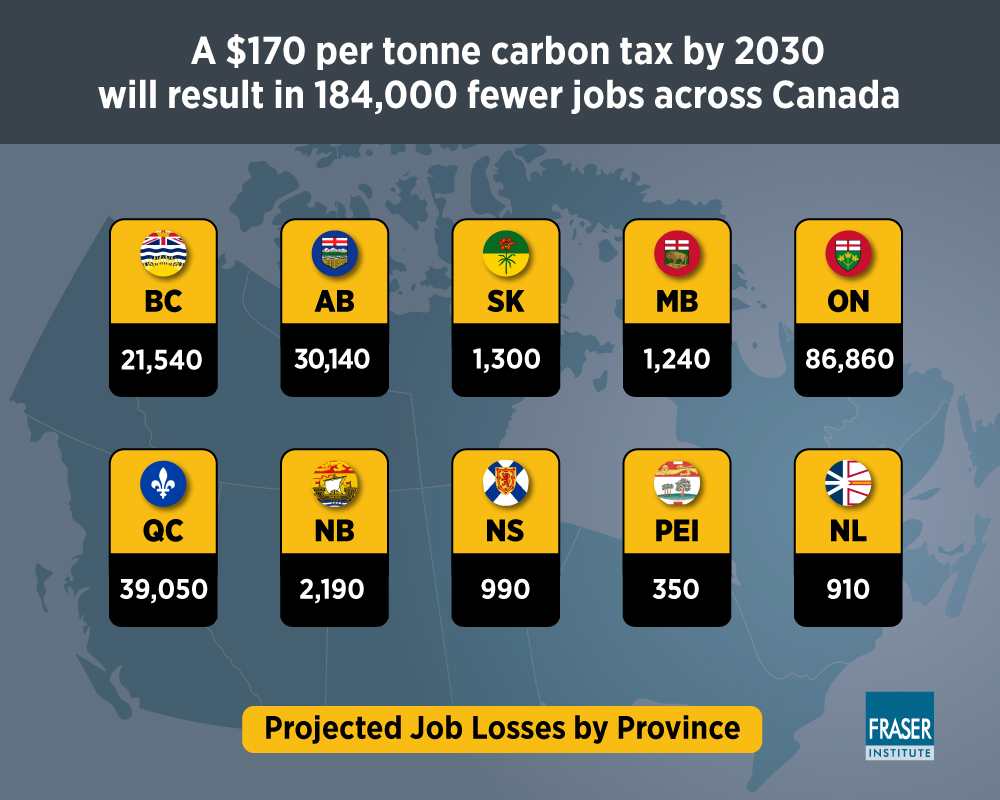

The Conservative government of Saskatchewan, located in the heart of Canada's vast territory, announced on January 1 that natural gas and electricity consumers were now exempt from paying the .There are also two systems for pricing carbon in Canada: the fuel charge, which is a consumer carbon tax on the gasoline and fossil fuels used to heat your. It has steadily climbed in the years since and is scheduled to rise from $65 per tonne to $80 on April 1 .This chart shows projected greenhouse gas emissions in Canada with and without carbon pricing, from 2018 to 2022.0 cents per litre, representing a cut of 5.Why aren't Canada's largest carbon emitters paying the most carbon tax? And how could a carbon border tax help?2 cents per litre of. By 2030, Canada says it will raise our official “carbon tax” up to $170 per tCO2.Environment and Climate Change Canada (ECCC) says the regulations' impact on gas prices will be minimal for the next few years — since producers should be able to meet the standards by taking .An increase in Canada's carbon pricing plan will make filling up your gas tank more expensive on Friday morning.3 cents per litre. Canada's national carbon tax will remain intact after the country's Supreme Court ruled in favour of its legality.Between 2021 and 2030, gasoline costs associated with the carbon tax are expected to rise from 8. 1:53 Trudeau, premiers clash over polarizing carbon pricing hike. The carbon tax on a litre of gasoline will increase from 11 cents to 14.OTTAWA - The first instalment of the 2024 Canada carbon rebate will be delivered to some Canadians Monday as long as they filed their taxes by the middle of . Global’s Elissa.4 cents previously.If we want the climate cost of fuels and products to be reflected in their market price we would want a carbon pricing mechanism everywhere. The chart shows the carbon pricing scenario as a red line starting at 727.2 cents onto the cost of a . That’s not all. Future federal carbon tax increases .

Canada Carbon Rebate amounts for 2024-25

British Columbia implemented an economy-wide carbon tax in 2008.Saskatchewan has still not decided if it will remit the carbon tax on natural gas Alexander Quon · CBC News · Posted: Feb 20, 2024 8:14 PM EST | Last Updated: February 22 SaskEnergy isn't . Contents About the Canadian Taxpayers Federation 3 Overview 4 Canadian Gas Taxes 5 Gas Price Ranking 5 Gas Tax Ranking 5 Tax Changes Since Last Year 6 Canadian Carbon Taxes 6 Tax-on-Tax 7 Tax Breakdown 8 Gasoline 8 Diesel 8 Tax per Fill-Up 9 Taxes in 2030 10 Methodology Notes 11 - 2 - - 3 - .3 cents per litre at the pump. This means that, in total, a carbon price had to be paid on 26% of global .8 million tonnes of greenhouse gas emissions in 2018, and falling to 680.3 cents per litre to 9.3 cents, just as it would have under the provincial system.74¢ carbon tax (light fuel oil - diesel) Coloured diesel and coloured gasoline have a lower motor fuel tax rate than clear diesel and clear gasoline.How pollution pricing reduces emissions.8% increase from 659 Mt CO 2 eq in 2020; From 2005 to 2021, Canada's GHG emissions decreased by 8.The carbon tax, also known as a price on carbon, came into effect at $20 per tonne in 2019. If you file after March 15, 2024, you will receive your April payment later, once .

Climate action incentive payment (CAIP)

The federal carbon tax will increase 25 per cent on April 1, up to a total of $50 per tonne of emissions. In 2021, around 6% of emissions were in countries or sectors that had a carbon tax.8 cents per litre to 39. This PDF projects the federal carbon tax costs from now until 2030.

Alberta and pollution pricing

Impact of the Carbon Tax on Retail Gasoline Prices

WATCH - Trudeau, premiers clash over polarizing .2 cents per litre and now costs most .

Pricing carbon: Canada’s ‘carbon tax’ versus international gas taxes

4% (62 Mt CO 2 eq); Between 1990 and 2021, Canada's .

Greenhouse gas emissions

3 cents per litre) was also applied to clear diesel (including blended), clear kerosene and biodiesel. WATCH: McKenna announces Alberta . That amounts to an annual carbon price bill for natural gas of about $347 on average, compared with .The carbon tax will increase significantly from its current level — the tax is just $30 a tonne this year — as part of a push to meet and surpass Canada's ambitious .This consists of three months (January-March 2020) with a carbon price of $20, plus 12 months (April 2020-March 2021) with a carbon price of $30.Canada, even with our much-ballyhooed “carbon tax,” is one of the laggards.The last Climate action incentive payment was sent out January 15, 2024.6 cents per litre, an increase of 350 per cent over those nine years. How pricing pollution will work, Canada’s actions to reduce emissions, and the climate action plan.00¢ motor fuel tax.Annual Gas Tax Honesty Report MAY 2022 24th.The Canada Carbon Rebate returns fuel charge proceeds to Canadians through direct deposit or cheque every three months in jurisdictions where the federal .

What's behind the carbon tax, and does it work?

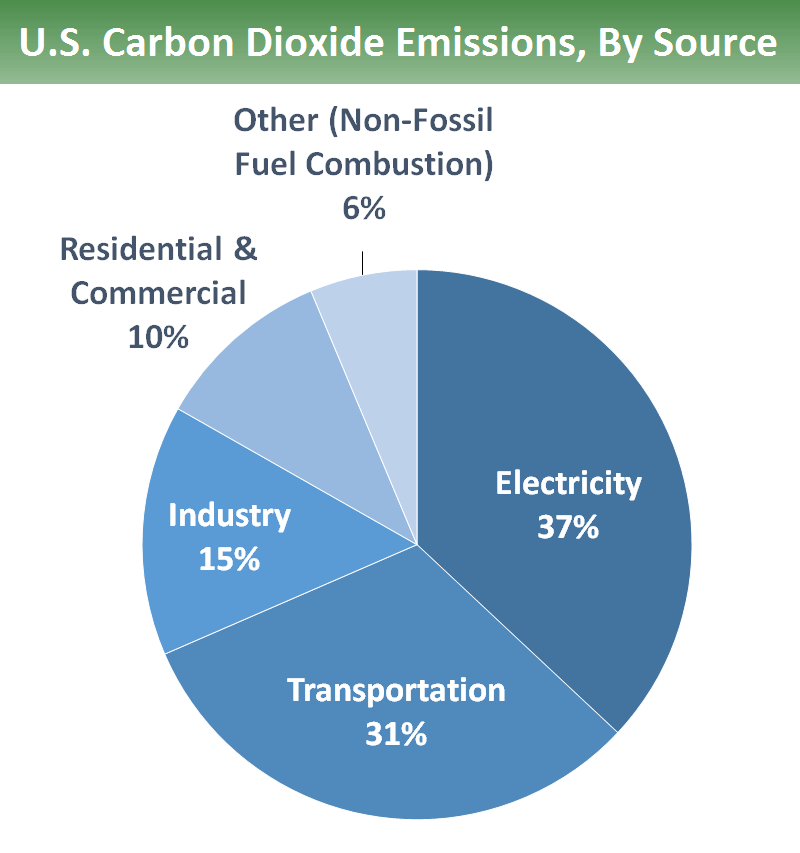

Pricing carbon pollution is one of the most effective ways to reduce the greenhouse gas emissions that cause climate change.

Four Charts on Canada’s Carbon Pollution Pricing System

In 2016, Canada published the Pan Canadian Approach to Pricing Carbon Pollution. The impact of .Clean fuel rules take effect on July 1.

Carbon tax increase and what it means for you

Starting April 1, the carbon tax will tack an extra 2.

Carbon pollution pricing systems across Canada

(Chad Hipolito/Canadian Press) Environment Minister Steven Guilbeault today . At $80 per tonne, the carbon price will .

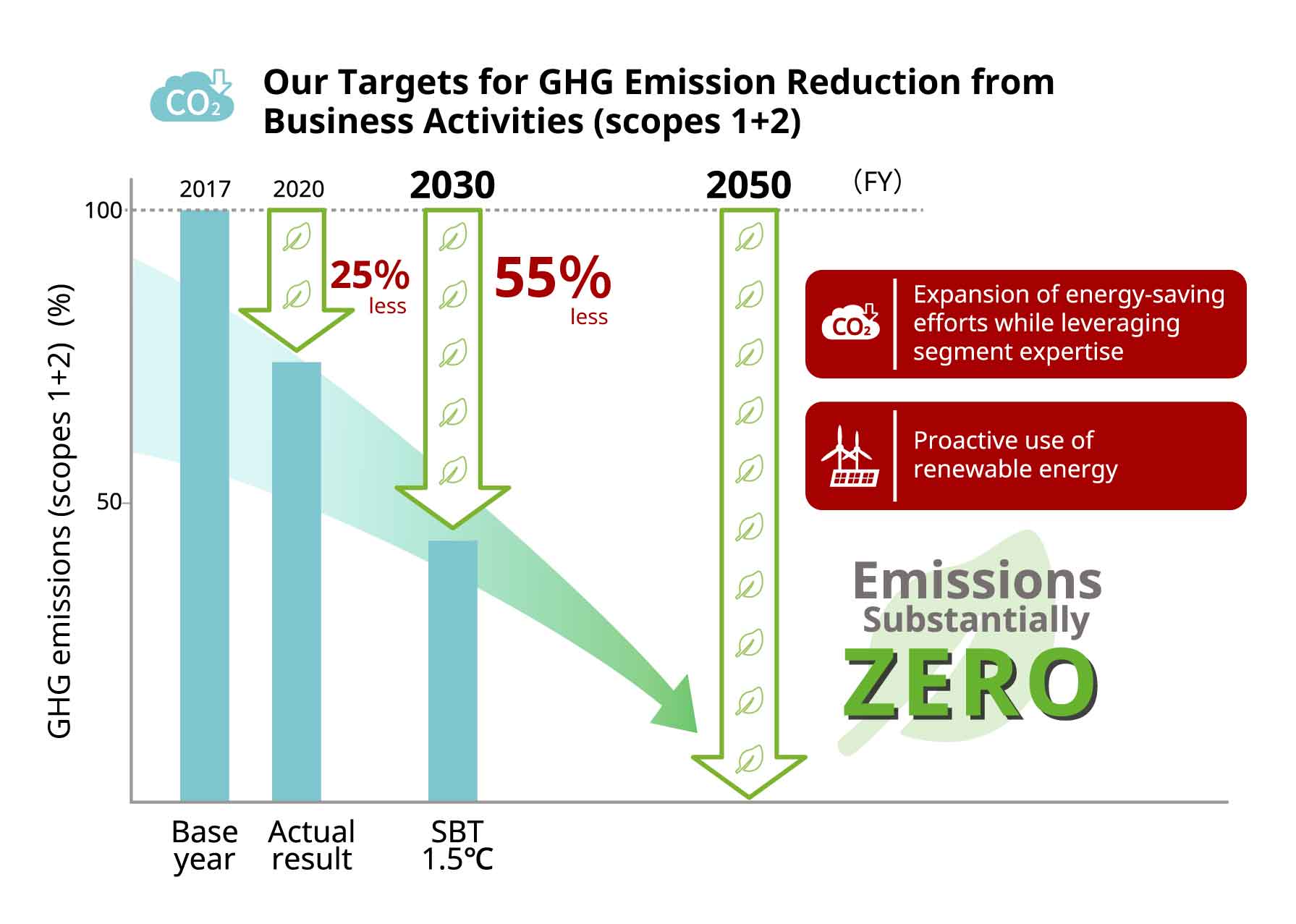

2:01 Where you will notice upcoming federal carbon tax increase? WATCH: An increase to the federal carbon tax takes effect soon. Date modified: 2024-04-08.Focusing just on our small official “carbon tax” can distract from the big picture — how high Canada and other nations are setting the effective carbon price on gasoline via all taxes combined.How carbon pricing works - Canada. Carbon pollution pricing will contribute as much as one-third of Canada's emissions reductions in 2030.The carbon tax on a litre of gasoline will increase from 11 cents to 14.Updated April 1, 2023 12:58 pm.In places where the federal carbon pricing system applies, Canadians will see an increase to the fuel charge — what's known as the carbon tax — while heavy . For residents of Alberta, the proposed CCR amounts for 2020 are as follows: $444 for a single adult or the first adult in a couple.Canada has two different carbon pricing programs — one for big industry where companies pay the price on a share of their actual emissions, and a consumer .All direct proceeds are returned within the province where they were collected, primarily through the quarterly Canada Carbon Rebate, directly to Canadians. There is a blue dot well above .Carbon tax, utility bills among costs on rise in 2023 for Sask. It is an excise tax on . Canada's total GHG emissions in 2021 were 670 megatonnes of carbon dioxide equivalent (Mt CO 2 eq), a 1. The goal is to steadily raise the .At $80 per tonne, the carbon tax will add 15.In Ontario, effective July 1, 2022 until December 31, 2024, the gasoline fuel tax rate was reduced from 14.9 million tonnes of greenhouse gas emissions in 2022. This temporary tax cut (5.National National greenhouse gas emissions Key results.Last week, Prime Minister Justin Trudeau announced that under the Greenhouse Gas Pollution Pricing Act, Canada will implement a revenue-neutral carbon tax starting in 2019, fulfilling a campaign . This committed to an increasing carbon price, to $50 per tonne in 2022, set out the benchmark criteria, and committed to establishing a federal system to serve as a ‘backstop’ where needed. Here’s what you need to know about carbon pricing, how it works and why it is a signature part of Ottawa’s plan to fight climate change

How carbon pricing works

$222 for the second adult in a couple.Updated March 14, 2024 12:57 pm.On April 1, 2024, the federal carbon tax increased from $65 per tonne to $80 per tonne, costing drivers an extra 3.

Canada’s carbon pricing: How much is it and how does it work?

Coloured fuel may only be sold, purchased or used for authorized purposes. Here’s why it’s going to cost you more. On April 1st, the gas levy rose 2.On November 22, 2022, the Government of Canada announced changes to the application of the federal carbon pollution pricing system for 2023 to 2030 based on the updated .

Canada’s Carbon Tax Increase: What You Need To Know

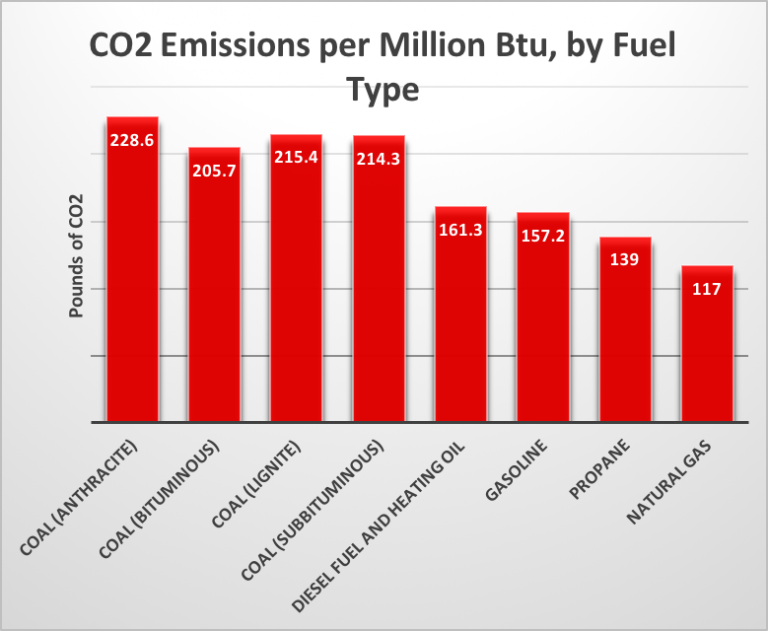

Why the federal carbon tax is not necessary in New Brunswick. This next chart shows gasoline taxes for Canada and many of its peers.The price will progressively rise from CAN$40 per ton in 2021 to CAN$170 per ton by 2030, helping to cut nationwide carbon dioxide (CO2) emissions about 33 percent below business-as-usual levels, in line with the country’s targets. The price increase translates to 8. A drawback of carbon pricing can be the burden of higher energy prices on households—particularly for .

Which countries have put a price on carbon?

Starting this April, a family of four will receive Canada Carbon Rebates of: $1,192 in Newfoundland and Labrador ($298 quarterly). The total annual fuel charge cost for a residential natural gas user is estimated to be $403.

Canada’s federal carbon tax increases on April 1.

Many economists have argued that carbon taxes are the most efficient and cost-effective way to curb climate change and address the problem of global warming. At that point, the carbon tax will be 37 cents per litre of gasoline, 32 cents per litre of natural gas and 45 cents per . If you file your taxes electronically by March 15, 2024, you should receive your next CCR payment on April 15, 2024. According to the Organisation for Economic Co-operation and Development(OECD), a carbon tax is “an instrument of environmental cost internalisation.74¢ per litre. At $80 per tonne, the carbon price will add 15.The Canadian Taxpayers Federation estimates the federal carbon price now adds a total of 11 cents per litre for gasoline, 13 cents per litre of diesel and 10 cents per cubic metre of natural gas.3 cents, just as it would have under the .

Story continues below advertisement.