Canadian inheritance rules

Instead, the Canada Revenue Agency (CRA) treats the estate as a sale, unless the estate is inherited by the surviving spouse or common-law partner, where certain exceptions are possible.The good news is no inheritance tax in Canada.3 Provincial Variations Specific to Ontario.One of your loved ones just passed away.

Inheritance Tax in Canada

The inheritance tax is a tax that is charged on the value of your estate when you die.

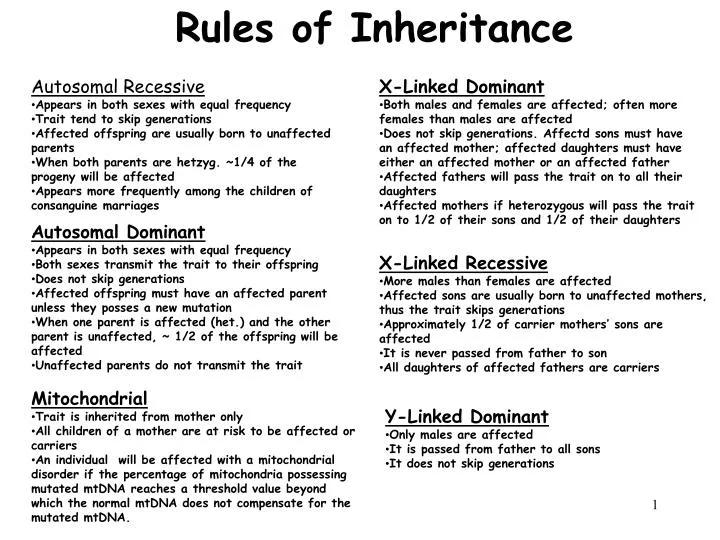

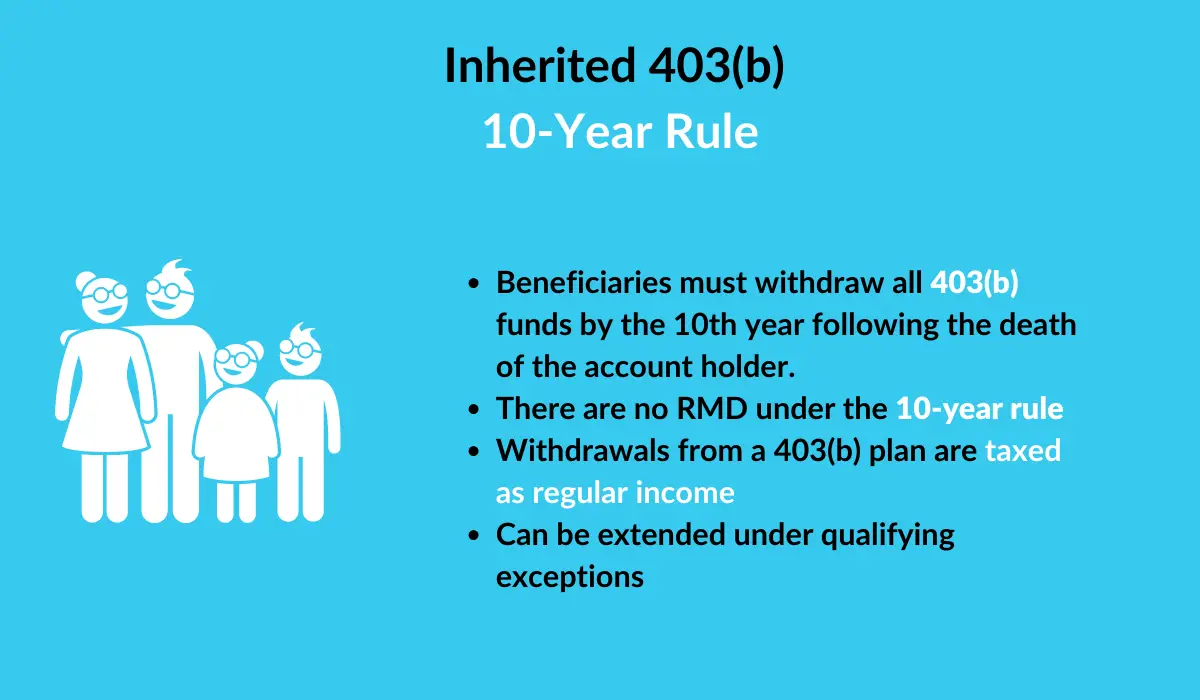

If you have no children . But receiving an inheritance in Canada isn’t so cut and dry. The tax implication of inheriting foreign real estate differs depending on whether or not you decide to keep this type of property. Similarly, if the gift is a trust resident in .If a non-resident beneficiary lives in a country that has an inheritance tax, the beneficiary might very well find themselves subject to tax on the inheritance that they get.What are the inheritance tax changes in 2018? The July 2018 report Born to Win: Wealth Concentration in Canada since 1999 from the Canadian Centre for Policy Alternatives addresses the disparity in wealth between Canada's wealthiest families and the rest of the population.Foreign Real Estate.This consolidated version of the Canada-France Income Tax Convention, as signed on May 2, 1975, and amended by the protocols signed on January 16, 1987, November 30, 1995, and on February 2, 2010, is provided for convenience of .Rules and Exceptions for Canadian Inheritance Tax on Property: To comprehend the capital gains tax rates associated with inheriting real estate in Canada, it’s essential to understand different scenarios: When you sell your primary residence, you are not required to pay taxes on capital gains, as it is considered a sale of your primary . Canadian inheritance law has seen a rapid evolution over the past two decades, leading to a change in estate planning strategies.Defining Probate in the Canadian Legal System.Irish inheritance rules.A living inheritance might be $200 every Christmas and birthday, amounting to $400 a year or $20,000 over 50 years.You’re one of the 60% of Canadians who expect to receive one.Estate Taxes in Canada.In Australia special capital gains tax (CGT) rules apply to the transfer of assets from the estate of a deceased person.Most countries have progressive tax rates, but around one third apply a flat rate, and tax rates also vary widely. This means that the estate pays the taxes owed to the government, rather than the .These rules are as follows: If you leave a spouse and children, your spouse is legally entitled to one-third of the succession, your children to two-thirds. In Canada, there is no inheritance tax. The transfer of the asset is considered to have occurred on the day the person died. This means that you would owe capital gains taxes on the $75,000 increase in capital.The Crackdown on Student Protesters.The regulations made under the Succession Law Reform Act were recently amended to increase the value of a surviving spouse's preferential share from $200,000 to $350,000 where a deceased died intestate on or after March 1, 2021.Tax rules for gifts and inheritances - FREE Legal Informationlegalline. The election allows you to ensure the income earned within the ROTH (interest, capital gains, dividends, etc) are deferred from taxation.No, Canada doesn’t have an inheritance tax. If the deceased has not made a will, the order of .Is inheritance taxable in Canada? There is no inheritance tax or death tax in Canada. Alternatively, you might provide financial support for your spouse’s education so they can advance in their career. For tax purposes, the inherited property has a cost base . If you were named in their will and about to receive some inheritance, you might wonder . In the United States, that number is closer to a staggering .Rules for Foreign Inheritance in Canada.

Learn strategy for inheritance tax planning in Canada. In fact, if the estate is small, there may be no probate and thus no executor, so this approach may in fact be required if you want to obtain your inheritance (unless you wish to start . In 2021, only about 5 per cent of . CGT applies to any CGT asset that changes ownership.September 12, 2021.14 lignesInheritance law in Ontario is governed by the Succession Law Reform Act . The Supreme Court Civil Rules dealing with probate and administration (probate rules) have been amended to . Receiving income of a deceased . Estate settlement is the process of collecting a decedent's assets, resolving debts, paying taxes, filing legal paperwork, and distributing remaining assets to the rightful recipients.Temps de Lecture Estimé: 4 min

Canada Inheritance Tax Laws & Information

Tax fairness is important for every generation, and it is particularly significant for younger Canadians.Clarifies obligations relating to property inheritance in the context of Nisga'a and Treaty First Nation lands, and; Lowers the minimum age at which a person can make a will from 19 to 16 years old ; Probate rules – 2014 amendments.Since there are no inheritance taxes in Canada, you are not required to pay anything to inherit real estate. Usually, this amount . This means that if you are a beneficiary and receive an inheritance from an .Generally, when you inherit property, the property's cost to you is equal to the deemed proceeds of disposition for the deceased person. Similarly, it could be passing down a family heirloom to your kids while you’re still alive.Assuming you’ll be receiving the ROTH before the end of the year you’ll want to ensure that you file the necessary ROTH IRA tax elections with CRA before the deadline of your 2021 Canadian income tax return.

Canada Inheritance Law: How it Works

If you have no children but are survived by your spouse and parents, two-thirds of the succession is legally the . It also means your loved ones will have to deal with a complicated and .

However, you may have tax obligations for the assets you inherit: capital gains tax may apply if you dispose of an asset inherited from a deceased estate; income tax applies as usual to any dividends or rental income from shares or property you inherited. Probate is the court-supervised process of estate settlement, and it is the probate court that appoints an executor (usually in . This means that you do not have to pay personal income tax on the money you receive from an inheritance. For example, under BC’s WESA, persons who are 16 years old and above can make a will.By Anna Alizadeh. In this article, we delve into the intricate world of inheritance law in the Great White North, shedding light on various aspects that are often enveloped in legal .There are no inheritance or estate taxes in Australia.caRecommandé pour vous en fonction de ce qui est populaire • Avis

Inheritance Tax in Canada: What You Need To Know

There is yet another treacherous detail .In Canada alone, the younger generation will inherit about $150 billion before 2026, found RBC Wealth Management.

However, the estate may be subject to capital gains . We can’t stress enough how important it is to make a will in Ireland relating to your Irish assets.The budget proposes to increase the capital gains inclusion rate from 1/2 to: 2/3 for dispositions after June 24, 2024 for corporations and trusts, and.

Property you inherit or receive as a gift

2024 Federal Budget analysis

According to Canadian regulatory frameworks, no tax is usually paid on the legacy itself if your client inherits a capital gift according to an inheritance.

Rules for Inheriting Foreign Property

Generally, in Canada, anyone who receives a gift or inheritance will not have to include this in their income.When you inherited it, it had a value of $125,000.While there is no inheritance tax in Canada, which means there are no inheritance tax rates or inheritance tax exemptions, there are quite a few situations . Although this tax appears draconian at first, the US Estate Tax exemption amount of $11.If the estate qualifies as small, you may be able to claim your inheritance directly from the current asset holder, following province-specific rules (in the decedent's home province). Probate, in the Canadian legal system, refers to the legal process of validating a deceased person’s will.

NON-RESIDENT BENEFICIARIES

If you choose not to or cannot pay this, the value will be taken from the deceased’s estate. But you need to know that once you want to occupy the .

Inheriting Real Estate in Canada: Your Ultimate Guide

Had this home been a primary residence, you would only owe tax on 50% of the capital gain. of sound mind or is mentally capable.Specific rules govern the distribution of the remainder of the succession.

Inheritance tax across Europe: How do the rules and rates vary?

This is not right. Without this you will be considered to have died intestate. The regular investment account can be transferred to you tax free. On average, Canadians will receive $100,000 or so in inheritance value, with British Columbians receiving the higher end and Maritime citizens receiving the lower end.

In essence, this becomes a form of double taxation.

Understanding Probate in Canada: Everything You Need to Know

Table of contents. “But that doesn’t mean that the deceased person’s estate is not taxed. However, if you are a Canadian tax-resident, the revenue on that heritage can be taxed on them.In Canada, an inheritance is when assets, property, or money are transferred from a deceased person to a beneficiary.You’ll also need to file a form T1135 to report your US assets on your Canadian return.4 million USD .If the 5-year rule applies, it means that only your French assets would be subject to French inheritance taxes, while cash, property, shares or other assets held in the US would be taxed there. Beneficiaries are often family members, but can also . If the estate does not pay the tax on the assets, then there are limited circumstances where the Canada Revenue Agency (CRA) may pursue the beneficiary of those assets for the tax owed,” says Swan. Want to know if you inherit and calculate your inheritance share? You have to distinguish 2 situations. This is, in addition, the tax that is levied against the deceased in Canada.The provincial wills and estates laws state that for the will to be valid, the testator must be: 18 years old and above; and. What is inheritance law in Canada? How do Canadian inheritance laws work? Is there an inheritance tax? Can the Canadian Government take your . Losing a loved one is never an easy situation. But this doesn’t mean your .

Receiving and inherited ROTH IRA in Canada

(844) 538-2937 or (416) .

Receiving an Inheritance in Canada: A Complete Guide

Plus, things get dicey if a deceased person doesn . The most common types of capital gains assets are property, shares and fund investments. You don’t have to pay taxes on money you inherit, and you don’t have to report it as income.Canada, in general, does not have a federal inheritance tax.caTax-free way to pass on an inheritance while still alivemoneysense. Columbia University is at the center of a growing showdown over the war in Gaza and the limits of free speech. It ensures the authenticity of the will and serves as an official recognition of the deceased person’s intentions for the disposition of their estate.

Irish inheritance laws

In an article entitled “Americans Living in Canada and Canadians with US Property: You Are Subject to US Estate Tax”, we presented the US Estate Tax regime as it applies to Americans living in Canada and Canadians owning US property.

Trem Global

2/3 for the portion of . If the deceased wrote a will: Through the will, the deceased was able to distribute his wealth but also choose his legatees, therefore modifying the order of the heirs, set by law.

How Inheritance Works in Canada

Updated: November 2, 2023.