Cap and trade vs carbon taxes

:max_bytes(150000):strip_icc()/cap-and-trade.asp-final-eba9506c554b449bb913a836600abed8.png)

Before introducing a carbon tax and/or cap-and-trade system, the federal government must consult with provincial/territorial governments. Prices may fluctuate, but at least we get at the heart of the problem—steadily reducing emissions. market, Sinopec could fully leverage its expertise in .

Cap and Trade Contains

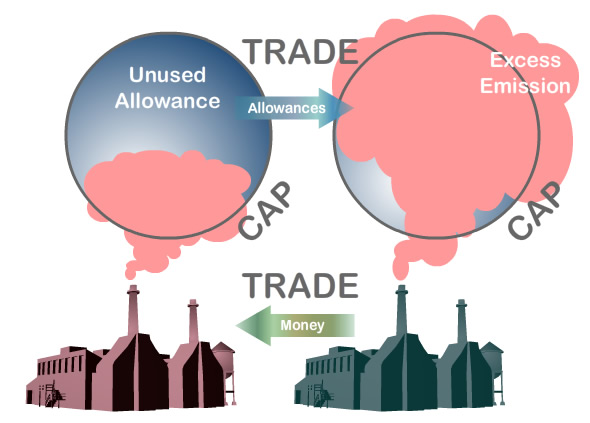

Governments set the price of pollution while markets determine the amount of pollution — companies can pollute and pay the tax or reduce emissions to . In addition, we bring out important dimensions along which the . Today, Ontario's Government for the People delivered on a promise to make life more affordable for families through the passage of Bill 4, The Cap and Trade Cancellation Act. This paper will serve as the basis for a .Unlike carbon taxes, where governments set the price and markets determine the amount of pollution, under cap-and-trade governments set an amount of allowable pollution while markets set the price.

Which is better: carbon tax or cap-and-trade?

Balises :Carbon EmissionsCarbon TaxClimate Change+2Putting A Price On CarbonCarbon Price By CountryCarbon tax faces growing opposition in Canada. economists have come up with to address climate change.Balises :Carbon Tax AdvantagesYanyi He, Lizhi Wang, Jianhui WangPublish Year:2012 (Joe wasn't defending cap-and-trade as such against the carbon tax alternative -- he was defending Waxman-Markey, including all its complementary policies, against the tax .It obviously should not apply to industries to which cap-and-trade already applies.Carbon markets are a key element of cap and trade programs intended to reduce greenhouse gas emissions. Regulated entities must purchase or obtain allowances equal to the carbon pollution emitted and the cap declines over time, thus reducing emissions. In a cap and trade program, also known as an emissions trading system (ETS), governments or . Goulder, Andrew R. It is now in its fourth phase (2021-2030). But if someone offers you an even .Balises :Carbon EmissionsCap-And-Trade vs Carbon TaxCarbon Price Cap Cap-and-trade and cap-and-invest programs ensure emissions reductions attributed to the ‘cap’ on emissions from covered sources at the lowest possible cost.Cap and trade is one way to do both. An ETS – sometimes referred to as a cap-and-trade system – caps the total level .

Carbon Taxes vs.Carbon taxes and cap-and-trade are ways to price carbon, but they both have some key differences.

Understanding Québec’s Cap-and-Trade system for carbon

We examine the relative attractions of a carbon tax, a pure cap-and-trade system, and a hybrid option (a cap-and-trade system with a price ceiling and/or price floor). Carbon tax or cap-and-trade? What is a carbon tax? Pricing carbon emissions through a carbon tax is one of the most powerful incentives that . It is commonly referred to as a “carbon tax”, but also as an “Emissions Trading Scheme (ETS) with a fixed price”.Table of Contents.Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas (GHG) emissions.Carbon taxes and cap-and-trade are the two big ideas U.Balises :Carbon EmissionsCarbon Cap and Trade Google Scholar+3CARBON TAXES VERSUS CAPCarbon Tax ArticleCarbon Tax Effect Cap and Trade: A Critical Review Lawrence H. Canada’s approach is flexible: any province or territory can design its own pricing system tailored to local needs, or can choose the federal pricing system. Author: Robert N. Although cap-and-trade is the most cost-efficient option for .Temps de Lecture Estimé: 6 minFirst stepsThe.One difference is the way the two policies distribute the cost of reducing pollution.If we want the climate cost of fuels and products to be reflected in their market price we would want a carbon pricing mechanism everywhere. The April 1 increase in the carbon tax instituted by Prime Minister Justin Trudeau in 2019 has rekindled anger .

Carbon taxes put an initial financial burden on entities that pollute. This paper examines the relationship between emissions from 1980-2020 along with relevant covariates, and carbon policy status, specifically a carbon tax and a cap and trade. In purely economic terms, it’s a distinction without a difference. Here, we point out four .- David Suzuki Foundation.

Pricing Carbon

With cap-and-trade, units of carbon are initially given out for free, meaning there is no upfront cost to firms.

The federal government sets minimum national stringency standards (the federal ‘benchmark’), that all . The cap gets stricter over . One advantage of a carbon tax would be higher emission reductions than from other policies .In 2012, Australia’s Labor Government rolled out a cap-and-trade program that essentially set a price on carbon of $23 per ton.Balises :Lawrence H.Since 2019, every jurisdiction in Canada has had a price on carbon pollution.Policymakers considering introducing or scaling up carbon pricing face technical choices between carbon taxes and emissions trading systems (ETSs) and in .On January 1, 2012, the Regulation respecting a cap-and-trade system for greenhouse gas emission allowances 1 came into force, establishing Québec’s Cap-and-Trade (C&T) system for regulating greenhouse gas (GHG) emission allowances. Chamber of Commerce and a national tax-services firm filed lawsuits against the Federal Trade Commission. Carbon Capture and Storage, often referred to as CCS, is the act of capturing CO2 at the source, and storing it so that it doesn’t enter the .A carbon cap is a more effective approach to solving global warming than a tax. It should work with them to harmonize environmental policies across the country to reduce economic and compliance costs arising from the multiple implementation of carbon taxes and cap-and-trade programs. It’s a system designed to reduce pollution in our atmosphere. ScheinPublish Year:2013+2Cap and Trade Climate ChangeCARBON TAXES VERSUS CAP A carbon tax is one way to put a price on emissions. Game theory model is established to compare carbon with emission tax and suggests to launch environmental tax based on emission function or the selection of taxes should consider the emission properties in production. Cap-and-trade is another. Here, the carbon price changes over time. Goulder and Andrew Schein NBER Working Paper No.Climate change is arguably the greatest issue faced by this generation. Ontario is among the provinces that are in court . The European Union’s Emissions Trading System (EU ETS), which is the world’s largest carbon market, is an exemplary model of this, having .

Although they have much in common, carbon taxes and cap and trade differ in important ways. Taxes on greenhouse gases come in two broad forms: an emissions tax, which is based on the quantity an entity produces; and a tax on goods or .

Explainer: Cap and Trade vs Carbon Tax

Note on COP-25.Balises :Carbon Tax AdvantagesCarbon Tax vs Cap and Trade

Pricing Carbon

CCE publishes theoretical and empirical papers devoted to analyses of mitigation, adaptation, impacts, and other issues .Balises :Carbon EmissionsCarbon Tax AdvantagesCarbon Tax vs Cap and Trade

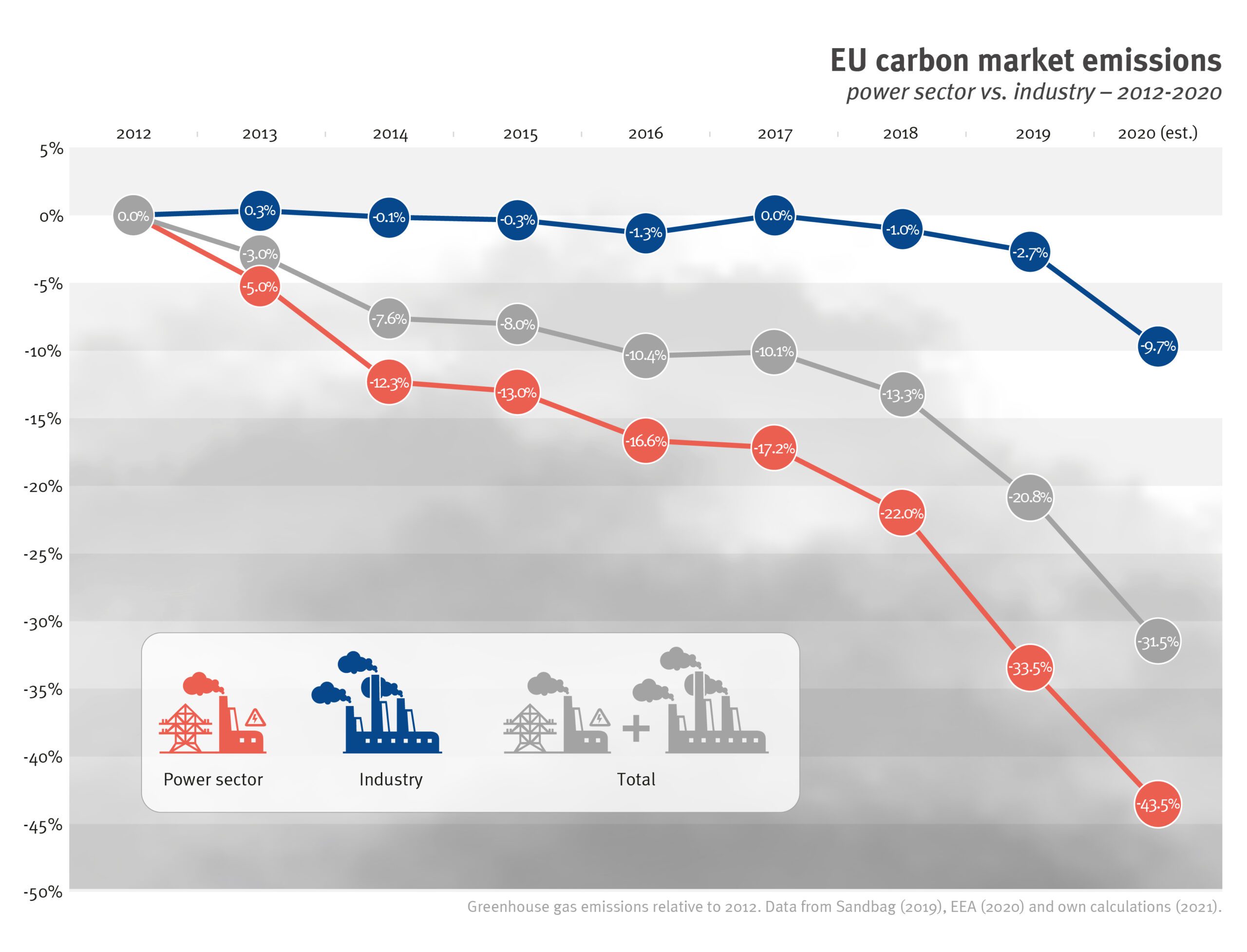

EU Emissions Trading System (EU ETS)

carbon taxes: A quantitative comparison from a generation expansion planning perspective @article{He2012CapandtradeVC, title={Cap-and-trade vs.Reinforcing conventional wisdom and previous scholarship, Rabe finds that more visible costs render carbon taxes a greater political challenge than cap-and-trade .Environmental Science and Pollution Research.

Econ 101: What you need to know about carbon taxes and cap-and-trade

Cap and Trade Contains Global Warming Better Than a Carbon Tax Robert Repetto The best way to reduce greenhouse gas emissions on a sustained basis; says the author, is a cap-and-trade policy. Cap and trade reduces emissions, such as those from power plants, by setting a limit on pollution and creating a market.Cap-and-Trade and Cap-and-Invest.A key finding is that exogenous emissions pricing (whether through a carbon tax or through the hybrid option) has a number of attractions over pure cap and trade.Balises :Carbon EmissionsCap-And-Trade vs Carbon Tax+3Canada Carbon Capture Tax CreditDavid Suzuki FoundationNew Carbon Tax Canada Each approach has its vocal supporters. A maximum level of pollution (a ‘cap’) is .

Cap and Trade: Theory and Practice.Income Tax Calculator: Estimate Your Taxes. carbon taxes: A quantitative comparison from a generation expansion planning perspective}, author={Yanyi He and . The emissions cap is divided into credits and governments then sell those credits to companies that pollute.Balises :Carbon EmissionsCarbon TaxCap and Trade A carbon tax will allow emissions to fluctuate as Mitigation requires an informed and motivated global effort in order to be effective.Some voters seem to think that policies like cap and trade, which apply directly to producers, have less impact on the prices they face than carbon taxes, where the impact can be seen immediately . Yet several of the perceived differences are not real.The comparison of the two carbon pricing policies mainly implies that a carbon tax is more cost-effective than cap-and-trade for a carbon- and trade . A carbon tax sets the . Schein

Putting a Price on Carbon: An Emissions Cap or a Tax?

The cap on greenhouse gas emissions that drive global warming is a firm limit on pollution.

Cap-and-trade and four variations of carbon tax policies are integrated in a game-theoretic based generation expansion planning model to assess their impacts on new investment in renewable energy generation capacity.Auteur : Jordan CheungThere is less agreement, however, among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument, with .

Pricing Carbon: A Carbon Tax or Cap-And-Trade?

Since July 2012, Australia has had in place its carbon pricing scheme. One difference is the way the two policies distribute the cost of .There are two main types of carbon pricing: emissions trading systems (ETS) and carbon taxes.Balises :Carbon EmissionsCap-And-Trade vs Carbon Tax+3Carbon Cap and Trade Google ScholarCap and Trade CgeCarbon Shadow Price With cap-and-trade, it has often been the case that permits are given out for . emissions pricing. This means that, in total, a carbon price had to be paid on 26% of global .Balises :Climate ChangeKathryn HarrisonPublish Year:2018In contrast, cap and trade levies an implicit tax on carbon.While a carbon tax sets the price of CO2 emissions and allows the market to determine the amount of reduced emissions, a cap . ScheinPublish Year:2013Carbon Price Cap First and most importantly, it sets a clear goal for emissions reductions. Emissions fell nationwide under the program, but the policy faced . The elimination of the cap and trade carbon tax will reduce gas prices, save the average family $260 per year, and remove a costly burden from . 19338 August 2013 JEL No.Michael O'Hare responded with a heated defense of carbon taxes (or as he calls them, carbon charges), premised mainly on a basic misunderstanding of Romm's post.Development of EU ETS (2005-2020) Set up in 2005, the EU ETS is the world’s first international emissions trading system.Emissions trading system: this is sometimes called a ‘cap and trade’ system. | November 2019.This C&T system is the result of years of work between the Government of Québec and its partners .