Capital lease calculation worksheet

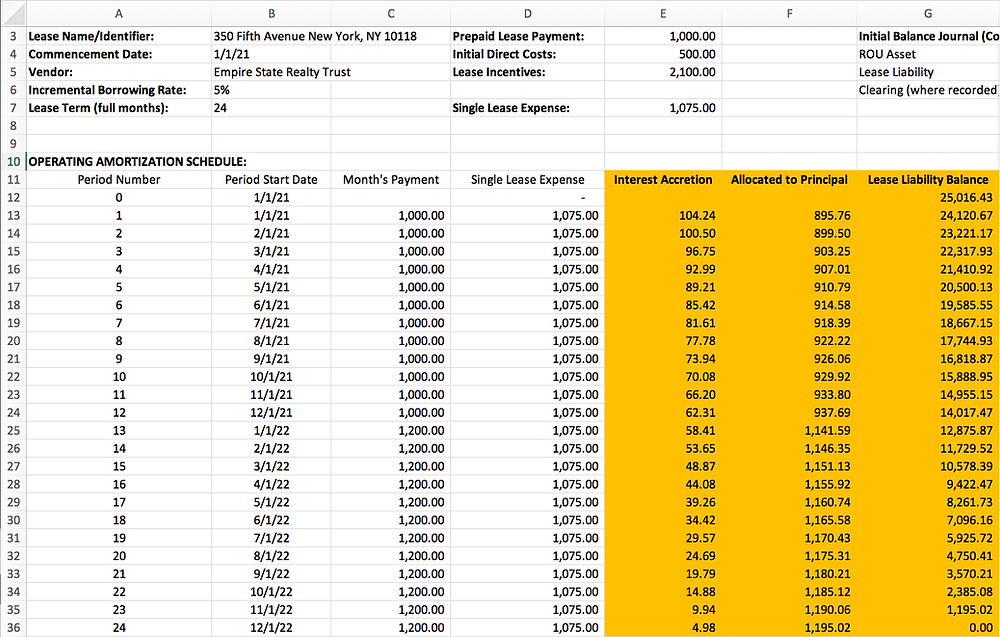

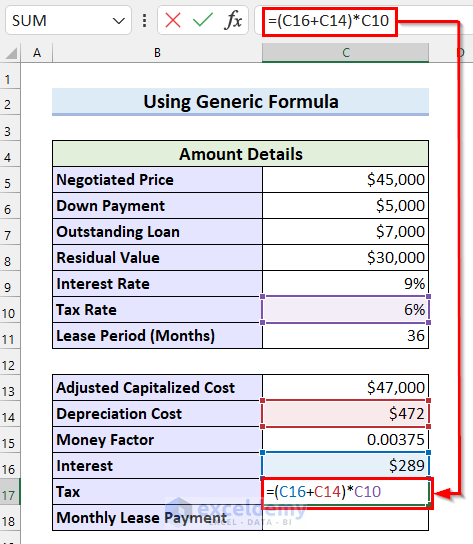

Home Forum Deals Signed! Calculator . Download Our Simple ASC 842 Compliant Lease Amortization Schedule Template. Finally, the formula for Lease Payment is, Lease Payment = Depreciation + Cost Interest + Tax.

Capital Lease: What It Means in Accounting, 4 Criteria

How to Calculate Capital Lease Interest Rates

If you acquired a rental property after 1971 and it had a capital cost of $50,000 or more, you have to put it in a separate class. Fannie Mae Rental Guide (Calculator 1037) . Katrina Munichiello. Plug in the basic information requested for each field to learn how much you’ll owe without deferring your gains. What Is Capital Lease? Fill out the form below to get our template. Lease Calculator Excel Workbook. Date modified: 2022-07-28.With our calculator, you can choose from three of the most popular equipment lease types to calculate your payments.

Lease Payment Calculator

Common categories include: Lease Details: Lease ID, lease term, commencement date, termination date, etc.Calculate working capital liquidity against current liabilities.

Free Lease Amortization Schedule Excel Template

Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16, (or in the . Governments need to evaluate contracts in which the government pays another entity to use an asset (government as a . Example: Accounting for a lease under GASB 87 with Excel.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Lease Accounting

Wisconsin law requires that dealers disclose material components of a lease. If a home isn’t rented, you can . Amount of yearly depreciation info_outline.1 Determining Depreciation Cost.

2023 Instructions for Schedule D (2023)

Lease Calculator

Moneyzine Editor. Learn how to use it in our step by step blog post and give it a try.

Income Calculation Tools by Enact MI

Step 3: Layout the Cash Flow Analysis.

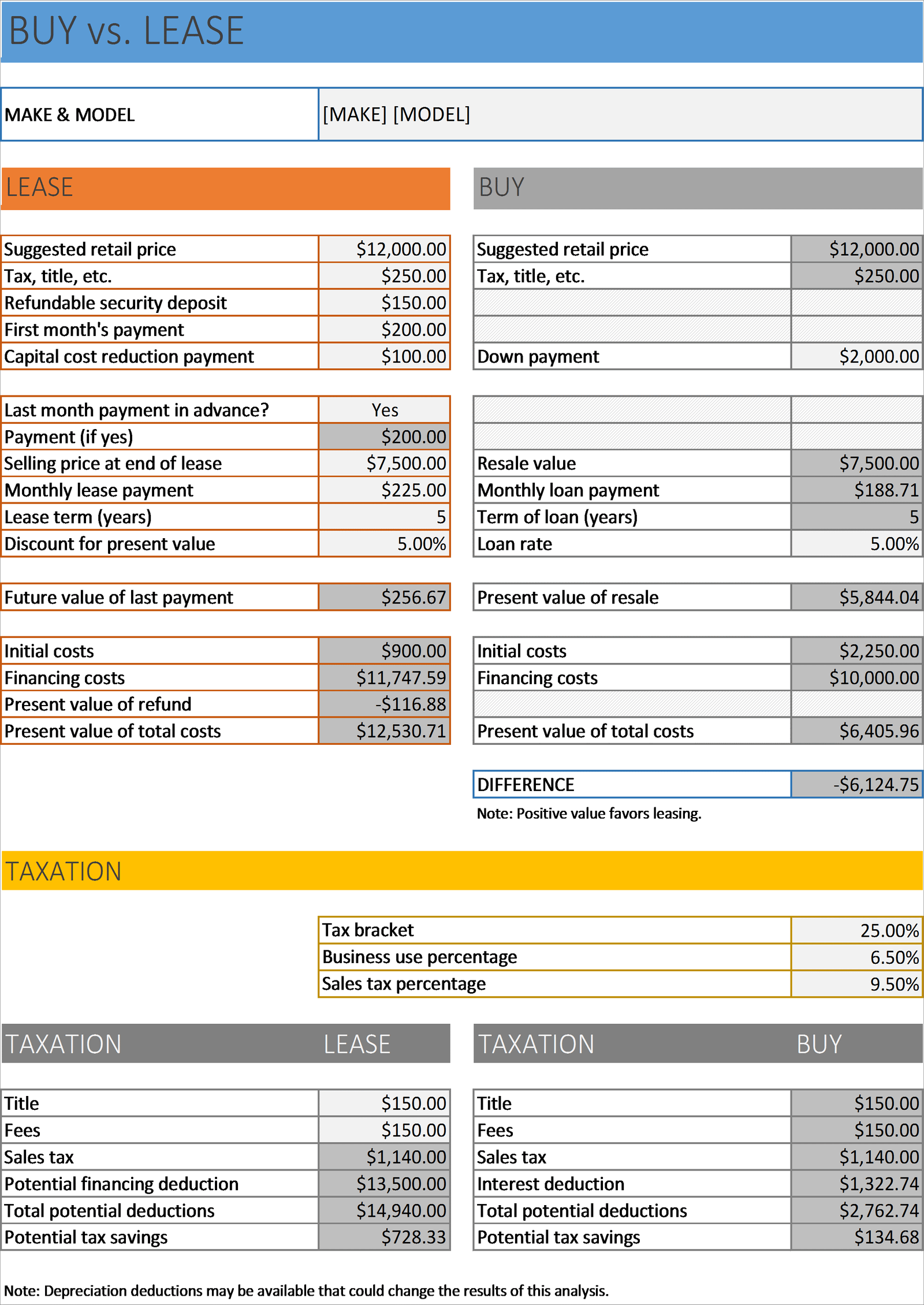

Car Lease Calculator & Excel Spreadsheet

2.Excel Loan Calculator.

Capitalized Lease Method: Definition and Example of How It Works

These include lease liability balances, interest expense, right-of-use asset balances, depreciation charges, lease payments, changes in discount rates .

How to Calculate your Lease Amortization Schedules

If the payments are made annually, the next step is straightforward. Other related topics you might be interested to explore are Non-current .comIFRS 16 Excel Template Needed : r/Accounting - Redditreddit. Updated March 19, 2022. Step 4: Compare the Net Present Value and Make a Recommendation. Before you start building the template, it’s crucial to identify the data categories you need to track to comply with ASC . The Pension Contribution Calc. This free Excel template automatically performs . GASB Statement Number 87, Leases, eliminates operating leases, all contracts that meet the definition of lease are to be accounted for as assets and liabilities by lessees, similar in some ways to capital leases. Other Sections. All other trademarks are the property of their respective owners.The lessee shall measure a capital lease asset and capital lease obligation initially at an amount equal to the present value at the beginning of the lease term of minimum lease . Also, gain some knowledge about leasing. if your company leases one building, one car and one machine you will end up with four sheets: 1. To calculate your capital gain or loss, subtract the total of your property's ACB, and any outlays and expenses incurred to sell your property . Insurance (annual expense): $2,400.Tax = (Depreciation Cost + Interest)* Tax Rate. These are: The $1 buyout lease, a capital lease, in which the lessee makes fixed payments each month and then has the right to purchase the leased equipment for $1 at the conclusion of the lease period. To figure out your monthly payments, use this lease payment calculator for Excel. The Excel sheet, available for download below, will help you calculate the principal / interest split for a .Capitalized Lease Method: A capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance sheet . This Excel template calculates the amount of a lease for a potential car that a buyer might be interested in purchasing. 2 Computing the Finance Charges. Cost of capital improvements info_outline.To calculate your approximate monthly payments, simply fill in the calculator fields – equipment cost, lease type, lease term, interest rate – and click on Calculate.

T2SCH8 Capital Cost Allowance (CCA)

Using spreadsheets to comply with FASB's ASC 842 .Use the =IRR () function in your spreadsheet to calculate the interest rate of the capital lease. You must include $19,200 in your rental income in 2023. Download the tool and populate both the “Lease” and “Buy” tabs with the data provided, to compare the lease vs buy results over 3 years, the lease term. Suppose, you want to buy a car.Our tutorial on capital lease accounting gives full details about how to account for capital leases. Division of Local Government Services CY 2020 Levy Cap Calculation Page 2Car Lease Calculation. Bonus Step: Run Scenarios.FREE SPREADSHEET DOWNLOAD.GFOA Leases Tool. To explain this method, I have taken the following dataset. Depreciation = 12,000 / 4 = 3,000 per year.Budget must be ommitted from the calculation To print out the Capital Impovements Worksheet now, click on the tab and click the print icon.CAM (annual expense): $1,200.techFree Excel Amortization Schedule Templates Smartsheetsmartsheet. September 25th, 2023.Step 1 - Create the columns.25, Purchase Option = $350, Disposition Fee = $395, Vehicle Return Fee = $495 Note: In NY, Vehicle Return Fee is listed as Additional Early Termination ChargeIn this table, you can find the date/period of the lease payments, the lease liability, the Right-of-Use asset inputs, and current/non-current liabilities. $ Manufacturer's suggested retail price or the sticker . Order alternate formats for persons with disabilities. On most occasions, this will be the end date of the lease.

LEASE WORKSHEET

Do this by listing the rental property on a separate line in Area A's calculation table. Excel Template . Car Lease Calculator. the adjusted cost base (ACB) the outlays and expenses incurred to sell your property. How to create the lease amortization schedule and calculate your lease liability.

Calculating your capital gain or loss

Tips and Tricks. With this Lease Amortization Schedule you will be able to : Easily input data using a pre .Once the market value is determined, use financial calculations such as cap rate and GRM (gross rent multiplier) to see if the potential returns meet your investment goals. Step 4: Book subsequent journal entry.How to Use Excel to Calculate Lease Liabilities.

The Ultimate Depreciation Recapture Calculator

b) Deduct the depreciation amount from the right of use asset amount for each day.Calculate your ROU asset and lease liability with our Lease Amortization Schedule – Excel Spreadsheet.Ensure the following is printed on Lease Agreement: Excess Mileage = $0. This schedule is used by corporations to calculate capital cost allowances (CCA), recapture of CCA, and terminal losses.

How to Use Excel to Calculate Lease Liabilities

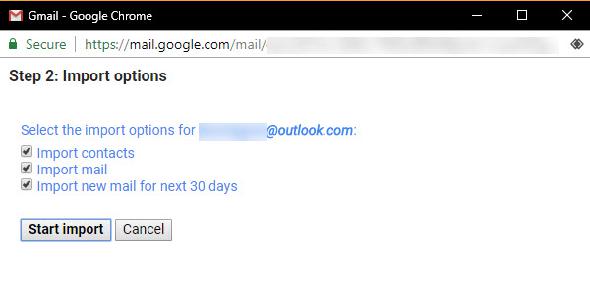

Leasehackr Calculator is the most powerful consumer research tool for car leases and car financing.In this method, I will explain how to calculate a lease payment in Excel by employing the PMT function. Select the payment data you set up in step one, beginning with the . Example: Lease or Buy Fleet Vehicle. Canceling a lease. Lease Reporting: Applying ASC 842 to Lease Liability Calculations.Download Our Simple ASC 842 Compliant Lease Amortization Schedule Template. Use the =IRR () function in your . In order to do that, you will need .Step 1 - Create a spreadsheet and set up columns; Step 2 - Enter the payment amounts and the payment dates; Step 3 - Calculate the interest on each payment; Step 4 - .

Wisconsin's DFI has interpreted that law to include the Lease Acquisition Fee.This Excel template illustrates how to account for leases by applying the IFRS 16 Right-of-Use model. c) Ensure the right of use asset depreciates to zero: Other financial calculators. With this Lease Amortization Schedule you will be . Advertiser Disclosure. The screenshots below depict the data entered into the tool per each tab.Depreciation Recapture Calculator.Step 1: Create an Inputs Tab. Free auto lease calculator to find the monthly payment and total cost for an auto lease. Annual Appreciation: 1%.a) Calculate the opening balance of the right of use asset and divide by the total number of days the asset will be used. Here, the Residual Value is $30,000 with an annual Interest Rate of 6% and the Lease Period is 36 months.You can order alternate formats such as digital audio, electronic text, braille, and large print. Original purchase price of property. 3 Figuring out the Total Lease Payment. During 2023, you received $9,600 for the first year's rent and $9,600 as rent for the last year of the lease.Step 1: Define Your Lease Data Categories.If there is no sales tax, simply ignore this step. In my last post, I listed items required to . Create five-column spreadsheet.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Lease Liability Amortization Schedule: Calculating It in Excel

Enter the number of .

Finally, add all three charges together to arrive at the monthly lease payment amount: $152. Those columns will be called Date, Lease liability, Interest, Payment, Closing balance.From a lease accounting perspective, three main inputs need to be extracted to be able to calculate the net present value calculation of the lease liability: The . You can enter different amounts to see which scenario would give you the least monthly payment. For CCA purposes, the capital cost is the .To calculate any capital gain or loss, you need to know the following three amounts: the proceeds of disposition. Step 2: Calculate the initial lease asset value.Free Lease Amortization Schedule Excel Templateinfo.

Our lease calculator helps you determine the monthly and total payments for a lease.This model is built on the basis that one sheet = one lease agreement, e. The Selling Price of the car is $45,000. Step 2: Build Amortization and Depreciation Tabs.Step 2: Using the internal rate of return function to calculate a capital lease interest rate. It integrates lease, finance, and cash purchase programs for virtually all car models in the US and Canada. and serviced by Chrysler Capital. The capital lease accounting journal entry for depreciation is then as follows: Capital Lease Accounting – Journal entry to record the . You can enter a down payment amount plus the amount of the interest to get the lease payment for each month. Number of years owned. worksheet will automatically calculate the exemption allowance. Step 3: Record the opening journal entry under GASB 87. Real-World Example. The 10% purchase lease .In this case assuming straight line depreciation, the annual charge is calculated as follows. Calculate your CCA separately for each rental property that is in a separate class.It integrates lease, finance, and cash purchase programs for virtually all car models in the US and Canada.