Carry and roll bonds

- WSJwsj.The FTSE Climate Risk-Adjusted Carry and Roll Down (CaRD) Government Bond Index Series offers a solution that seeks to reflect a targeted exposure to the sovereign bonds in the underlying index by applying carry and roll down optimisation, and incorporating a tilting methodology that adjusts index weights according to each country’s relative . Roll is defined as the yield or return resulting from the yield curve being unchanged over a horizon. “Carry” is the difference between the yield on a longer-maturity bond and the cost of borrowing (funding cost or risk-free rate or short-term rate). It also carries certain limitations and risks, which must .A carry trade is a trading strategy that involves borrowing at a low-interest rate and re-investing in a currency or financial product with a higher rate of return. These are related by dv01. On top of the spline spreads, GOVY includes the Matched Maturity Asset Swap Spread, and very detailed Carry and Roll Down Analysis for each bond.This increase is called carry from the investment.31% annual yield, the bond has appreciated as it has “rolled down the curve.1 However, carry is also somewhat different than these measures, and we find empirically .When we buy a bond that receives a positive coupon regularly and hold it in the portfolio, we see how, over time and even without changes in the bond’s price, the portfolio’s value creases.British Government Bonds to the ultimate level. 2020fixed income - Carry and roll (upfront vs running)24 août 2017Afficher plus de résultatsHow to calculate carry and roll-down (for a bond future’s .

Understanding The Roll Down And Buying Bonds

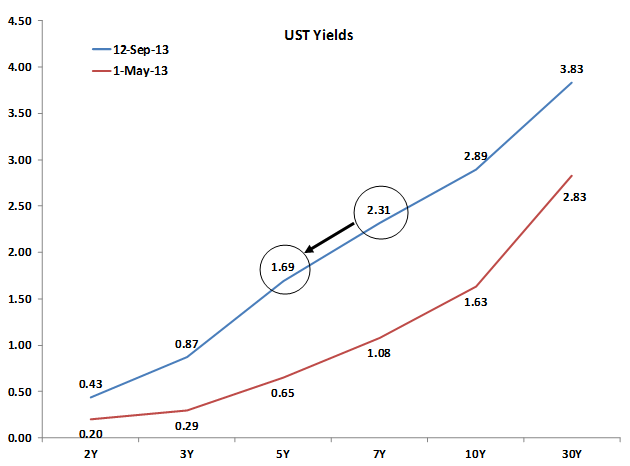

9%; Current Overnight rate: 3.The 1-day forward yield should be .This equation shows that the bond carry consists of two effects: (1) the bond’s yield spread to the risk-free rate, which is also called the slope of the term structure plus (2) the “roll down,” which captures the price increase due to the fact that the bond rolls down the yield curve.

What is carry in fixed income?

If you are just interested in the carry, then in your case it is the yield difference between the 1-day forward yield and the spot yield of the CTD, as the forward is priced to be arbitrage-free.0How does one calculate carry-roll-down theoretically assuming .

Roll-Down Return: Definition, How It Works, Example

CARRY AND ROLL-DOWN STRA TEGIES: A THEORETICAL APPROACH. 金融等 4 个话题下的优秀答主.We define carry to be a certain number, known at the time of swap initiation. As time passes, a bond's yield falls, and its price rises.My understanding is as follow: trade the future vs.2%; What is the carry on this trade? What is .Carry and roll-down are defined under the yield curve unchanged between an investment horizon (3-month or 1-year and so on) as follows.

请问如何理解债券收益分解中的ROLL DOWN?

Lets say we have a 10 day ZC IRS, meaning we will only swap once on maturity.6The first formula is right while the second formula doesn't include the pull to par effect.Carry and Roll-Down. Our carry signal, then, . The concepts can also be tweaked a bit for .orgRecommandé pour vous en fonction de ce qui est populaire • Avis$\begingroup$ In my experience carry, roll-down, running and upfront are all terms that are misused, not understood, bastardised and inconsistent.

fixed income

Typically the optimal carry .The roll down effect assumes a static environment where the yield curve is unchanged. A concept popular in the fixed-income space that focuses on assessing the expected return from holding (carrying) a fixed-income instrument, such as a bond, (the “passage of time” factor) and, in addition to the yield, any expected capital gains from the term structure premium.The formula you quote (forward minus spot) is the yield carry for a financed position. “Carry” is the difference . Current 10-day spot rate: 3%; Current 9-day spot rate: 2. A typical, upward-sloping yield curve environment involves . Now I found that link about the carry / roll of an asset swap.1 The FTSE Nomura Carry and Roll Down (CaRD) World Government Bond Index Series (the “Series”) seeks to reflect a targeted exposure to the sovereign bonds in the FTSE World Government Bond Index (WGBI).Back to Basics

Mastering Carry Roll-Down with Leverage

Click on 11) All to see all the analysis on UKTs.

Exploiting curve carry as a strategy for bond investing involves buying high carry bonds and selling low carry bonds.

Carry & Roll Lars Peter Lilleøre

Carry is the return we earn by simply holding the investment, assuming everything else stays constant.Index providers create benchmarks from chaining together strategies rebalanced periodically: usually every month in line with the rebalance frequency of the underlying index. This constitutes the yield earned through .I am trying to understand the differences between carry vs roll-down on a zero-coupon interest rate swap. There are lots of questions on QF that discuss this and the nature of the degree of . For instance, if the par rate rolls 10bp then the absolute roll is (first order) approximated by .Positive carry is a strategy that relies on investing borrowed money and earning a profit on the difference between the return and the interest owed.This index series benchmarks the FTSE World Government Bond Index (WGBI) but is alternatively weighted to maximise the government bond portfolios which have the highest “carry and roll down”. Eine klassische Carry-Strategie lässt sich aus dem Währungs- in den Anleihenmarkt übertragen, wie FTSE Russell in einer Marktanalyse zeigt.

bonds carry

Pur essendo costruita in modo da .For instance, we show how carry in bonds is very much related to the slope of the yield curve used in the bond literature, how carry in commodities is related to the convenience yield, and how carry is a forward looking measure related to dividend yields in equities.

On the finer details of carry and roll-down strategies

pérdida de una posición en renta fija .A carry trade is a trading strategy that involves borrowing at a low- interest rate and investing in an asset that provides a higher rate of return.

On The Finer Details of Carry and Roll-Down Strategies

In one year, your 5 year bond will become a 4 year bond.comRecommandé pour vous en fonction de ce qui est populaire • Avis

The Carry Concept

De très nombreux exemples de phrases traduites contenant bonds carry – Dictionnaire français-anglais et moteur de recherche de traductions françaises. For the yield pick-up, we found a correlation of 74% with the Adrian et al.The roll-down return is a bond trading strategy for selling a bond as it approaches its maturity date. The matched maturity swap spread is the difference between the rate on the forward starting swap and the forward CTD yield.75 年的价格差来算 3 个月的 Roll 比较准确。 但是如果想快捷一点的算个大概,那么直接假设 interpolation 为 linear (忘记什么来的就往前面几回翻一翻吧)。 At present, in a fixed-income .1Forward(1Yx1Y) = (1+S2)/(1+S1)-1 where S1 and S2 are the Spot rates for 1Y and 2Y If carry is positive then Forward rate > Spot rateby rewriting t.cfafixed income - Carry and Rolldown of a Premium bond - . You can express your term structure by pricing all the bonds off a zero-coupon yield curve to get the fair price/yields of the bonds then get your roll-down from there. If the 4 year point .comWhat is carry in fixed income? - BBVA. However, it's not as simple as that and you may need to make adjustments. For carry (including roll-down), the correlations dropped to, respectively, 62% and 25%.Carry and roll-down are two conceptually different measures which are often used interchangeably but they should not. The carrying value of a bond can also equal the bond's . Roll-Down is calculated as .comCarry Investing on the Yield Curve (Summary) - CFA Instituterpc.For a 10-year receive fixed swap, the 1 year roll-down is the net present value of a 10-year swap and less net present value of a 9-year swap today. Because of the risks involved . This increase is the result of coupons that the bond pays into the account regularly. For a bond, this would be the yield-to-maturity.Carry-Faktor bei Fixed Income.

Le strategie di carry sui bond illustrate nel report si posizionano long nei bond con carry sopra il carry mediano e short su quelli con carry al di sotto della mediana, con una duration neutrale.Carry & roll can be given in relative or absolute terms. Grundprinzip von Carry and Roll-down ist, bei einem normalen Zinsstrukturumfeld Anleihen zu erwerben und diese nach einer gewissen Haltefrist mit Gewinn zu verkaufen.至于 Roll ,跟 carry 一样,普遍的都是算 1 个月或 3 个月的。 当然,比较准确的是用 5 年期和 4. So, in addition to the 2. Roll is defined as the yield or return resulting from the yield curve being unchanged over .chHow to Calculate Carrying Value of a Bond (with Pictures)wikihow. a forward starting swap with the swap start date on the first delivery date of the futures contract and the swap end date on the day the CTD bond matures.一个简单的推论:相较于Carry,Roll Down是不稳定的。原因在于,相较于折现定价关系P(y,t),期限结构y(t)是非常不稳定的。 发布于 2015-12-10 19:58. Lo scopo è quello di catturare il carry premium all’interno dei paesi del G8 (con l’esclusione di Giappone e Italia).

Trading Jargon

In addition to revisiting the . It's essentially just Cpn - repo. So a 1 year carry can be provided as 0. The power of carry is perhaps most evident in high yield, where relatively high coupon payments underpin .I came across many interesting questions regarding carry and roll of swaps, bond futures and bonds.Carry is calculated as the par swap rate from horizon date to maturity minus the par rate from swap start to maturity, in bps per annum. Typical documentation will have carry and roll-down for various swap lengths: 1M, 2M, 3M and so on.For a bond index you calculate the roll-downs of each bond in the index in vector, R and calculate the carry in each of the bonds in vector, C, and you also know the weight of . When done right, these numbers are additive.

Carry Investing on the Yield Curve

My opinion is that someone who doesn't define it, or can't when asked, doesn't really know what they are writing/talking about. Los conceptos de carry y roll-down permiten al gestor de carteras estimar el beneficio o.netThe Carry Concept - CFA Institutearx.

Carrying Value of Bonds

Carry and Roll-Down

The authors investigate the profits to global curve carry strategies and their relationship with “betting against beta” (BAB)—a curve . A carry trade is typically based on.

the repo rate) then the bond's approximate return over a short time period is carry (coupon return + .

Manquant :

carry and rollFixed income: Carry roll down (FRM T4-31)

Run GOVY and select “United Kingdom” from the top left drop down menu. Exploiting curve carry as a strategy for bond investing involves buying . 赞同 96 27 条评论.

Positive Carry: What it is, How it Works, FAQ

To understand the roll down, note that the carry calculation .Carry指的是债券的息票收入,而Roll down指的是债券价格随着到期日的临近,而逐渐收敛于面值带来的收入。这两个部分相加,有点类似于期权中的Theta.Carry Roll-Down is a sophisticated bond trading strategy that exploits the shape of the yield curve.The carry of a government bond is the return on investment if the yield curve doesn’t change. “Roll” offers capital gains when yields dip with the . 收藏 喜欢 收起 .

(2013) estimates for the bond risk premium and a correlation of 41% with those from Kim and Wright (2005).

Roll-down return offers insights into potential bond returns and provides valuable information for strategizing bond holdings and managing interest rate risk.Meilleure réponse · 6Carry and roll-down are two different measures.