Cashless payments south korea

Leading payment methods when online.Speaking of cashless payments, GCash, a cross-border payment, announced on October 19, 2022, that they are now accepted in Asia's top travel destinations, including South Korea, Japan, Singapore, and Malaysia. The users found it suitable and easy to use instant payment methods during online shopping for immediacy and better checkout solutions . −8% to −1%.In the second quarter of 2022, around 40. YoY growth in payment transactions . TOKYO -- Cashless payments have grown to account for more than one-third of all consumption in Japan, fueled by the demand for touchless purchasing options during .Critiques : 976 If you are a resident and have a Korean bank account, you’ll have zero issues being cashless in Korea. Support is included for taxi payments, duty .Critiques : 975

3 apps in South Korea transforming the digital payments industry

South Korea was crowned as the cashless champion of Asia by GlobalData payments analyst Vlad Totia, with e-commerce spending making up roughly 6% of the country’s GDP and each card . These include users of Alipay, AlipayHK (Hong Kong SAR China), MPay (Macau SAR, China), .

Mobile payments in South Korea

Moving Towards a Cashless Society in South Korea

Almost every cafe, restaurant, shopping mall, and department store has free Wi-Fi advertised and available.The Bank of Korea's (BOK) latest triannual report on the use of paper currency from 2021 shows that only 21.

Globally, cashless payments are expected to grow by 80% between 2020 and 2025, and triple by 2030. This statistic illustrates the ownership rate of cashless payment instruments in South Korea as of November 2017. Credit cards are used for 72% of all Internet transactions in South Korea.7 percent of total payments in South Korea were made non-face-to-face, slightly down from about 41 percent in the . 10–50 basis-point cuts in rates across Asia, depressing liquidity revenues. The country wants to go coinless by 2020.SEOUL-- ( BUSINESS WIRE )--Leading mobile payment providers across Asia announced today an integration of Alipay+ cross-border digital payment solutions in .

The Cashless Wave: Riding South Korea’s Payment Revolution

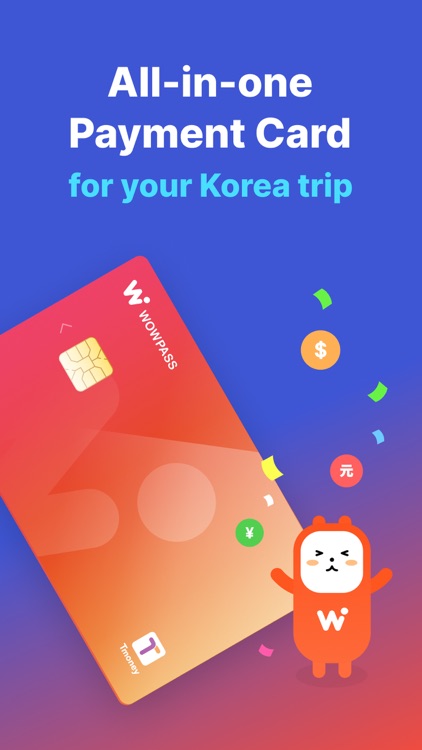

Alipay+ has partnered with multiple Asian payment providers in a bid to promote travel and tourism activity in South Korea.South Korea was crowned as the cashless champion of Asia by GlobalData payments analyst Vlad Totia, with e-commerce spending making up roughly . However, there are still advantages to using cash in certain situations, such as when small vendors or street markets only accept cash payments. You’ll find Wi-Fi in metro stations and onboard trains and buses, and get cell service everywhere, even underground or in long road and rail tunnels.According to a survey in South Korea in 2020, KakaoPay was the most popular mobile payment service among Millennials and Gen Z in South Korea with 51. It has actively promoted a cashless society, recognizing the economic benefits of reduced cash handling costs and enhanced transparency. Incentives such as tax benefits for businesses accepting .The Bank of Korea is planning a cashless society by 2020. The number of people who have . Leading mobile payment providers across Asia announced today an . With WOWPASS card, you can pay anywhere in Korea just like a local debit card, and use it as a Tmoney card to .

South Korea already has most of the infrastructure in place nationwide to go cashless.

Chinese financial technology giant Ant Group is ramping up cashless travel in South Korea through its Alipay+ .Published by L.South Korea is a well-developed payments market, with consumers preferring cashless payment.Alipay+ Partners with Leading Asian E-Wallets to Promote Cashless Travel in South Korea. Through the partnership, e-wallet users of AlipayHK, GCash, Touch ‘n Go and TrueMoney are now able to pay at over 120,000 merchants when travelling to the country. Leading providers. Users of e-wallets including AlipayHK, GCash (the Philippines), Touch ‘n Go eWallet (Malaysia), and TrueMoney (Thailand) are . If a shopper buys a 9,500 won item and pays with a 10,000 won banknote, for instance, the shopper will be credited 500 won to his or her . Safer, easier, cheaper than credit cards or currency exchange! Bestseller. This trend is largely driven by the convenience, security, and speed .Contactless payments due to COVID have ramped up this movement toward a cashless society.Cashless payment trends in Australia. 10–30% expected decline in global trade in 2020. As the country goes cashless, digital and mobile .

South Korea: share of non-face-to-face payments by quarter 2022

(976 reviews) 40K+ booked.

The new digital payment service allows users of six digital payment apps to travel and shop cashless across the country. Yoon , Jan 22, 2024.

Cashless Payments

Decline of 10–15%, excluding Mainland China.WOWPASS: Prepaid Card for Cashless Payment in Korea.

How Cashless Payments Help Economies Grow

In 2022, the value of credit card transactions in South Korea reached 988 trillion South Korean won, an increase from 886 trillion in 2021.Online shopping is the norm, as are mobile payments for the country’s tech-savvy millennials. South Korea is currently more cashless than China, however, there are far fewer people. Since Korea is largely a credit card-based society, cash is no longer accepted at many stores. It is important to carry both forms of payment and use them safely and . 50–70% decline in Q2 2020 discretionary consumer spending. This growth is fastest in the Asia-Pacific region, with an expected 109% .Ant Group said the partnership between Alipay+ and ZeroPay, facilitated by South Korean cross-border payments company ICB, was expected to enable 1.South Korea's penchant for cashless payment is confirmed in another survey.

Koreans increasingly embrace cashless society

According to research, only 14% of payments in South Korea involve cash. For one of the most wired nations in the world where electronic payments are already commonplace, it is . For one of the most wired nations .27 billion by 2025. However, older .

South Korea to kill the coin in path towards ‘cashless society’

This shows that even though . Leading mobile payment providers across Asia has announced an integration of Alipay+ cross-border digital payment solutions in South Korea in an effort to . More and more South Koreans are starting to rely on credit cards and various digital payment tools.Temps de Lecture Estimé: 9 minSouth Korea has typically been seen as the cashless champion of Asia.

The market is highly .

Cashless payments in Japan top one-third of spending

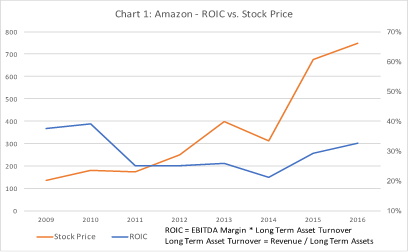

According to Statista, the rising digital payment transaction values show that cashless payment is becoming increasingly widespread in South Korea.

Alipay+ Brings Major Payment Providers To South Korea

It was reported that roughly 6% of .7 million merchants across South Korea.The e-commerce market witnessed significant growth due to the COVID-19 pandemic in South Korea, leading to wider acceptance of online and cashless payments, such as digital wallets and real-time payments.

3 brand power index (BPI) points.6 percent of payments made nationwide is done by cash. Various cashless payment methods are competing for the top spot in South Korea’s market, each with its unique features .According to the Bank of Korea, South Koreans had an average 78,000 won in cash in their pockets at any given time in 2018, down 33 per cent from 116,000 won three years earlier.You can now opt for a hassle-free, cashless payment method as GCash is now accepted in Asia's top travel destinations, including South Korea, Japan, Singapore, and Malaysia.The growing preference for digital wallets comes as mobile payment methods are becoming a lucrative business in Korea's increasingly cashless society, .This research survey titled Cashless Payments - Benefits, Challenges, Trends, and Opportunities attempts to find the reasons behind the rise of cashless payments, and identify the ongoing trends in the cashless payment world. To determine if the .8 percent and reach US$189. The cross-border payment, announced on Oct 19, is made possible through the e-wallet's collaboration with Alipay+. It has among the highest rates of credit card ownership — about 1. (Cash transactions in Sweden made up less than 2% of the value of payments in 2018, for example.When it comes to eCommerce transactions, most South Koreans prefer to pay via credit card.South Korea is a connected country.As a resident of Korea, I can’t remember the last time I HAD to use cash.

According to a survey conducted in South Korea in December 2021, Naver Pay was the most widely used mobile payment service in South Korea, at 75 percent.The Alipay+ global cross-border digital payments are now accepted by more than 1.South Korea is already one of the least cash-dependent nations in the world.By Kristin Mariano On Sep 29, 2022. Mobile payments.

Alipay+, Asian e-wallets drive South Korea’s cashless travel

According to a survey by the Bank of Korea, digital payments accounted for 20. Leading mobile payment providers in South Korea 2021.Korea is moving towards a cashless society, with many businesses now only accepting card or mobile payments.9 per citizen — and .