Cd yield to worst

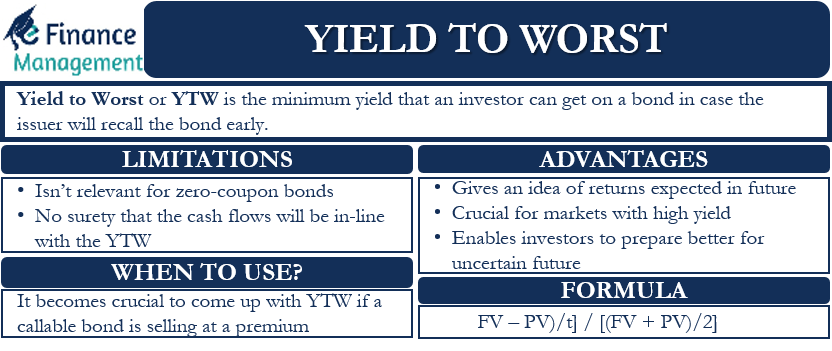

Yield to Worst (YTW) is a metric used to evaluate the potential return of a bond under the worst-case scenario, considering factors like call provisions, credit .Yield to Worst provides insight into the minimum yield an investor would earn if certain conditions, such as call options or early redemption, are triggered before the bond’s maturity. Es gibt jedoch eine andere Kennzahl namens Yield-to-Call (YTC), die oft mit YTW verwechselt wird. Examples of Yield-to-Worst (YTW) in Real-World Situations. Because CDs generally have a fixed annual percentage yield (APY) you can get a reasonably accurate calculation of how . Current yield is a snapshot of the bond’s annual rate of return, while yield to maturity looks at the bond over its term from the date of purchase.

Get updates on podcasts, webinars, courses, and more .What does Yield to Worst (under Ask )even mean? Worst what? Is this the yield one would receive if they purchased a secondary CD?

Top CD Rates Today: April 8, 2024

Suppose an investor purchases a bond with a yield-to-maturity of 5%, but the bond has a call option that can be exercised in two . Often, these types of bonds have a .Yield-to-Worst takes into account all possible scenarios, including calls, puts, and maturity, and provides the investor with a more accurate estimate of the bond's yield. Unlike other yield measurements, YTW considers factors such as call provisions, credit ratings, and interest rate changes that could impact the bond’s yield. YTM and YTW are the same for all the CDs you've seen because you haven't looked at any callable CDs, or if you have, the price is less than 100. Coupon Rate: 6%. But several major financial institutions are now offering brokered .

Rendement au pire (définition, formule)

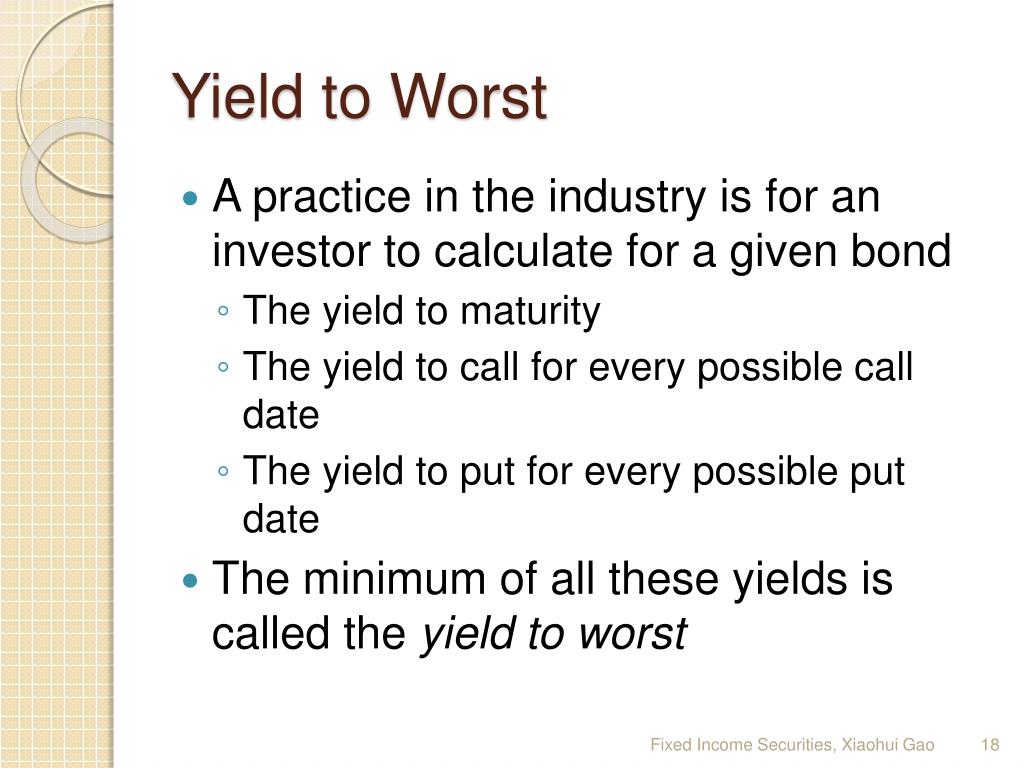

The yield to worst is a calculation that shows the lowest yield possible for a bond, assuming the bond doesn’t default entirely.

Yield-to-Worst

Not understanding the yield to worst and how to use it, can turn a 5% yield to maturity into a 2% yield to worst if an investor isn't careful.Yield on a bond refers to its effective interest rate based on market price. Here we discuss the top differences between coupon rate and yield to maturity along with infographics and a . Michael J Boyle. For a bond's price, enter its yield. For a callable bond (a bond with an option for the issuer to call or .O Yield to Worst (YTW) é uma métrica financeira que é usada para calcular o rendimento mínimo esperado de um título de dívida, como um título do governo ou um título corporativo. Suppose that a bond’s maturity date is June 15 th, 2031, and it currently trades at a 5% discount to par value (market price of $950 vs. É uma medida importante para os investidores, pois fornece uma estimativa do retorno que eles podem esperar obter se o título for resgatado antes da .Here’s a summary of our best CDs, organized by the highest annual percentage yield (APY) range. Source : Bloomberg, périodes de récession aux États-Unis selon le NBER (zones grisées), yield to worst (%) de l'indice ICE BofA US High Yield , taux des Fed Funds (borne supérieure, %), spread ajusté des options (OAS) de l'indice .Quel est le rendement au pire (YTW)? Le rendement au pire (YTW) peut être défini comme le rendement minimum qui peut être reçu sur une obligation en supposant que l'émetteur ne fait défaut sur aucun de ses . What to know : Tax-equivalent yield is the easiest way for investors . The formula used to calculate Yield to Worst involves considering different potential scenarios.75 percent for a one-year CD. This metric is particularly beneficial .Graphique 1 : les rendements des obligations américaines high yield subissent la double influence des taux et des spreads.

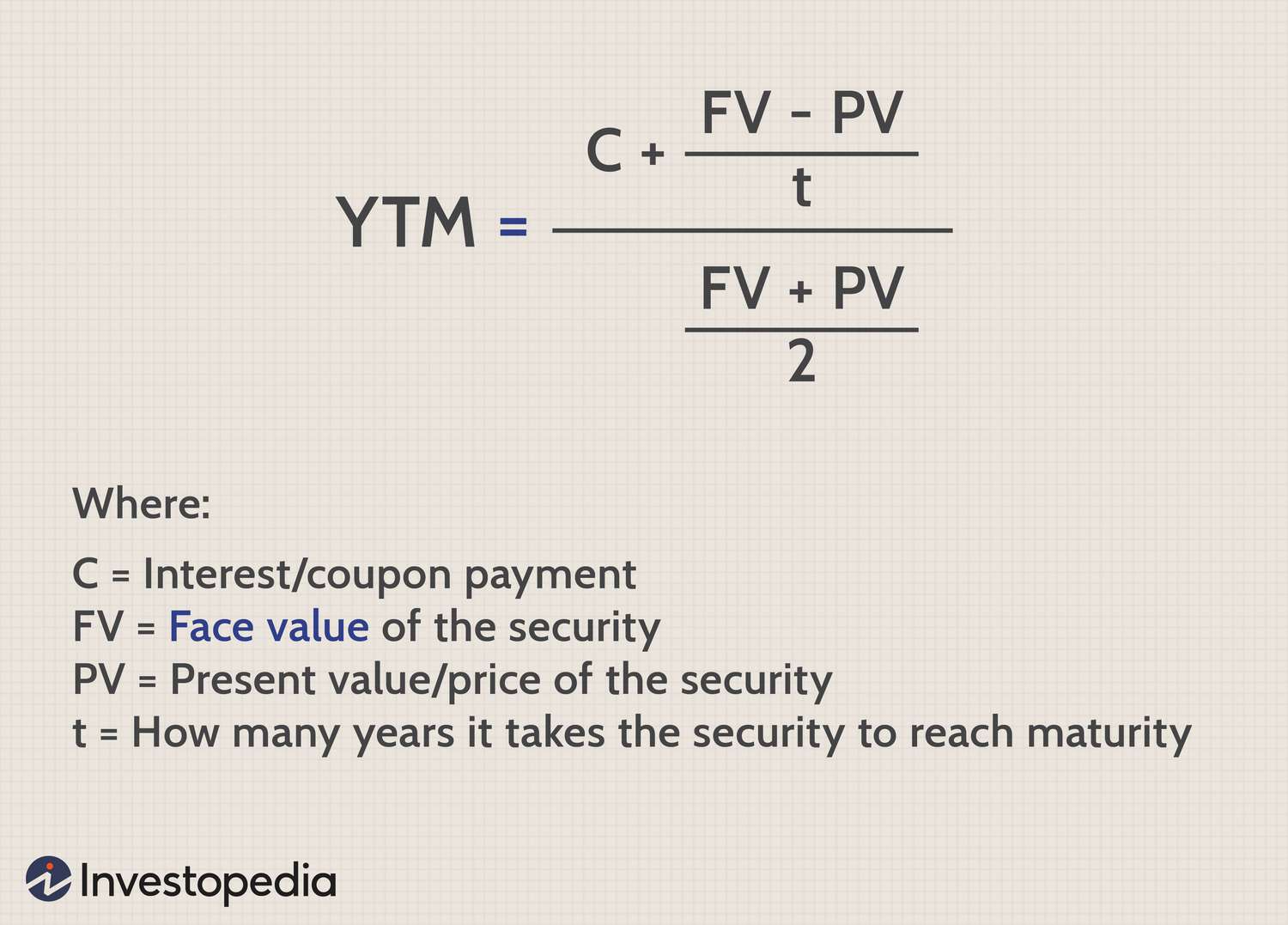

Now, we’ll enter our assumptions into the Excel formula from earlier to calculate the yield to .

CD Calculator

Yield to worst is the lower of yield to maturity or yield to call.50% APY, 11 months, $1,000 minimum to open.Spread To Worst: The difference in overall returns between two different classes of securities, or returns from the same class, but different representative securities.

Yield to Worst (YTW): A Guide for Smart Investors

IBKR Campus Newsletters . However, nominal yields do not factor in inflation. Today's top CD rate across terms is 5.

Can someone help me to comprehend secondary market CDs?

The lower yield of yield-to-call and yield-to-maturity.Yield to worst (YTW) is the lowest yield an investor can expect when investing in a callable bond. Two common yields that investors look at are current yield and yield to maturity. Yield-to-maturity indicates the effective rate if the bond is allowed to mature, yield-to-call indicates the effective .Yield to worst is only relevant if the CD is callable, in which case it's the yield you'd get if the CD were called at the first call date. In diesem Blog besprechen wir den Unterschied zwischen YTW und YTC und wann es angebracht ist, Yield-to-Worst zu verwenden.50%, you would need a taxable bond yielding 5.Yield to Worst Explained Definition and Significance of YTW. The YTW is calculated by making worst-case scenario assumptions on the issue by calculating the return that would be received if the issuer uses provisions, including prepayments . YTW will be less than YTM for a callable CD selling at a premium (more .Yield-to-Worst. How Does Yield to Worst (YTW) Work? The concept is best .

To calculate it, divide the tax-exempt bond's current yield by (1 – your federal tax bracket).De très nombreux exemples de phrases traduites contenant worst yield – Dictionnaire français-anglais et moteur de recherche de traductions françaises. Note that hover over capability does not impact the calculations already displaying above the chart. The call premiums or penalty fees for early repayment range from 5.Bankrate’s list of top-yielding CD rates are much higher than today's national average yield of 1.16%; Yield to Worst (YTW) – Par Bond = 8. Es ist eine Art von Rendite, auf die Bezug genommen wird, wenn eine Anleihe Bestimmungen enthält, die es dem Emittenten ermöglichen würden . Hover over the chart to see specific bond and price information that updates dynamically as the relationship between price and yield changes. The bond is callable at the end of each anniversary year.The Yield to Worst (YTW) represents the lowest possible yield a bond can generate if the issuer fulfills all payment obligations.The yield to worst would be lower of the two yields.

Yield To Worst: What It Is And Why It's Important

On this page is a bond yield to worst calculator.

Durch die Berücksichtigung beider Kennzahlen können Anleger fundiertere Entscheidungen über ihre festverzinslichen .Depending on the characteristics of a bond and its current market price, it computes the yield to worst – the worst yield you could see between any call features or maturity (but see the note below).70% APY, 13 months, $500 minimum to open .

Yield to Worst (YTW)

Frequency of Coupon: 1.Yield to Worst (YTW) – Discount Bond = 11. IL CD today (you can find the details here), and I'm strugging to understand the details.

Yield to Worst: An Essential Tool for Risk Assessment

The yield to maturity is the estimated annual rate of return for a bond, assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate.

Obligations high yield

die mit einer Anleihe erzielt werden kann, die innerhalb der Vertragsbedingungen vollständig funktioniert, ohne in Verzug zu geraten.

Yield to Worst vs Yield to Worst Den Unterschied verstehen

Yield to Worst (YTW)

Investors of callable bonds should always compare yield-to-call and yield-to-maturity to determine a bond’s most conservative potential return.The yield of a bond changes with a change in the interest rate in the economy, but the coupon rate does not have the effect of the interest rate.Yield to Worst (YTW): Simple Calculation and Excel Example.The YTW of a callable bond shows the interest rate which would apply if the issuer terminated the bond at the earliest possible interval.The yield to worst is the lowest potential return an investor can get from investing in a bond, assuming there is no default.Ally Bank® (Member FDIC): 4. Yield to Worst (YTW) is a financial metric that helps investors assess the minimum yield they can expect from a . Yield to Worst (Ask) 3. To update the calculations, . The yield to worst is a risk that every bond investor needs to be aware of.

What Is Yield to Worst?

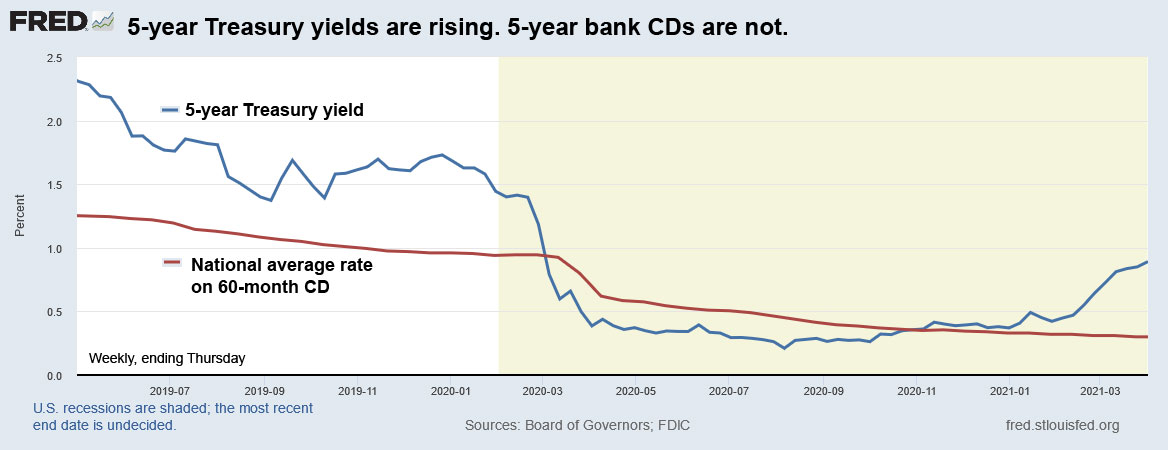

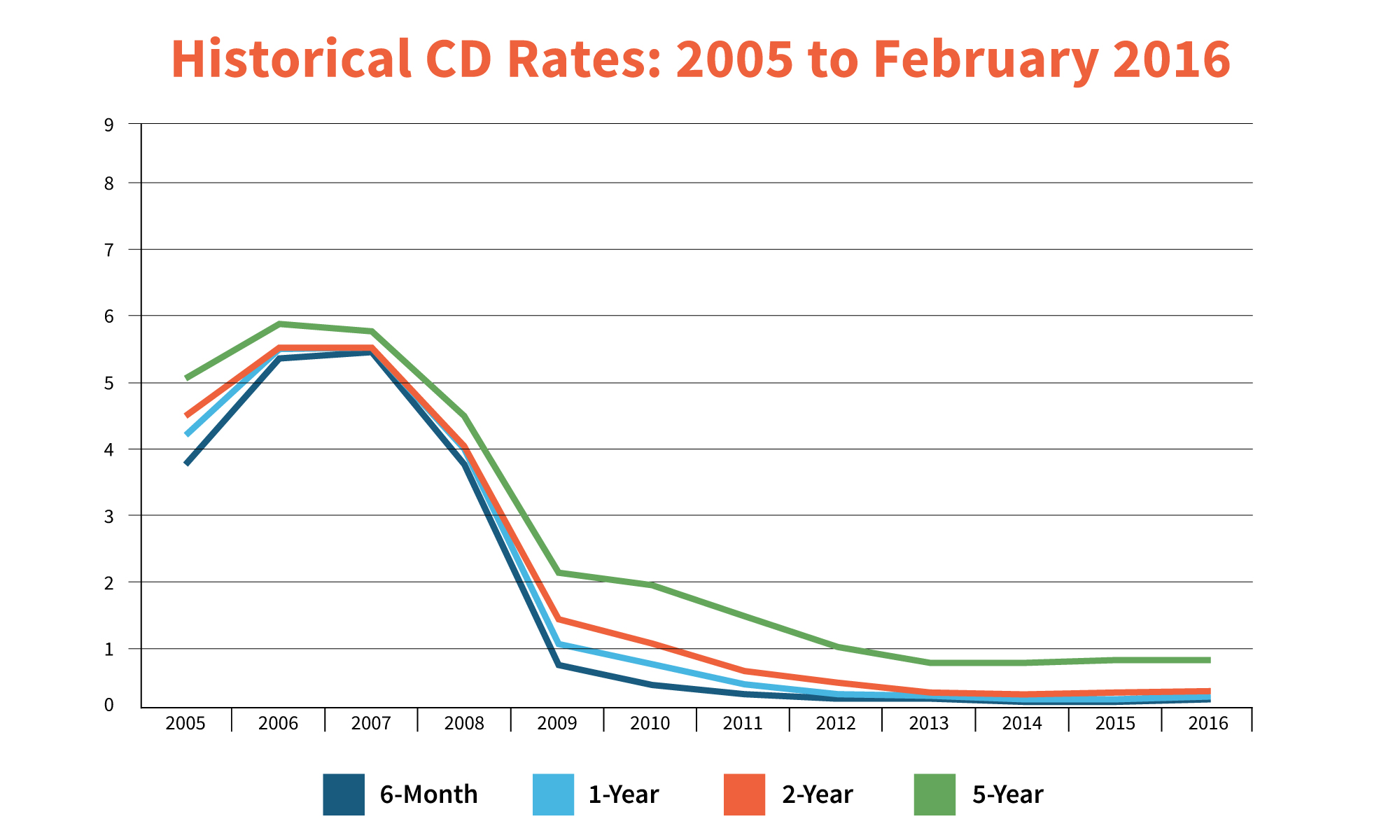

Came across a HARRIS N.Example of yield to worst: You buy a 1000-Swiss-franc bond which has a 5-year term and a 5% annual interest rate.Traditional CDs at banks and credit unions are yielding an average of less than 2. In other words, the worst-case outcome for investors in this case is to hold the bond .Certificate of Deposits (CDs) Best CD Rates for April 2024: Up to 5. By considering various scenarios, including call provisions, early redemptions, and changes in interest rates, YTW provides a conservative estimate of the lowest yield an investor can . Marcus by Goldman Sachs: .

Understanding Bond Yield Measurements

Competitive CDs are .250 Maturity Date: 09/29/2025 Call Protection: NO Bond Type: CD Interest Accrual Date: 09/29/2010 First Coupon Date: 03/29/2011 Price .Here's what's listed: CUSIP: DSA991209 Pay Frequency: SEMIANNUAL Coupon: 3. Best for 3-Month CDs: EverBank Basic CD — 3.

By calculating YTW, investors can gain insights into both the potential .What is the ‘Yield To Worst – YTW’.

请问金融术语Z-spread to worst是什么意思?

Page preview: Table of contents.

Yield to Worst (YTW) Berechnung Theoretisch besteht die Formel zur Berechnung des schlechtesten Ertrags aus zwei Hauptkomponenten: YTW selbst ist eine der drei am Anleihemarkt verwendeten Renditemessgrößen, wobei die Rendite bis zur Fälligkeit und die zu nennende Rendite die beiden anderen sind.First Coupon Date: 03/29/2011. Fact checked by. Worst comes from - Either yield to maturity or yield to call depending on .00% APY, 11 months, no minimum to open.Der Yield-to-Worst hilft Anlegern, das potenzielle Abwärtsrisiko einer Anleihenanlage zu verstehen, während die Duration den Anlegern hilft, die potenzielle Volatilität einer Anleihenanlage zu verstehen. Marcus by Goldman Sachs: 4. Related Terms Yield-to-Maturity. The yield to worst (YTW) is the lowest potential yield that can be received on a bond without the issuer actually defaulting.When a bond trades at or below par value, the Yield to Worst equals the Yield to Maturity. The spread to worst . Recommended Articles.Yield-to-Worst ist ein Maß für die niedrigstmögliche Rendite ,.10%; Aside from the premium bond, the yield to worst (YTW) is .Es cada vez más habitual ver en las fichas descriptivas de los fondos de inversión de renta fija una medida de rentabilidad denominada yield to worst o “rentabilidad al peor”, que acompaña a otro parámetro más familiar, como es la rentabilidad a vencimiento o yield to maturity.3% in the current year (2024) down to . It also lists national average CD rates and how much you’d earn for each . How to calculate your CD earnings. For example, if you're in the 32% tax bracket, to match the tax benefits of a tax-exempt bond yielding 3.

:strip_icc()/i.s3.glbimg.com/v1/AUTH_59edd422c0c84a879bd37670ae4f538a/internal_photos/bs/2019/u/L/1n2XeETpeg14i4pKIkUg/rua-da-agustura.jpg)