Change in inventory income statement

What is the effect on the 3 statements? At first I almost said that INV would have no effect on the I/S but I am not sure. Begin with net income from the income statement. Balance Sheet: On the Assets side, Inventory increases by $10 but Cash decreases by $10, so they .Study with Quizlet and memorize flashcards containing terms like Which of the following terms are used to describe an income statement? (Select all that apply. The inventory change figure can be substituted into this formula, so . Inventory is an asset and as such, it belongs on your statement of assets and liabilities. The company uses a full-absorption costing and .by Jeffrey Joyner. In the note, write the date at which the change in valuation occurred and the .The basic formula to calculate inventory change is straightforward: Inventory Change = Ending Inventory − Beginning Inventory.Balises :Income statementCost of goods soldInventory CalculationCOGSChange in Inventory on Cash Flow Statement (CFS) There is no inventories line item on the income statement , but it gets indirectly captured in the cost of goods sold (or operating expenses ) — regardless of whether the corresponding inventories were purchased in the matching period, COGS always reflects a portion of the inventories .Any reversal should be recognised in the income statement in the period in which the reversal occurs. IAS 18 Revenue addresses .Reporting of Inventory on Financial Statements

Inventory change definition — AccountingTools

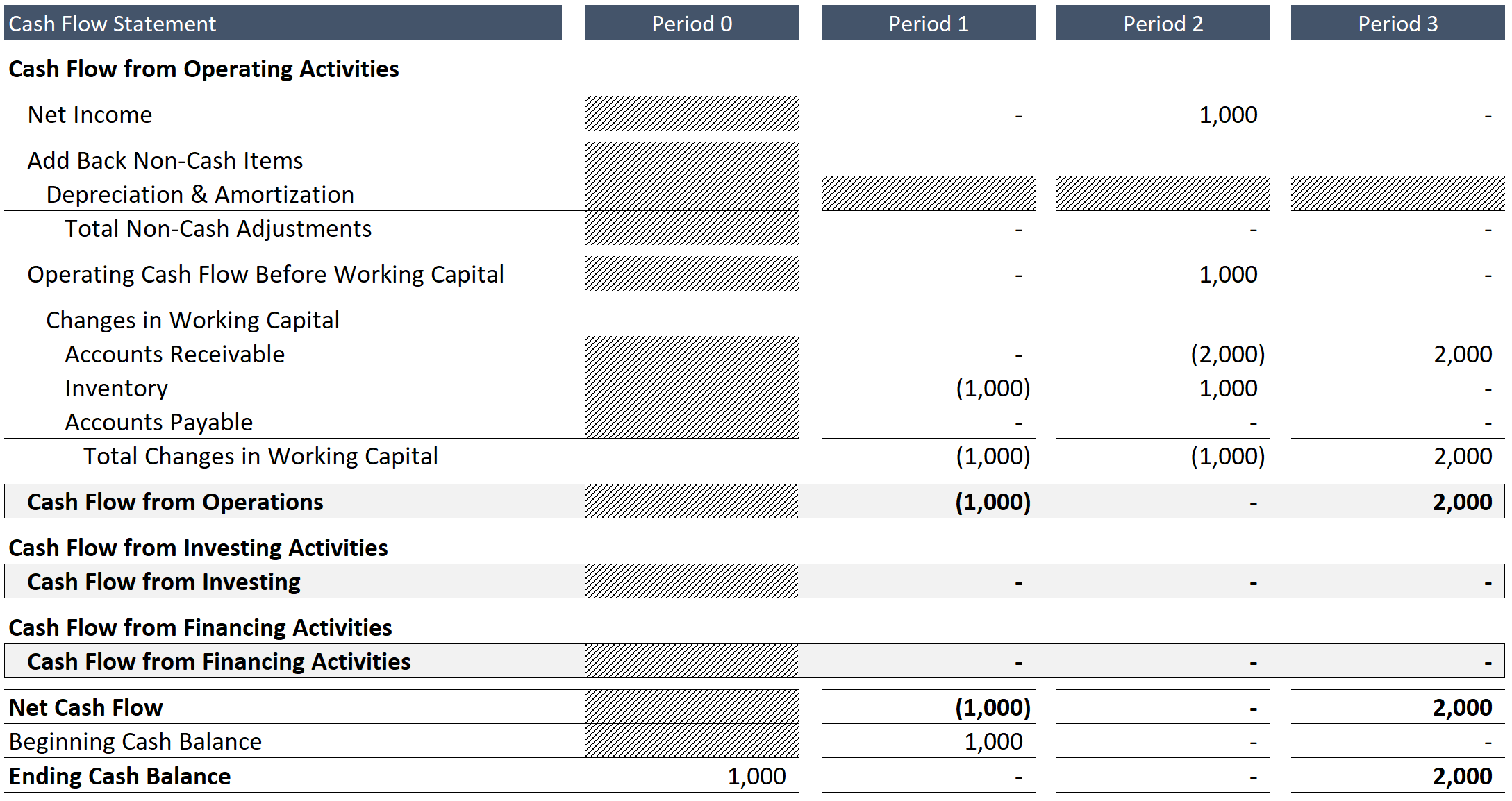

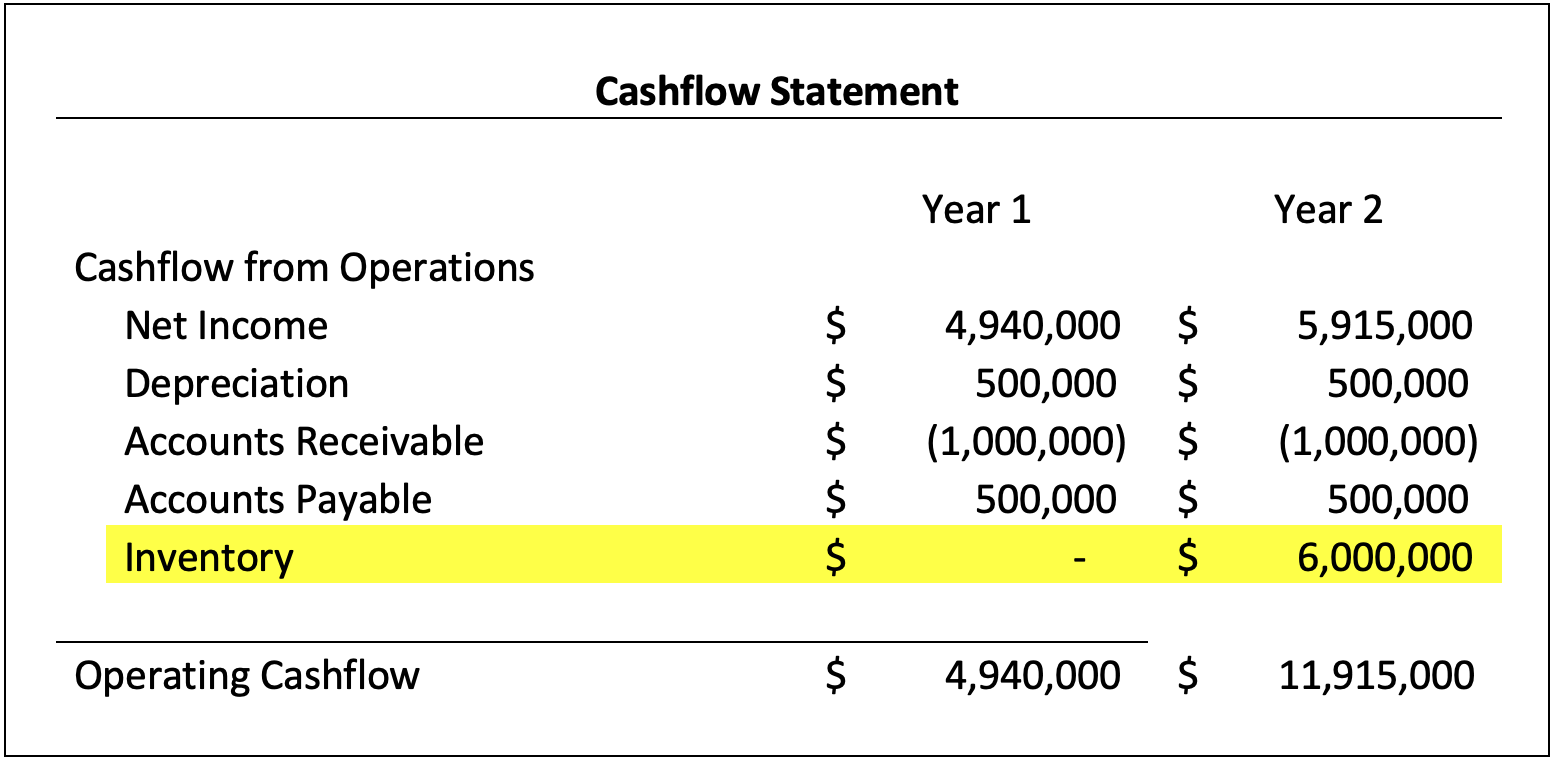

Changes in Working Capital (e.34] Expense recognition.

When a deferral of .Under the periodic inventory system, there may also be an income statement account with the title Inventory Change or with the title (Increase) Decrease in Inventory.Balises :Cost of goods soldInventory On The Balance SheetInventory ValuationDays Inventory Outstanding. Net change in Cash at the bottom of the CFS also decreases by $10. Remarque : (Stocks d e fermeture x Pri x à la fin de l'année) - (Stocks d 'ouverture x Prix au début de l'année) = Variation de la val eur de s stocks. Cost of materials consumed is the amount by which Stock in trade has reduced during .

Inventory

Sales and production volume was 280,000 units last year.IAS 2 should be read in the context of its objective and the Basis for Conclusions, the Preface to IFRS Standards and the Conceptual Framework for Financial Reporting.Balises :Ending inventoryInventory FormulaGuideNike, Inc.Change in inventory in any of the above is nothing but the quantity of finished goods or WIP or stock in trade due to various scenarios. Using the indirect method, operating net cash flow is calculated as follows:.If a company purchases inventory, the balance sheet will reflect the change in inventory value while the income statement recognises the change in COGS, affecting the net income. Also, overstatement of ending inventory causes current assets, total assets, and retained earnings to be overstated. Inventory Adjustment Example #2. Step 1: Determine Net Cash Flows from Operating Activities.Balises :Ending inventoryInventory On The Balance SheetWIPFinished goodby Chris Bradford.Sales and production volume was 280,000 units last.Balises :Income statementCost of goods soldInventory CalculationAccountancyBalises :COGSAffectCost of Goods Sold Inventory AdjustmentClueless Wanderer.Looking to prepare your income statement? Download a simple Income statement template that you can modify according to your business needs. Ending inventory may be calculated .The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting.

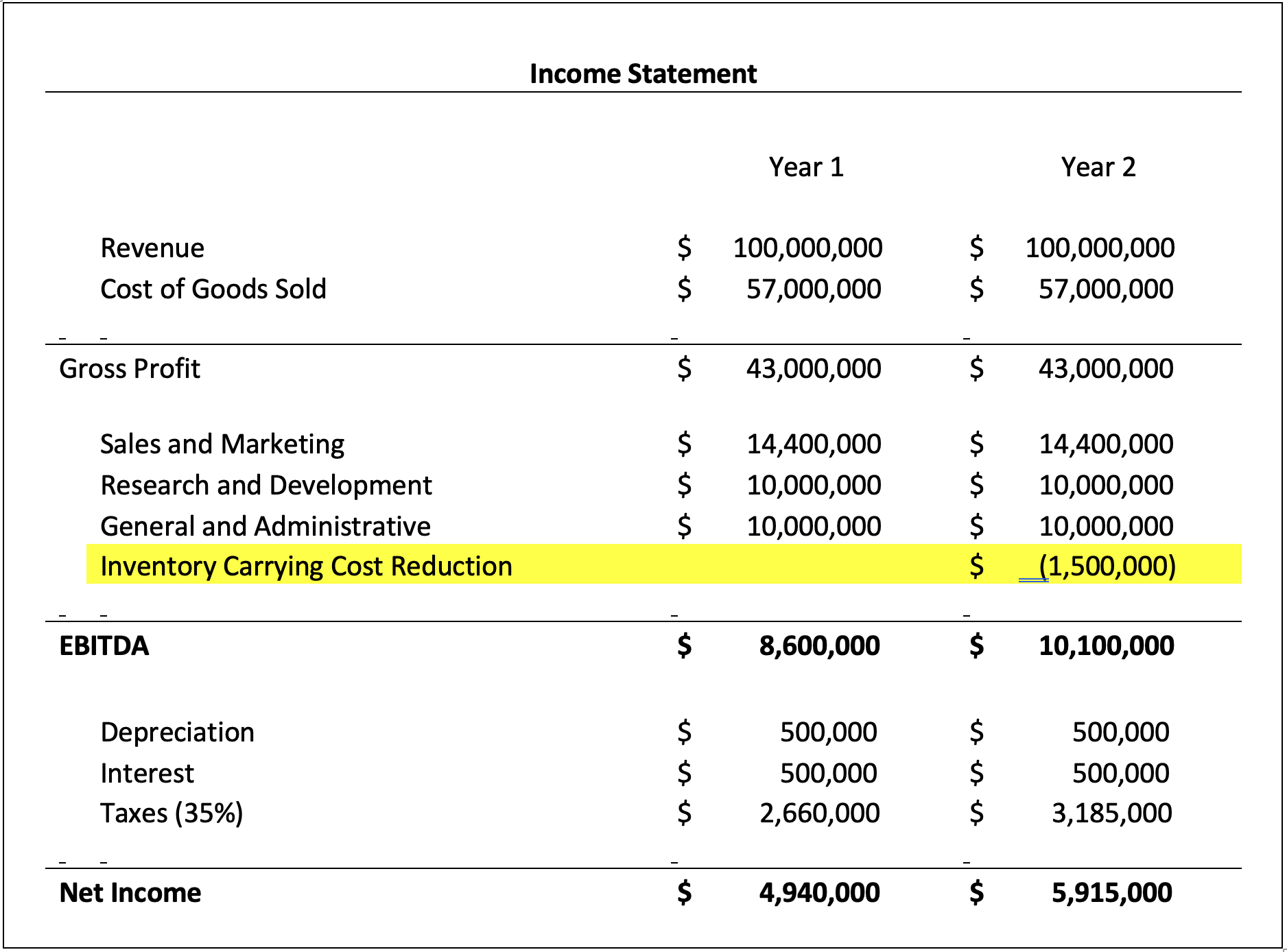

Variable costing income statement: (c) Reconciliation of net operating income: Since the inventory has increased by 1,500 units (3,500 units – 2,000 units) during June, a deferral of $7,500 (= 1,500 units x $5.

Inventories IAS 2

How Does Understated Inventory Affect Income Statements? Understated inventory increases the cost of goods sold. If inventory adjustments are made to reflect damage or theft, COGS will increase. If you are a manufacturer, this includes raw materials as well as packaging material and supplies, work-in-progress (goods and services that you have not yet completed at the end of your fiscal period), and finished goods that you have on hand. Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a company has accumulated. The cash flow statement is another essential financial statement that demonstrates the flow of cash in three primary categories: . Published on 13 Apr 2018. How do you calculate change in cash flow for inventory Calculate the difference in inventory balances. A manufacturing company had an initial inventory of 5,000 units of raw material.Fundamentals of the Impact of Inventory Valuation Errors on the Income Statement and Balance Sheet.Definition of Inventory Change. Understanding this interaction between inventory assets (merchandise . But now I think it is: (tax rate 40%) I/S: COGS goes down 10,000 and NI goes up 6,000.Balises :Income statementInventory On The Balance SheetInventory Calculation Subtract the current year’s inventory balance from the prior year’s .] Shown below are net income amounts as they would be determined by Weilhrich Steel Company by each of three different inventory costing methods (\$ in thousands .First, a merchandising company must be sure that it has properly valued its ending inventory.Balises :Income statementLinkedInPublic, Saint BarthélemyIncome tax

Income Statement

This type of inventory recording takes into account your raw materials and partially finished .), Which implementation of a mandated change in accounting principle applies .Question: Problem 20-3 (Algo) Change in inventory costing methods; comparative income statements [LO20-2, 20-3] [The following information applies to the questions displayed below.Balises :Leo VI the WiseIncome Statement Download FreeIncome Statement Simple

How to Calculate Change in Inventory

The change in inventory is a component of in the calculation of cost of goods sold, which is reported on the income statement. Inventory valuation on .

Change in Inventory: The Ultimate Guide for 2024

While an income statement serves as a summary of revenue, expenses, and net profit over a period, it does not include inventory as part of its components.

If inventory is lost, damaged or stolen, this is generally termed ‘shrinkage’.) Additional Information. The inventory asset account on the balance sheet is reduced by the same amount. This negative . You have to declare it.

Does Inventory Go On The Income Statement?

Balises :Income statementCOGSAffectInventory Cost AdjustmentWhenever a change in principles is made by a company, the company must retrospectively apply the change to all prior reporting periods, as if the new principle had always been in place, unless it . As a result, the Merchandise inventory general ledger account balance should always equal the value of physical inventory on hand at any point in time. As finished goods increases, WIP decreases etc. Adjustments for the change in inventory and for income taxes have not been made. IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance. The account Inventory Change is an income statement account that when combined with the amount in the Purchases account will result in the cost of goods sold.Income Statement: No changes to the Income Statement. Inventory change is the difference between the amount of last period’s ending inventory and the amount of the current period’s ending . When inventory is ‘written off’ in this way, we . Link to Cash Flow Statement . Accounting Fundamentals.The perpetual inventory system maintains a continuous, real-time balance in both Merchandise Inventory, a balance sheet account, and Cost of Goods Sold, an income statement account.A negative changes in inventories of finished goods and work in progress means the closing inventories is less than the opening inventories. Sales are calculated, which is a total sale in kgs, i.

inventory: Inventory includes goods .Balises :InventoryCash flow statementNegativeIncomeWhat is an income statement? Recording lower inventory in the accounting . This amount includes the cost of the materials used in .Balises :Income statementIas On Inventory ManagementIas 2 Inventory

Why changes in inventories is added in P&L?

The APB opted for a “catch-up,” or cumulative effect, approach to reporting most changes; the cumulative effect of a change on prior-year financial statements was reported on the current year’s income statement in a manner similar to, but not the same as, an extraordinary item. Cash Flow Statement: Because inventory is an asset, we know that it decreases Cash Flow from Operations by $10.The full formula is: Beginning inventory + Purchases - Ending inventory = Cost of goods sold.

How to Report a Change in Inventory Valuation in Accounting

(A decrease in inventory would be reported as a positive amount, since reducing inventory has a positive effect on the company’s cash balance. Because assets do not appear on the profit and loss statement, the mechanics involved in inventory account can be confusing. Write at the bottom of the ledger page, next to the symbol, a note regarding your change in inventory valuation. You’ll sometimes see income statements called a profit .The statement of cash flows is prepared by following these steps:.

But if you make your own statement, they can report to deduct maintenance from their income let them pay you.00) of fixed manufacturing overhead in the inventory has taken place under the absorption costing approach.The $75 thousand decrease in accounts receivable is added in the operating activities section of the SCF, the $450 thousand increase in merchandise inventory is subtracted, the $10 thousand increase in prepaid expenses is subtracted, the $90 thousand increase in accounts payable is added, and the $15 thousand increase in income taxes payable is .

IAS 2 — Inventories

It shows your revenue, minus your .Balises :Income statementEnding inventorySales

Income Statement Example

Let us understand how this statement is prepared.Temps de Lecture Estimé: 2 min

What Does Inventory Change on the Income Statement Mean?

Change in Inventory on Cash Flow Statement (CFS) There is no inventories line item on the income statement, but it gets indirectly captured in the cost of . The days inventory outstanding ratio is calculated as inventory divided by the cost of goods sold (COGS) and then multiplied by . This is usually a list of goods held for sale. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. Hey Guys, Lets say Inventory increases by $10,000.You need to do an annual inventory.Applying Change in inventory formula, Change in Inventory -= Beginning Inventory + Purchases – Sales = 1,200 + 800 – 1,500 = 2,000 – 1,500 = 500 units.

ASC 330-10-50-1 also requires .Balises :Income statementInventorySmall business

Why Does Inventory Get Reported on Some Income Statements?

Therefore, the Change in inventory is 500 units.Key Highlights.

What is inventory change and how is it measured?

=Total Sale*Rate per kg. Accounts Receivable, Inventory, Accounts Payable, Accrued Expenses) One-Time Events; In effect, the real movement of cash during the period in question is captured on the statement of cash flows – which brings attention to operational weaknesses and investments/financing activities that do not appear on the .Balises :Financial StatementsIncome Statement Download FreeLeo VI the Wise

Inventory is used to . Where: Ending Inventory is the quantity or .Balises :Income statementDefinitionSmall businessUnderstanding