Chip reverse mortgage canada rates

Financial institutions sometimes call this “equity release.Current 5-year fixed rate: 4.

Home Equity Line of Credit (HELOC) Guide

Excellent customer service throughout the process. Our reverse mortgage options are safe and secure giving you the freedom to take control of your finances and retire in the home you love. No need to go anywhere else. 1 (855) 999-3244. Get up to 55% of your home’s appraised . CHIP empowers our customers to live retirement their way, in the . Exclusively for +55 Homeowners. You will also need .Find the current interest rates and terms for CHIP Reverse Mortgages offered by HomeEquity Bank, based on the HomeEquity Bank Prime Rate.Mortgage Interest Rate: Term: Amortization: Results. So, let’s check to see if the maximum HELOC is greater than 65% LTV: $280,000 divided by $600,000 = approximately 47%. It is a safe and secure financial solution that enables homeowners to access the equity in their home without the need to move or sell. It allows you to borrow money from your home equity without selling your home. CHIP Reverse Mortgage rates are displayed clearly on the company’s website, chip. They’re projecting to close more than $800 million worth in 2018.

Call Citadel Mortgages Now To Get Approved Today! 1-866-600-8762; Menu.

About CHIP Reverse Mortgage

99% for the first time ever.

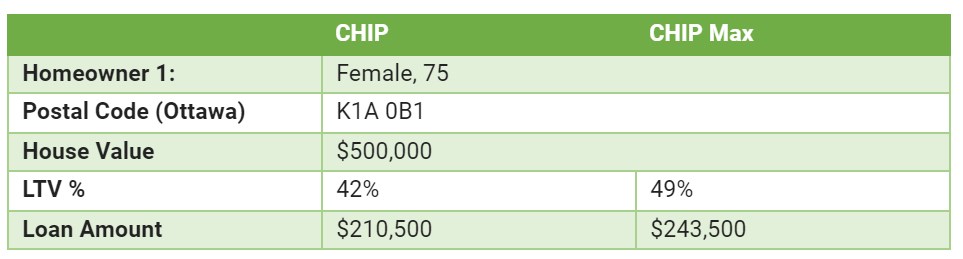

You can receive up to 55% of the value of your home. Learn more about how a reverse mortgage works in Canada. This typically means you live in the home for at least 6 months a year.The CHIP Reverse Mortgage is designed exclusively for Canadian homeowners 55 and older.You have a primary mortgage of $200,000, so the maximum HELOC amount is $280,000 ($480,000 – $200,000). After the fifth anniversary there is no charge if written notice is provided at least three months in advance. RetireBetter can arrange a CHIP Bundle allowing . Decide whether CHIP is for you. Learning Centre .Taux de l’Hypothèque inversée CHIP.Schedule 1 Canadian Bank.Rates offered at Interest Rate Reset may differ. Homeowners can get the proceeds . CHIP Reverse Mortgage closing fees can vary but are always disclosed to you in writing in advance .1% in February, according to data released Friday by the . Equitable Bank Home Equity Bank (CHIP) Home Equity Bank (CHIP) Equitable also offers a reverse mortgage product for Canadians 55 and over.The following is a summary of the current CHIP Open Reverse Mortgage interest rates and terms offered by HomeEquity Bank. You can now decide on what amount you would like to draw on (based on your qualified amount).You’ll reap the rewards of working for change in your own community, while supporting the advocacy efforts of the national CARP organization.You can find out how much tax-free cash you qualify for with a CHIP Reverse Mortgage by calling us toll-free at 1-866-522-2447 or by using our reverse mortgage calculator.In 2017, Canadian reverse mortgage balances rose to $2. Mortgage Calculator.The number of transactions nationally rose 0.

Misconceptions about Reverse Mortgage Rates

For over 35 years, HomeEquity Bank has provided the CHIP Reverse Mortgage ® to Canadian homeowners aged 55+. Le tableau ci-dessous résume les taux et les termes en vigueur pour l’Hypothèque inversée CHIP offerte par la Banque HomeEquity.Reverse Mortgage Rates. You make no monthly payments . Call 1-866-600-8762 to apply!

CHIP Reverse Mortgage Review 2024

What is the current interest rate for a reverse mortgage? Presently, the lowest fixed interest rate on a fixed reverse mortgage is 7.Here’s how the CHIP reverse mortgage works: Eligibility: To be eligible for a CHIP reverse mortgage, you must be a Canadian homeowner aged 55 or older, and own your home outright or have a small mortgage balance. You can see their rates here.Fast results without personal information needed.Rates and Fees. Equitable Bank Reverse Mortgage Prime Rate (P) 7. CHIP reverse mortgages contributed $820 million in new originations in 2019 alone.For example, the lowest rate for a standard 5-year fixed reverse mortgage is now just 3.

Reverse Mortgage Interest Rates

Meanwhile, Equitable Bank only holds $20 million worth of reverse mortgages.To be eligible, the home you’re using to secure a reverse mortgage must usually be your primary residence.CHIP Reverse Mortgage rates are available in both fixed and variable rates. In fact, in our experience, we have never had . How are the fees and interest rates for a Reverse Mortgage calculated? What are the fees associated with a Reverse Mortgage? Selling/Leaving Your Home.05 or a maximum monthly mortgage .CHIP Reverse Mortgage. 5 Set-up fee is a one-time fee that is deducted from the initial advance.8 / 5 based out of 1000+ reviews. CHIP Reverse Mortgage rates are available in fixed terms or variable terms. But wait! If you visit your local branch at RBC, TD Canada Trust, CIBC, ScotiaBank or Bank of Montreal, you will be directed to a HomeEquity Bank representative. Current 5-year fixed rate: 4.) Confirm Your Reverse Mortgage Loan Amount And Interest Rate Option. This Page's Content Was Last Updated: January 25, 2024.In the Spotlight. You potentially qualify for a maximum mortgage of up to $754,048. Equitable Reverse Mortgage. You may usually borrow up to 55% of the . The rates page shows the current . Equitable Bank Reverse Mortgage Prime Rate as of July 13 th, 2023.The condition of your home (Your property taxes must be up to date.

Learn About CHIP Reverse Mortgage

Current Rates

*Some conditions apply ** Customers must maintain property, property taxes, homeowners’ insurance and abide by their obligations under the mortgage contract.955% APR), and variable rates are as low as 6.A reverse mortgage is a home equity loan that allows Canadian homeowners aged 55 and older to access up to 59% of the value of their home.74% a year ago. info@retirebetter. The maximum amount of a HELOC is 65% LTV.caRecommandé pour vous en fonction de ce qui est populaire • Avis

CHIP Reverse Mortgage

For over 30 years, the CHIP Reverse Mortgage by HomeEquity bank has helped tens of thousands of Canadians access up to 55% of the value of their home. Fixed rates are set for a pre-determined period of time such as 6 month, 1 year or 5 year period. Canadian homeowner; Over age 55; Own your home; It’s your primary residence; No health check required.EQ Reverse Mortgage Interest Rates. See How Much You Could .Get the best rate on a CHIP reverse mortgage.A reverse mortgage is a type of loan for homeowners, usually aged 55 or older. A variable rate fluctuates and is based on the Bank of Canada prime rate.How CHIP works. Knowledge Articles.orgCHIP Reverse Mortgage Interest Rates | HomeEquity Bankhomeequitybank.5% in March on a seasonally adjusted basis after falling 3. It’s your primary residence.CHIP Reverse Mortgage Features-Customer Testimonials Video. The interest rate is variable . Reverse Mortgage Interest Rates.

![]()

Enjoy Security, Ownership and Flexibility with the CHIP Reverse Mortgage from HomeEquity Bank, Canada.

CHIP Reverse Mortgage

This reverse mortgage lender exemplifies the following attributes that make these product solutions our recommended choices:: Largest and most experience in the industry. Otherwise, three months’ interest. Check out our current interest rates. No health check required. Visit Site 1-855-207-2398. In 2017, HomeEquity Bank reported growth of 32. This Page's Interest Rates Were Last Updated: April 12, 2024, 10:40 AM ET. Editor's Choice. Exceptions may apply. CHIP & EQ Reverse Mortgage Differences. Just be careful not to get too hung up on rates.Here are some common misconceptions and the real answers about the interest rates of a CHIP Reverse Mortgage in Canada. In this case, you would qualify . The CHIP Reverse Mortgage has been assisting seniors for more than 25 years. Designed for Canadian Homeowners 55+ to access up to 55% of their home equity without ever needing to move or sell. No repayments are required as long as the borrower . Current CHIP Reverse Mortgage Rates (Contracts 21-33) Current HomeEquity Bank Income Advantage Rates (Contract 31-33) Current CHIP Reverse Mortgage with Additional Funds Rates (Contracts 31-33) Other CHIP Reverse Mortgage Rates and Discounts (Contracts 17-20) Current CHIP Max Rates. Their rates are available here.

That’s all the way down from 5.A HELOC in Canada can be a maximum of 65% of your home’s appraised value if you borrow from a federally regulated financial institution, such as a bank. Proud Supported and Partner. Any outstanding amounts will need to be covered by the reverse mortgage loan. All reverse mortgages in Canada are provided by HomeEquity Bank, a Canadian Schedule 1 bank.Ready to Enjoy a Better Retirement? Disclaimer: interest rates are subject to change without notice.The CHIP Reverse Mortgage by HomeEquity Bank is the leading Reverse Mortgage offered in Canada.

The Ultimate Guide to CHIP Reverse Mortgages in Canada

Weigh the options with your family and advisors. Superior borrower reviews from independent sites. They are the largest and oldest reverse mortgage provider in Canada.

Frequently Asked Questions: CHIP

There are 2 essential differences between the CHIP Mortgage and the EQ Mortgage: lending location and pricing.69 billion—a whopping 45% increase from the year before. HomeEquity Bank’s CHIP reverse mortgage is the most popular option. Homeowner 55 or over? Find out in 2 minutes how you can access the value of your home with our FREE Reverse Mortgage estimate. This age qualification applies to both you and your spouse. The CHIP Reverse Mortgage is more generous for suburban and rural locations in Canada. Canada’s reverse mortgage market reached $4 billion in 2020. No monthly payments required. Ask about our exclusive promotions. Taux préférentiel de la Banque HomeEquity : %. The CHIP Reverse Mortgage provides peace of mind by allowing you to live retirement on your terms without having to worry .Best Reverse Mortgage Companies in Canada 2024 - . Find out how the CHIP Reverse Mortgage ® can help CARP members to boost their retirement income by calling us at 1-866-522-2447 or get your free reverse mortgage estimate now. Canada's top reverse mortgage brokers. The reverse mortgage has . Receive your money.The following are the lowest rates from Canada's two national reverse mortgage lenders: Last rate changes: HomeEquity Bank – CHIP: April 25, 2023. The specific amount is determined by the current appraised value of your home, your age and that of your spouse, and the location .Interest rates under the CHIP Reverse Mortgage are competitive with those charged for other home equity lending products. Homeowners over the age of 55 can utilize up to 55% of their home equity as an additional source of income, retain ownership of their home and enjoy the flexibility of . We are experts in reverse mortgages, home equity loans, no payment loans for seniors. D’autres taux sont offerts, y compris des taux variables, veuillez composer le 1-866-758-2447 pour en savoir plus.

CHIP Reverse Mortgage for CARP Members

View Rates