Cii insurance qualifications uk

Claims handling is of such importance, it also considers .

Certificate in Insurance

Chartered Insurance Institute

Learning

University degrees that link to CII qualifications.

CII logo are registered trade marks of The Chartered Insurance Institute. It develops an understanding of the sector and the mortgage process, enabling advisers to meet individual client needs.The Advanced Diploma comprises three compulsory units and option units from across the insurance qualifications framework.The Award in General Insurance (Non-UK) is an introductory qualification that develops your understanding of the basic principles of insurance, the main legal principles related to insurance contracts, the main regulatory principles related to insurance business and the key elements to protect consumers.

Qualifications and credits achieved via . Our qualifications rise in difficulty, from Level 2 Awards to Advanced study at Level 6 and 7 . You may be eligible to claim exemptions for qualifications obtained through other professional bodies or universities. Enhancing technical knowledge and understanding. It enables you to develop the knowledge and confidence you need before you begin to focus your subsequent studies and specialise according to your ambitions a nd career requirements .

Certificate in Insurance

The CII Level 3 Certificate in Insurance is a core qualification for insurance staff working across all sectors of the industry.Specific study time guidelines are provided for each unit on its webpage and in the CII qualifications brochure.The CII promotes higher standards of integrity, technical .

Fellowship

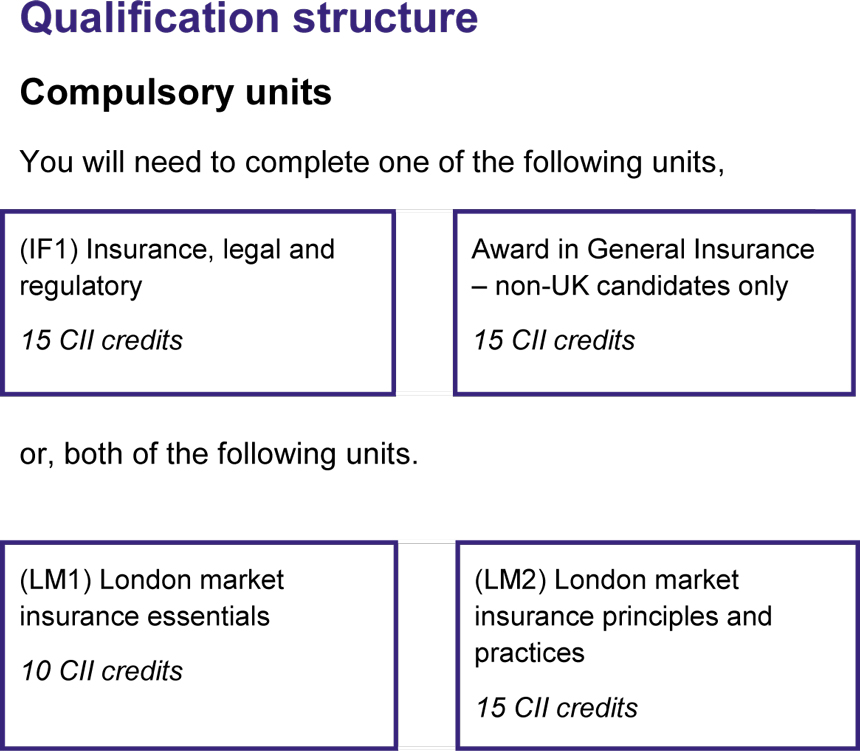

Diploma in Insurance. The Advanced Diploma in Insurance is a professional qualification providing an .Monday 30th October 2023 — 1 min read.uk Ref: CII – IOB001 (11/12) C12J_7333 CII insurance qualifications framework 2013 Overview brochure www.To be awarded a CII qualification, you must fulfill the completion requirements of the qualification you are looking to complete. The Chartered Insurance Institute 42–48 High Road, South Woodford, London E18 2JP tel: +44 (0)20 . It enables you to develop the knowledge and .The Certificate in Insurance typically requires three units to complete: the core learning requirement – unit Insurance, legal and regulatory (IF1) and a further two units of choice.Success in CII qualifications is universally recognised as evidence of knowledge and technical expertise.The Award in General Insurance (Non-UK) is an introductory qualification that develops your understanding of the basic principles of insurance, the main legal principles . The Chartered Insurance Institute (CII) Group has launched its new qualifications brochure for 2024, detailing the learning opportunities and assessments . The Certificate develops knowledge and understanding of the underwriting disciplines within the London Market, .

The CII insurance qualifications framework is regularly reviewed, and where necessary, enhanced and updated to reflect the current and future needs of the profession. Tel: +44 (0)20 8989 8464 Email: customer. The flexible structure of our qualifications allows you to create an individual learning programme that suits your needs.uk Our vision Our vision is to build public trust . PMI policies are underwritten by for-profit and not-for-profit organisations, while health trusts and . Who is this qualification for? Ideal for candidates outside the UK who provide financial advice, act as an insurance agent, or aspire to either of these . Find out which . Advanced Diploma in Insurance. You must obtain a pass in a unit, at the same level or above, from the CII insurance qualifications framework by method of examination, coursework assessment, mixed assessment (both coursework assessment and an online For holders of our Diploma in Insurance. Our insurance and personal finance qualifications cater for all levels of knowledge and experience, from new entrants through to seasoned professionals.The Chartered Insurance Institute 42–48 High Road, South Woodford, London E18 2JP tel: +44 (0)20 8989 8464 fax: +44 (0)20 8530 3052 email: customer.CII’s CII’shigher-level insurance qualifications (subject to completion (subjectrequirements), including the Certificate in Insurance, for which you will have . It is what the FSA has termed a ‘transitional qualification’ in that holders will satisfy the RDR qualification requirements, with any short-fall between the coverage of this qualification and the new exam .LAST UPDATED ON Jul 25, 2023. Over 35,000 individuals have passed it or are working towards completion.ukCII Certificate in Insurance | Wiser Academywiseracademy. The Chartered Insurance Institute is the premier professional body for the insurance and global financial services industry located in London, UK.Building on introductory knowledge gained from the Award in London Market Insurance, the CII Level 3 Certificate in London Market Insurance includes the addition of compulsory unit (LM3) London market underwriting principles.

Insurance Claims Handling (non-UK) (WCE)

ukRecommandé pour vous en fonction de ce qui est populaire • Avis

Diploma in Insurance

Advanced Diploma in Insurance

The CII's purpose, as set out in .Qualification details. Professionalism begins with qualifications. U nits P61, P62, P63 & P64 have been withdrawn. The CII Group has launched its new qualifications brochure for 2024, detailing the learning opportunities and assessments . The Certificate in Insurance is a core qualification for insurance staff working across all sectors of the industry (and the logical progression from the introductory-level .

Your guide to studying with us curiosity

It looks at the knowledge and skills you will need to handle claims in a professional, consistent and accurate manner.

Qualifications

Our members are able to drive personal development and maintain .

The CII qualification framework allows you to create your own learning pathway to help you achieve your chosen qualifications. Putting professionalism into practice. Completing three personal lines awards satisfies one of these units, with only the core unit and a further unit of choice required for completion. The default Enrolment option for this unit includes: . This represents the . It provides a more .Qualifications. The level 3 Certificate in Mortgage Advice meets the FCA’s qualification requirements for mortgage advisers. Who is this qualification for? .Chartered Insurance Institute 3rd Floor, 20 Fenchurch Street London EC3M 3BY Telephone service Mon to Fri: 9am – 5pm (GMT) Webchat - Mon to Fri: 8am - 6pm.uk website: www.

The Certificate develops core knowledge and confidence of the key disciplines needed before you focus your subsequent studies and specialise according to your ambitions and career requirements. The default Enrolment option for this unit includes: Latest version of the core learning .The Diploma in Financial Planning is a tried-and-tested qualification.Insurance Qualifications & Chartered Status with Marine and Cargo Components and CPD Courses for Insurance Professionals. Other units from the CII insurance framework – 6-50 CII credits.Assessment entry.

CII Group launches new 2024 qualifications brochure

A minimum of 290 CII credits must be obtained for successful completion, with at least 205 CII credits at Diploma level or above, including at least 150 CII credits at Advanced Diploma level.

Join us

The Certificate in Insurance is a level 3 qualification that enables learners to advance their understanding of insurance principles, functions and products.CII Level 3 Certificate in Insurance Qualification specificationcii. The Diploma in Insurance is a technical and supervisory qualification for insurance . PMI provides benefits to around 10% of the UK's population and the relationship between private healthcare and the NHS can be complex.

CII Level 3 Certificate in Insurance

Liability Insurances (M96) – 25 CII credits.

Qualifications

Recognition of prior learning.Designed for insurance practitioners working outside the UK, this unit covers the claims handling process including notification, assessment, settlement and associated financial factors.Find all our learning-based content, including insurance and personal finance qualifications, training, accreditation schemes, and our knowledge and CPD content, to .

Amity University (India) – MBA (Insurance and Banking) and MBA (Insurance and Financial Planning) Bayes Business School, City University, London - MSc Corporate Risk Management Bayes Business School, City University, London – MSc Insurance and Risk Management Birla Institute .For holders of Chartered Insurance Institute Certificate level qualifications.

Following the latest review, the CII is introducing a range of . To find out more about our qualifications, please select an area and choose from levels available below.The Certificate in Insurance is a core qualification for insurance staff working across all sectors of the industry (and the logical progression from the introductory-level Award for . Our members are able to drive personal development and maintain their professional standing by adhering to our Code of Ethics and by accessing a range of learning services. Subject to the published qualification completion requirements these can be used to help you achieve CII qualifications more quickly.

Fast track your future

Certificate in Mortgage Advice

Motor Insurance (M94) – 25 CII credits.CII’s CII’shigher-level insurance qualifications (subject to completion (subjectrequirements), including the Certificate in Insurance, for which you will have satisfied the compulsory unit completion requirement.

Insurance Law (M05)

uk