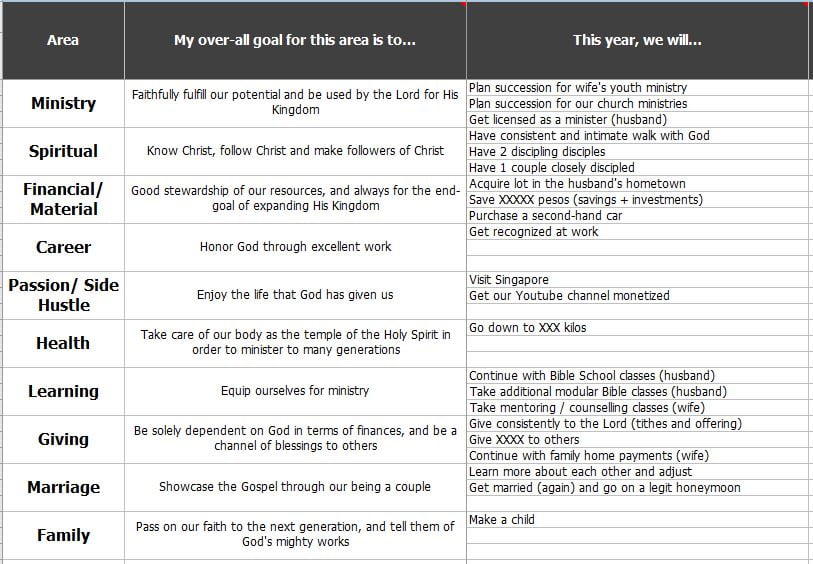

City of phila taxes

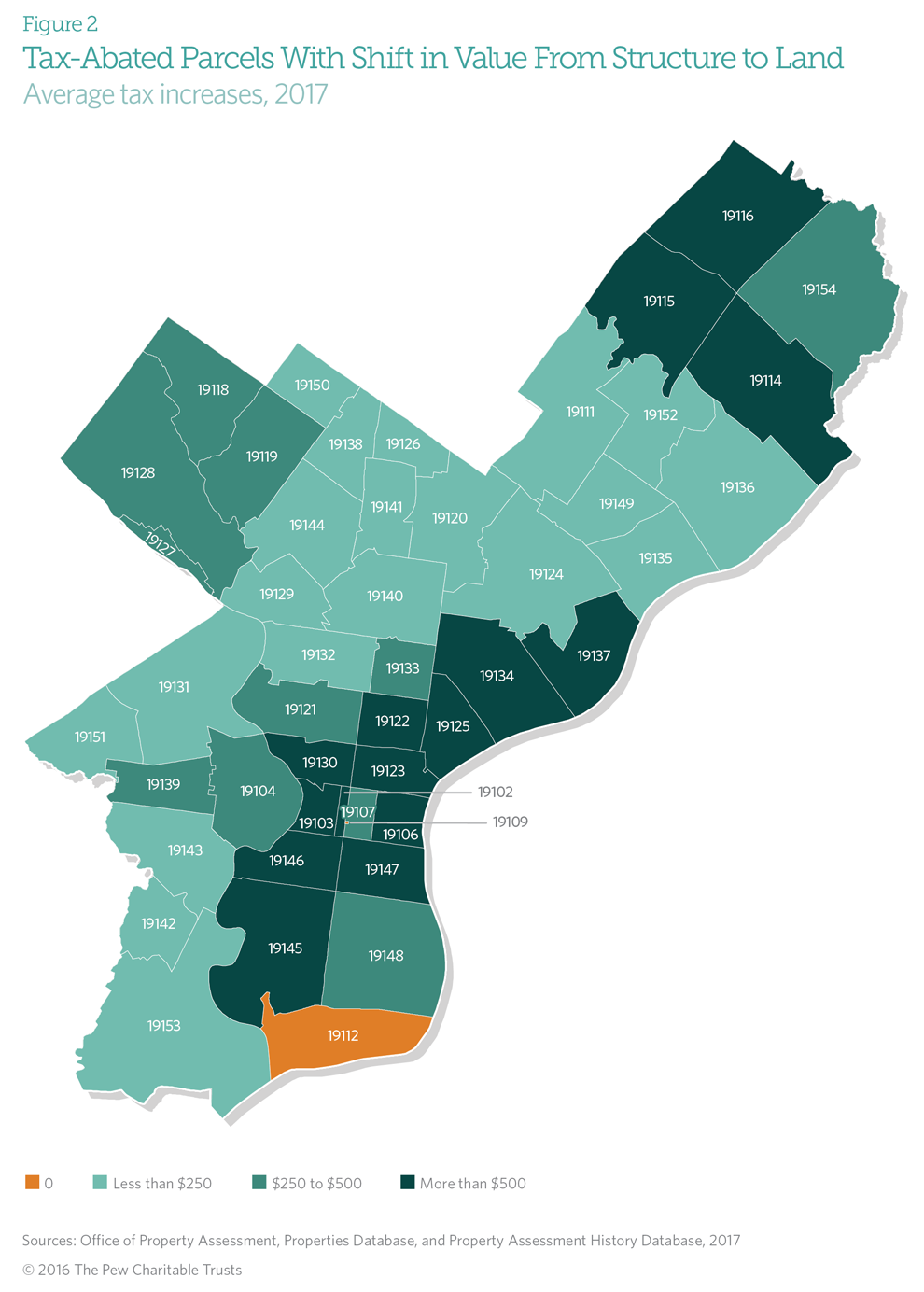

There is a statutory exemption . But you must submit appropriate documentation to establish this relationship. You can file Business Income and Receipts Tax (BIRT), Net Profits Tax, and School Income Tax (SIT) returns electronically. Check the Department of Revenue’s website for current NPT rates. The deadline to file a 2025 market value appeal is October 7, 2024. The most common . Business taxes by type . This content was last updated on January 31, 2023, by Department of Revenue. Applications must be received by March 31, 2024. Tax forms and instructions have moved to the Department of Revenue’s website.Learn more about the Philadelphia Tax Center in this guide. Learn about abatement and exemption programs that can help you lower your real estate tax bill. May 21, 2019 : PDF.Seventy-one percent of Philadelphia’s property tax revenue came from residential parcels, the highest share among the comparison cities, in fiscal 2021—well . These include: Philadelphia Beverage Tax (PBT) Liquor .The Department of Revenue imposes various taxes that must be filed and paid by businesses that are operated and/or located in Philadelphia. How to file and pay City taxes; Make an appointment to pay City taxes or a water bill in person; Use Modernized e-Filing (MeF) for City taxes; Interest, penalties, and fees; Apply for the electronic funds transfer (EFT) program; Business [email protected] sure to select the correct year for which you are requesting a refund. or by e-mailing the PDF form to appealinquiry@phila.

Real Estate Tax

Another option is mailing your forms and payments to the Department of Revenue.You can choose to file any City tax on the Philadelphia Tax Center, but a few taxes must be filed online.Property tax balances dating from 1972 to present. Each row represents a tax period (year) for a particular parcel.415% per $1,000 of gross income (before expenses) and 6.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Filing and paying your taxes

Tax Payment Options and Information

Information about filing and payment for different types of business taxes, business tax credits, . Tax abatements reduce taxes by applying credits to the amount of tax due. Rates, due dates, discounts, and exemptions for the City's Real Property Tax, which must be paied by owners of property in Philadelphia. Report an change to lot outline for your property taxes How to report a change in property divisions to .Rates, due dates, discounts, and exemptions for the City's Real Property Tax, which must be paied by owners of property in Philadelphia. Tangled title worksheet (español) PDF: Utilice este formulario si su nombre NO figura en la escritura de la propiedad en la que vive, pero . The City will no longer accept paper copies of the annual Wage Tax . If your property has been assessed and you believe the assessed value is incorrect, you can file an appeal with the Board of Revision of Taxes (BRT).

Set up a Real Estate Tax Installment Plan

To apply by paper, you must complete and mail in the current-year installment plan application, including all required information. Entity ID (such as a Social Security Number or Employer Identification Number) Property address (if applicable) Compliance type (for example, Zoning Board or . An application may be filed by mail, in person Monday through Friday, between the hours of 8:30 A. Account number.Look up your property tax balance - City of Philadelphiaphila.

Property taxes

Philly Realty Transfer Tax: what is it and how does it work?

This content was last updated on October 26, 2022, by Register of Wills.

New Website to File and Pay Philadelphia City Wage Tax

(215) 686-6600 about all other taxes.30% on your net income (2020 tax year). The Longtime Owner Occupants Program (LOOP) is a Real Estate Tax relief program. Payments, assistance & taxes. (215) 685-6300 about your water service or bill. The Department of Revenue no longer accepts CDs and other electronic media through the mail.W-2 submission instructions. Employers and payroll service providers with 250 or more W-2s must submit them electronically through the Philadelphia Tax Center. This content was last updated on January 20, 2023, by Department of Revenue.April 24, 2024 Fatoumata Fofana-Bility Department of Revenue. This content was last updated on November 17, 2023, by Department of Revenue.If your property has been assessed and you believe the assessed value is incorrect, you can file an appeal.Property Inquiry.Pay your taxes and other fees online for various City of Philadelphia services, such as water, licenses, permits, and commercial trash.

Employers with fewer than .Set up a Real Estate Tax payment plan for property you don’t live in.

Corporate & Tax Group

Photo credit: @urphillyfriend.If your issue can’t be handled over the phone, the representative will make an appointment for you to come into the MSB.gov or call (215) 686-6600.ORourke @phila.

![Philadelphia business taxes, a complete digest [chart] - Technical.ly](https://technical.ly/wp-content/uploads/2011/06/philly-taxes.png)

Tax exemptions and abatements.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Philadelphia Tax Center guide

Our office hours are Monday through Friday, 8 a. As Chief Deputy City Solicitor of the Real Estate & Development Unit, Brendan O’Rourke leads the Law Department’s group responsible for representing the City in real estate transactions and economic development issues. We’re always working to improve phila.For questions about City tax refunds, you can contact the Department of Revenue by emailing the Tax Refund Unit or calling any of the following phone numbers: (215) 686-6574.By examining current cash collections along with projections for the remaining quarter, the city’s major taxes will provide the General Operating Fund with almost $4.The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City.gov or call (215) 686-6565 for help. Filing and payment methods, instructions, .Tax forms & instructions.Tax information for owners of property located in Philadelphia, including tax rates, due dates, and applicable discounts. Find out what's changing, what to expect, . TAXES BEFORE YOU START. Meanwhile, you can track a refund petition you submitted to the City using the Where’s My Refund tool on the Philadelphia Tax Center.

Use Modernized e-Filing (MeF) for City taxes

Download tax forms and instructions.gov or call us at (215) 686-6574, 6575, or 6578 for help or more information. The City will not accept submissions through FTP, CDs, or any other electronic media.6317% (City) + .You can file your NPT return electronically. You don’t have to pay the Realty Transfer Tax if the transfer of home ownership is between family members, such as spouses, siblings.

Property and real estate taxes

Different processing units within the Department use different P. Use the forms on this page to file your appeal. Multiple languages are available. Email your refund-related questions to refund.Chief Deputy City Solicitor. (215) 683-5291.Real Estate Tax. The estimated market value of your property is not uniform with similar surrounding properties. On May 9, 2022, the City of Philadelphia released updated assessed values for all properties in the city. (215) 686-6578.Property assessment appeal documents and forms. Steps the City will take to ensure that people pay bills and taxes.

City of Philadelphia Dept.Payment Center - City of Philadelphia . Find the amount of Real Estate Tax due for a . Assistance programs available for owner-occupied households. 311 provides direct access to City government information, services, and real-time service updates. This content was last updated on March 6, 2024, by Department of Revenue.

Apply for the Longtime Owner Occupants Program (LOOP)

When you can’t, we encourage paying property taxes or water balances over the telephone.

Philadelphia

Please be sure to include any address or identifying information that might help the OPA to find the property account you are referencing.

Get Real Estate Tax relief

Includes balances owed and credits/overpayments. Inheritance Tax Department.govHow do I file my city taxes for Philadelphia? - Intuitttlc. Look up your property tax balance.

Philadelphia’s Use and Occupancy Tax (U&O) is a tax on any real estate located in the city that is used .

Get a tax account; Get tax clearance; Filing and paying your taxes. For the 2022 tax year, the rates are: 0.Property taxes | Services | City of Philadelphiaphila. By submitting this form, you opt-out of this feature.Get information about property ownership, value, and physical characteristics. If you have any further questions about the differences between BIRT and NPT or any other business taxes, please email revenue@phila. You are also exempted from . Philadelphia, PA 19107.

How do I contact the tax department of the City of Philadelphia?

When you contact the Tax Clearance Unit, you’ll need to provide your: Taxpayer name. You may be eligible if your property assessment increased at least 50% over last year, or at least 75% over the past five years. Vendors who want to substitute or replicate a City of Philadelphia tax form should reference the Department of Revenue’s Tax return .311 provides direct access to City government information, services, and real-time service updates. You may need the following information before you pay online: Federal Entity Identification Number (EIN) or your Social Security Number (SSN) or Philadelphia Tax Account Number and Philadelphia Department of Revenue PIN (Personal Identification Number).Tax Payment Options and Information – Business Services. It's fast, easy & secure, .You can contact the City of Philadelphia at 215-686-6600 or you can write to them at: City of Philadelphia Department of Revenue.

W-2 submission instructions

govHow do I contact the tax department of the City of Philadelphia?revenue-pa.Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.The best way to file and pay your City of Philadelphia taxes and water bills is always online.The City of Philadelphia participates in the IRS Modernized e-Filing (MeF) Program.

Tax services

The City of Philadelphia is launching a new tax filing and payment website on November 1, 2021.The deadline to apply for LOOP is September 30 each year. Kennedy Boulevard. Arrange a payment agreement if you have difficulty paying taxes on real estate that you own but don’t occupy. Get a tax account. (215) 686-6575.You can email tax. How can we make this page better?

Payments, assistance & taxes

Use this form if you do not want your current year taxes to be included in your Owner-Occupied Payment Agreement (OOPA). Includes both enforcement measures and ways to pay outstanding judgment.