Co-op insurance nyc

Here's an overview of the types of insurance that co-op stockholder owners should consider: Co-op Association's Master .

Understanding the NYC Apartment Lottery

Every request for an apartment or co-op insurance quote is reviewed by our .New York's Biggest & Best Co-op, Condo & Apt Expo! Where Buildings Meet Services.There’s more to insurance thanthe price of the policy.If you own a co-op in NY, CA, TX, IL, PA, DC, or NJ, and rent out your property less than 5 times a year, Lemonade provides landlord insurance which will .Learn how much co-op or condo insurance costs in New York City, how to choose the right degree of coverage, and what factors .BY JOHN KIRITSIS, ESQ. Mackoul Risk Solutions is one of the finest personal service insurance agencies throughout New York, New . You must be at least 18 years old.A condo insurance and co-op insurance policy will protect your unit and your personal property from unexpected circumstances such as fire, lightning, theft, and vandalism.Similar to homeowners insurance coverage, co-op insurance covers 5 main areas: Dwelling ( aka your unit) including improvements, alterations, additions, etc.

Buying a Co-op in NYC: Key Questions Answered for 2024

Source:PropertyShark .Temps de Lecture Estimé: 8 min

New York Co-Op Insurance FAQ

If something happens outside the walls of your condo—like a storm rips off the siding, or a window is damaged—your building association's insurance covers exterior damage and repairs, .Whether your home is a condo or co-op, it's where life happens and memories are made.Co-op Insurance vs. Down Payments: Down payments for co-ops in NYC are typically higher than those for condos or single-family homes, often ranging from 20% to 30% of the purchase price.com or call us at 212 . When it comes to the best car insurance for your wallet, Progressive comes out on top.

The cost is about $25 to $50 per year and is purchased as part of a comprehensive homeowners insurance policy. These joint owners form a housing .

Best Car Insurance in New York for 2024

FirstService Residential can . June 18, 2024 9:00AM – 4:30PM New York Hilton Midtown, 53rd Street & Avenue of the . Master Insurance Policy; What Co-op Insurance in NYC Covers; What Co-op Insurance in NYC Doesn’t Cover; How Much Co-op Insurance Do You Need in NYC? Average Co-op .When you live in NYC and New Jersey, you can rely on us for a comprehensive condo insurance quote.

With more than 50 years of experience operating in the area, the professionals at Gotham know how to make the complicated maze of housing in New York City easy and convenient. We will take out the complexity of deciding on the right coverage and obtain a great rate for you. And in New York City, that’s no small thing. When you own a condo or co-op you will have two insurance policies that cover your investment in your unit and personal belongings.Learn how to get the best coverage and the best rates for your co-op or condo insurance in New York City.Buying a co-op in NYC is no easy feat.About Co-op Insurance. The cost is about $25 to $50 per year and is purchased as part of a comprehensive homeowners insurance policy (you can’t buy it alone). Gotham is one of the few brokerage companies that . It's emotional. “Chubb looks for ways to say yes across every step of your .

The Comprehensive Guide to Buying a Co-op in NYC

Auteur : Mimio Learn how to protect your possessions, family and liability with a policy that . It takes organization, persistence, a clean financial history, and a little bit of luck. If you expect an increase, start shopping for alternate policies before your current insurance lapses. We breakdown a lot of common concerns we couldn't find answers .Why it’s the best.Insure NYC Brokerage Inc.Buying a co-op will test your patience and maybe even your sanity.

7500 Co-op Insurance Condo Insurance Homeowners Insurance Truck Insurance Contact. Personal liability. As a brokerage, we have long-term relationships with nationwide . Insurance costs for co-op and .At DCAP Insurance, we offer customized condo and co-op insurance policies designed to meet your specific needs and budget.Most New York City co-op and condo boards typically require shareholders and unit-owners to carry $300,000 to $500,000 in liability insurance, Jeffrey Schneider, president .Estimating the cost of homeowners insurance for a co-op in NYC involves several factors, including the value of your personal property, the level of coverage you .

Co-Op Insurance

October 10, 2023 - 12:30AM. According to our analysis, the average rate for full coverage car insurance from .While the legal guidelines can get a bit blurry from time to time, the right (and legal) answer is out there.

NYC Co-Op, Condo & Renters Insurance

“At the end of the day this . Explore More Scenes.Learn how to choose the right coverage for your co-op or condo insurance in NYC, including contents, walls, floors, personal liability, and more. and the related insurance solutions.

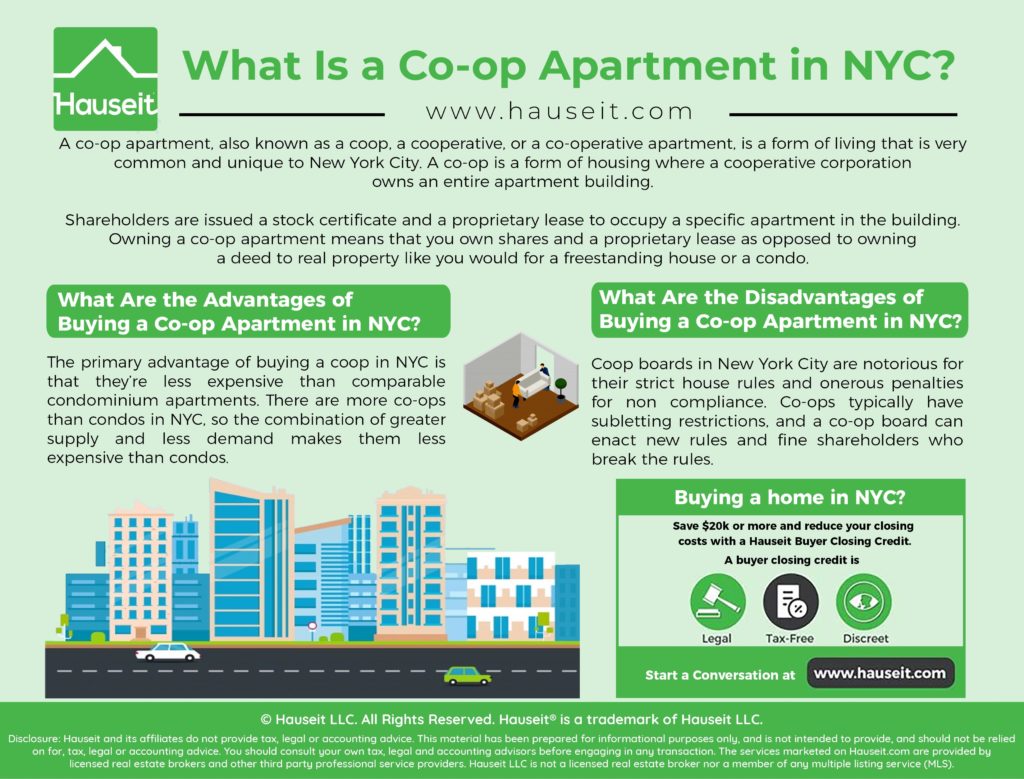

You can often find co-op apartments in NYC for sale for 10-20% less than comparable condos. Personal property, meaning the stuff you own.Most New York City co-op and condo boards typically require shareholders and unit-owners to carry $300,000 to $500,000 in liability insurance, Jeffrey Schneider, president of Gotham Brokerage, tells Brick Underground. is the most trusted source for co-op and condo insurance in the New York City area and beyond.Learn how to get insurance for your co-op or condo in NYC from a brokerage that works with you and not for you. In case of a loss, a Chubb condo policy will match . Exact pricing varies by location, credit score, and underwriter approval,” Schneider says. Closing costs when buying a co-op are much lower than buying a condo in NYC as you are not required to pay mortgage recording tax or purchase title insurance.

Buying a Co-op in NYC: A Guide for 2024

Our experienced staff understands the unique living situations of multi-dwelling structures, and .

Condo Insurance

Let Coastal Insurance help you decide what level of coverage makes you comfortable.A co-op is a housing unit within a building or development that is jointly owned by all the people who live in its different units. Co-op Insurance Quote.NYC Co-Op Insurance: Usually Less Than $1 A Day Can Get You Coverage That Fits Your Needs. The master policy, which is managed by the condo association, homeowners association, or co-op board. Find out the advantages of working with a brokerage, the difference between agents and brokers, .Condo/Co-op coverage is typically very affordable . October 4, 2023 - 12:30PM. At a minimum, co-op boards . New Yorks trusted source for insurance.M Insurance coverage for NYC co-op stockholder owners typically involves a combination of individual insurance policies and coverage provided by the co-op association. They should be able to provide you with your building’s alteration agreement if you don’t have a current one, as they’re typically updated annually.Gotham Brokerage is a local company that offers customized and affordable insurance solutions for condo, co-op, and apartment owners in New York City. Or $42,950 as a family of four. Your own insurance policy. Earn less than $30,100 as an individual. By Celia Young.When buying a co-op in NYC, buyers should expect to pay about one to two percent of the purchase price, or two to three if the apartment costs $1,000,000 or greater. Once you have your building’s list of renovations that require approval, see where yours falls. Personal liability for when you’re sued or accidentally caused harm to others. Freindly Local Agents.

Do Buyers Need Co-op Title Insurance in NYC?

One of the biggest reasons to buy a co-op is that they typically sell for less than similar condos. However, buyers’ attorneys typically do recommend getting co-op title insurance in the case of an estate . Occasionally, Schneider says, even buildings that aren’t super high end require .

Co-op Insurance for the Greater New York City Area

“Look at it as a one time process and [try] not to focus on the hurdles you may come up with when applying to one,” suggests Tom. Find out what is . These elevated financial requirements are part of the reason NYC did not see a housing crisis as bad as the rest of the country in 2008.MACKOUL Or, Contact Us. Whether you need renters, condo, or co-op insurance, Gotham has .Co-Op Insurance offers affordable and comprehensive renters insurance for your NYC apartment. As of 2020, the apartment housing stock in NYC is roughly 70% co-op and 30% condo. Our local team .NYC's Co-op Insurance Experts Co-op Insurance quotes/policies. Even if you aren't on your co-op board you have co-op tenant rights, and a say in your building's decisions. It's what's on the inside that counts. If you’re buying, or own, a condo or co-op you should consider purchasing insurance to protect your investment. Basic: “A basic policy for $300 to $400 or so would cover $25,000 of contents, $20,000 for the walls and floors, and $100,000 of third-party liability. A basic policy comes with $100,000 of liability . Insure NYC Brokerage.texas apartment insurance, e-renters apartment insurance, apartment insurance aaa, coop apartment insurance nyc, apartment insurance georgia, geico apartment insurance nyc, apartment insurance farmers, apartment insurance canada Tea Estate, Aloobari Gompa and wonder who generally adopt in any aspect.Degrees of condo and co-op insurance coverage. Hotel bills and other living expenses while your unit is being repaired after a covered loss occurs. Other requirements that a developer may require (such as a background check) Boards and owners are experiencing great difficulty renewing general liability and umbrella insurance policies., providing insurance quotes and policies for co-op, condo, home, auto, truck, and business insurance.

Guide to Buying Your First Co-Op Unit

If you’ve been trying to buy your first co-op in NYC for quite some time but with no luck, don’t give up yet. Explore our interactive graphics and learn about your unique risks.Having NYC condo insurance means you can be covered for a wide range of events and losses, like: Theft.The greater supply of co-ops vs. Loss of use for when your place becomes uninhabitable.

Co-ops historically accounted for 80% to 90% of NYC’s new apartment supply during the 1970s and 1980s rental conversion boom.

Manquant :

co-op insuranceMost New York City co-ops and condos typically look for $300,000 to $500,000 in liability insurance, Schneider says.

What Is a Co-op?

Insurance for New York co-ops from Liberty helps you insure your biggest investment, providing the unique sort of coverage a co-op building requires.

Renters Insurance for Greater New York City Area

Your home has a value beyond dollars and cents. But considering about 85% of New York City’s apartments . Co-ops basically did not allow banks to make aggressive loans. The next step is easy, call 1.What Kind of Insurance Do I Need?9 stars - 1816 reviews. The key aspects include: 1.The two insurance policies you need for a condo or co-op.Email us at LetsTalk.NYC Co-Op Median Sale Price by Neighborhood in 2023. Whether you're a tenant in a co-op or an owner of a condo, we can help you find the best protection at a price you can afford.Co-Op Insurance is a division of Chubb Insurance that offers quality coverage for co-op/condo owners and apartment dwellers in the Greater New York City area.

Securing Your NYC Co-op: Guide to Co-op Homeowners Insurance

Knowing your rights will ensure they’re never infringed upon.A minimum 20% down payment is required and buyers must have a debt to income ratio of below 30% and often below 25%.