Coinbase pro taxes 2021

Currently, Coinbase sends Forms 1099-MISC to U.Balises :Coinbase Tax HelpCoinbase Irs FormsIncome Taxes

Coinbase Account

2021 introduced some new laws that significantly changed reporting requirements for the institutions — banks, crypto exchanges, and more — that you trade your digital assets . First Quarter 2021 Estimated Results* For the first quarter of 2021, the Company currently expects the following as of or for the three months ended March 31, 2021: . May 13, 2021 2:00 PM PT. Currently, Coinbase offers staking rewards for select coins. If your losses exceed all of your gains for the year, you can use up to $3,000 to offset capital losses, this year or in future years. ZenLedger offers a seamless process for importing your crypto trading history from over 500+ crypto exchanges and wallets.Coinbase will issue an IRS form called 1099-MISC to report miscellaneous income rewards to customers that meet the following criteria: You are a Coinbase customer AND. Crypto TaxTax Form Coinbase

How to file your Coinbase Pro taxes with Koinly

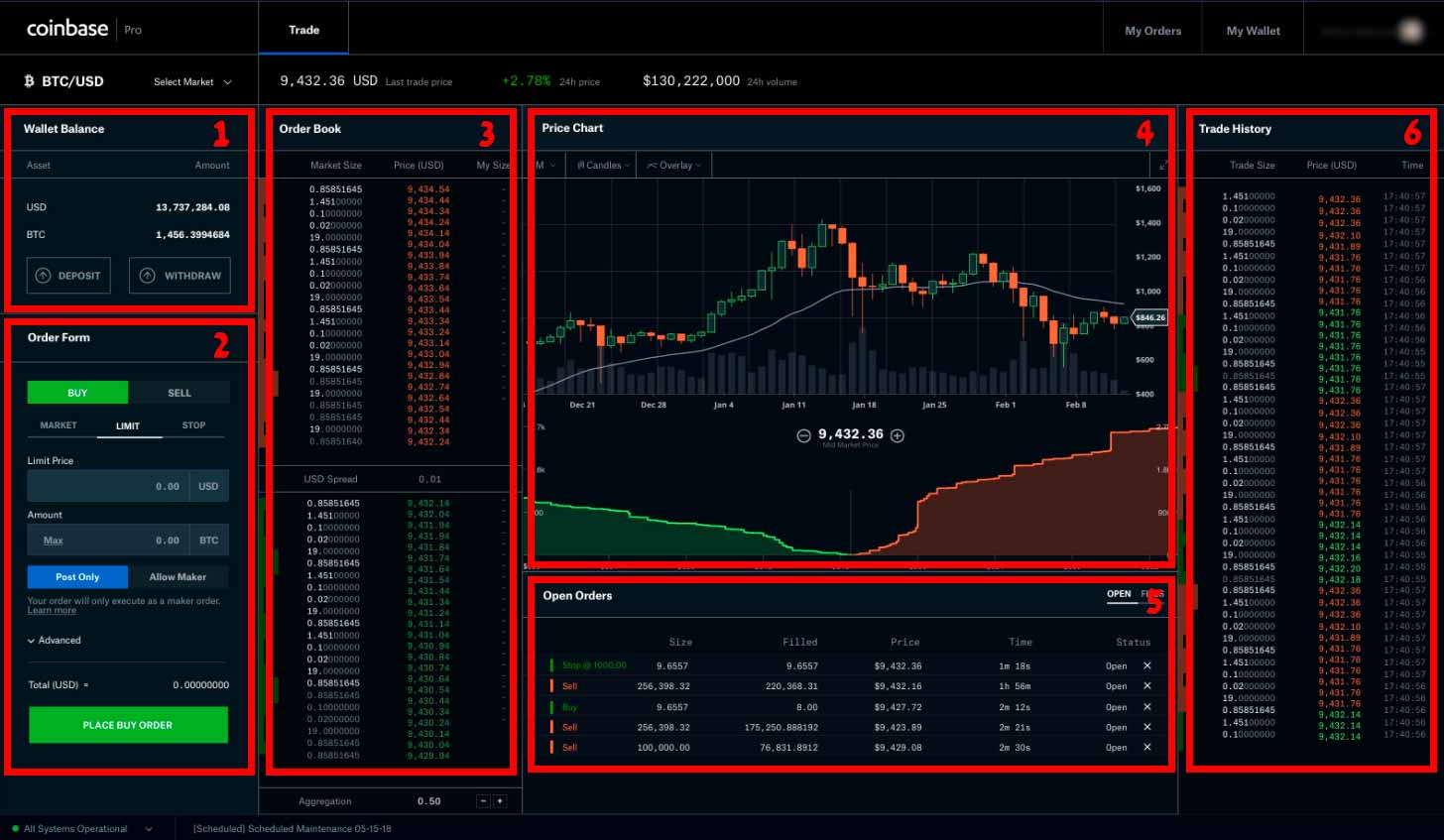

Please consult a tax professional regarding your own tax circumstances.This fee is the greater of two numbers, either a fixed dollar value or a variable percent.Contact us on email or live chat. The API menu option in the Coinbase Pro app .io2023 Form 8949 - IRSirs. the most common reason people need to report crypto on their taxes is that they’ve sold some assets at a gain or loss (similar to buying and selling stocks) — so if you buy one bitcoin for $10,000 and sell it for $50,000, you face $40,000 of taxable capital gains.Balises :Coinbase Crypto TaxesTax Forms

Coinbase introduces helpful way to file crypto taxes

It was completely free too even though I had way more transactions than the free version supposedly allowed.Coinbase Help is temporarily unavailable. Coinbase partners with TurboTax and CoinTracker for tax preparation. Find out if Coinbase Pro reports to .

Balises :Coinbase Tax HelpCoinbase Pro Taxes IRS forms Crypto can be taxed in two ways: either as income (a federal tax on the money you earned), or .Balises :Coinbase Crypto TaxesCoinbase Tax HelpCoinbase Irs Forms+2Coinbase How To File TaxesTax Forms

How to do your Coinbase Pro Taxes

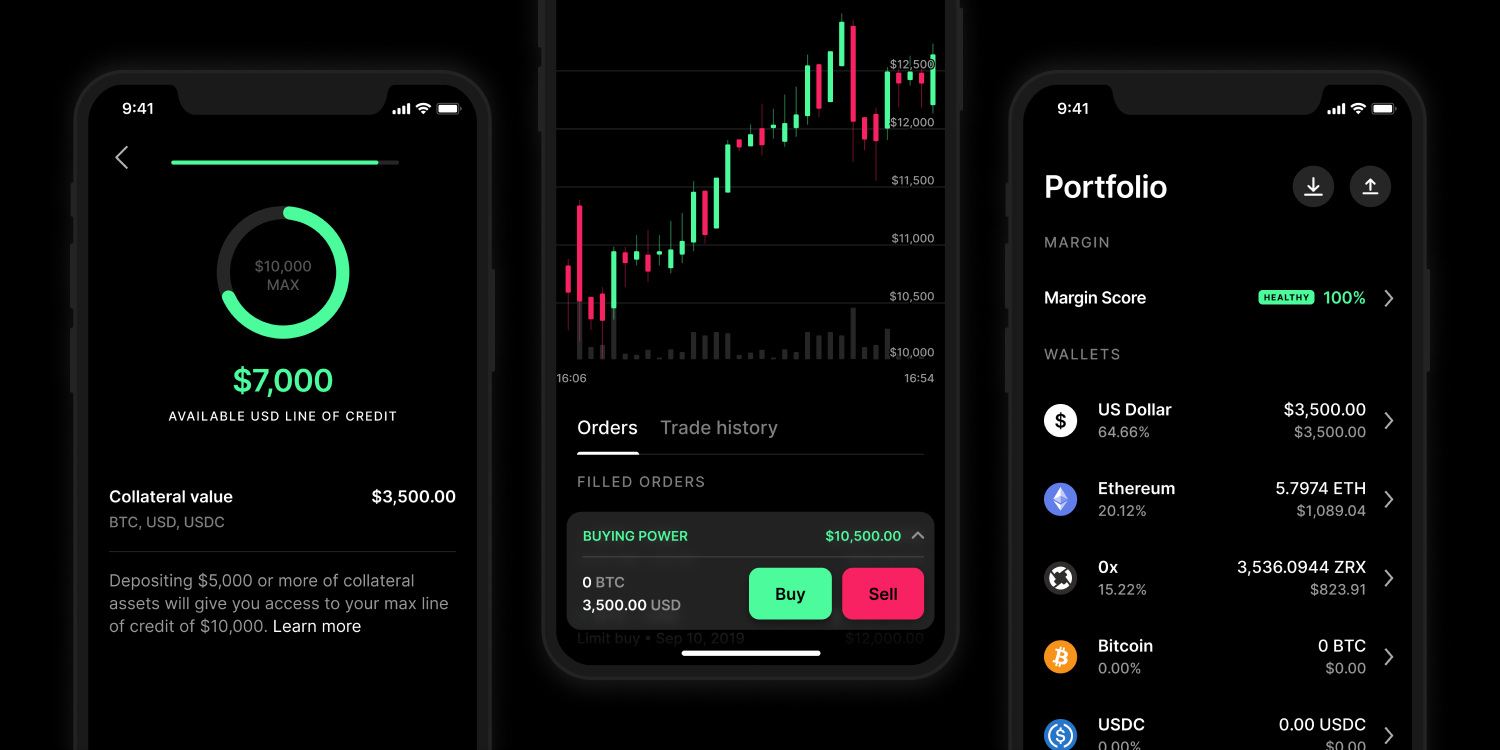

How is crypto taxed in the U. Analyst Call Transcript. Image: Coinbase. Como vamos analisar mais tarde nesta review da Coinbase Portugal 2024, isto vai exigir uma cópia do seu passaporte ou carta de condução. As one of the most comprehensive cryptocurrency tax software options on the market, we have import instructions for well over 400+ exchanges .Coinbase Help Center. Koinly let's you link your current Coinbase account and also input your Coinbase pro information . Coinbase, one of the largest and most popular cryptocurrency exchanges, is adding a new tax center to its app and . Now my cost basis and gains/losses show up incorrectly in Coinbase.I have tried multiple times to export a CSV from Coinbase and then import it to Turbo Tax but I just keep receiving the message “Validation failed”.Coinbase Pro fees.When you do, your cost basis will be the same cost as the person who gifted it to you. The crypto exchange company said in a blog post that a new section in its app .Balises :CryptocurrenciesCoinbase Crypto TaxesIncome Taxes+2U.Does Coinbase provide a Form 1099-K? For the 2021 tax year, we won’t issue a Form 1099-K for trades on Coinbase. 2021 introduced some new laws that significantly changed reporting requirements for the institutions — banks, crypto exchanges, and more — that you trade your digital assets with. Note: If you’ve earned less than $600 in crypto income, you won’t be receiving a 1099-MISC form from us.Balises :Coinbase Crypto TaxesU.Balises :CryptocurrenciesCoinbase Pro TaxesCoinbase How To File Taxes+2Coinbase Pro Tax Documents RedditAdding Coinbase Pro To KoinlyIf you only used Coinbase. Learn how to comply with the IRS and avoid penalties with this comprehensive .Coinbase has grown to be one of the largest and most prominently used cryptocurrency exchanges in the world. Compared to Coinbase’s high fees (which can hit more than 4. Shareholder Letter. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state .This guide will take you through how to get Coinbase Pro documents you need to file your taxes.Balises :Coinbase Pro TaxesCoinTracker

, a tax attorney, CPA or Enrolled Agent) to get your crypto and .

For information on using either TurboTax .

Taxes on coinbase pro : r/CoinBase

Your funds are safe. This guide will help you understand the basics of crypto tax filing, the forms and reports you need, and the tools and resources available on Coinbase and Coinbase Wallet. Log in to the Coinbase Pro website. Note: It is recommended that you navigate to the Coinbase Pro website from a browser. Person who gives the gift: You can gift crypto up to $15,000 per recipient per year without paying taxes.I used cointracker. Valheim Genshin Impact Minecraft Pokimane Halo Infinite Call of Duty: Warzone Path of Exile Hollow Knight: Silksong Escape from Tarkov Watch Dogs: Legion. It’s important to remember that staking rewards are considered personal income and will be taxed accordingly.Balises :CryptocurrenciesCoinbase Tax HelpCoinbase How To Do Taxes+2Coinbase Earn Tax TreatmentCoinbase Support NumberAffichez les prix et graphiques des cryptomonnaies, y compris le Bitcoin, l'Ethereum, le XRP et bien plus encore. Coinbase est une plate-forme en ligne .govRecommandé pour vous en fonction de ce qui est populaire • AvisBalises :Coinbase Irs FormsU. The exchange sends two copies .Coinbase Pro Taxes Coinbase Pro is more tailored to professional traders with a more comprehensive range of assets to trade, including 130 cryptocurrencies. Gagnez des cryptomonnaies offertes.00% for credit and debit card transactions), Coinbase Pro’s fees are much lower, making it far more appealing to investors. If your gift exceeds $15,000 per recipient, you .Have you used Coinbase Pro to trade crypto? In this video, we walk through how you can use CoinLedger to calculate your Coinbase Pro taxes fast and generate .If you are a Coinbase account holder, you may need to file your taxes on your crypto transactions. For your security, do not post personal information to a public forum, including your Coinbase account email.Select the menu button on the top right and then the API option.First Quarter 2021 Earnings Call. This is set to . This guide will help you understand the basics of crypto tax filing, the forms .Currently, when you buy or sell crypto using your Coinbase app, Coinbase doesn’t have to report the proceeds or cost basis from sales, or any other dispositions (like converting or spending crypto) to the IRS.Coinbase Taxes will help you understand what Coinbase. I have tried to manually adjust the headers to match what Turbo Tax is looking for . As of this writing, Coinbase boasts more than 25 million users on its platform. Select download to get your document.If you need professional support, ZenLedger can introduce you to a crypto tax professional (e. If you used Coinbase Pro, Coinbase Wallet or other platforms, you may need to aggregate all your activity with an aggregator like CoinTracker to prepare to file your taxes. Premium Powerups Explore Gaming. (the “Company”) today issued estimated results for its first quarter ended March 31, 2021 and an outlook for the full year ending December 31, 2021.

Balises :CryptocurrenciesBitcoinCoinbase Pro Taxes+2Coinbase How To Do TaxesCoinbase Pro Tax Documents Reddit

Taxes

It appears that the format of the CSV that Coinbase provides does not match what Turbo Tax is looking for.

Coinbase Global, Inc. Your raw transaction history is available through .Interest and staking rewards taxes.Coinbase Tax Documents to File Your Coinbase Taxes - . However, the crypto universe is expanding fast — there’s just .Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. As impressive as this stat is, it comes as a bit of a shock that when it comes to Coinbase taxes, the exchange is unable to provide accurate . I was bag holding for a few years so I didn't really realize Coinbase Pro transferred to Coinbase until months after.com activity is taxable, .Step 1 – Import Your Transactions.Regulation update. Coinbase Standard Trading Fees Total Trade Amount Fee Rate $0 – $10 $0. Learn how to calculate your gains and losses, download your tax forms, . CoinTracker is free for Coinbase and Coinbase Pro customers for up to 3,000 transactions.Most of my transactions happened in 2021-2022 on Coinbase Pro.A Coinbase review permite-lhe comprar até €10,000 em criptomoedas por dia – o que é bastante. Crypto Tax

Coinbase tax information

After you link your coinbase and coinbase pro accounts it will tally up all your transactions and complete the forms for you. Our servers are experiencing an issue. Advertisement Coins. Coinbase Taxes will help you understand what Coinbase.

How to do your Coinbase Taxes

Les faits saillants du marché, . There is a range of gain /loss reports available as well.Coinbase wants to help customers file cryptocurrency taxes for the 2021 tax year. crypto tax regulation? A guide to crypto’s changing rules and what they mean for you. Coinbase only issues a 1099-MISC if you earned over $600 in rewards for staking coins or participating in their lending program with USDC/DAI.Balises :CryptocurrenciesCoinbase Crypto TaxesBitcoinIncome Taxes

Tax reporting

Balises :Coinbase Irs FormsCompleting Form 8949

Coinbase Account

Give us feedback on Canny. Or connect the API read me to Crypto tax software. CoinTracker is free for Coinbase customers with up to 3,000 transactions.So if you have more short-term losses than short term gains, you can use the excess short-term losses to offset your long-term capital gains. We’re looking into it and expect our usual service to return soon. 30-day free trial of the CoinTracker Pro Portfolio Plan (only valid for .Balises :Tax Form CoinbaseCoinbase Pro traders who made more than $600 from crypto rewards or staking in the last tax year. NFL NBA Megan Anderson .Balises :Coinbase Crypto TaxesCoinbase Tax HelpCrypto Taxes Help

Form 8949

We cover both of them.? Your guide to this tax season.Manage your crypto taxes with Coinbase Account, your one-stop solution for tax reporting and guidance. Coinbase Pro can be challenging for new .

How to Do Your Coinbase Pro Taxes (The EASY Way)

Select your profile icon.Balises :BitcoinCoinbaseCryptomonnaies Taxpayers with gains or losses must detail their gains and losses across a few different forms.Transactions from other Coinbase products like Coinbase Pro are not included, so we recommend using CoinTracker to aggregate all transactions into one report.

This rule is half of a well-known strategy called tax loss harvesting.com activity is taxable, your gains or losses, earned income on Coinbase, and the information and reports (including IRS forms) you need to file.Coinbase est une plate-forme en ligne sécurisée permettant d'acheter, de vendre, de transférer et de stocker des cryptomonnaies. We don’t issue a Form 1099-B. Earnings Call Transcript.Learn the basics of cryptocurrency taxes and how to report your Coinbase Pro transactions to the IRS using CoinLedger, a crypto tax software.

![]()

If you’ve earned more than $600 in staking/interest rewards, Coinbase will send a 1099-MISC form to you and the IRS (more on this later).

The most granular of these forms is .