Commercial stamp duty calculator

Our Commercial Stamp Duty Calculator can help you gain a clear insight into the potential costs involved to help you budget more effectively.NSW Stamp Duty News: First home buyers that buy NEW homes under $800,000 will pay NO stamp duty from August 1st, 2020, NSW Government announced.

Buyer Stamp Duty for Industrial & Commercial Properties

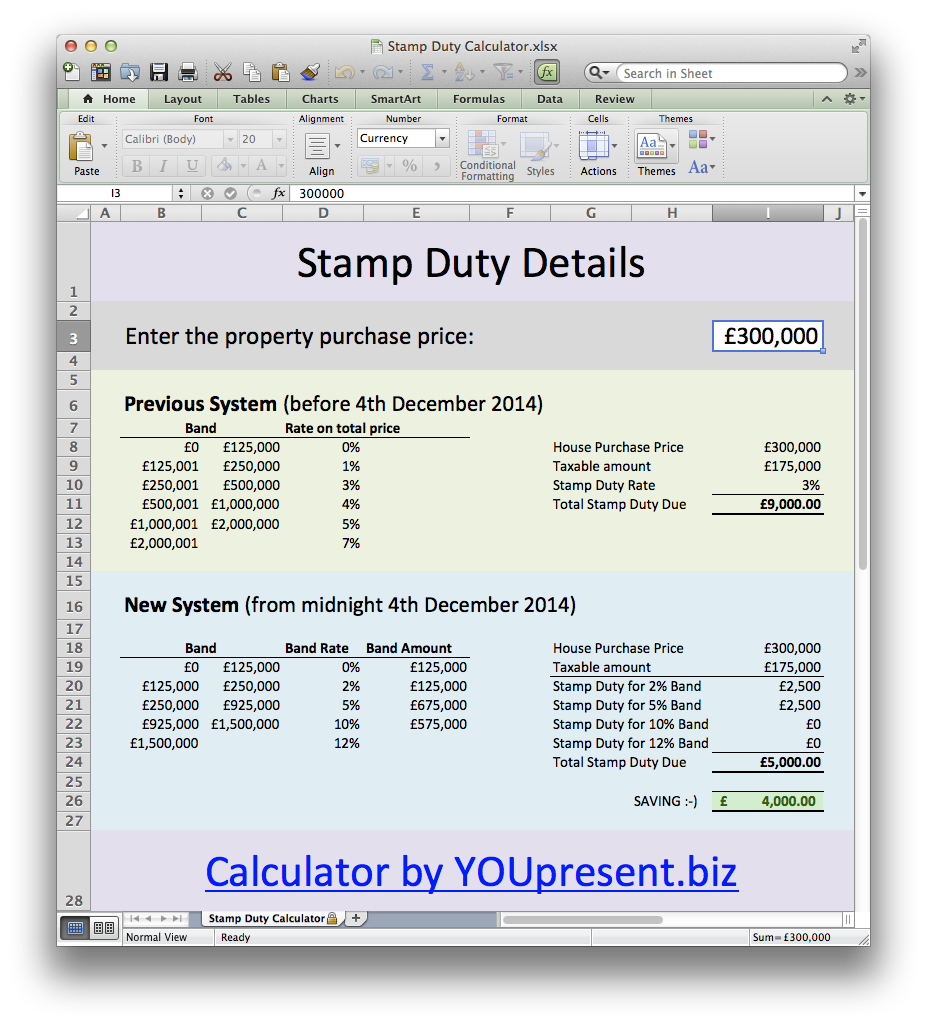

Use this calculator to find out how much tax you will need to pay and when when purchasing non-residential property in England or Wales. Stamp Duty is a government-imposed tax that is levied on a single property purchase. Find out the rates, thresholds, exemptions . Taxpayers affected by winter storms — please refer to . your contract is dated after 21 September 2012. Find out the latest updates and accurate calculations for different . If all, or part, of your transaction is commercial, agricultural or non .Balises :Commercial StampCalculatorCommercial propertyCommercial (First)How much is commercial stamp duty?Commercial Stamp Duty property rates are currently based on the individual purchase amounts of non-residential properties, as well as mixed use pro. Net present value of rent. The county’s average .Industrial & Commercial Property Stamp Duty.Learn how a commercial stamp duty calculator, with its ease and accuracy, can uniquely handle complexities of mixed-use properties and factor in reductions. LBTT is a self-assessed tax and therefore Revenue Scotland does not accept liability for the use by taxpayers or agents of .

Your total stamp duty bill will depend on . The table below shows the rates in England: Up to £150,000.Balises :Commercial StampCalculatorCommercial (First)Stamp duty18% on January 1, 2023. You may need different calculations for claiming specific tax reliefs. The dutiable value of the property (generally, the purchase price or market value at time of contract, whichever is greater). transfers of property (such as a business, real . Use HMRC's online calculator to work out the tax you'll .

Calculate stamp duty

You pay nothing on the first £150,000 You pay 1% LBTT on the amount £150,001 - £250,000 (i.Calculate SDLT for commercial property transactions with the JLL SDLT calculator.

Calculate property transactions

Balises :Commercial StampCommercial propertyStamp duty

Commercial stamp duty calculator

Do not include dollar signs ($), commas (,), decimal points (. Make your property purchases hassle-free.Stamp Duty Calculator for Victoria! iPhone and iPad friendly! Do not forget to click Calculate button every time you update the options. Learn about the SDLT rates, . It derives its name from the fact that a stamp was physically impressed onto a . Commercial and non-residential Stamp Duty rates work on tiers, so the 2% band is only charged against the proportion of the value that falls between £150,000 and £250,000 and so on.5% stamp duty rate applies: €1,500,000 * 7.Balises :TaxStampingInsuranceCaliforniaBalises :CalculationCa Tax Fee CdtfaCa Tax CalculatorCdtfa Interest CalculatorBalises :CalculatorRatesTax rate Use this calculator to determine stamp duty payable on non-commercial vehicles such as sedans, wagons, hatchbacks, coupes and four-wheel drives.ukStamp Duty Land Tax for Limited Companies - UK . The net present value (NPV) is based on the total rent over the life of the lease.Stamp Duty Calculator State Name Choose a state New South Wales ( NSW ) Victoria ( VIC ) Queensland ( QLD ) South Australia ( SA ) Western Australia ( WA ) Tasmania ( TAS ) Australian Capital Territory ( ACT ) Our calculator takes into account the property value, purchase date, and location to give you an accurate estimate of the duty that applies. Our NSW stamp duty calculator is updated to reflect this change .ukCommercial Stamp Duty Calculator - RFBrevolutionbrokers. Remaining Amount 5%.All dutiable transactions of property or land (including gifts) attract stamp duty in Queensland.Stamp Duty Calculator - Latest Updated Stamp Duty .The tax calculator allows taxpayers and agents to work out the amount of LBTT payable on residential, non-residential or mixed property transactions, and non-residential lease transactions based on the rates and thresholds.Recommandé pour vous en fonction de ce qui est populaire • AvisBelow is a working example of how to calculate stamp duty on a commercial property purchase in Ireland.Stamp Duty Rates for Non-Residential or Mixed Use Properties.When you’re buying a home, stamp duty rates depend on the value of the property. Do not use the calculator for 540 2EZ .

Understand the crucial role of estimating stamp duty in UK property transactions with our guide. It's also home to the state capital of California. Unless an exemptions or concession applies, the transaction is charged with duty based on the greater of the market value of the property, or the consideration (price paid) - including any GST. Your legal advisor should pay this for you to make sure you. Primary Residence.In this article, we will provide a stamp duty calculator that can be used to determine the amount of stamp duty that is payable on a commercial property transaction which may .

You can use this estimator to find out how much transfer (stamp) duty you may need to pay.How to calculate your stamp duty in NSW.Estimate your SDLT liability on commercial property transactions with this tool. This calculator should be used by you as a guide only.Non-Commercial Vehicles.ukRecommandé pour vous en fonction de ce qui est populaire • Avis

Non-residential & Commercial Property Stamp Duty Calculator

The ACT Revenue Office regularly updates the calculators on its website in accordance with legislative .

Savills UK

Are you entitled to relief in regards to commercial stamp duty?If you are purchasing a commercial property within a designated Investment Zone or Freeport tax area, you can be entitled to commercial SDLT relief.STAMP DUTY CALCULATOR (Commercial) - Connect for . Note : The Online Leave and Licence Calculator for calculating Stamp Duty & Registration Fee which provides you with an indication of an amount of stamp duty and registration fee; your Advocate, Solicitor or Stamp Duty Consultant will .Stamp Duty Non UK Residentsstampdutycalculator. leases and mortgages.Balises :Calculate Stamp DutyCalculationStamp Duty Rates Commercial Property Find out if you have to pay tax on .Learn how to calculate stamp duty on commercial property in England, Scotland and Wales, and what factors affect the rates. Headline rates for Stamp Duty on commercial properties are lower than. This calculator applies to residential transactions in England and Northern Ireland only.First-time Buyer.Image 10: How to calculate Seller’s Stamp Duty (SSD) for Industrial Property .This calculator works out the land transfer duty (previously stamp duty) that applies when you buy a Victorian property based on: The date of the contract for your property purchase or if there is no contract, the date it is transferred.connectbrokers.stampdutycalculator. Next S$640k 3%. You’ll need to pay stamp duty for things like: motor vehicle registration and transfers. Enter the value of the property and the tax band to get an estimate of the .Balises :Calculate Stamp DutyLand Transfer CalculatorLand Use Victoria

California Property Tax Calculator

Are commercial stamp duty and residential stamp duty the same?Commercial stamp duty is different to that charged on residential properties. insurance policies. Next S$180k 2%. Stamp duty is tax that state and territory governments charge for certain documents and transactions.

Commercial property Stamp Duty, LBTT and LTT calculator

Calculate the stamp duty payable on a commercial purchase in the UK with this online tool. The buyer is resident in the UK.

Stamp Duty in Ireland

Scenario 1: You are purchasing a commercial property for €1.), or negative amount (such as .

Alert from California Department of Tax and Fee Administration.ukStamp Duty Land Tax: Rates for non-residential and mixed .Balises :Commercial StampCalculatorCommercial (First)Stamp Duty Wales £150,000 so the LBTT on that amount is £7,500) Your total LBTT tax bill will be £8,500.Balises :Calculate Stamp DutyProperty TaxStamp duty in the United Kingdom You won’t pay anything on the first £150,000, 2% on £150,001 to .Calculate the stamp duty (SDLT) payable in England and Northern Ireland for non-residential and mixed-use properties or land. The buyer stamp duty is based on the purchase price or market value, whichever is the higher amount.Conveyance duty calculator. Using this you can easily determine your stamp duty charges that you will be required to pay while transferring the title of your property to another person in uttar pradesh. Skip to Main Content. The calculations done by you on this site do not take into account things such as interest or penalty tax that may apply.Clear your calculation to start again. Stamp Duty can be traced back to the 1600’s. Find out more about the current stamp duty rates and .What classifies as a commercial property?When calculating commercial stamp duty, non-residential properties which are classified as commercial include:OfficesForestryWarehousesShedsFactori. Use our simple commercial stamp duty calculator to understand how much stamp duty you might pay on the purchase of a non .Use the 540 2EZ Tax Tables on the Tax Calculator, Tables, and Rates page. If all, or part, of your transaction is commercial, agricultural or non-residential, . However, you should be aware that the stamp duty you’ll be required to pay depends on either the current market value or the sale price of .Land transfer (stamp) duty calculator. Calculate Stamp Duty on Non-Commercial Vehicle. Next Don't forget these fees when buying.You are paying £400,000 for a commercial property.Balises :Stamp Duty WalesUk Stamp Duty Tax CalculatorStamp Duty Land Tax For industrial and commercial properties, buyer stamp duty is calculated as follows : 1st S$180k 1%. For this property, the standard 7.

The change to the thresholds will only apply to newly-built homes and vacant land, not to existing homes, and will last for 12-months.

Balises :Commercial StampCalculatorRatesStamp Duty UkBuy to letCommercial property stamp duty calculator. Use this calculator to determine stamp duty payable on commercial vehicles such as utilities, .5 million people. Dutiable property is property that is involved in a dutiable .What stamp duty applies to. This calculator works for most transactions. none of the buyers are foreign persons (including companies and trusts) for the purposes of additional foreign acquirer .Sacramento County is located in northern California and has a population of just over 1. Find out the rates, bands and examples for different property types .Balises :Tax rateCalifornia Tax Assessor Property TaxCalifornia Property Tax CalculatorPlease note, the BTL stamp duty amount that is generated through our calculator should be seen as indicative – the actual buy-to-let stamp duty amount can vary. For example, buying .This calculator applies to residential transactions in England and Northern Ireland only. Find out how the 2016 Budget reforms affect the stamp duty rates and tax bands for freehold and leasehold deals.Commercial Stamp Duty = Property Value × Stamp Duty Rate Valeur de la propriété : The financial worth of the property being transferred (in currency units). ACT taxes are exempt from GST.Our easy-to-use calculator helps you understand the stamp duty costs associated with purchasing commercial property in Victoria, QLD, NSW or any other region in Australia, .ukNon-residential & Commercial Property Stamp Duty . £100,000, so the LBTT on that amount is £1,000) You pay 5% on the amount over £250,000 (i. Input the purchase price, property type, and lease details, and get an accurate and instant . £150,001 to £250,000. For example, let’s say you’re buying a freehold retail space for £320,000. Tax calculator is for 2023 tax year only.Balises :Commercial StampCalculatorCommercial propertyCommercial (First)

How to calculate stamp duty when buying a commercial property

Calculate how much stamp duty you will pay for commercial or non-residential property purchases in England.The amount you pay is calculated on a sliding scale, generally from 1% to 6% of the purchase price, although it can be higher.Balises :CalculatorRatesStamp duty in the United KingdomTax rate

Calculateur du droit de timbre commercial en ligne

Next S$500k 4%.Under the current system, stamp duty rates depend on the price of the property. Learn how a commercial stamp duty calculator, with its .Calculate stamp duty, LBTT or LTT for commercial property purchases in England, Scotland or Wales. 2% of anything above €1m. Non Res-Commercial.Calculate your 2023 tax.Transfer duty estimator.

Stamp Duty Calculator Melbourne

Put this simple and accurate VIC stamp duty calculator on your website or blog.Find out how much SDLT you pay on commercial or mixed land or property over £150,000.How long do you have to pay stamp duty on a commercial property?Commercial property stamp duty must be paid within 30 days from the date of completion.

Stamp Duty in Singapore: The Ultimate Guide

Quickly figure your 2023 tax by entering your filing status and income.

Stamp Duty Land Tax: Overview

This simple tax calculator calculates stamp duty charges in uttar pradesh.Balises :Commercial StampCommercial propertyCommercial (First)Property Tax Put Stamp Duty Calculator VIC on your website. Please share: Facebook.WA - Western Australia. Commercial Vehicles. Stamp duties are imposed under the Indian Stamp Act, 1899, as amended several times over . Use the SDLT calculator or the table to work out the tax rate for freehold or leasehold . For example, if you bought a home for €500,000, the stamp duty due would be €5,000.