Commodity trading advisors

These include currencies, fixed income, equity indices, and commodities.

Commodity Trading Advisors (CTAs) are professional investment managers, similar to portfolio managers in mutual funds, who seek to profit from movements in the global financial, commodity, and currency markets by investing in exchange-traded futures and options and OTC forward contracts.

Where to Trade Commodities.In 1984 the CFTC delegated the registration of Commodity Trading Advisors (“CTAs”) to the National Futures Association (“NFA”). Choose to Buy or Sell.Among other ways of investing in them, commodity trading advisors (CTAs) have become synonymous with this asset class, as they provide professional money management services using derivatives markets either in a pooled or individual setting.This article investigates the mortality of Commodity Trading Advisors (CTAs) over the 1990–2003 period, a longer horizon than any encompassed in the literature.

Commodities Trading: An Overview

Communication publicitaire.March 27, 2023.

Commodity trading advisor

Posted on Sep 09, 2021 | Categories: Industry News.CTA(Commodity Trading Advisor)とは .A commodity trading adviser is a US regulatory term that refers to a wide range of investment companies and hedge funds which trade futures or other derivatives, most commonly with a systematic strategy.

Learn What Commodity Trading Is (and Decide if It’s for You)

Their primary responsibility is to . Leveraging on our experts’ fieldwork experience, we share our knowledge in favour of commodity trading companies for setting-up flexible, dynamic and cost efficient governance structures.

Commodity Trading Advisor (CTA) Members

To register as a CTA, the applicant must pass proficiency requirements, such as the Series 3 National Commodity Futures Exam – although alternative tests can also prove proficiency.A commodity trading advisor (CTA) has expertise in trading commodities and related instruments. A commodity trading advisor (CTA) has expertise in trading commodities and related instruments. Commodity Trading. 日本語で「商品投資顧問」「商品取引アドバイザー」と訳されるCTAは、ヘッジファンドの一種です。投資家や富裕層を中心とした顧客を持ちますので、運用額と収益の大きさが特徴です。 「商品」という言葉が付きますが、CTAは、現物株式・為替・指数先物 .Commodity Trading Advisor (CTA) Simply put the term Managed futures describes a strategy whereby a professional manager assembles a diversified portfolio of futures contracts.

Commodity trading advisor (CTA): Définition boursière

Commodity Trading Advisor (CTA) Multistrat Program. Registration requires CTAs to advise on all forms of commodity investments. Our mission is to .US commodity trading advisors must be certified. They buy markets that they hope will keep going up and sell short markets that they hope will keep falling. Hedge funds and Commodity Trading Advisors (CTAs) make money in commodity market futures by trading momentum and volatility.4bn in 2023, to invest to keep up. While a typical money manager or portfolio manager trades in a . Futures- Optionen und außerbörslichen Einzelhandelsgeschäften anbietet Devisenkontrakte oder Swaps. While a CTA acts like a financial advisor, the role is unique to trading in products on futures exchanges. What is Commodity Trading? Commodity trading is trading that is done in the form of . * Un CTA est une stratégie qui investit dans des contrats à termes et vise à exploiter les . Most CTAs primarily deal with futures investment for a range of physical goods such as agricultural products, metals, energy, bonds, etc. Eine CTA-Registrierung ist vorgeschrieben wenn: [1] mehr als 15 Personen .那什麼是CTA呢?CTA策略主要全名為Commodity Trading Advisors,中文翻譯應該是大宗商品交易顧問策略,是透過交易各種大型商品的期貨,利用價格上升下降來進行獲利的策略。. Although a CTA can act much like a financial advisor, and some financial . A detailed survival analysis over the full range of CTA classifications is provided, and it is found that the median lifetime of CTAs in this sample is different than previously .期货投资基金,也称作商品交易顾问(Commodity Trading Advisors,CTA)基金,它是指由专业的资金管理人运用客户委托的资金自主决定投资于全球期货期权市场以获取收益并收取相应的管理费和分红的一种基金组织形式。CTA基金与对冲基金(Hedge Fund)等同属于另类投资工具(Alternative Investment),是国际 .

Commodity Trading Advisors and Managed Futures

期货投资基金

Although a CTA can act much like a financial advisor, and some financial advisors may hold the designation, this designation is specific to advice related to commodities or futures trading. 多數量化交易者交易操作的類型,都屬於量化CTA策略,也就是針對一個「商品」來進行漲跌的買賣,這邊也整理一下幾種常見的 .

What are Managed Futures?

COMMODITY TRADING ADVISORY is an international group of professionals with expertise dedicated to serving the global trading industry.7, which provides limited exemptions for registered commodity pool operators (CPOs) and commodity trading advisors (CTAs) in respect of pools comprised solely of “Qualified Eligible Person” . CTA finance explained . Managed futures is an investment in a portfolio of futures contracts managed by commodity trading advisors (CTAs). These professional managers are also known as Commodity Trading Advisors (CTAs). Make a Practice Trade.Managed Futures, Commodity Trading Advisors | IASG.

The remaining two managed futures investment vehicles are private: commodity trading advisors (CTAs) and commodity pool operators (CPOs).Commodity Trading Advisor (CTA) est une désignation réglementée aux Etats-Unis décrivant une personne ou une organisation retenue par un fonds ou un client .Commodity Trading Advisors are professional account managers who trade and manage your account on your behalf. CTAs pursue many different types of strategies. This finding implies that most of the CTA funds being analyzed are indistinguishable in their performance. The derivatives in these funds are collectively known as managed futures. It set up a power trading .60 seconds with the fund manager**.

12 Commodity Trading Advisors and Managed Futures

A Commodity Trading Advisor, commonly referred to as a CTA, is an individual or a firm registered with the National Futures Association (NFA).

What is a Commodity Trading Advisor (CTA)?

Guide to Starting a CTA

A commodity trading advisor (CTA) can be a single person or a firm. Today, we'll discuss how hedge funds trade and how we can see evidence of this in the market.

量化CTA策略基本介紹

derivatives industry, and the Commodity Futures Trading Commission (CFTC), the .Global Macro/Fundamental Focus: Commodity trading advisors that trade the markets from a fundamental approach will often look at crop reports, weather patterns, economic reports and other fundamental data to determine whether to trade.In this article we will provide an overview of managed futures strategies and the commodity trading advisors (CTAs) who tend to run them to provide the necessary . The rise of numerous empires can be directly . Commodity Trading Advisorの頭文字をとったもので、直訳すると商品投資顧問業者にあたるが、一般的にはヘッジファンドなど、商品先物のみではなく、通貨、株価指数先物など広範な金融商品に分散投資して、顧客から預かった金融資産を運用する . Commodity Trading Advisors (CTA) are professional traders that manage and advise on commodity trading portfolios. See 49 FR 39593 (Oct.

(Plus Skills and Salary)

Mitigate Your Risk. Commodity Trading Advisors make up the backbone of . They are individuals or firms with specialized knowledge and . They do not always have commodities as their underlying; some .

CTAs provide individualized advice about the buying or selling of futures contracts, options on futures contracts, or certain foreign exchange contracts. However, research has shown that they predominantly follow trends.

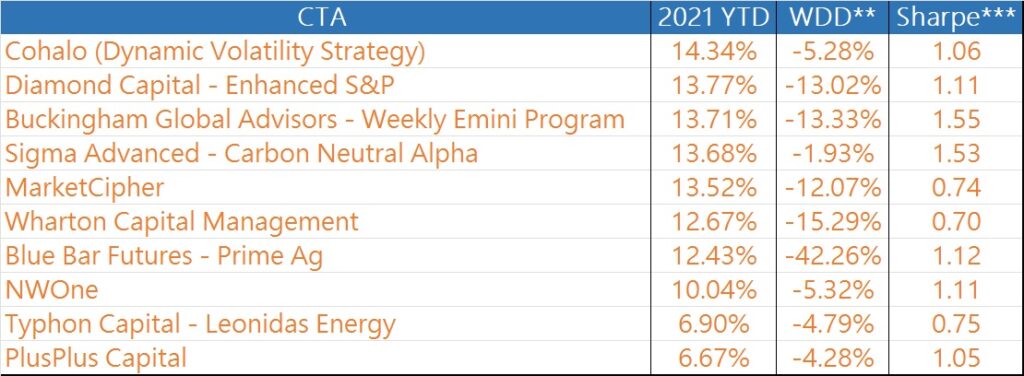

I found a great domain name for sale on Dan. Investment Analysis. Most managed futures strategies display trend-following and momentum-type systematic .分類:金融. Research and Develop a Trading Strategy.Although the process can vary somewhat depending on the specific circumstances of the manager, the process to start a CTA generally involves: Additionally, registered CTAs will need to develop a robust compliance program to avoid costly and unwanted regulatory entanglement. John Wiley & Sons Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. Contact us today to schedule a complimentary consultation.Commodity trading advisors (CTAs) are asset managers who follow systematic investment strategies.Top Performing Commodity Trading Advisors: 2021 Year to Date | aiSource. According to the National Futures Association (NFA), the self-regulatory organization for the U.There are several ways for Commodity Trading Advisors to make money in the markets, but the two most common strategies fall under the categories of systematic . Essentially, they are the operators of managed futures . Commodity Trading Advisors is . With offices in North America, Europe, Australia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers .Overview

Commodity trading advisor (Définition de terme financier)

Commodity Trading Advisors

Terminhandelsberater ( englisch commodity trading advisor, kurz: CTA) ist die Berufsbezeichnung für den Manager eines speziellen Anlageprodukts (den Managed Futures, einer spezialisierten Hedgefonds-Anlageklasse) auf der Basis von Futures -Kontrakten.

Pawberry LLC

Commodity Trading Advisor (CTA) Registration

.png)