Cpp contribution rate 2022

45% for both employees and employers. Canada Tax Agency . This person claims the basic personal amount.Second Additional Employee and Employer Contribution Rate Maximum Second Additional Employee and Employer Contribution; Second additional CPP contribution: 68,500.4 per cent in 2022. This additional rate was phased in between 2019 and 2023. The federal income tax rates Opens a new website in a new window for 2023 were: This Page's Content Was Last .CPP contribution rate for self-employed. It increased this rate to 5.00% Self-employed maximum contribution $7,735. 18, 2021, 5:00 AM UTC. So an employer will only receive a copy. Average Monthly Payments E.caWorking past 65? Beware this Canada Pension Plan odditytheglobeandmail.These are the base contributions to the CPP. Maximum CPP and QPP benefit amounts increase every month as a result of the enhancement.

CPP: Higher Deductions Coming to Your 2022 Paycheque

The Canada Pension Plan (CPP) increase in 2022 brings important changes and implications for Canadian workers and retirees.For 2022, the contribution rate for employees and employers is set to increase to 5.

Calculate CPP contributions and deductions

This results in a maximum CPP contribution of $3,754 (($66,600 gross wages – $3,500 exemption) x 5. Maximum contribution amount for self-employed. Any amounts over the maximum pensionable amount will not be subject to CPP.CPP contributions are jumping higher than expected in 2022. Consulting with financial advisors and exploring other retirement savings options can help individuals navigate these . This means that you and your employer each contribute 5. The contribution rate on .45% of your employment income, up to the annual maximum pensionable earnings (YMPE). As of 2022, the contribution rate is 5. Monthly Average of New Benefits E. The employee and employer contribution rates for 2022 will be 5.Canada Revenue Agency has announced the 2022 limit for maximum pensionable earnings under the Canada Pension Plan. The employee is responsible for sending an original completed copy of Form CPT30 to the CRA.CPP Rate Table 1: Information required to calculate CPP.2 GIS Married - Pensioner 20.caRecommandé pour vous en fonction de ce qui est populaire • Avis

Actuarial Report (31st) on the Canada Pension Plan

The maximum employer and employee contribution to the plan for 2022 will be $3,499.95% for the last .CPP CPP Disability and survivor amounts 2022 $674.

Half of this contribution is made by employees, and the other half by employers.

Canada Pension Plan (CPP) Contributions

2023 CPP rates

9 per cent in 2021 to 11. Paying tax on CPP payments. The CPP is currently going through an enhancement phase with the intention to make it easier for individuals to retire. Overview of the Quebec Pension Plan (QPP) The QPP is a parallel public pension plan for the province of Quebec.

CPP CONTRIBUTION RATES, MAXIMUMS AND EXEMPTIONS. Since 2019, CPP enhancement has been phasing in. GIS & ALW: Calculation of Income Reduction and Cut-Off Point 18.CPP Contribution Rate; 2022: 5. Number of Benefits E.

The contribution rate has been steadily increasing since 2018, where it settled at 4.92 for this pay period.

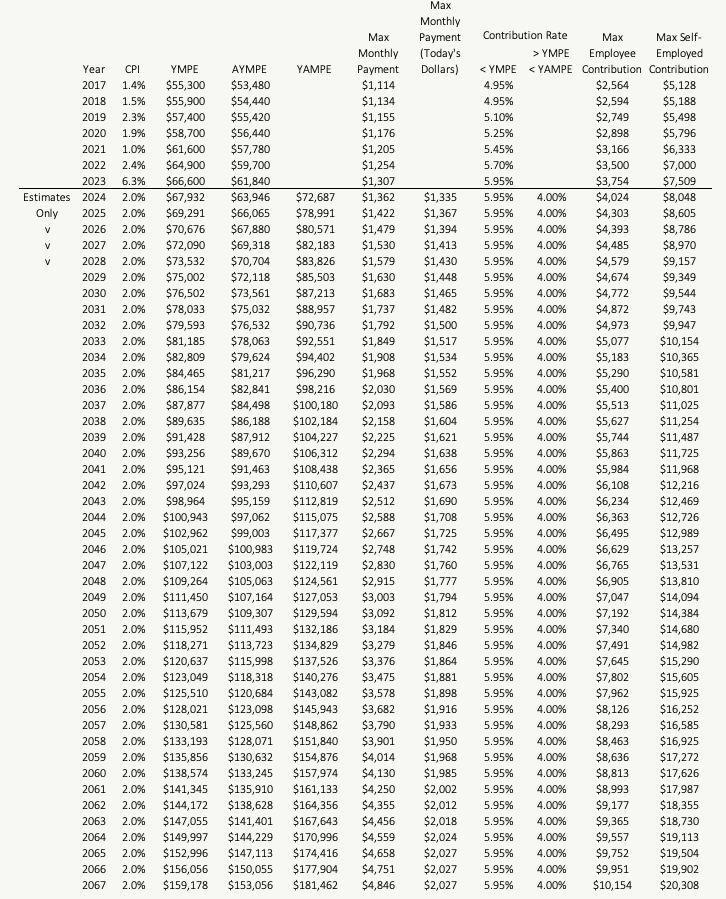

The CPP should be calculated on gross income, not the after-tax income.The contribution rate is 9. Note 5: New Year's Additional Maximum Pensionable Earnings (YAMPE) under the enhanced CPP starts in 2024 and is phased in over two years.Canada Tax Agency Announces Pension Plan Contribution Rates for 2022.

Canada Pension Plan Increase in 2022: What You Need to Know

In 2022, the CPP earnings ceiling is $64,900.Stopping CPP contributions - Canada. If your employment income exceeds this amount, you will only need to contribute the maximum CPP contribution.

Canada Pension Plan and Quebec Pension Plan Rates

As a result of the increase in the CPP contributions rate for 2022, the maximum contribution of an employer and employee to the plan will be $3,499.

CPP and EI for 2022

Canada Pension Plan Contribution Rates

Beginning January 1, 2024, you must begin to calculate the second additional CPP contributions (CPP2) on earnings . Free Consultation of Alternative Options for Seniors.

YMPE = Year's Maximum Pensionable Earnings. Employees and employers contribute equally on earnings that are between the Basic Exemption amount . The YMPE is the maximum amount of earnings . Since 2019 the . CPP: Calculation of Maximum New Benefits 17. Basic exemption amount.The increase in contribution rate is due to the continued implementation of the CPP enhancement. The Canada Pension Plan (CPP) provides partial replacement of earnings to contributors and their families during retirement, or in case of disability or death.The CPP contribution rates are based on your employment income. Professional Corp. Instant CPP contribution calculator, get all rates and maximums of the Canada Pension Plan for 2022 earnings.70% each for employees and employers. Old Age Security (OAS) Maximum Income level amount 1 cut-off 2 Old Age Security pension (at age 65) 3,4 $642. The new ceiling will be $64,900 up from $61,600 in 2021.25 Not applicable 6,830,465 Guaranteed Income Supplement (GIS) • Single person who receives an OAS pension $959. Overview of the Quebec . Top CPP Rate Table 2: .90% for self-employed persons, with maximum pensionable . But what is not pre-determined is the maximum pensionable earnings.80 (previously $3,166. This threshold is adjusted annually to account for inflation, ensuring that pensions keep pace with the rising cost of .Canada Pension Plan (CPP) contributions . Net Payments E.

How much CPP will I get?

00 Contribution rate for self-employed 11.60 if self-employed) Guess How Much Bill Makes

Canada Pension Plan/Old Age Security Quarterly Report

25% for both employee and employer). Contribution rate increase of 1.45 per cent in 2021.00: You stop deducting CPP and CPP2 (if applicable) when the employee reaches their maximum annual . These are the base . CPP: Contribution Rates Calendar Year D.The employee and employer contribution rates for 2022 will be 5.45% for employers, for a total combined contribution rate of 10.70% and the self-employed contribution rate will be 11.

1 GIS Single 19. That's because Canada's average income rose — the pandemic leaving many lower-wage workers out of the economy. The self-employed .9% over the past two decades. The increased contribution rate will .45% for employees and 5.20%: It is important for individuals to plan accordingly for these CPP rate increases, taking into consideration their current and future financial needs. The CPP max 2024 contribution rate will remain at 5. CPP contributions = 0.

Maximum benefit amounts and related figures

The contribution for self .

Contributions to the Canada Pension Plan

7% in 2022 from 5.The YMPE for 2022 was $66,600. CPP payments are taxed based on your overall taxable income.Contributions to CPP are compulsory for all working Canadians aged 18-70.0595 × ( $1,200 – ( $3,500/52 )) = $67.The 2022 maximum pensionable earnings are $64,900, with a basic exemption of $3,500. Maximum Pensionable Earnings: $64,900 (up from $61. YAMPE = Year's Additional Maximum Pensionable Earnings. As of 2023, self-employed workers in Canada are contributing 2% of their pensionable earnings to CPP .The CPP rate tables provide a list of CPP amounts from 1966 onwards. The maximum employer and employee contribution to the plan . The contribution for self-employed workers is scheduled to increase . From 2019 to 2023, the contribution rate for employees was increased gradually from 4.By filling out Form CPT30, Election to Stop Contributing to the Canada Pension Plan, or Revocation of a Prior Election, and giving it to an employer, the employee can either stop or restart their CPP contributions. The maximum pensionable earnings amount in 2022 is $64,900. The Canada Pension Plan (CPP) is a crucial part of the Canadian social security system, providing financial support to eligible individuals upon retirement, disability, or death.0% under the enhanced CPP starts in 2019 and is phased in over five years. For starters, there will be an increase in the CPP contribution amounts.00 CPP contributors statistics Total Number of contributors (2021) 14.70% each from the previous 5.70 % (rate is up 0.9% on earnings in the original earnings limit, and 8% on the additional range (for example, between the original earnings limit and the new one) This .Calculate CPP contributions and deductions.beginning in January 2022.40 and the EI premiums are $19.95% from the employer and 4. The system is under more pressure from more Boomers retiring. The agency calculates this amount by comparing .95% for employees and employers and 11.For the year 2022, the CRA increased the CPP contribution rate for employees and employers to 5. The maximum earnings threshold for the Canada Pension Plan (CPP) is a key consideration when it comes to calculating pension benefits.Employee/employer maximum contribution $3,867. Canada Pension Plan (CPP) Calculator 2023. The employee gets a personal tax credit . To get a better idea of how much CPP you’ll receive, ask Service Canada for your CPP statement of contributions. The contribution rate for CPP is set at 5.As at 31 December 2021 Tabled before Parliament on December 14, 2022 The results contained in this report confirm that the legislated contribution rates are sufficient to .