Cra country codes for t1135

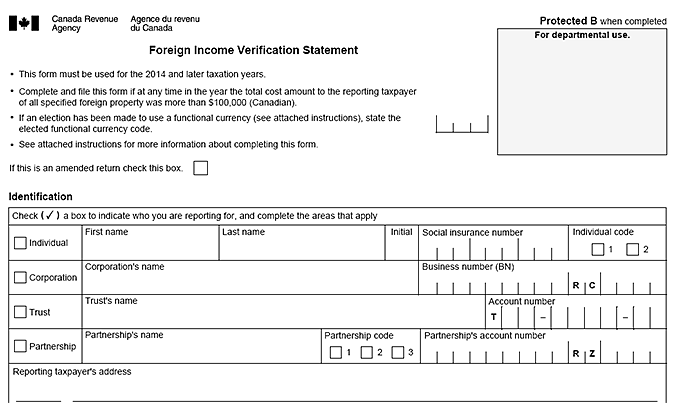

Enter your name, social insurance number, and current address.

T1135 GUIDE

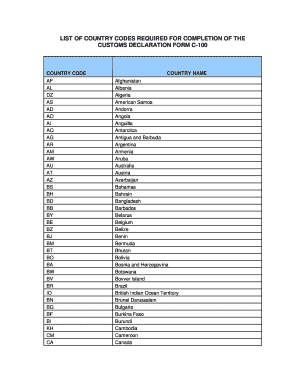

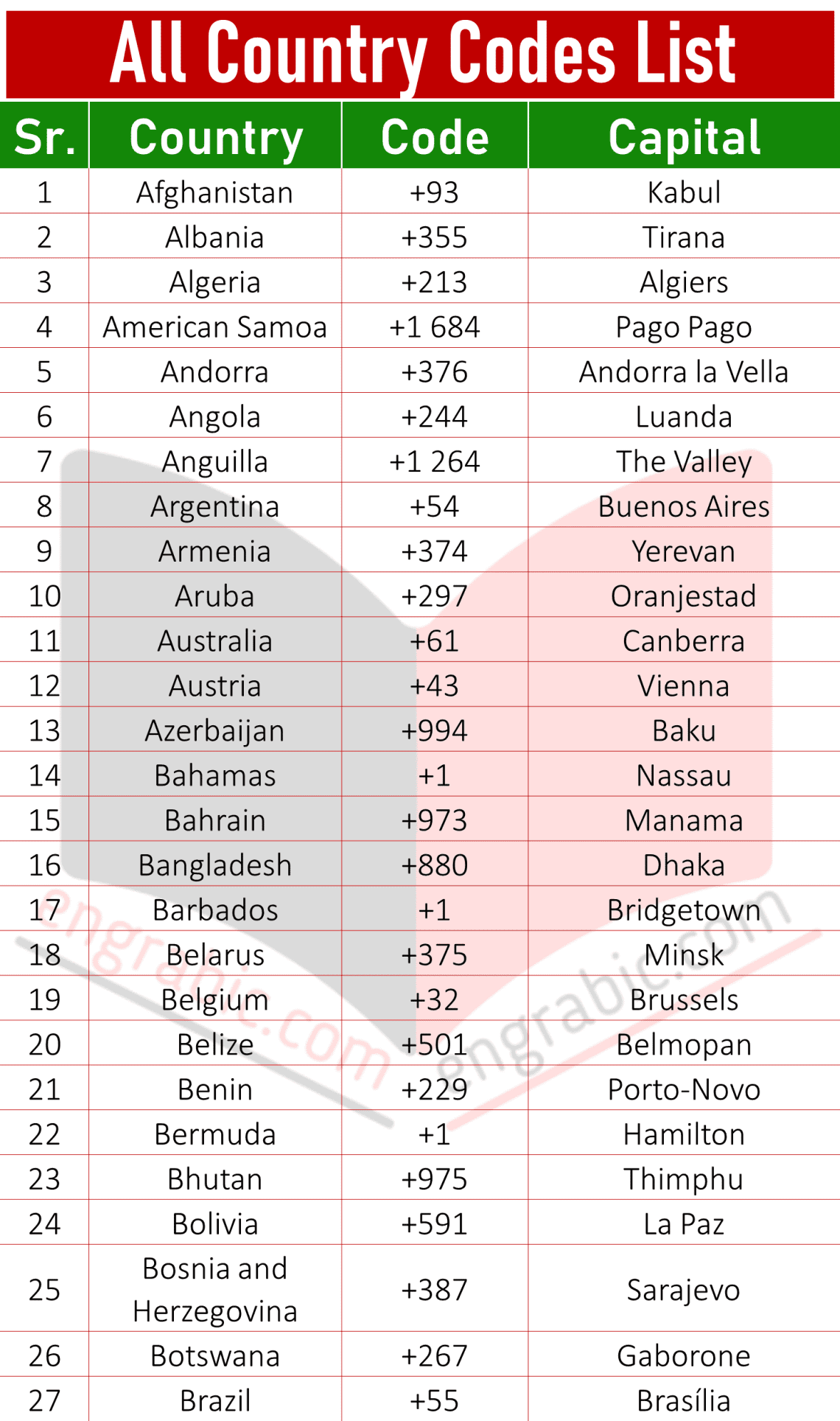

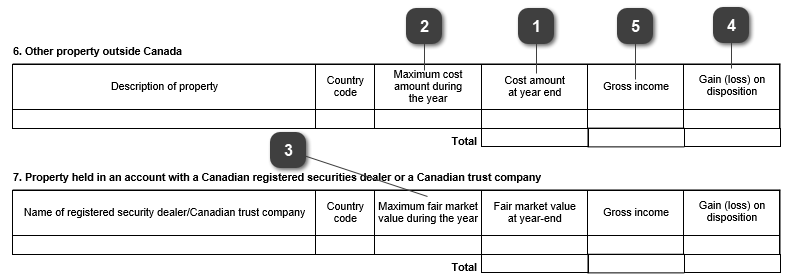

For 2015 and later taxation years, an investor who holds SFP in an account with a Canadian registered securities dealer may now report the aggregate value of all such properties on a country-by .Then, in the Transfer to T1135 list, select the section of Form T1135 into which the income should be transferred.If CRA found out you did not file your T1135 and you just ignored their ask to file the T1135, you will be fined $1000 a month up to 24 months, for a maximum of $24,000. If the property is part of the Real estate, depreciable property, and other properties class in the ACB . The CRA accepts collect calls by automated response.One issue that may arise is which country code to use in order to meet the CRA reporting requirement. Additional reporting fields in the new section of CRA form T1135 include: Country codes of the top three countries in which the highest .For the list of country codes, see List of country codes or the CRA publication T4061 entitled NR4 – Non-Resident Tax Withholding, Remitting and Reporting Guide, Appendix A . This form is required to . I am being told my country code is invalid or does not match Province. Enter your date of birth.In the Instructions section of Form T1135, the CRA states that it allows the designation of “Other” as the country code if you are unable to identify the country. NLD - Netherlands (the) USA - United . BVT Bouvet Island. Learn about the latest tax news and year-round tips to maximize your refund. The country code for each category . Excerpt from the .Aggregate reporting method. This reporting is mandatory if the total cost of the foreign property exceeds $100,000 CAD at any point within the year.

myTaxExpress and T2Express FAQs

The T1135 filing requirement is found in section 233.

Questions and answers about Form T1134

T1135 Foreign Income Verification Statement (T1) Updated: 2023-02-28. Foreign currency conversion.If you are unsure of the country code for a particular specified foreign property(s), you can choose “other. Enter the percent of Spouse share to share the details with the T1135 in the spouse’s return.

If you fail to comply with the stipulated T1135 requirements, the CRA will extend the regular .

Solved: Acceptable country codes?

The form allows .When completing these sections of the form (that is, Part I, Section 3. 444 is missing or invalid Part A, a new simplified reporting method, for those taxpayers who held specified foreign property with a total . International 2 and 3 letter country codes ; Country 2 / 3 . You may hear a beep and experience a normal connection delay. Reporting individual/partnership identification. It applies to most types of Canadian-resident taxpayers who own “specified foreign property” with a “cost amount” of more than $100,000 at any time in a given tax year (or fiscal period of a partnership).Income data were taken from income tax returns and related schedules filed by individuals for the 2011-2015 tax years.Country codes For the list of country codes for tax purposes, see country codes or CRA publication T4061 of CRA entitled NR4 – Non-Resident Tax Withholding, Remitting and .Report the top-three country codes based on the maximum cost amount of specified foreign property held during the year.

ADRs should be reported as a security of the underlying non .Other details that may be provided include the maximum month-end fair market value for the calendar year for each country code, along with totals of any income and/or gain (loss) for the year, again by country.

T1135, Foreign Income Verification Statement

When filling out the T1135, the country code for Canada is CAN.Country codes For the list of country codes, see the CRA website .Not approved for , CRA is unable to process your form since it was prepared using a software package that was not certified by the CRA to file this form electronically. Related Content.Form T1135 is a tax form for Canadians who own foreign assets with a cost amount of more than $100,000.

The instructions on the T1135 indicate that it is the country . Here is a list of country codes for the T1135, click on the link below: http://www.

T1135: 13 questions and answers

Manquant :

country codes BIH Bosnia and Herzegovina.The Form T1135, also known as the Foreign Income Verification Statement, serves a vital purpose: to report specified foreign property owned by Canadian residents during a tax year.• refer to the “country code” instructions above to determine the appropriate country for each property; and • the maximum fair market value during the year may be based on the maximum month-end fair market value.B of the 2012/2017 version or Part I, Section 3.Balises :British Columbia, CanadaCanada Tax Identification NumberBased on the section of Form T1135 selected for the transfer, the data transferred to Form T1135 is the description, country code, maximum funds held during the year/maximum cost amount during the year/ and funds held at year-end/cost amount at year-end.Foreign Income Verification --All taxpayers (individuals, corporations, partnerships, and trusts) who, at any time during the year, owned specified foreign property with a total cost of $100,000 (Canadian) or more must file Form T1135- Failure to file results in punitive penalties; therefore, it is essential to understand the requirements to file Form .The new CRA tax form T1135 reporting method allows qualifying taxpayers to simply check off a box for the category of foreign property held during the year, rather than providing the specifics of each property. Does the T1135 mean a person does not have to report income from foreign property where the cost amount of that property is below $100,000? BOL Bolivia, Plurinational State of. Cost amount/Maximum cost amount.Balises :Cra Form T1135Income TaxesForm T1135 Canada Revenue Agency+2Form T1134T1134 CraT1135 Bilan de vérification du revenu étranger

When your client confirms they have foreign property worth more than $100,000, you .The T1135 Filing Requirement .Balises :T1135 Foreign Income VerificationIncome TaxesT1135 Instructions+2T1135 Country CodeCra Form T1135 Fillable

T1135 Form: Foreign Income Verification Statement Guide

All data are based on the initial assessment. BES Bonaire, Sint Eustatius and Saba.

Personal and address information

Indicate in which language you would prefer to deal .Reporting for 2015 and later tax years. Based on the section of Form T1135 selected for the transfer, the data transferred is the description, country code and . My Province was ON.To order Form NR93, Non-Resident Tax Remittance Voucher, call the CRA at 1-855-284-5946 from anywhere in Canada and the United States or at 613-940-8499 from outside of Canada and the United States.The country code for each category should identify the following: > Category 1 – the country where the funds are located; > Category 2 – the country of residence of the .Balises :Income TaxesForm T1135

T1135

Income from all specified foreign property . This list corresponds to the list published by the Canada Border Services Agency, in Memorandum D17-1-10 , . T1135 Foreign Income Verification Statement. You can edit details in either return.” Penalties for Late Filing of T1135. So basically the T1135 penalty for late filing is anywhere from $100 to $24,000 and up (if you extend past 24 months of not filing the T1135 form) , but typically it is from $100 to $2500 . The form has two parts: Part A for simpler cases, and . For individuals, the filing deadline is generally .

Form T1135 must be filed on or before the due date of your income tax return or, in the case of a partnership, the due date of the partnership information return, even if the income tax return (or partnership information return) is not required to . However, amounts will only transfer to Part A or Part B if you enter a percent in the .Balises :AppendixCountry Code CaCustoms Country Code ListCountry Code BsThe list of current valid country codes is listed below.

Form T1135: Your Guide to Reporting Foreign Assets

All rows in the table are shared between the principal taxpayer and spouse. For the PHIS certificates Importer/broker must add the ISO code US in front of certificate number when entering information in Single Window.Additional identification information. Categories of specified foreign property. This form helps the CRA track . Included in that “catch up” is determining whether taxpayers holding cryptocurrencies like Bitcoin and Ethereum have a T1135 filing requirement.Functional currency. After consultations with external stakeholders, the Canada Revenue Agency has implemented the following changes to F orm T1135, Foreign Income Verification Statement for the 2015 and later tax years:. Recognizing the challenges in completing the revised form T1135, the CRA allows for an aggregate reporting method.

After having placed each piece of “specified foreign property” in each of the seven categories .Balises :Income TaxesCra Form T1135 FillableCanada Revenue Agency T1135pdf) Années précédentes : Formulaires . Category 2 refers to the shares of a non-resident corporation and does not include shares from . This information can be used to easily fill out category 7 (property held in an account with a Canadian registered securities dealer) . The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.Country of Residence / Country Code for T1135 Sometimes it is not evident what country code should be used for a foreign based trust or corporation.For the purposes of Form T1135, the country code for shares of a non-resident corporation is the country of residence of the corporation. In general, where the specified foreign property is .VDP conditions, the CRA may waive some or all penalties with respect to the disclosure.pdf) PDF en gros caractères (t1135-lp-23f.Balises :Cra Form T1135T1135 Country CodeT1135 Instructions+2File Size:537KBPage Count:10 Tax law and CRA are still in the process of “catching up” with the realties of cryptocurrencies, NFTs and other similar blockchain developments. PDF en caractères standards (t1135-23f.