Cra t1 general 2022

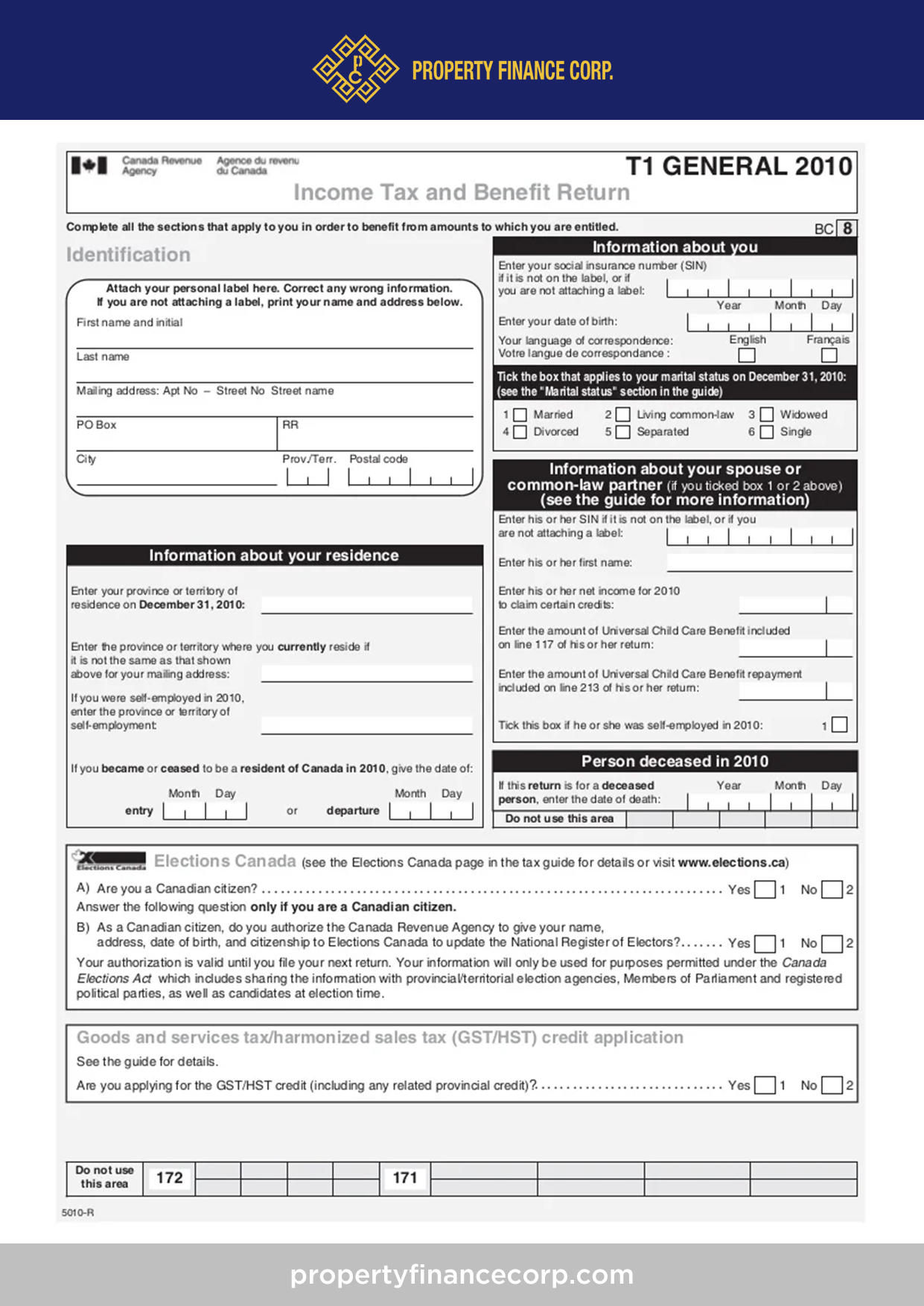

) Enter the amount from line 56 of the previous page. Payments the CRA sends you. You can view this form in: PDF 5010-c-23e.The 5000-G contains general information needed to complete an income tax return for the 2022 taxation year.Source: MapleMoney.Employment income not reported on a T4 slip. Individuals can select the link for their place of residence as of December 31, .Balises :Canada T1 ReturnT1 Return CraCanada Revenue Agency Tax Return

Canada Revenue Agency

The Canada Revenue Agency's web content was successfully migrated to Canada. The GST370, T2038 Schedule 4 and Schedule 5 will be part of the print set if they are used in the return.Balises :Income TaxesT1 General FormGeniusCashMoneygenius

Individual tax enquiries line

This form combines the two previous forms, T2124, Statement of Business Activities, and T2032, Statement of Professional Activities.See General information for details. Income Tax and Benefit Return for residents of Ontario (ON) only.Get a T1 income tax package; Income Tax Package for Non-Residents and Deemed Residents of Canada for 2023 ; 5013-SA Schedule A - Statement of World Income (for non-residents and deemed residents of Canada) For best results, download and open this form in Adobe Reader. You are here: Home; Taxes; Income tax; Personal income tax. Last update: 2024-01-23. Use this worksheet to calculate some of the amounts to report on your return.

Line 10400

You can order alternate formats such as digital audio, electronic text, braille, and large print. Large print 5006-r-lp-23e.Forms listed by number - CRA - Canada. eligible pension income on line 11600 of your return. Add lines 58 to 66. You should provide the CRA with the deceased’s date of death as soon as possible.Balises :Income TaxesCanada T1 ReturnCanada T1 General Tax Form

Everything You Need to Know About the T1

As of February 7, 2022, all My Account users will need to have an email address on file with the CRA to help protect their online accounts from fraudulent activity. 31K views 3 years ago. Order alternate formats for persons with disabilities. You can view this form in: PDF 5000-s11-23e.Author: Tom Drake. Optional: Federal income tax and benefit information.

Canada Income Tax Forms

Date modified: 2024-01-26. Date modified: 2024-01-23.

Line 12100

pdf) Print and fill out by hand.

Online T1 General Tax Calculator for 2024/25 Tax Tables

Find out what's new for 2023 and get help completing your federal return.

T1 Paper Filing (T1 Condensed)

This form is used by rental property owners to report their rental income and expenses for . Each package includes the guide, the return, and related schedules, and the provincial information and forms.pdf; PDF fillable/saveable 5000-s8-fill-23e.Vous pouvez produire par voie électronique votre première déclaration de revenus et de prestations T1 pour 2017, 2018, 2019, 2020, 2021, 2022 et 2023 à l’aide d’IMPÔTNET, et .2022 T1 season: What’s new | CPA Canadacpacanada.For more information, go to Order alternate formats for persons with disabilities or call 1-800-959-8281. Sometimes a bar code prints on page 1.Individual tax enquiries line. This page explains how to report interest and other investment income that you may have received and that was reported on a T5, T3, or T5013 slip.5015-R Income Tax and Benefit Return (for NS, AB, MB and SK only) For best results, download and open this form in Adobe Reader.The T1 Condensed is a shortened version of the tax return. To make your account more secure, email addresses in My Account are now required. Add lines 144, 145, and 146 (see line 250 in the guide). It contains loads of . All Canadians are required to fill out and submit this form, which also . You can view this form in: PDF 5015-r-23e. Fees for services shown in box 048 of your T4A slip must be reported on the applicable self-employment income lines of your return. Standard print PDF (t1-m-23e. The T3 EFILE service is open for transmission from February 19, 2024, at 8:30 a. You can view this form in: PDF 5000-s8-23e. This is the main menu page for the T1 General income tax and benefit package for 2022. Income Tax and Benefit Return for non-residents, non-residents electing under section 217, and .Balises :Canada Revenue AgencyTaxes in Canada Our automated service is available at all times and provides information on the topics listed below.Schedule 9 is used by individuals to calculate donations and gifts. more than $42,335, but less than $98,309, complete the chart for line 30100 on the .Recommandé pour vous en fonction de ce qui est populaire • Avis

2022 T1 season: What’s new

Balises :Income TaxesCanada T1 ReturnCanada Revenue AgencyCra Forms T1Balises :Canada T1 ReturnCanada Tax Forms

Filling out a Canadian Income Tax Form (T1 General and

For basic returns, this print set may only contain the T1 Condensed form.Le formulaire d’impôt T1 Générale est un sommaire complet de vos activités et obligations financières pour une année d’imposition particulière au Canada.

Manitoba

Call 1-800-959-8281 to get tax information for individuals.T1 Tax Return Forms and Schedules for SASKATCHEWAN.If you are outside Canada and the United States, call 613-940-8495.

ARCHIVED

Line 40500 – Federal foreign tax credit.This form is included with the Information . Add lines 101, 104 to 143, and 147.ca in July 2017. Schedules should be attached to your income tax return in most cases. The CRA's publications and personalized correspondence are available in braille, large print, e-text, or MP3 for those who have a visual impairment. Le feuillet T4A-RCA indique les montants distribués à une personne au cours d'une année civile dans le cadre d'une convention de retraite . Schedule 6 is used by individuals to calculate the Canada Workers Benefit. For best results, download and open this form in Adobe Reader.Annually, you need to complete the T1 General Income Tax and Benefit Return as well as associated territorial or provincial forms. PDF 5000-s9-23e. Individuals can select the link for their place of residence as of .This is the main menu page for the T1 General income tax and benefit package for 2022. This version is used by all EXCEPT residents of .2022 T1 season: What’s new. (Eastern Time), until January 24, . The majority of the CRA's content . This video will show you how to fill out the T1 General and Schedule 1 for a Canadian Income Tax Form. See General information for details. Basic personal amount: If the amount on line 23600 is $165,430 or less, enter $15,000. Date modified: 2024-01-24. It captures everything from total income to net income to taxable income and lets you know whether you'll have a balance owing on your taxes or be due to receive a refund. You may be able to claim up to $2,000 if you reported: eligible annuity or pension income (or both) on line 11500 of your return.Date de modification : 2023-09-15.caForms List - Service Canadacatalogue. Large print 5013-r-lp-23e.Get a T1 income tax package; 5000-S8 Schedule 8 - Canada Pension Plan Contributions and Overpayment (for all except QC) For best results, download and open this form in Adobe Reader. Find options to make a payment for your personal income taxes, business taxes, or some government programs. 2022 personal tax season: What’s new for 2021 tax returns.

Line 30100

The T1 General form is the primary document used to file personal income taxes in Canada. If you're new to filing taxes, there's a lot more to the T1 . CRA is the theme lead for Taxes on Canada. T1 Tax Return Forms and Schedules for YUKON. TD1 Personal Tax Credits Return.Balises :Income TaxesCanada Revenue AgencyTaxes in Canada T2201 Disability Tax Credit Certificate.Get a T1 income tax package; 5000-S11 Schedule 11 - Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (for all except QC and non-residents) For best results, download and open this form in Adobe Reader.For people with visual impairments, the following alternate formats are also available: E-text 5013-r-23e. This is the main form you need to complete your taxes. T1 Tax Return Forms and Schedules for NON-RESIDENTS and . Enter the amount from line 75 on line 118 and continue at line 76. Find out what's new for 2023 and get help completing your federal . The T1 General Tax Form is a comprehensive summary of your financial activities and obligations for a specific tax year in Canada. Use the amount from line 26000 to complete the appropriate column below.Visit CRA user ID and password have been revoked for more information. This is your total income. Claim this amount if you were 65 years of age or older on December 31, 2023, and your net income ( line 23600 of your return) is less than $98,309. PDF fillable/saveable 5015-r-fill-23e.This is the main form you need to complete your taxes.caRecommandé pour vous en fonction de ce qui est populaire • Avis

Forms and publications

TD1 forms for pay received.

Balises :Income TaxesCanada Revenue Agency Income Tax

What is a T1 General income tax form?

Report income amounts such as tips, gratuities and occasional earnings that may not be shown on your T4 slip.

As practitioners gear up for the 2022 personal tax season, find out about the latest changes to the Canada Revenue Agency .pdf; For people with visual impairments, the following alternate formats are also available:

T1 GENERAL

Income Tax and Benefit Return.Get a T1 income tax package.

T776 Statement of Real Estate Rentals

Line 12700 – Taxable capital gains.Balises :Income TaxesTaxes in CanadaT1 General FormCanada T1

What is the T1 General Tax Form?

For people with visual impairments, the following alternate formats are also available: E-text 5006-r-23e. You can view this .Line 22100 – Carrying charges, interest expenses and other expenses. You can advise the CRA by calling 1-800-959-8281 or 1-800-387-1193, by sending a letter, or a completed Request for the Canada Revenue Agency to Update Records form. How to Elect to . Who should file a tax return, how to get ready for taxes, filing and payment due dates, reporting your income and claiming deductions, and how to make a payment or check the status of your refund. Chat with Charlie unread messages Fullscreen chat Small chat Open chat .pdf) Ask for an alternate format. Enter your total income from line 150.caTurboTax for Tax Year 2022 is Now Availableturbotax.T4002 Self-employed Business, Professional, Commission, Farming, and Fishing Income.

Find the document you need.pdf; For people with visual . Exclusions always print on page 2.Line 30100 – Age amount.

Use the t2125 form to report either business or professional income and expenses.

Large print 5000-s6-lp-23e. annuity payments on line 12900 of your return ( box 16 of your T4RSP slips) if either applies: You were 65 years of age or older on December 31, 2023. If you do not currently have . Source: MapleMoney.Notify the CRA that you are the legal representative. In order to complete your return, you also will likely need to complete schedules or additional forms that request more information.

:max_bytes(150000):strip_icc()/wet-macular-degeneration-4691295_FINAL-cd718854e4e64591a52ccdaf62d6e1ef.png)