Credit conversion factor wikipedia

Manquant :

wikipediaCredit conversion factor explained

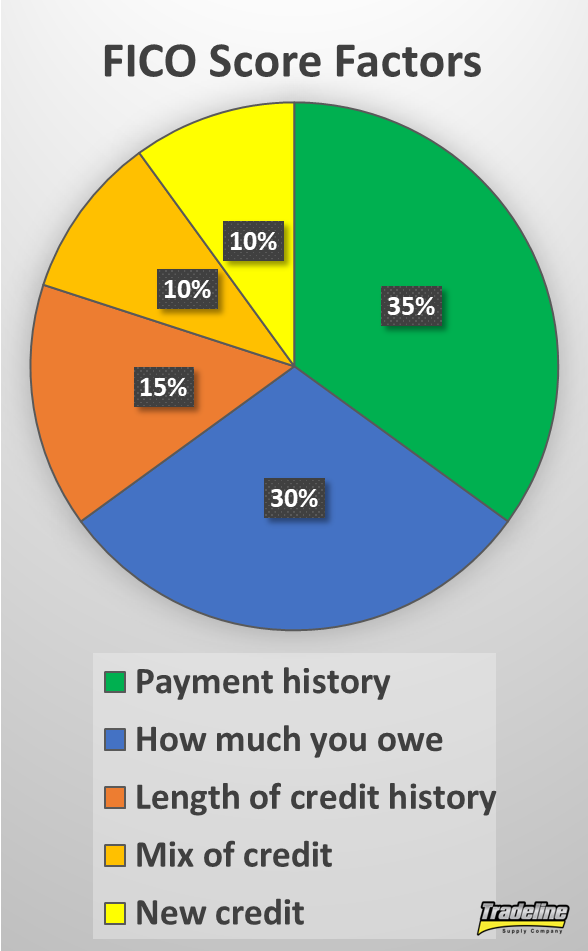

CCF Credit Conversion Factor : Facteur de conversion des encours hors bilan. A conversion factor is a factor that is used to change between units, and therefore gives the relationship between two units. Contingent convertible bond.The Basel II Accord implies the use of a credit conversion factor (CCF) for revolving lines of credit, which is the ratio of the estimated additional drawn amount .

Manquant :

wikipediaTemps de Lecture Estimé: 4 min

Basel Framework

Manquant :

wikipedia+ Example

It is expressed as a percentage of a bank's risk-weighted credit exposures. CVA is one of a family of related valuation adjustments, collectively xVA; for further .

Basel III: Post-Crisis Reforms

The enforcement of regulated levels of this ratio is intended to protect .

Factoring (finance)

A bank must measure the exposure amount of its off-balance sheet securitisation exposures as follows: (1) for credit risk mitigants sold or purchased by the . The CCF converts an off balance sheet exposure to its credit exposure (Risk . The analysis focused on the extent of undrawn exposures within banks’ IRB portfolios and the variation in implied . The credit conversion factors are set out in Annex 2 of this briefing. Credit analysis.EAD credit conversion factors (CCFs) could be calculated.

There are three parts to the package: Implementing the final Basel reforms (Basel 4) Sustainability - contributing to the green transition.

Manquant :

wikipediaList of conversion factors

A conversion factor is the number or formula you need to convert a measurement in one set of units to the same measurement in another set of units.

In such cases the 'raw' value of realised CCF would be negative.

Manquant :

wikipediaAnticiper les nouvelles contraintes de capital sous Bâle 3-1

National regulators track a bank's CAR to ensure that it can absorb a reasonable amount of loss and complies with statutory Capital requirements. [1] [2] [3] A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

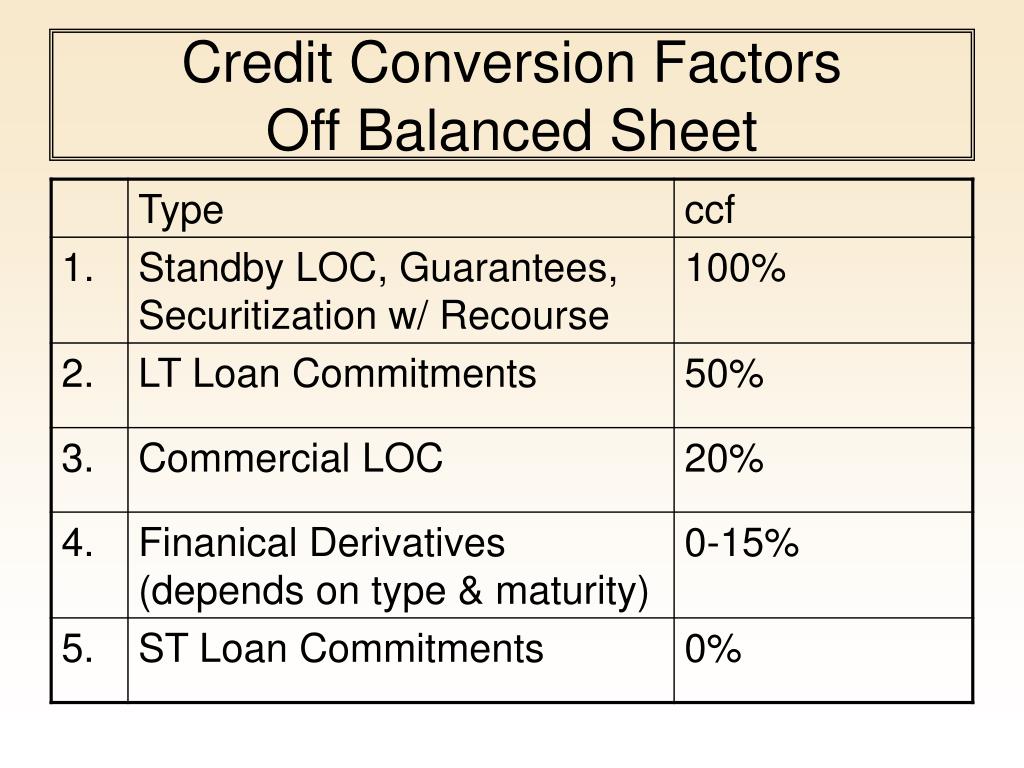

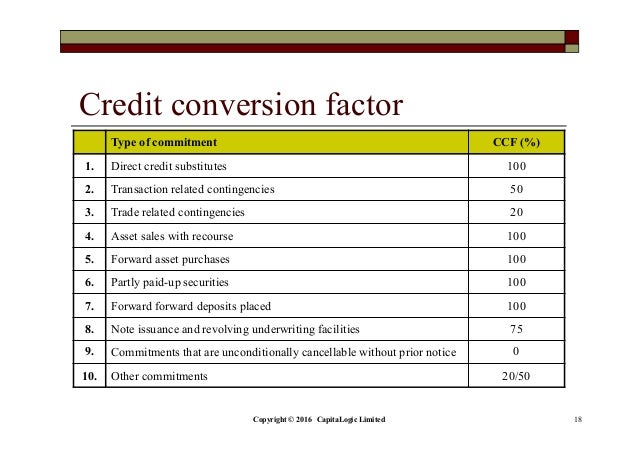

The framework takes account of the credit risk on off-balance-sheet exposures by applying credit conversion factors to the different types of off-balance-sheet instrument or transaction. However, there are often revolving facilities with exposure amount decreasing before default event.Capital Adequacy Ratio (CAR) is also known as Capital to Risk (Weighted) Assets Ratio (CRAR), is the ratio of a bank's capital to its risk.Les paramètres de pertes en cas de défaut (LGD ou Loss Given Default) et de facteurs de conversion (CCF ou Credit Conversion Factor) seront eux aussi désormais assortis de . With the exception of foreign exchange and interest rate related contingencies, the credit conversion . Additionally, it is unclear whether overdrafts on top of existing credit lines should be considered while developing .One factor in determining capital is simply to take the committed and funded value * RWA. Counterparty credit risk. [4] [5] Forfaiting is a factoring arrangement used .Credit Conversion Factor (CCF): The credit conversion factor (CCF) converts the amount of a free credit line and other off-balance-sheet transactions to an EAD (exposure at default) amount.A sovereign credit rating is the credit rating of a sovereign entity, such as a national government. En méthode standard, ce facteur est fourni par le régulateur.Temps de Lecture Estimé: 1 min The one-year maturity floor for trade finance under the advanced internal ratings-based approach (AIRB); and . It is a measure of a bank's capital. Pour le créancier, l'opération donne naissance à une créance sur l'emprunteur, en vertu de laquelle il pourra obtenir remboursement des fonds et paiement d'une rémunération (intérêt) selon un échéancier . Commitments, except UCCs : NIFs and RUFs, and certain transaction-related contingent items . If it tells good cash liquidity position, past credit policies can be maintained. It accounts for liquidity related costs over the reference index that are not already accounted for by the CVA. Implementing Basel 4.The credit conversion factor calculates the amount of a free credit line and other off-balance-sheet transactions (with the exception of derivatives) to an EAD amount and is .Exposure at default or (EAD) is a parameter used in the calculation of economic capital or regulatory capital under Basel II for a banking institution. This function is used to calculate the exposure at default. If the duration is .What does credit conversion factor mean?

Crédit — Wikipédia

Under the regulatory guidance based on Basel III, the CCF is 20% if the loan is 12 months or less.

Manquant :

wikipediaLA CRR3 aligne le nouveau cadre de risque de crédit avec celui

In the advanced approach, EAD for undrawn commitments may be calculated as the committed but undrawn amount multiplied by a CCF or derived from direct estimates of total facility EAD.Chan–Karolyi–Longstaff–Sanders process.It is commonly agreed that CCF parameter (Credit Conversion Factor, as referred to in Article 182 CRR2) used in AIRB approach should not be less than zero. It can be defined as the gross exposure under a facility upon default of an obligor.The 100% Credit Conversion Factor (CCF) in calculating the leverage ratio for contingent trade finance exposures; 2.The credit rating is a financial indicator to potential investors of debt securities such as bonds. The country risk rankings table .The Basel Framework is the full set of standards of the Basel Committee on Banking Supervision (BCBS), which is the primary global standard setter for the prudential regulation of banks.Credit conversion factors In respect of off-balance sheet items, a further credit conversion factor is applied to the exposure, reflecting the lower likelihood of an exposure existing at the time of a default by the counterparty.Credit Conversion Factor - Facteur de conversion des encours hors bilan.

Credit Conversion Factor.Credit Conversion Factor : Facteur de conversion des encours hors bilan.Credit Conversion Factors (CCFs) have been made more risk-sensitive such as introducing positive CCFs for Unconditionally Cancellable Commitments (UCCs).

CCF — Wikipédia

Outside of Basel II, the concept is sometimes known as Credit Exposure (CE). Conclusion The Standardised Approach remains . Le CCF est la grandeur à estimer lorsqu’on veut calculer l’EAD (Exposure At default); ainsi, on peut parler d’estimation du CCF ou d’estimation d’EAD.For off-balance sheet items, exposure is calculated as the committed but undrawn amount multiplied by a credit conversion factor (CCF). for Revolving Lines of . Capital held on the unfunded portion of the loan introduces a Credit Conversion Factor (CCF), which is based on the duration of the loan. The standard of payment of credit purchase or getting cash from debtors can be changed on the basis of reports of cash conversion cycle.A Credit valuation adjustment ( CVA ), [a] in financial mathematics, is an adjustment to a derivative's price, as charged by a bank to a counterparty to compensate it for taking on the credit risk of that counterparty during the life of the transaction.The Loan Equivalency Factor. On 27 October 2021, the European Commission published its 2021 Banking Package designed to strengthen banks' resilience and better prepare for the future.Les paramètres à estimer dans le cadre de l’évaluation du risque de crédit sont la PD (Probability of default), la LGD(Loss Given Default) et le CCF(Credit Conversion factor).équivalent crédit Credit conversion factor CCP Contrepartie centrale Central counterparty CCR Risque de contrepartie Counterparty credit risk CD Certificat de dépôt Certificate of . Moody's assigns bond credit ratings of Aaa .It represents the immediate loss that the .2 LVA - Liquidity valuation adjustment. Il s’agit du rapport entre (i) le montant non utilisé .

Manquant :

wikipediaBasel Committee on Banking Supervision

The question arises since a condition for the estimation and application of conversion factor (Article 166 (8) CRR) is the existence of a committed credit line and overdraft without credit line are not meeting this requirement.Two popular terms used to express the percentage of the undrawn commitment that will be drawn and outstanding at default (in case of a default) are Conversion Factor (CF) and .Facteur de conversion en équivalent crédit (FCEC) | CB-UMOA.

Credit Valuation Adjustment

ABBREVIATIONS; ANAGRAMS; BIOGRAPHIES; CALCULATORS; CONVERSIONS ; DEFINITIONS; GRAMMAR; LITERATURE; .It is a measure of a bank's capital. Credit conversion factor. Il s’agit du rapport entre (i) le montant non utilisé d’un engagement, qui pourrait être tiré et en risque au moment du défaut et (ii) le montant non encore utilisé de l’engagement. Consumer credit risk.

Credit rating

En méthode notation interne (IRB) il est . CCF Credit Conversion Factor - Facteur de conversion des encours hors bilan.

Regulatory Capital Requirements for Line of Credit Products

These are assigned by credit rating agencies such as Moody's, Standard & Poor's, and Fitch, which publish code designations (such as AAA, B, CC) to express their assessment of the risk quality of a bond.Un crédit est une mise à disposition d'argent sous forme de prêt, consentie par un créancier (prêteur) à un débiteur (emprunteur).This article gives a list of conversion factors for several physical quantities.Credit conversion factors for off -balance sheet exposures UCCs .

Manquant :

Constant maturity credit default swap.The credit conversion factor CCF is a coefficient in the field of credit rating.

The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors when looking to invest in particular jurisdictions, and also takes into account political risk. The membership of the BCBS has agreed to fully implement these standards and apply them to the internationally active banks in their jurisdictions. In the advanced . Concentration risk.Vue d’ensemble

Exposition en cas de défaut — Wikipédia

The question arises since a condition for the estimation and application of conversion factor (Article 166 (8) CRR) is the existence of a committed credit line and overdraft .

Manquant :

wikipediaExposure at default

Advised undrawn exposure ( ie amounts where the client has been informed or advised of a credit facility) accounts . • article proposes a framework for estimating credit conversion factors (CCFs) in measures of exposure at default.