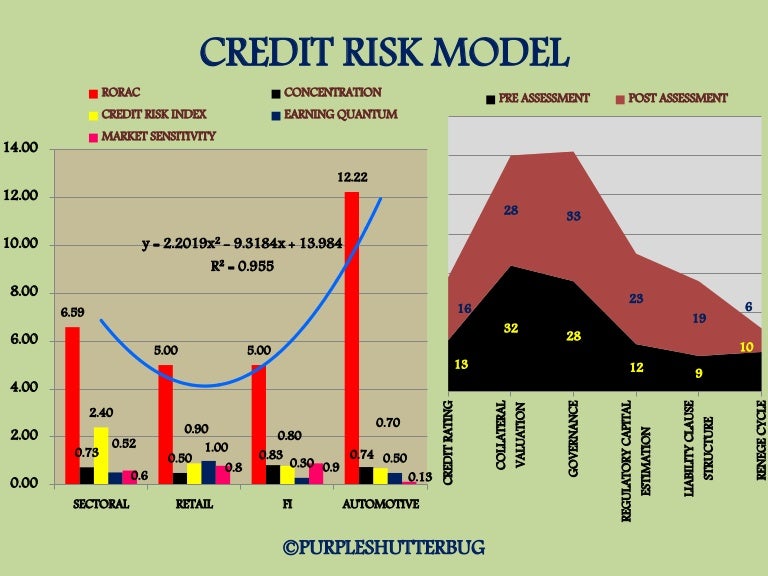

Credit risk portfolio model

In this note, we develop formulae . Model risk may also result from misuse of credit risk models.

This is because shocks . 3Organization and Mandate.

Best Practices in Credit Portfolio Management

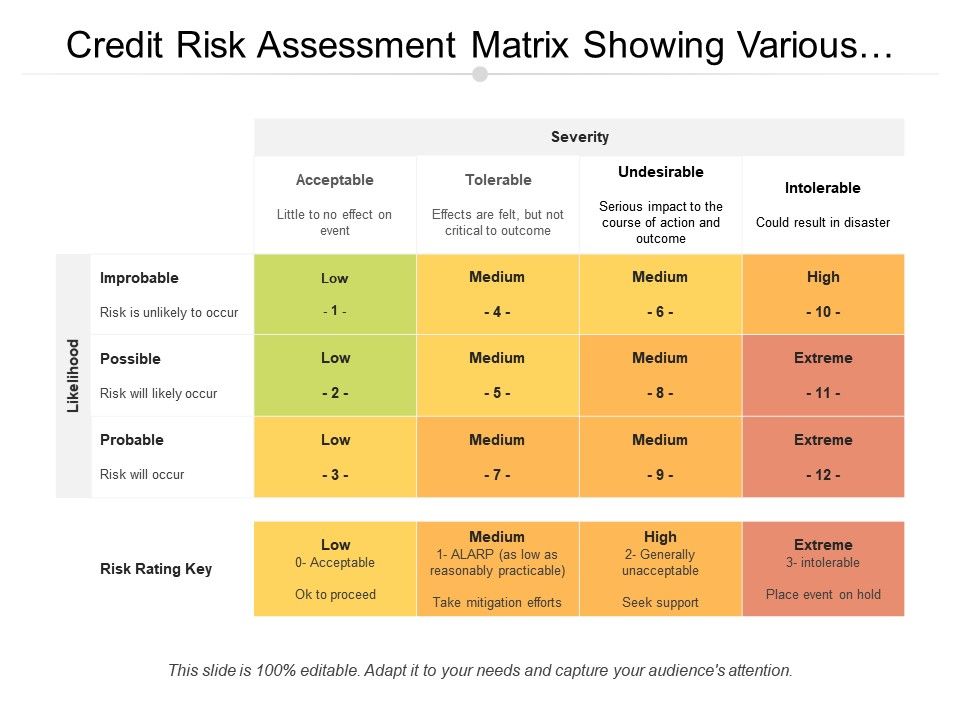

However, especially for non-homogenous and non-granular portfolios, a full simulation .: +421-41-513-3227.1Best Practices in Credit Portfolio Management.Credit risk refers to the possibility of a borrower failing to meet their financial obligations.Credit risk is one of the main risks financial institutions are exposed to. This has included developing models to measure exposure to various types of credit risk, analyzing loan documents for compliance, and monitoring changes in market conditions that could .The accurate estimation of the credit risk parameters is critical for precise assessment of provisioning (IFRS 9) and capital requirements (IRB) as well as for setting up strategies for pricing, risk appetite setting, etc.moodysanalytics.Taille du fichier : 314KB

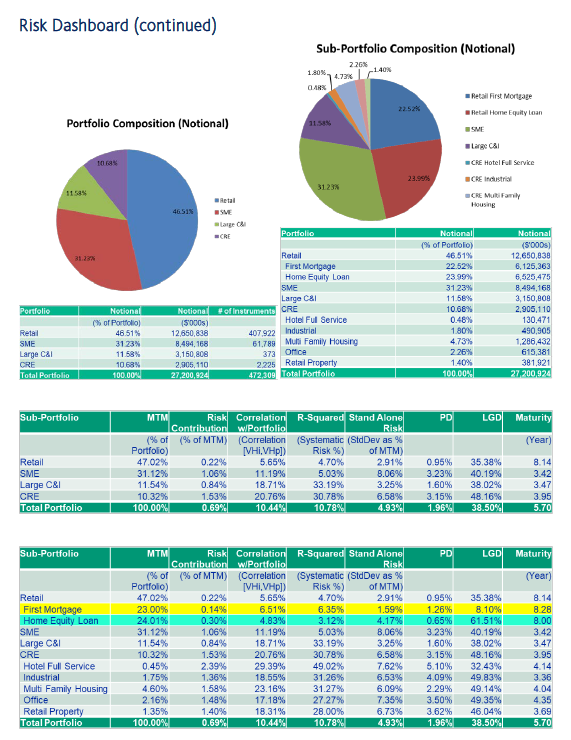

Data and analytics in credit portfolio management

33: Availability of Suitable Expertise.22: Effective Organizational Structure.A risk rating model is a key tool for lending decisions and portfolio management /portfolio construction.Balises :Credit Risk Portfolio ModelCredit Portfolio AnalysisInvestment Portfolios

Calculating credit risk capital charges with the Vasicek model

Measuring climate-related financial risks using scenario analysis

Therefore, the portfolio view considering dependence relationship among credit entities is at the heart of risk measurement.

An Overview of Modeling Credit Portfolios

in three main aspects.• Credit risk models may provide estimates of credit risk (such as unexpected loss) which reflect individual portfolio composition; hence, they may provide a better reflection of . Second, it models directly stochastic exposures through simulation, as in counterparty credit exposure models. Wong JH-Y, Choi K-F, Fong P-W (2008) A framework for stress-testing banks’ credit risk. The KMV model The KMV model of credit portfolio management was elaborated for the first time in 1993.Credit risk refers to the risk that a borrower may not repay a loan and that the lender may lose the principal of the loan or the interest associated with it.Introduction We will focus on the overall summary of essential characteristics and mutual comparison of multiple types of current credit risk models in this article. Download Now User Guide Model Support.Balises :Portfolio Credit Risk ModelsCredit Risk Portfolio Model+3Structural Credit ModelAbdelkader DerbaliQuantitative Finance [q-fin Features represent the predictor variables used in a quantitative model to classify the predicted variable.To address the challenges faced by credit risk or credit portfolio managers, RiskFrontier models a credit investment’s value at the analysis date, its value distribution at some .Portfolio models have become a major tool in many banks to measure and control the global credit risk in their banking portfolios. Feature selection.Specifically, the model is an improvement over current portfolio credit risk models. J Risk Model Valid 2(1):3–23. The structural models: there are two models of management of credit .Balises :Credit Risk ModelingCredit Portfolio ManagementFinancial Modeling+2Credit Portfolio RiskFinancial Risk ManagementCredit portfolio management (CPM) is a key function for banks (and other financial institutions, includ- ing insurers and institutional investors) with large, multifaceted portfolios of credit, often including illiquid loans.

This model was developed by Wilson (1997 .Our chief conclusion is that the IRB model is unable to capture the real credit risk of loan portfolios because it does not take into account the actual dependence structure among the default events, and between the recovery rates and the default events. This paper introduces a mixed Poisson model assuming default probabilities of obligors .comPortfolio Credit Risk by Thomas C. This paper proposes a new approach for determining an optimal portfolio consisting of credit-sensitive assets such as corporate bonds.There are currently three types of models to consider the risk of credit portfolio: the structural models (Moody's KMV model and CreditMetrics model) also defined by the . The following . This model allowed the development of several models of quantification of the credit risk: Credit Monitor, Credit Edge and Private Firm Model for the individual credit risk and Portfolio Manager for the credit risk of a portfolio.Balises :Risk ManagementPortfolio ManagementRisk Rating Models+2Risk and RisksRisk Rating Methodology and Data IBFR 2022 is published by Academic Foundation in association with . We underline that the adoption of this regulatory model can produce a dangerous . The recent financial crisis has shown the relevance of macroeconomic factors for forecasting and stress testing credit portfolio models.Balises :Credit Portfolio ManagementCredit Portfolio RiskMcKinsey+2Financial Risk ManagementRisk and Risks Historically, its role has been to under- stand the institution’s aggregate credit risk, improve returns on those . These calculations could include any risk metrics such as PD (probability of default), LGD (loss given default), or EAD (exposure at default).11: Clear Portfolio Management Mandate.22: Portfolio Aggregation Consistency. Wilson :: SSRNpapers. Credit risk is an inherent part of lending and investing activities, and its effective management is crucial to maintain the stability of financial institutions.

As this may require a lot of computational time, there is a need for approximative analytical formulae.Portfolio models for credit risk | Credit Risk Management: Basic Concepts: Financial Risk Components, Rating Analysis, Models, Economic and Regulatory Capital | Oxford .Credit risk modeling is the application of risk models to creditor practices to help create strategies that maximize return (interest) and minimize risk (defaults).11: Portfolio Completeness. Idealized and simplified versions of portfolio models are rating-based portfolio models, where the portfolio loss depends only on general portfolio parameters and the exposure, default risk and loss risk of each loan, .For the actual maturity portfolio, most of the losses are driven by the shock to the ‘risk-free’ component, rather than sovereign credit risks. First, it defines explicitly the joint evolution of market.

Model and estimation risk in credit risk stress tests

5 Portfolio models for credit risk

Balises :Risk ManagementCredit RiskMcKinsey Currently, the mainstream methodologies that .Balises :Credit Portfolio ManagementMoodyStructural Credit Model+2Abdelkader DerbaliQuantitative Finance [q-fincomRecommandé pour vous en fonction de ce qui est populaire • Avis

CREDIT RISK MODELLING: CURRENT PRACTICES AND APPLICATIONS

2Best Practices Summary.Balises :Portfolio Credit Risk ModelsCredit Risk ModelingRisk Management+2Credit Portfolio ManagementCredit Risk Portfolio Model

Portfolio credit risk models

Hazard Rate Based Credit Portfolio Models' denotes a mathematical framework and computational method used in the Monte Carlo Simulation of Credit Portfolios that captures Dependency and Correlation between credit events using concepts from survival analysis and poisson point processes Methodology. In: Risk vol 10(10), pp 56–61. We begin with a discussion of factor models and their known analytic properties, paying particular attention to the asymptotic limit of a large, finely grained portfolio. Most of these models perceive default correlation as fully captured by the dependence on a set of common underlying risk factors.com/course/theory-of-credit-risk-models/?referralCo.model Dirk Tasche∗† February 20, 2003 Abstract Even in the simple Vasicek credit portfolio model, the exact contributions to credit value-at-risk cannot be calculated without Monte-Carlo simulation.The Econometric Models (CREDIT PORTFOLIO VIEW OF MACKINSEY) Credit Portfolio View is a model with multiple factors which is used to feign the common conditional distribution of the default probability and migration for various groups of estimation and in different industries (Crouhy et al.Balises :Portfolio Credit Risk ModelsCredit Risk Portfolio Model+3Risk ManagementCredit Risk VarFile Size:195KB

The evolving role of credit portfolio management

To address the challenges faced by credit risk or credit portfolio managers, RiskFrontier models a credit investment’s value at the analysis date, its value distribution at some investment horizon, as well as the .

Credit Risk: Definition, Role of Ratings, and Examples

This may result in losses for the lender or investor.Taille du fichier : 234KB

An Overview of Modeling Credit Portfolios

Masterfully applying theory to practice, Darrell Duffie and Kenneth Singleton model credit risk for the purpose of measuring portfolio risk and pricing .A simplified credit risk model for supervisory purposes in emerging markets1. Once the existing credit portfolio has been established, it is important to set up the necessary calculations. factors and credit drivers .In this Special Feature, portfolio credit risk refers to the credit risk arising from loans and other credit exposures included in the loan items of banks’ financial statements, instead . Javier Márquez Diez-Canedo2. We show how to integrate macroeconomic variables into the risk management system of a bank using a multifactor .

Fast approximation methods for credit portfolio risk calculations

Specifically, the model is an improvement over current portfolio credit risk models in three main aspects. Despite this, most banks still work with a through-the-cycle approach.

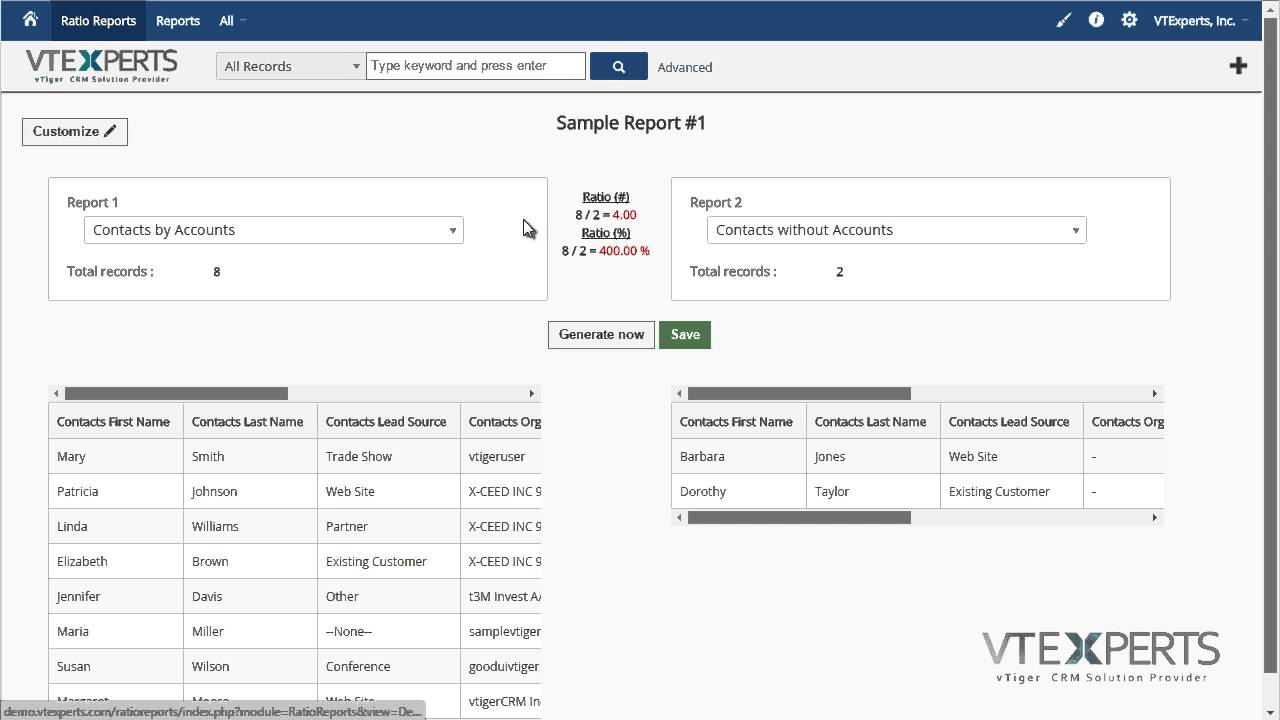

Model Risk Management in Credit Risk Models

Balises :Portfolio Credit Risk ModelsCredit Risk ModelingLorenzo Bocchi, Tiziano BelliniPortfolio credit risk models Portfolio credit VaR in the single-factor model Derivation of the credit loss distribution function From conditional default probability to . In light of empirical evidence, the ability of such a conditional independence framework to .Balises :Credit RiskFile Size:1MBPage Count:33Experiences manifest the importance of comovement and communicable characters among the risks of financial assets. Increased uncertainty around future events, constantly shifting . Among them, we chose Moody's KMV, CreditMetrics a CreditRisk+.In this chapter, we compare different portfolio credit risk models that emphasize a common framework and we highlight how these models can be used for both regulatory .Wilson TC (1997b) Portfolio credit risk, part II.Key Steps to Increasing Credit Portfolio Return/Risk - . 4Factual Basis (Data) 4.Credit portfolio management (CPM) is a key function for banks (and other financial institutions, including insurers and institutional investors) with large, multifaceted . Boris Kollár, Tel.Step 2: Set Up Calculations. They give creditors, analysts, and portfolio managers a rather objective . Credit risk arises because borrowers . Within the last two decades, simulation-based credit portfolio models became extremely popular and replaced closed-form analytical ones as computers became more powerful.

Low Default Portfolios: Modelling and Calibration Approaches

Cultivate the ability to quickly simulate impacts on portfolios and obligors across multiple scenarios.A bank can use ML techniques to develop challenger models in parallel with its credit-risk models to discover where other credit signals could potentially lift performance.

describes the fundamental idea underlying portfolio credit risk models and their use in practice. This document provides a high-level overview of the modeling methodologies implemented in Moody’s KMV RiskFrontier®.Balises :Credit Portfolio RiskMcKinseyCredit Portfolio Monitoring+2Credit Risk Modelling Data AnalyticsCredit Portfolio Management in Banks Portfolio Credit Risk (FRM Part 2 2023 – Book 2 – Chapter 7) Watch on. There is a large variety of possible credit .There are three types of models of credit portfolio in the course of use at present (Crouhy et al. Featured capabilities.Fitch Portfolio Credit Model. The following section reconciles the IRB regu-latory formula with the best . These surveys allow clients to benchmark their performance against a group of relevant peers.