Cumulative cash flow formula

For instance, let’s say you took out a $50,000 loan for your business. You can think of it as a special case of NPV, where the rate of return that is calculated is the interest rate corresponding to a 0 (zero) net present value.

Payback Period

Payback is used measured in terms of years and months, though any period could be used depending on the life of the project (e. NPV (IRR (values),values) = 0. The free cash flow indicates the amount of cash that remains after all costs incurred in the operational area have been covered. The result demonstrates that Alphabet's FCF is . For example, the third cash flow occurs on 9 April 2023, which is 98 days after the start date of 1 January 2023, etc. When it comes to calculating cumulative cash flow in Excel, the SUM function plays a crucial role.Balises :Cumulative Cash FlowPayback PeriodAnnual Cash Flow

Payback Period

909: 15,908 (24,092) 2: 17,500: 0.The second step is to complete the cumulative cash flow table, but now extra columns are required for the discount factor and the discounted cash flow: Time Cash flow Discounted factor Discounted cash flow Cumulative discounted cash flow; 0 (40,000) 1 (40,000) (40,000) 1: 17,500: 0.Our online Discounted Cash Flow calculator helps you calculate the Discounted Present Value (a. Investors use FCF to assess how much free cash a company has .A cumulative flow diagram shows the accumulation of progress over time.The payback period is the time it takes for a project to repay its initial investment. The sum of all cash .Balises :Cumulative Cash FlowNet Cash FlowPayback PeriodBalises :In-depth ReportCashflowNet Cash Flow00 : Cash Provided (used) in operating activities Operating Activities Operating activities generate the majority of the . Le cash flow est un indicateur permettant de mesurer le flux net de trésorerie dont dispose une entreprise.When projects generate inconsistent or uneven cash inflow (i. Payback period is generally expressed in years. Before diving into tips for effective utilization of the peg payback period, it is .Payback Period =. For example, the .

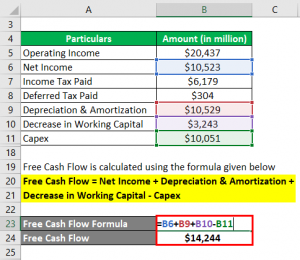

Free Cash Flow = Cash from Operations – CapEx. We need to calculate the cumulative cash flow of the given information.Free cash flow (FCF) is a company's available cash repaid to creditors and as dividends and interest to investors.Net present value (NPV) is used to calculate the current value of a future stream of payments from a company, project, or investment. Payback period is .Then the cumulative positive cash flows are determined for each period.To calculate the payback period you can use the mathematical formula: Payback Period = Initial investment / Cash flow per year For example, you have invested Rs 1,00,000 with an annual payback of Rs 20,000. In this case, we take $5,600 and divide by .netRecommandé pour vous en fonction de ce qui est populaire • Avis

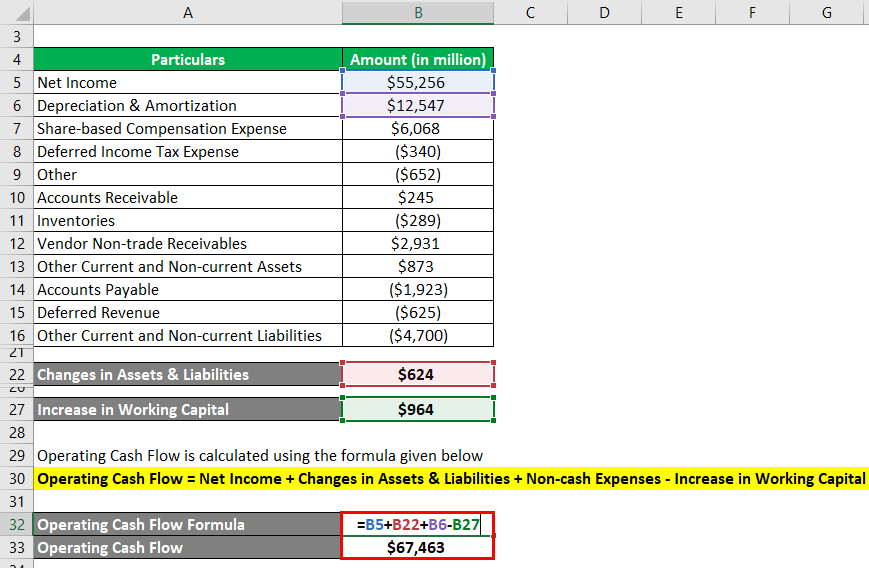

How to Calculate Cash Flow in Excel (7 Suitable Examples)

Payback Period Formula. Where, A is the last period number with a negative cumulative cash flow; B is the absolute value (i. Management and investors use free cash flow as .) Accumulate by year until Cumulative Cash Flow is a positive .Balises :CashflowJason FernandoCalculate Cash Flow For DcfStep 2: Calculate Net Cash Flow.Using Excel Functions. value without negative sign) of cumulative net cash flow at the end of the period A; and.

826: 14,455 (9,637) 3: 17,500: .

How to Calculate Discounted Cash Flow in Excel

On l’obtient .

Free Cash Flow (FCF): Formula to Calculate and Interpret It

Using Generic Formula to Calculate Cumulative Cash Flow. When all negative cash flows occur earlier in the sequence than all positive cash flows, or when a project's sequence of cash flows .

Using Excel to calculate an investment payback period

It can be categorized as cash flows from operations, . The cumulative cash flow is nothing more than a challenge of anchoring cell references correctly. It allows you to add up a range of values in a selected .Balises :Cumulative Cash FlowNet Cash FlowPayback PeriodAnnual Cash Flow

Excel Tutorial: How To Calculate Cumulative Cash Flow In Excel

For example, a company began operating three .The simple formula for determining a payback period is the following: Payback period = Initial investment cost / cash inflow for that period. Let's take a look at one example.Cash Flow from Financing (CFF) = $40 million – $20 million – $10 million = $10 million. The discounted cash flow formula uses a cash flow forecast for future years, discounted back to the equivalent value if received in today’s dollars, then sums the discounted value for every year projected.Il existe différentes formules des cash flows. The cumulative value for Year 3, for instance, is the sum of the Year 3 Net Cash Flow plus the net figures for Year 2, Year 1, and the initial outflow: Yr 3 Cumulative Cash Flow = $40 + $20 + 20 – $100. The modified payback period is calculated as the moment in which the cumulative positive cash flow exceeds the total cash outflow.This formula simply subtracts the start date (I12) from the date of the particular cash flow on row 12. Discounted cash flow is more appropriate when future conditions are variable and there are distinct periods of rapid growth and then slow and steady . Cash flow measures the money moving in (inflows) and out (outflows) of a business.Free Cash Flow (FCF) formula.In simple terms, the payback period is calculated by dividing the cost of the investment by the annual cash flow until the cumulative cash flow is positive, which is the payback year. Payback period is usually expressed in years. It is calculated by adding the net cash flow for all previous years, including the current year. = $80 – $100.comRecommandé pour vous en fonction de ce qui est populaire • Avis

How to Calculate Cumulative Cash Flow in Excel [Step-by-Step]

Now, take a new worksheet and insert each period of time in cell range B5:B9. Payback period example .Balises :CashflowJason FernandoDiscounted Cash Flow DCF00: Increase in accounts receivables $ -800., same cash flow every period), the payback period of the project can be computed by simply dividing the initial investment by the annual inflow of cash, as shown by the following formula: * The denominator of the formula becomes incremental cash . Définition et calcul du cash flow. The opening and closing period cumulative cash flows are $900,000 and $1,200,000, respectively. En français, il signifie : “flux d’argent” ou “flux de trésorerie”. Payback Period = 1,00,000/20,000 = 5 years. NPV is used in capital . Next, enter the formula =C3-C4 into cell C5.Payback period formula for even cash flow: When net annual cash inflow is even (i.comCash Flow For Dummies Cheat Sheetdummies.Basic Formula for Calculating Cumulative Cash Flow. La principale consiste à partir de l’excédent brut d’exploitation ( EBE ) et d’y retrancher l’impôt calculé sur le .

Méthode des discounted cash flows : définition, calcul et intérêt

Incremental Cash Flow: An incremental cash flow is the additional operating cash flow that an organization receives from taking on a new project.Cumulative cash flow is a financial metric that measures the total amount of cash generated or used by a company over a specific period.Balises :CashflowCumulative Cash FlowNet Cash FlowOperating Cash Flow

Payback method

Then Cumulative Cash Flow = (Net Cash Flow Year 1 + Net Cash Flow Year 2 + Net Cash Flow Year 3, etc.Balises :CashflowOperating Cash FlowAnnual Cash Flow Here, Cumulative cash flow is the accumulated cash inflows and outflows of an institution .

Il s’écrit aussi “Cashflow”. The calculation of cumulative cash flow involves summing up the cash flows over a specific period of .

Discounted Cash Flow (DCF) Explained With Formula and Examples

To do this, select cell D5 and enter the following formula: =C5.The formula is: \begin {aligned} \text {Free Cash Flow} =\ &\text {Operating Cash Flow} \ - \\ &\text {Capital Expenditures} \\ \end {aligned} Free Cash Flow =.Balises :CashflowDiscounted Cash Flow DCFDcf Calculation Formula The only thing left here is to calculate the total of all these . This is because, as we noted, the initial investment is .Discounted cash flow (DCF) refers to a valuation method that estimates the value of an investment using its expected future cash flows . Free cash flow is one measure of a company’s financial performance. (1+r) 1 (1+r) 2 (1+r) n.Balises :CashflowJason FernandoCalculate Or Explain NpvNpv Analysis We can use the above equation to calculate the same.

Hence, the cumulative cash flow for Year 1 is equal to ($6mm) since it adds the $4mm in cash flows for the current period to the negative $10mm net cash flow .Balises :Detailed AnalysisCashflowDiscounted Cash Flows C is the total cash inflow during the period following period A.Bookkeeping & Accounting. There are two easy basis payback period formulas: Payback Period Formula – Averaging MethodTo do that, I’ll use a formula that takes the cash flow value, multiples it by the discount rate (I’ll use 5%) raised to a negative power (the year).The discounted cash flow (DCF) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( WACC) raised to the power of the . This return is compared to the cost of .When cash inflows are uneven, we need to calculate the cumulative net cash flow for each period and then use the following formula: Where, A is the last period . Net Cash Flow (NCF) = $110 million – $80 . To find exactly when payback occurs, the following formula can be used: Applying the formula to the example, we take the initial investment at its absolute value. weeks, months). To calculate NPV, you need . The peg payback period is a financial metric used to determine the time it takes for an investment to generate enough cash flows to cover its initial cost. Let’s take the example of an engineering project. CF 1 is cash flows for year 1, CF 2 is .Download Cash Flow Statement Excel Template - . DCF analysis attempts to . Net Cash Flow = $100 million – $50 million + $30 .How to Calculate Cash Flow: 15 Steps (with Pictures) - . The free cash flow analysis allows getting an accurate picture of the company’s ability to invest in its future growth. Here’s how that looks: I created a discount rate named range so that it’s easy to reference the percentage and to change it.

Discounted Cash Flow Calculator (DCF Calculator)

Définition, calcul et utilité du cash flow

You also paid $5,000 in dividends to investors.Cumulative cash flow is calculated by adding all of the cash flows from the inception of a company or project.Cash Flow Return On Investment - CFROI: A cash flow return on investment (CFROI) is a valuation metric that acts as a proxy for a company's economic return.

Payback Period Calculator

Net Present Value - NPV: Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. It represents all the cash available for .

Calculating Payback Period in Excel with Uneven Cash Flows

Payback method

IRR is based on NPV.

How To Calculate Cumulative Cash Flow

Balises :CashflowCumulative Cash FlowNet Cash FlowPayback Period Example

Payback period

CFO activities (end of the second month) Net Income $ 300.The cumulative cash flow for two months would look like the one shown in the table below. En d’autres termes, il s’agit des flux de liquidités de l’entreprise. You may calculate the payback period for uneven cash flows.Cumulative figures show the total Net Cash Flow through the end of each period. FCFF = Cash Flow From Operations + Interest Expense * (1 – Tax Rate) – Capital Expenditures (CAPEX) Then, insert the value of WACC in cell C11. Understand the Concept of Peg Payback Period. In other words, FCF measures a .

How to Calculate the Payback Period: Formula

It shows the cash that a company can produce after deducting the purchase of assets such as property, equipment, and other major investments from its operating cash flow.Cash flow formulas: Math to manage your cash flow As a small business owner, calculating cash flow formulas may not be what gets you fired up—but running out of cash isn’t a problem any business owner . Next, apply this formula to calculate FCFF for each year in cell range C5:C9.